オプション週間レポート – 11月3日:年末の市場戦略が形成される中、インプライド・ボラティリティが後退

レポート発行日:2025年11月3日。掲載されている意見および情報は参考資料としてご利用ください。投資助言ではありません。推奨戦略として、BTCリバース・ブル・カレンダー・スプレッドをおすすめします。期間限定でオプション取引の手数料が割引されます、https://www.gate.com/zh/campaigns/3109

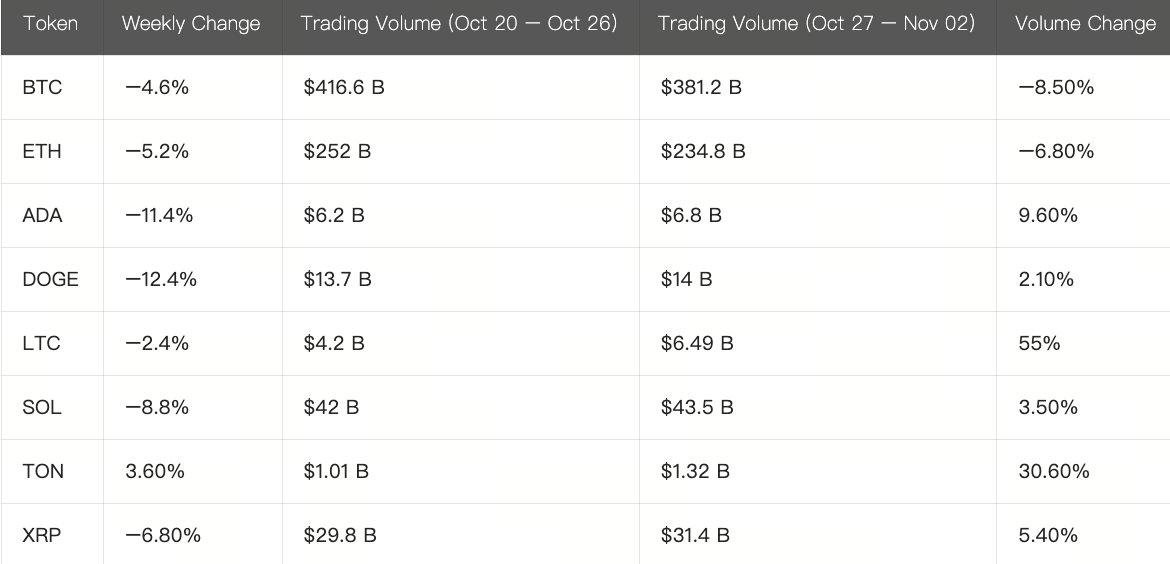

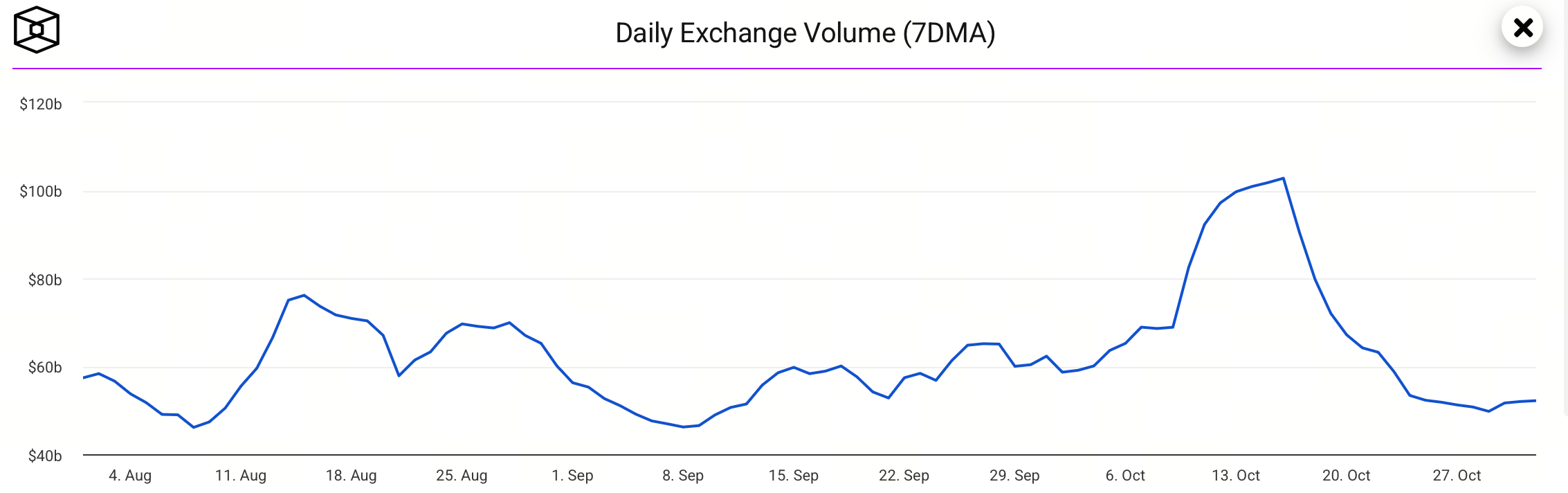

2週連続の急落を経て、全市場の7日間平均現物取引高は低水準で横ばいとなっています。

10月末時点で、市場は概ね安定しているものの、明確な方向感を欠いた状態です。投資家は現在、2つの主要な材料を受けて次の展開を探っています。ひとつは10月末に発表された利下げ、もうひとつは世界2大経済国首脳会談による貿易緩和シグナルです。両イベントは短期的なリスク選好の形成に決定的な影響を及ぼしました。

過去1週間(10月27日〜11月3日)は、政府機関閉鎖の長期化で主要経済指標が公表されず、政策の透明性が低下しました。その結果、市場は12月利下げへの警戒感を強め、25ベーシスポイントの利下げ確率は約90%から67.3%まで低下しています。

