Gate Ventures Weekly Crypto Recap (August 11, 2025)

Gate Ventures

TL;DR

- The impact of bond issuance is accumulating, and the trend of fiscal dominance could accelerate in the coming months.

- This week’s economic data includes US CPI, PPI, retail sales, industrial production and UoM sentiment data.

- ETH rose above $4,300 (+6.6% WoW) and BTC topped $122,000 (+22% WoW); ETH/BTC rebounded to 0.0035 but remains well below its previous cycle peak.

- Total crypto market cap hit $4T, with $1.05T excluding BTC and ETH; altcoins continue to underperform majors.

- Towns Protocol launched but has seen slow ecosystem and user growth despite a strong founder background and dual a16z backing.

- Succinct, a leading zk co-processor project, delivered the strongest TGE performance in its sector with a $1.4B FDV and dual Paradigm investments.

- Chainlink introduced the Strategic LINK Reserve to support long-term network growth.

- Verb Technology to become the first public TON Treasury Asset following a $558M raise.

- ParaFi and Pantera joined a $217M round for Satsuma’s Bitcoin treasury and AI strategy.

- Most funded projects are in the infrastructure sector.

Macro Overview

The impact of bond issuance is accumulating, and the trend of fiscal dominance could accelerate in the coming months.

The impact of bond issuance is accumulating, and risks may surface by September, potentially forcing the Fed to implement QE or something similar. According to the latest guidance from the Treasury Borrowing Advisory Committee, the US Treasury is expected to net issue $1tn in treasuries between July and September, including $470bn in long-term bonds. By the end of September, the Treasury aims to replenish the TGA to $850bn, up from the current level of approximately $410bn. This implies that around $440 billion in reserves will be drained. If the Fed continues QT over the next two months, it will drain more in reserves, potentially some position below the ample reserve line of $3.05tn.

The trend of fiscal dominance could accelerate in the coming months. If the US economy remains stable, inflation rises and dollar liquidity tightens, it will be difficult for Treasury yields to stay low. This would conflict with the Trump administration’s policy goals and could prompt greater intervention in monetary policy. The market is speculating that Trump may nominate Kevin Warsh to accelerate dovish changes. If the Fed continues QT, it will lock in high interest rates on newly issued bonds, decreasing the effectiveness of deficit spending. Fiscal authorities may bypass the Fed to implement measures to control the yields.

US inflation data will be published on Tuesday for an update on July inflation conditions. The front-running data are therefore suggesting that CPI may rise to over 4% in the coming months. Retail sales and industrial production data will also be anticipated with PMI data showing an upturn in services activity, supporting better retail sales reading. Manufacturing production slowed from June. Business optimism has gone to among the lowest level since the pandemic, reflecting suppressed confidence among private sector firms ahead of the UoM sentiment update.

DXY

The dollar index dropped slightly last week, as the traders started to bet on more rate cuts and more aggressive monetary strategies this year.

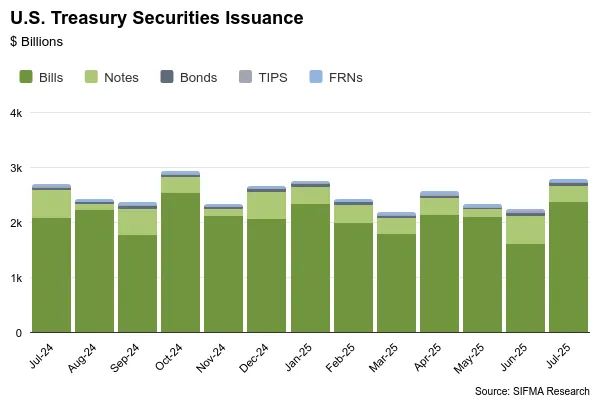

US Treasury Security Issuance

The US Treasury’s total security issuance significantly recovered last month, due to the easing of the debt ceiling and passing the OBBBA. The majority of issued securities are bills, followed by short-term notes and other financial instruments.

Gold

Gold prices remained a stable but upward position last week and approached the $3,400 line. As the US and Russia are set to meet in Alaska and the US Gov is planning on changing the Fed’s Chairman, the investors are still in favour of safe-haven assets.

