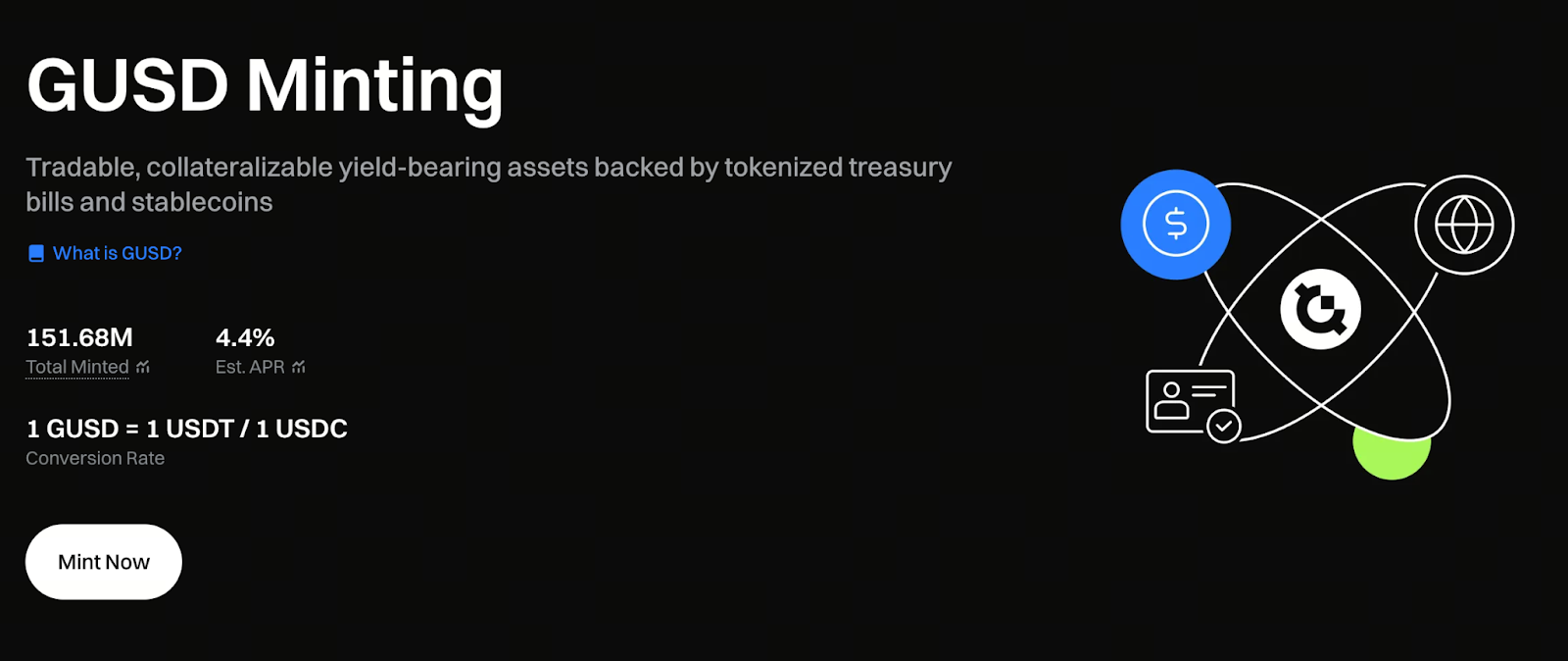

GUSD: Transforming Stablecoins from Passive Storage to Active Growth

Stablecoins: Evolving from Safe Havens to Yield-Generating Assets

Historically, stablecoins in the crypto market have acted as safe harbors for capital—pegged to the US dollar, they primarily facilitated risk management and transaction settlement. The integration of DeFi and real-world assets (RWA) is quietly reshaping the role of stablecoins.

GUSD preserves the core value peg of traditional stablecoins and introduces a yield mechanism, empowering holders to earn additional returns while maintaining stability. This transforms holding from a passive state into an intelligent asset experience that grows naturally over time.

Real-World Asset-Powered Returns

GUSD’s architecture transparently brings the interest structure of traditional financial markets on-chain. Its yield is drawn from actual low-risk financial instruments such as US short-term Treasury bills and high-grade corporate paper, not speculative models.

This approach delivers two key benefits for GUSD:

- Price Stability — A 1:1 peg to the US dollar ensures minimal volatility.

- Real Yield — Interest paid is backed by tangible, off-chain assets.

For crypto investors seeking reliable returns, GUSD operates as a yield-generating dollar. This expands the possibilities for stablecoins, enabling both stability and growth.

Flexible Entry Methods

GUSD provides two streamlined entry options for different investor profiles:

- Instant Exchange Conversion: Swap USDT or other stablecoins for GUSD in seconds—perfect for fast movers.

- On-chain smart contract minting: Use smart contracts to mint GUSD at a 1:1 ratio, participate directly in RWA yield distribution, and enjoy transparent on-chain returns.

Whether you’re a long-term strategist or a short-term arbitrageur, you can adjust your entry and exit to balance yield and liquidity.

Start minting GUSD now and earn annualized returns daily: https://www.gate.com/staking/GUSD?gt_disable_intercept_jump=1

Yield Structure

GUSD features an accumulating interest model with periodic settlements.

For example:

If you mint GUSD using 100 USDT and the underlying annualized yield is 20%, you will redeem approximately 120 USDC at maturity.

Returns accumulate automatically over time—no manual action needed. Users benefit from the steady returns of traditional bonds combined with DeFi’s flexibility, allowing assets to appreciate naturally.

Enabling Diverse On-Chain Financial Applications

GUSD transcends the yield-generating stablecoin category, serving as a foundational component for Web3 finance. Today, GUSD powers a wide range of on-chain use cases:

- Staking and Lockup: Earn extra rewards for long-term holding.

- Community Engagement and Airdrops: Incentivize early adopters and contributors.

- DeFi Module Integration: Deploy in lending, margin trading, launchpools, yield pools, and more.

These applications make GUSD a catalyst for on-chain financial activity—moving stablecoins from static wallet holdings to dynamic participants in capital flows and value creation.

GUSD’s Three Key Advantages

- Clear long-term holding rewards

GUSD rewards duration—the longer you hold, the greater your interest, making it ideal for long-term portfolio strategies.

- High liquidity and flexible access

Supports both exchange and on-chain operations for instant purchase or redemption, ensuring your funds remain accessible.

- Robust ecosystem integration

GUSD functions seamlessly across DeFi platforms, maximizing asset utility and efficient circulation.

These three advantages make GUSD not just a stablecoin, but a growth engine for on-chain finance.

Risk and Compliance Statement

This material is for general informational purposes only and is not investment advice. Before engaging with GUSD or any yield-focused stablecoin product, users should thoroughly understand all risks, yield structures, and platform policies, and consult with a professional financial advisor.

User Agreement: https://www.gate.com/legal/user-agreement

Conclusion

GUSD signals a new era for stablecoins, ushering in yield generation backed by real assets and on-chain interest distribution. It transforms the dollar’s value from static preservation to steady, time-based growth. As Web3 financial infrastructure matures, GUSD stands as both a stablecoin and a bridge between traditional finance and decentralized innovation—enabling every dollar to actively generate value.

Related Articles

Pi Coin Transaction Guide: How to Transfer to Gate.io

Flare Crypto Explained: What Is Flare Network and Why It Matters in 2025

How to Use a Crypto Whale Tracker: Top Tool Recommendation for 2025 to Follow Whale Moves

What is N2: An AI-Driven Layer 2 Solution

2025 BTC Price Prediction: BTC Trend Forecast Based on Technical and Macroeconomic Data