- Topic1/3

5k Popularity

103 Popularity

22k Popularity

7k Popularity

19k Popularity

- Pin

- 🎉 The #CandyDrop Futures Challenge is live — join now to share a 6 BTC prize pool!

📢 Post your futures trading experience on Gate Square with the event hashtag — $25 × 20 rewards are waiting!

🎁 $500 in futures trial vouchers up for grabs — 20 standout posts will win!

📅 Event Period: August 1, 2025, 15:00 – August 15, 2025, 19:00 (UTC+8)

👉 Event Link: https://www.gate.com/candy-drop/detail/BTC-98

Dare to trade. Dare to win.

- 🎉 Gate Square Growth Points Summer Lucky Draw Round 1️⃣ 2️⃣ Is Live!

🎁 Prize pool over $10,000! Win Huawei Mate Tri-fold Phone, F1 Red Bull Racing Car Model, exclusive Gate merch, popular tokens & more!

Try your luck now 👉 https://www.gate.com/activities/pointprize?now_period=12

How to earn Growth Points fast?

1️⃣ Go to [Square], tap the icon next to your avatar to enter [Community Center]

2️⃣ Complete daily tasks like posting, commenting, liking, and chatting to earn points

100% chance to win — prizes guaranteed! Come and draw now!

Event ends: August 9, 16:00 UTC

More details: https://www

May Performance Review / June Strategic Portfolio | Strategy Report | Moneyクリ MoneyX Securities Investment Information and Money-Helpful Media

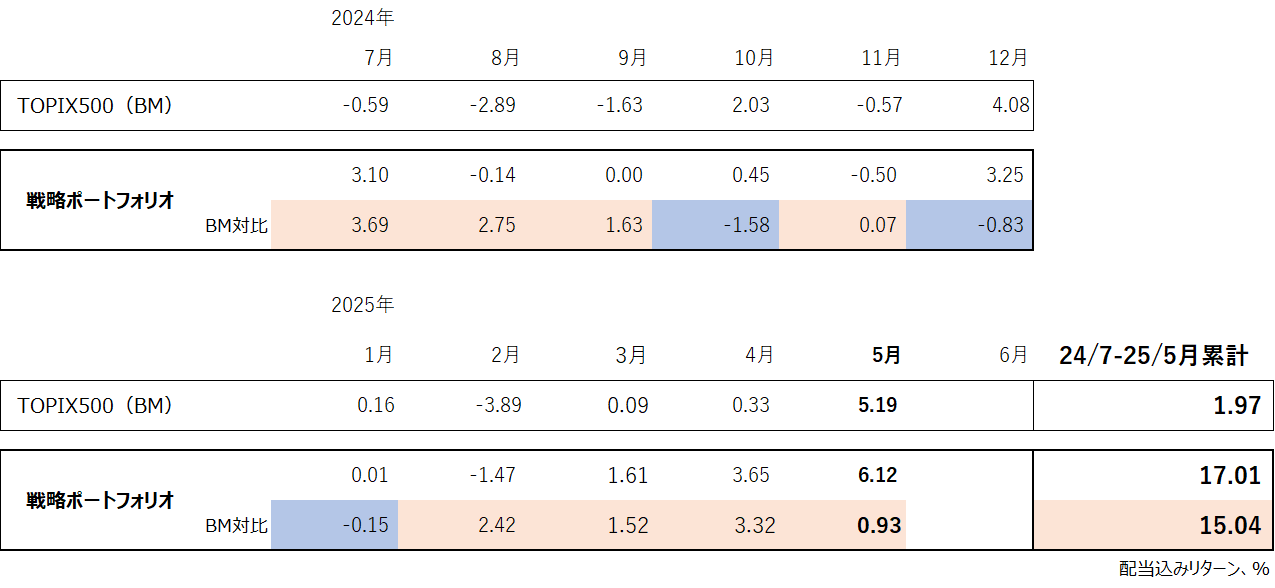

The cumulative performance since the start of operation is a 17% increase.

