One of the most interesting developments in the TON ecosystem right now is how xStocks are redefining access to traditional markets through on-chain infrastructure.

For decades, exposure to equities has meant broker accounts, limited trading hours, custody risk and jurisdictional barriers. xStocks flip that model entirely. Built on TON, xStocks are tokenized representations of real world assets that live directly onchain. That means users don’t rely on a broker to hold assets on their behalf, they hold them directly in their own TON wallet. Self custody isn’t a feature here, it’s the default.

Another key advantage is 24/7 market access. Unlike traditional equities that follow fixed trading hours, xStocks can be bought, sold or integrated into DeFi strategies at any time. Markets no longer “close” liquidity stays alive around the clock.

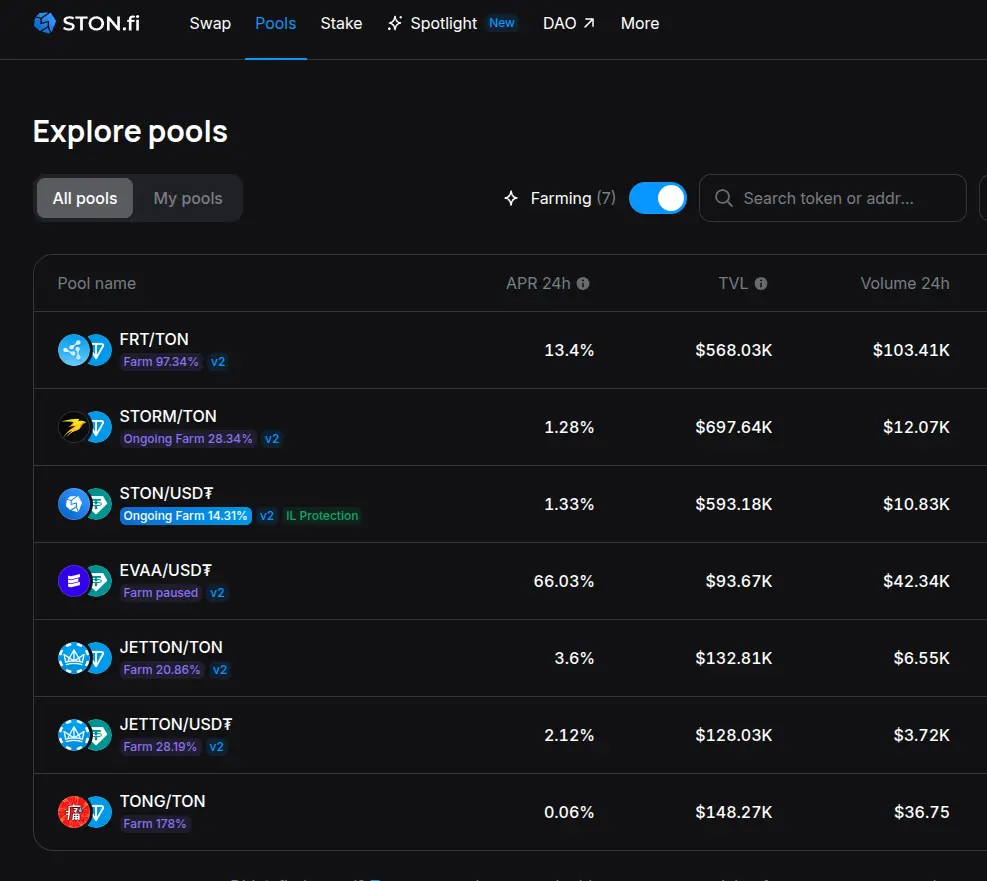

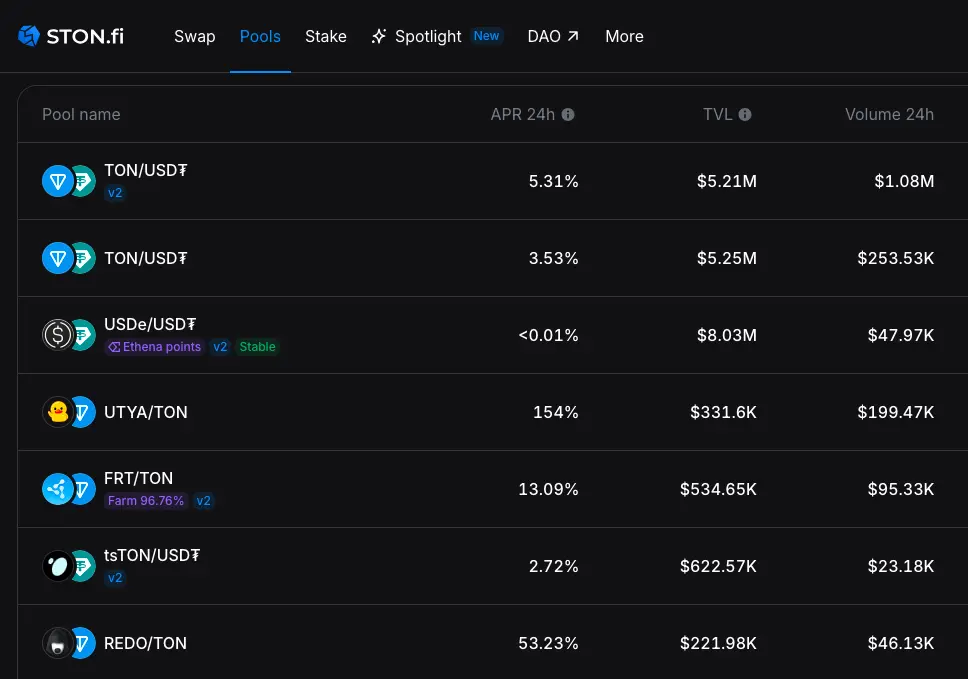

What really sets xStocks apart is how naturally they fit into the TON DeFi ecosystem. On platforms like STONfi, users can:

Swap TON based USDT directly into xStocks

Provide liquidity and earn rewards Use xStocks alongside other onchain assets Move between asset classes without leaving their wallet, This creates a seamless experience where crypto and traditional finance coexist inside the same liquidity rails. It’s also important to highlight the architecture:

STON fi acts purely as an interface. The xStocks themselves are issued and managed by independent, regulated third party providers, ensuring separation between infrastructure and asset issuance. This modular approach is critical for scalability, transparency, and long term trust.

Rather than asking whether tokenized equities will “pump,” the better question is:

How are people actually using them?

Are users holding xStocks as long-term exposure?

Trading them like crypto native assets?

Deploying them in DeFi strategies?

Or using them as a bridge between TradFi and onchain finance?

Those usage patterns will tell us whether “unified finance” is just a narrative or a real shift already in motion.

xStocks on TON don’t just offer access to equities.