こうした不透明感にもかかわらず、10月の取引高は回復し、市場活動が完全に停滞していないことが示されました。

資金フロー面では、現在の流入はより規律的で機関主導型が中心です。たとえば年初来のスポットBitcoin ETFへの純流入は価格ファンダメンタルズを支えていますが、同時にBlackRockなどの主要商品への依存度の高さも明らかとなっています。一部取引日における短期純流出は、資本フローの脆弱性と集中リスクを示します。今後、純流入がより多様な商品や運用者に分散すれば、市場の持続力は一段と高まるでしょう。

取引戦略は引き続きイベント主導型を維持し、不透明な局面ではポジション管理を徹底。オプション戦略(ボラティリティ買い・プロテクティブプット)を優先するか、小口で段階的にポジションを構築して流動性と方向性リスク双方に対応してください。

Bitcoin (BTC) オプション市場サマリー

BTC現物の動向:直近1週間、Bitcoinは$108,000〜$115,000の下落チャネルで推移し、高値圏での保ち合いと短期的な下値試しの展開となりました。週半ばには$108,000付近のサポートが複数回試され、短期的な買いが入り吸収力の健在さが示されました。$115,000〜$120,000ゾーンでは強い抵抗が続き、突破にはさらに強力な資本流入や好材料が不可欠です。