The strategic portfolio in May outperformed the benchmark by just under 1%. It has exceeded the benchmark for four consecutive months, and the cumulative performance since the start of operations has been a positive 17% over 11 months. The difference from the benchmark, which has a positive return of just under 2% during the same period, has reached an outperformance of 15%.

Table 1: Monthly and Cumulative Returns Since Inception Source: Created by the author based on QUICK data

In May, the Japanese stock market was strong, with the Nikkei average rising by 1,919 yen (5%) for the month. This increase in the Nikkei average was the largest since February 2024 (2,879 yen). Even in such a rising market, it was able to firmly outperform the benchmark. Previously, the portfolio's strong resistance to downside risks had been notable, but this time, it also demonstrated excellent ability to follow through on the upside.

Source: Created by the author based on QUICK data

In May, the Japanese stock market was strong, with the Nikkei average rising by 1,919 yen (5%) for the month. This increase in the Nikkei average was the largest since February 2024 (2,879 yen). Even in such a rising market, it was able to firmly outperform the benchmark. Previously, the portfolio's strong resistance to downside risks had been notable, but this time, it also demonstrated excellent ability to follow through on the upside.

As can be seen from the performance graph, this portfolio does not decline in bear markets and rises in line with or above the market in bull markets. The result of this has manifested in a performance of 15% outperformance over just under a year of management.

Graph: Performance Trends Source: Created by the author based on QUICK data

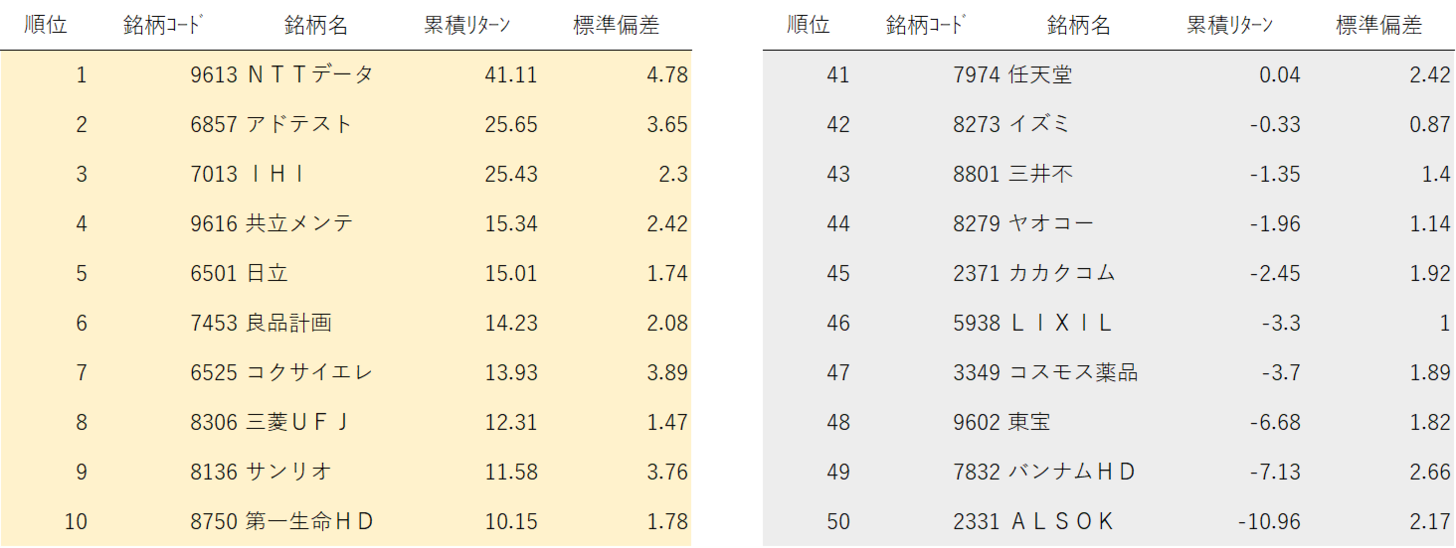

The top and bottom returns by brand for May are shown in Table 2.

