Cryptoaman01

用户暂无简介

Cryptoaman01

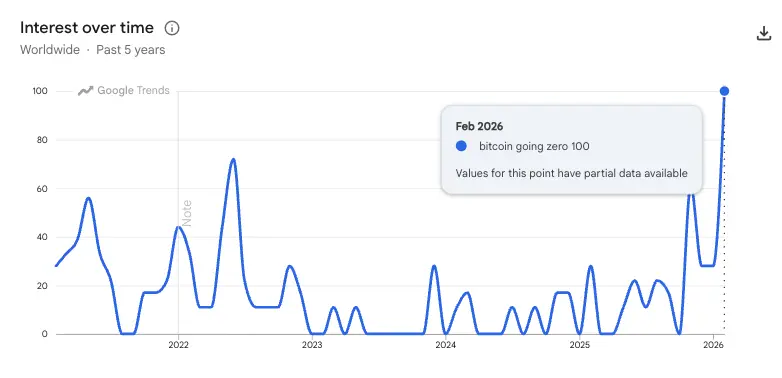

🚨 市场血洗:仅在60分钟内,加密货币市场蒸发了253亿美元!

极端波动严重清算了多头和空头仓位——请保持止损和风险管理!

查看原文极端波动严重清算了多头和空头仓位——请保持止损和风险管理!

- 赞赏

- 2

- 评论

- 转发

- 分享

🚨 CME集团将24/7!

机构巨头CME集团宣布,从5月29日起,他们的加密货币期货和期权交易将实现全天候交易。

现在,华尔街与加密市场之间的差距将永远被弥合!

查看原文机构巨头CME集团宣布,从5月29日起,他们的加密货币期货和期权交易将实现全天候交易。

现在,华尔街与加密市场之间的差距将永远被弥合!

- 赞赏

- 2

- 评论

- 转发

- 分享

🚨 白宫稳定币对决!

今天,白宫举行第三次高风险会议,Coinbase、Ripple 和大型银行将面对面,解决关于稳定币收益的持续僵局。

这是市场的重大日子;如果今天事情顺利,最终协议可能在3月1日前达成!

查看原文今天,白宫举行第三次高风险会议,Coinbase、Ripple 和大型银行将面对面,解决关于稳定币收益的持续僵局。

这是市场的重大日子;如果今天事情顺利,最终协议可能在3月1日前达成!

- 赞赏

- 2

- 评论

- 转发

- 分享

- 赞赏

- 2

- 1

- 转发

- 分享

KML_Crypto3 :

:

紧握 HODL,自己多做调研(DYOR)。🚨 最新消息:稳定币收益会议!

明天上午9点东部时间(印度标准时间晚上7:30),加密货币和银行业领导人关于稳定币收益的第三次重要会议将在白宫举行。预计将有重大更新!

查看原文明天上午9点东部时间(印度标准时间晚上7:30),加密货币和银行业领导人关于稳定币收益的第三次重要会议将在白宫举行。预计将有重大更新!

- 赞赏

- 点赞

- 评论

- 转发

- 分享

🚨 终身监禁于尹锡悦!

韩国前总统尹锡悦因于2024年12月实施戒严和煽动叛乱被判处终身监禁。

法院认定他破坏了宪法秩序。

他是韩国首位因如此严重罪行而被判刑的当选领导人。

查看原文韩国前总统尹锡悦因于2024年12月实施戒严和煽动叛乱被判处终身监禁。

法院认定他破坏了宪法秩序。

他是韩国首位因如此严重罪行而被判刑的当选领导人。

- 赞赏

- 2

- 评论

- 转发

- 分享

- 赞赏

- 1

- 评论

- 转发

- 分享

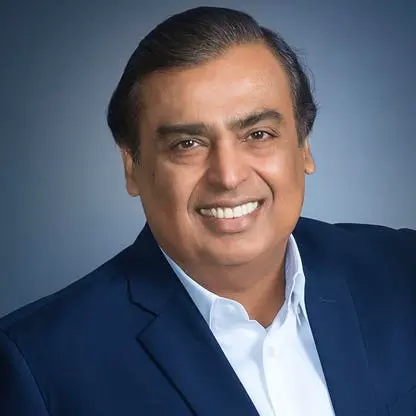

🚨 Ambani的AI革命:穆克什·安巴尼宣布投资$110 十亿,用于在印度建设AI基础设施!

查看原文

- 赞赏

- 2

- 2

- 转发

- 分享

dragon_fly2 :

:

钻石手 💎查看更多

- 赞赏

- 2

- 评论

- 转发

- 分享

🚨 印度对16岁以下未成年人禁用社交媒体吗?