They offer a new financial primitive, where ownership, liquidity, and composability exist without intermediaries.

For decades, exposure to equities has meant broker accounts, limited trading hours, custody risk and jurisdictional barriers. xStocks flip that model entirely. Built on TON, xStocks are tokenized representations of real world assets that live directly onchain. That means users don’t rely on a broker to hold assets on their behalf, they hold them directly in their own TON wallet. Self custody isn’t a feature here, it’s the default.

Another key advantage is 24/7 market access. Unlike traditional equities that follow fixed trading hours, xStocks can be bought, sold or integrated into DeFi strategies at any time. Markets no longer “close” liquidity stays alive around the clock.

What really sets xStocks apart is how naturally they fit into the TON DeFi ecosystem. On platforms like STONfi, users can:

Swap TON based USDT directly into xStocks

Provide liquidity and earn rewards Use xStocks alongside other onchain assets Move between asset classes without leaving their wallet, This creates a seamless experience where crypto and traditional finance coexist inside the same liquidity rails. It’s also important to highlight the architecture:

STON fi acts purely as an interface. The xStocks themselves are issued and managed by independent, regulated third party providers, ensuring separation between infrastructure and asset issuance. This modular approach is critical for scalability, transparency, and long term trust.

Rather than asking whether tokenized equities will “pump,” the better question is:

How are people actually using them?

Are users holding xStocks as long-term exposure?

Trading them like crypto native assets?

Deploying them in DeFi strategies?

Or using them as a bridge between TradFi and onchain finance?

Those usage patterns will tell us whether “unified finance” is just a narrative or a real shift already in motion.

xStocks on TON don’t just offer access to equities.

They offer a new financial primitive, where ownership, liquidity, and composability exist without intermediaries.