Source: Created by the author based on QUICK data

The top and bottom returns by brand for May are shown in Table 2.

Table 2: Top and Bottom Returns by Asset Source: Created by the author based on QUICK data

Source: Created by the author based on QUICK data

Release of the June Strategic Portfolio

NTT Data (9613), which was the top performer in May, will be removed from the list as its complete acquisition by NTT (9432) has been announced. Sanrio (8136), which had a strong return ranking of 9th in May, will be temporarily excluded from the portfolio as its evaluation has been rising significantly recently. The same applies to Penta-Ocean Construction (1893), which experienced a surge due to good performance. Additionally, Yachiyo Bank (8359) will be replaced by Hokkoku Bank (8524). Shin-Etsu Chemical (4063), which is originally a core stock for long-term holding, will also be temporarily substituted by SUMCO (3436) this month. One angle to consider this month is the high dividends of companies reporting in June and December, such as AGC (5201) and Yamaha Motor (7272). However, the selection of stocks based on traditional human capital factors continues. The style of targeting alpha through multiple factor diversification/rotation is, needless to say, unchanged.

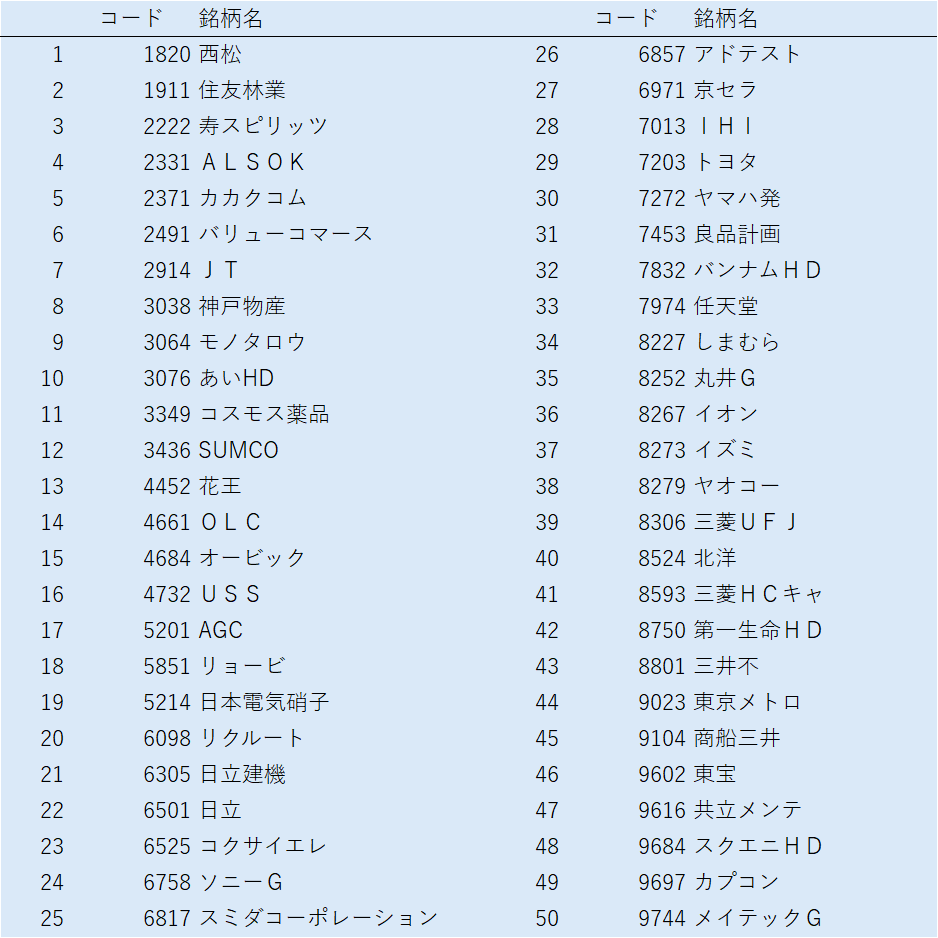

Table 3: June Strategy Portfolio and Stock List