Crypto Markets Overview

1. Main Assets

BTC Price

ETH Price

ETH/BTC Ratio

Last week, ETH broke above $4,300 and BTC surged past $122,000, posting week-on-week gains of 6.6% and 22%, respectively, as of Monday. The ETH/BTC exchange rate also rebounded to 0.0035, still far below the previous cycle’s peak of 0.0085. Likewise, SOL/ETH fell to 0.0043. As we anticipated, most off-exchange inflows were directed toward ETH, while on-exchange altcoins saw only limited capital inflows. Meanwhile, BTC spot ETFs recorded net inflows, and ETH spot ETFs saw inflows of 207,800 ETH.

2. Total Market Cap

Crypto Total Marketcap

Crypto Total Marketcap Excluding BTC and ETH

As of this Monday, the total cryptocurrency market capitalization stood at $4 trillion. Excluding BTC and ETH, the aggregate market cap was $1.05 trillion, representing week-on-week increases of 8.6% and 8%, respectively. Altcoins continued to underperform major tokens in terms of price gains.

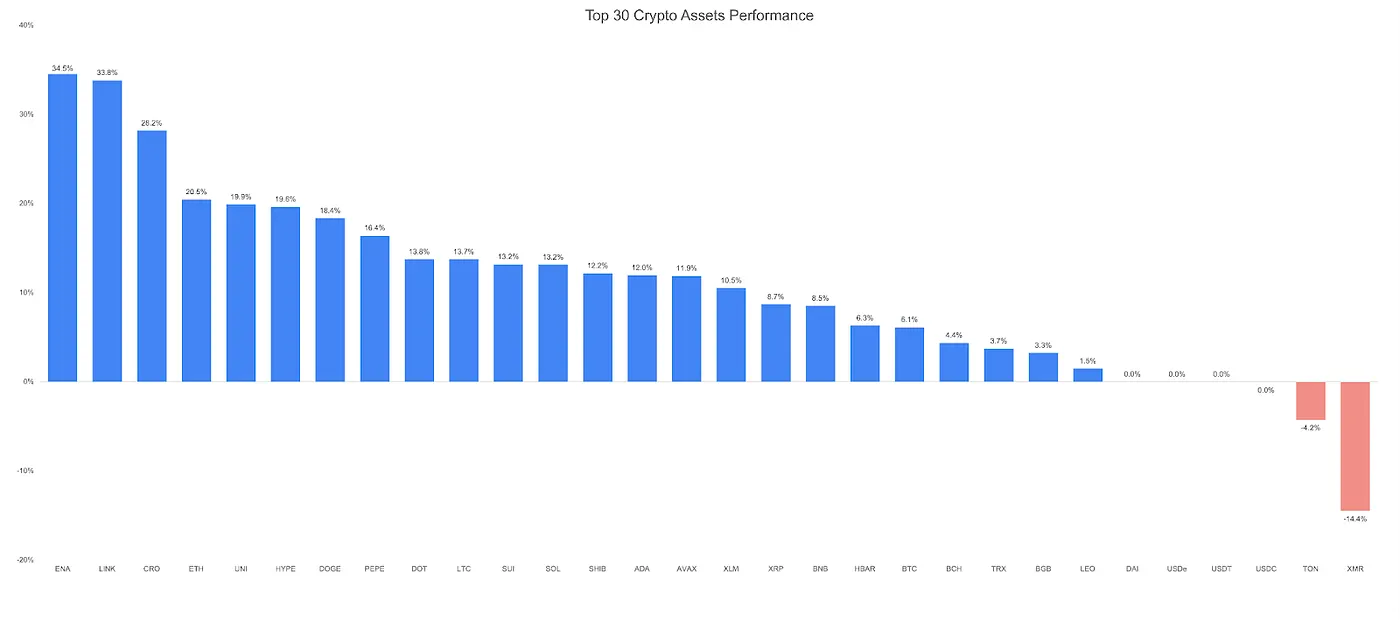

3. Top 30 Crypto Assets Performance

Source: Coingecko and Gate Ventures, as of 11st August 2025

Last week, most of the top 30 tokens posted gains, with ETH rising more than 20%, UNI up 20%, and SOL advancing 13%. Despite the broad-based uptick, price movements for most tokens were relatively muted. ETH, however, reached a new high for the current cycle, with its growth trajectory closely resembling that of BTC last year.

