Ethereum Price Prediction: ETH Stablecoin Inflows Signal Potential 2026 Breakout

Preface

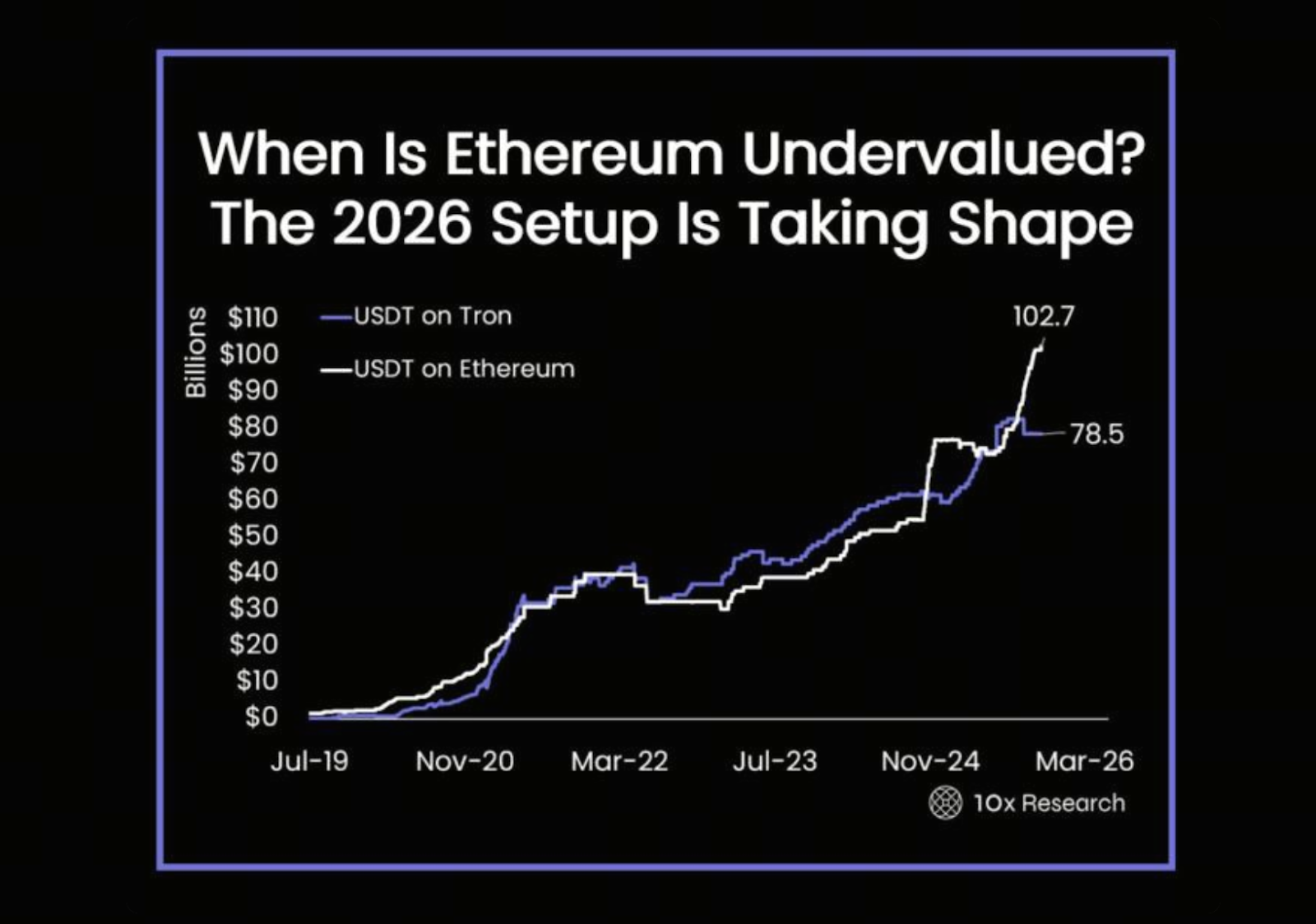

Data from 10x Research indicates that stablecoin inflows and staking activity are forming a significant structural trend, potentially setting the stage for ETH’s next major bull run in 2026.

Stablecoin Inflows Point to Capital Returning to Ethereum

Although ETH’s recent price action has been subdued, on-chain liquidity paints a different picture. According to 10x Research, since Trump’s election, the supply of USDT (Tether) on Ethereum has surged from $54 billion to over $102 billion—nearly doubling. This influx of capital has quietly entered the Ethereum ecosystem, largely under the market’s radar.

(Source: 10x Research)

In contrast, Tron—long the dominant chain for stablecoin activity thanks to low fees—has started to lose ground. The steady increase of USDT on Ethereum signals a return of capital to the platform, laying the foundation for the next potential market recovery.

Institutional Investors Are Eyeing Ethereum

This capital return is driven by broader regulatory and institutional trends. The new U.S. administration’s crypto policy emphasizes transparency and on-chain activity, aligning with Ethereum’s core strengths. Meanwhile, staking providers like P2P Validator—managing more than $10 billion in assets—are streamlining the staking process for institutions and enhancing security. This positions Ethereum as a central portfolio component for both liquidity and yield generation. As market confidence returns, these factors could further drive ETH prices upward.

A Potential 2026 Breakout Is Taking Shape

While ETH’s price movement currently appears quiet, Ethereum is steadily building a structure that favors a significant breakout—supported by strong network fundamentals, liquidity, staking activity, and positive regulatory momentum.

Historically, the largest rallies often emerge from periods of market calm. ETH is currently trading near $3,580, holding above the $3,200 support level. If the recovery continues, key resistance points to watch include $3,650, $3,710, and $3,920.

Start ETH spot trading now: https://www.gate.com/trade/ETH_USDT

Conclusion

While Ethereum’s recent surface calm may be deceiving, the convergence of stablecoin inflows, increased institutional participation, and supportive policy is quietly preparing the ground for a major rally in 2026. Short-term traders can focus on key support and resistance levels, while long-term observers should monitor ecosystem developments and capital flows to capture the next breakout opportunity.

Related Articles

Pi Coin Transaction Guide: How to Transfer to Gate.io

Flare Crypto Explained: What Is Flare Network and Why It Matters in 2025

How to Use a Crypto Whale Tracker: Top Tool Recommendation for 2025 to Follow Whale Moves

What is N2: An AI-Driven Layer 2 Solution

2025 BTC Price Prediction: BTC Trend Forecast Based on Technical and Macroeconomic Data