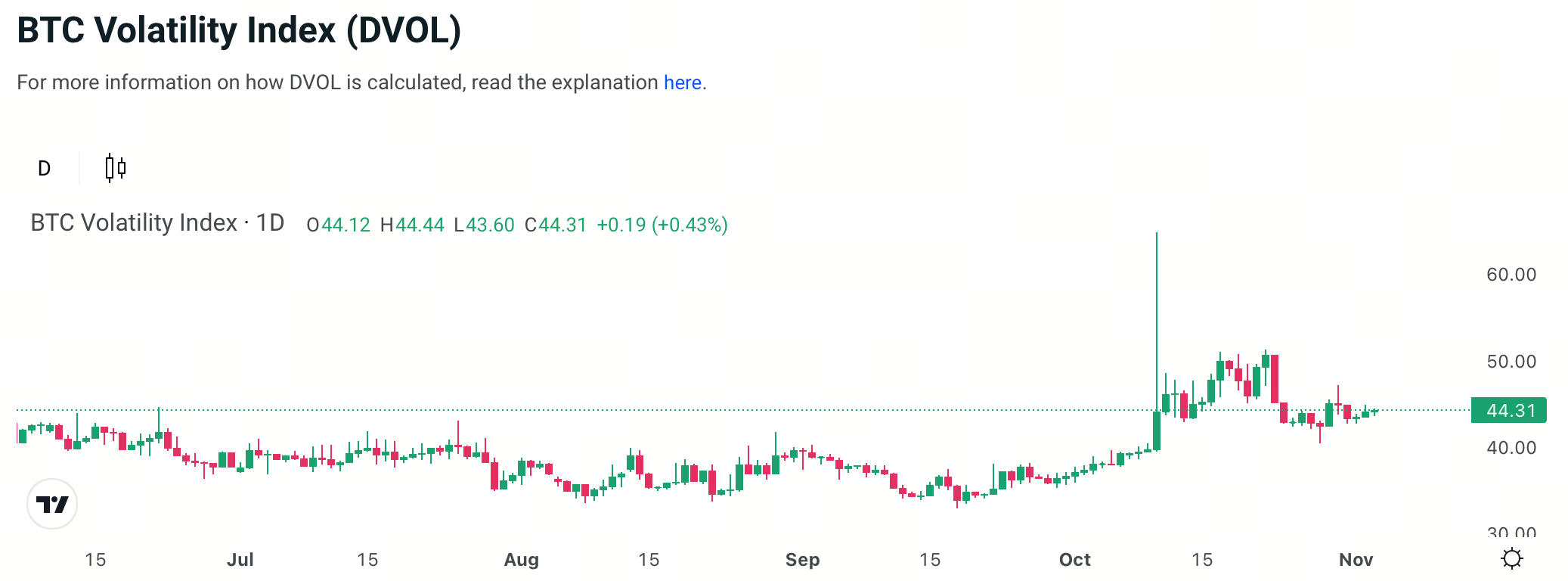

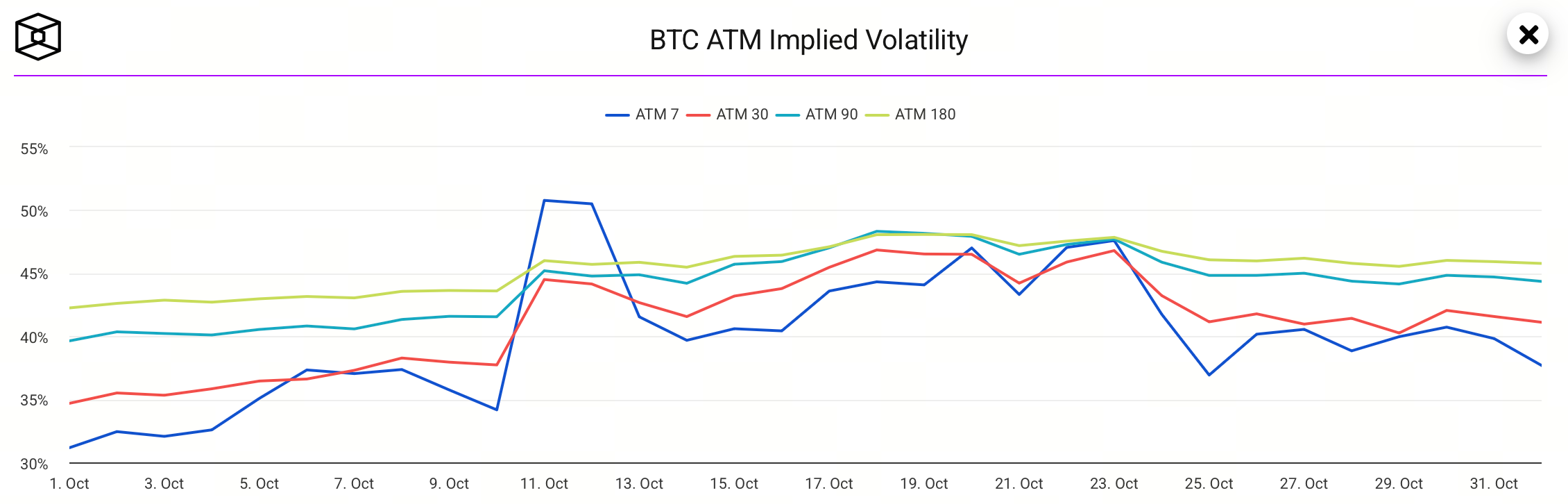

オプション市場:最新公開データによるBTCインプライド・ボラティリティ(IV)は44.3%となり、直近高値からの反落後に安定。