4. New Token Launched

The most notable new token listings last week were Towns Protocol and Succinct.

Towns Protocol is a decentralized group chat platform that was led by a16z in both its Series A and Series B rounds. However, as a social application, the barriers to achieving scale are particularly high, and its current ecosystem and user growth remain lackluster — largely in line with expectations. The project boasts a strong team background: its founder spent seven years at Sequoia Capital and also worked at Benchmark, which may explain a16z’s decision to invest twice.

Succinct, by contrast, is a well-known player in the zk co-processor vertical. The past two months have seen a wave of token generation events (TGEs) in this segment, including Delphinus and Lagrange. Among them, Succinct has delivered the strongest performance, with a fully diluted valuation (FDV) of $1.4 billion. It has also been backed by Paradigm in two separate investment rounds.

The Key Crypto Highlights

1. Chainlink launches Strategic LINK Reserve to fuel long-term network growth.

Chainlink has unveiled a strategic LINK reserve, designed to bolster the long-term growth, security, and sustainability of its decentralized oracle network. The reserve is funded by both offchain enterprise payments, from clients such as Swift, Euroclear, Mastercard, UBS, and Aave, and onchain service revenue from DeFi and cross-chain integrations. The program began by acquiring over $1M worth of LINK during its initial phase. Payments for Chainlink services, whether in stablecoins or other formats, are programmatically converted into LINK using decentralized exchanges. This “payment abstraction” mechanism ensures that all revenue sources, including large-scale institutional adoption, directly contribute to the reserve.

The reserve will remain untouched for several years, allowing steady accumulation as Chainlink’s global footprint expands. With hundreds ofMs in historical revenue and a key role in powering tens of trillions in transaction value across DeFi, banking, RWAs, and cross-chain use cases, Chainlink’s move signals a deliberate strategy to link commercial growth with native token demand.

2. Verb Technology to become first public TON Treasury Asset after $558M raise

Verb Technology Company saw its stock surge over 200% intraday on Monday after announcing a $558M PIPE financing and a strategic pivot into crypto. The social commerce firm will rebrand as TON Strategy Co., becoming the first publicly traded company to hold Toncoin as its primary treasury asset. Proceeds will fund the acquisition and staking of Toncoin to generate yield and align with institutional demand for blockchain-native reserves.

The deal was led by Kingsway Capital, whose CEO Manuel Stotz also serves as president of the TON Foundation and will assume the role of executive chairman at TON Strategy Co. Other backers include Blockchain.com, Vy Capital, Animoca Brands, and The Open Platform (TOP); all of which maintain direct partnerships with the TON Foundation in areas such as gaming, tokenized assets, and Telegram-integrated Mini Apps.

Verb’s move reflects a broader crypto treasury trend among public companies, with recent corporate raises targeting assets like ETH, TRX, BNB, SUI, and SOL. In late July alone, at least 16 companies disclosed plans to deploy over $7.8B into cryptocurrencies, signaling accelerating institutional adoption beyond Bitcoin.

3. ParaFi, Pantera Join $217M funding for Satsuma’s Bitcoin treasury and AI strategy

Satsuma Technology PLC (LSE:SATS) has completed a £163.6M ($217M) oversubscribed capital raise, issuing its second secured convertible loan note with significant settlement in Bitcoin. Initially targeting £100M, demand exceeded expectations by over 60% before books closed on 28 July.

The round was led by ParaFi Capital and joined by Pantera Capital, Blockchain.com, Kraken, Arrington Capital, and Digital Currency Group, alongside major London-based institutional equity funds managing over £300B in assets. The notes, convertible at 1p per share pending shareholder approval, would substantially increase Satsuma’s share count upon full conversion.

In a first for the London market, £96.9M, equivalent to 1,097.29 BTC was settled in cryptocurrency, aligning with Satsuma’s Bitcoin-native treasury strategy. These BTC holdings are managed by the company’s Singapore subsidiary, the raise a “landmark validation” of the firm’s vision at the intersection of decentralised AI and Bitcoin treasury management. To boost transparency, Satsuma will release unaudited interim results on 6 August and publish monthly updates, an uncommon disclosure commitment for public companies in emerging asset classes.