继澳大利亚和法国之后,印度政府现在也在考虑对16岁以下儿童实施社交媒体禁令!

你认为16岁以下的儿童应该被禁止使用社交媒体吗?

查看原文继澳大利亚和法国之后,印度政府现在也在考虑对16岁以下儿童实施社交媒体禁令!

你认为16岁以下的儿童应该被禁止使用社交媒体吗?

- 赞赏

- 2

- 评论

- 转发

- 分享

🚨 OPENAI 在印度扩展:新办公室即将开启!继新德里之后,@OpenAI 现在将在孟买和班加罗尔开设新办公室。印度现已成为全球第二大 ChatGPT 用户群,每周用户数超过1亿((100万+用户)。他们还与塔塔集团达成了重要合作,以提升印度的人工智能基础设施。

查看原文

- 赞赏

- 2

- 评论

- 转发

- 分享

🚨 印度的黄金力量:超过美国储备!

印度家庭持有的黄金约为34,000+吨——是美国黄金储备的4倍!

自2025年1月1日以来,黄金价格已大幅上涨94%。

这些持有的总价值现已超过3.8万亿美元。

印度家庭持有的黄金约为34,000+吨——是美国黄金储备的4倍!

自2025年1月1日以来,黄金价格已大幅上涨94%。

这些持有的总价值现已超过3.8万亿美元。

查看原文

- 赞赏

- 1

- 评论

- 转发

- 分享

热门话题

查看更多24.31万 热度

86.92万 热度

1063.69万 热度

9.8万 热度

51.31万 热度

热门 Gate Fun

查看更多- 市值:$2448.27持有人数:10.00%

- 市值:$2444.82持有人数:10.00%

- 市值:$2441.37持有人数:10.00%

- 市值:$2434.48持有人数:00.00%

- 市值:$0.1持有人数:10.00%

置顶

福利加码,Gate 广场明星带单交易员二期招募开启!

入驻发帖 · 瓜分 $20,000 月度奖池 & 千万级流量扶持!

如何参与:

1️⃣ 报名成为跟单交易员:https://www.gate.com/copytrading/lead-trader-registration/futures

2️⃣ 报名活动:https://www.gate.com/questionnaire/7355

3️⃣ 入驻 Gate 广场,持续发布交易相关原创内容

丰厚奖励等你拿:

首帖福利:首发优质内容即得 $30 跟单体验金

双周内容激励:每双周瓜分 $500U 内容奖池

排行榜奖励:Top 10 交易员额外瓜分 $20,000 登榜奖池

流量扶持:精选帖推流、首页推荐、周度明星交易员曝光

活动时间:2026 年 2 月 12 日 18:00 – 2 月 24 日 24:00(UTC+8)

详情:https://www.gate.com/announcements/article/49849Gate 广场内容挖矿奖励继续升级!无论您是创作者还是用户,挖矿新人还是头部作者都能赢取好礼获得大奖。现在就进入广场探索吧!

创作者享受最高60%创作返佣

创作者奖励加码1500USDT:更多新人作者能瓜分奖池!

观众点击交易组件交易赢大礼!最高50GT等新春壕礼等你拿!

详情:https://www.gate.com/announcements/article/49802🏮 新年快乐,马上发财!Gate 广场 $50,000 红包雨狂降!

发帖即领,手慢无 👉 https://www.gate.com/campaigns/4044

🧨 三重惊喜,陪您红火过新年:

1️⃣ $50,000 红包雨:发帖即领,新用户 100% 中奖,单帖最高 28 GT

2️⃣ 马年锦鲤:带 #我在Gate广场过新年 发帖,抽 1 人送 50 GT + 新春礼盒

3️⃣ 创作者榜单赛:赢国米球衣、Red Bull 联名夹克、VIP 露营套装等豪礼

📅 2/9 17:00 – 2/23 24:00(UTC+8)

请将 App 更新至 8.8.0+ 版本参与

详情:https://www.gate.com/announcements/article/49773Gate 广场“新星计划”正式上线!

开启加密创作之旅,瓜分月度 $10,000 奖励!

参与资格:从未在 Gate 广场发帖,或连续 7 天未发帖的创作者

立即报名:https://www.gate.com/questionnaire/7396

您将获得:

💰 1,000 USDT 月度创作奖池 + 首帖 $50 仓位体验券

🔥 半月度「爆款王」:Gate 50U 精美周边

⭐ 月度前 10「新星英雄榜」+ 粉丝达标榜单 + 精选帖曝光扶持

加入 Gate 广场,赢奖励 ,拿流量,建立个人影响力!

详情:https://www.gate.com/announcements/article/49672