Key Ventures Deals

1. Perle secures $9M Seed Funding to enhance AI training via blockchain Incentives

Web3-AI startup Perle has raised $9M in a Seed round led by Framework Ventures, project previously raised $8.5M in an October 2024 pre-seed led by CoinFund, bringing its total funding to $17.5M. The capital will launch Perle Labs, a blockchain-based platform that rewards users for providing accurate, high-quality datasets to train AI models.

Perle’s approach uses onchain attribution and cryptoeconomic incentives to encourage global participation in AI data curation. By tapping human reviewers for rare, ambiguous, or context-specific scenarios, Perle aims to address AI’s “long tail” problem, where models struggle with edge cases. Decentralizing human feedback will reduce bias and improve model performance. Framework’s Vance Spencer added that AI progress will depend more on better structured data than simply scaling model parameters. Unlike closed-source AI leaders such as Anthropic, OpenAI, and xAI, Perle focuses on verifiable, high-quality human feedback. Its forthcoming self-serve platform will cover the full AI development lifecycle, from multimodal data collection (audio, image, text) to model fine-tuning.

2. Euphoria raises $7.5M to simplify derivatives trading experience on MegaETH

Euphoria, a MegaETH-based crypto derivatives platform, has raised $7.5M from over 100 investors, including Karatage, Figment Capital, Robot Ventures, and angels like Kain Warwick and Santiago Santos. The funding combines a $2.5M Pre-Seed (Nov 2024) and a $5M seed (Feb & Jul 2025) via SAFE + token warrants, valuing Euphoria in the upper >$100M post-money.

The startup is developing a mobile-first “tap trading” interface for options and perpetuals, aiming to remove technical barriers like order book navigation, margin management, and leverage calculations. Instead, users tap a grid predicting price targets, making derivatives trading as intuitive as casual mobile gaming. Derivatives account for ~80% of all crypto trading volume, yet remain inaccessible to most retail users. Euphoria’s UX is inspired by how Robinhood democratized stock options trading, with a revenue model combining market-making and trading fees, similar to Hyperliquid

3. Pantera led $20M raise for OpenMind’s decentralized OS for robots

Pantera Capital is leading a $20M funding round for OpenMind, a robotics and AI startup developing a decentralized operating system for intelligent machines. Other backers include Coinbase Ventures, Digital Currency Group, and Ribbit Capital.OpenMind’s flagship product, FABRIC, is a hardware-agnostic operating system designed to enable seamless integration of AI-enabled robots into everyday environments.

Acting as a coordination protocol, FABRIC allows robots from different manufacturers to communicate, share location and context, and collaborate on tasks regardless of origin or operating environment. Current robotics ecosystems are siloed. FABRIC aims to create an open, secure “nervous system” for machines, enabling them to reason, act, and evolve together, similar to how the internet connects disparate computers. By removing interoperability barriers, OpenMind seeks to establish a shared, secure network where robotic systems can coordinate efficiently, expanding AI-driven automation across industries.

Ventures Market Metrics

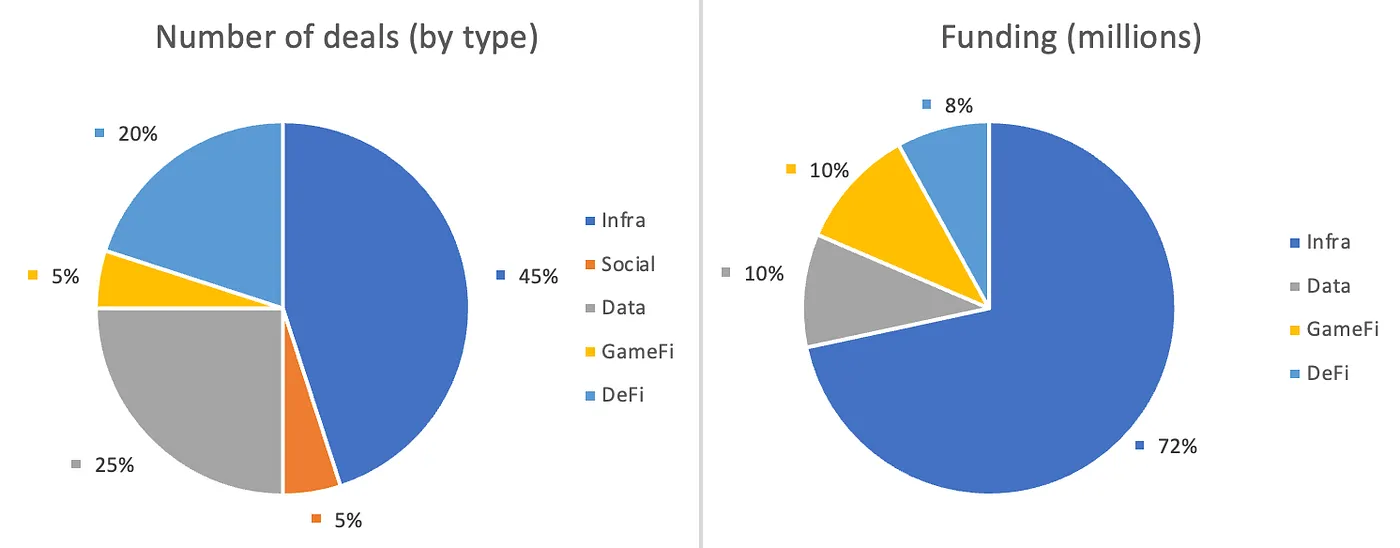

The number of deals closed in the previous week was 20, with Infra having 9 deals, representing 45

% for each sector of the total number of deals. Meanwhile, Social had 1 (5%), Data had 5 (25%), Gamefi had 1 (5%) and DeFi had 4 (20%) deals.

Weekly Venture Deal Summary, Source: Cryptorank and Gate Ventures, as of 11th Aug 2025

The total amount of disclosed funding raised in the previous week was $143, 30% deals (6/20) in previous week didn’t public the raised amount. The top funding came from Infra sector with $315M. Most funded deals: OpenMind $20M; Mantra ($OM) $20M.

Weekly Venture Deal Summary, Source: Cryptorank and Gate Ventures, as of 11th Aug 2025

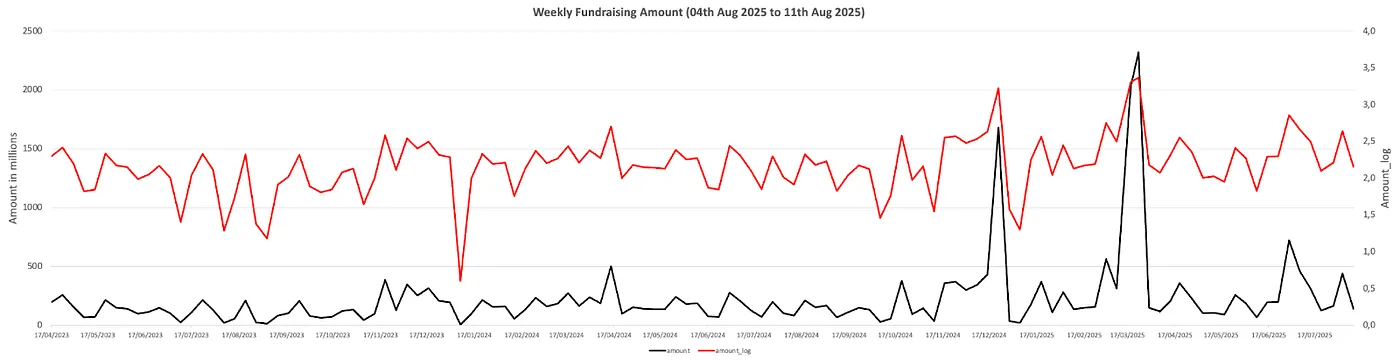

Total weekly fundraising rose to $143M for the 2nd week of Aug-2025, a decrease of -67% compared to the week prior. Weekly fundraising in the previous week was up +43% year over year for the same period.

About Gate Ventures

Gate Ventures, the venture capital arm of Gate, is focused on investments in decentralized infrastructure, middleware, and applications that will reshape the world in the Web 3.0 age. Working with industry leaders across the globe, Gate Ventures helps promising teams and startups that possess the ideas and capabilities needed to redefine social and financial interactions.

Website: http://gate.com/ventures

The content herein does not constitute any offer, solicitation, or recommendation. You should always seek independent professional advice before making any investment decisions. Please note that Gate Ventures may restrict or prohibit the use of all or a portion of the services from restricted locations. For more information, please read its applicable user agreement.

Thanks for your attention.

แชร์

เนื้อหา