今後の価格変動は収束傾向が見込まれます。

短期・長期IVのスプレッドは正常化しており、市場は短期ボラティリティへの対応をより合理的に進めています。

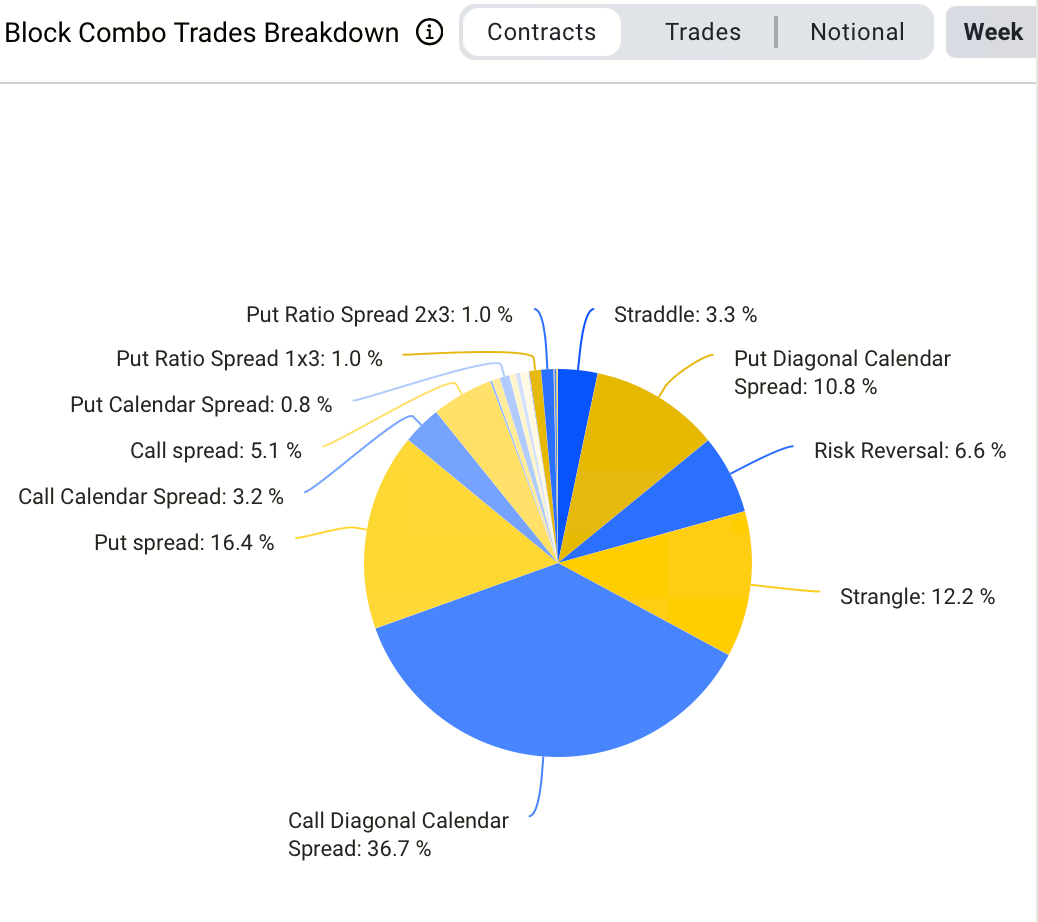

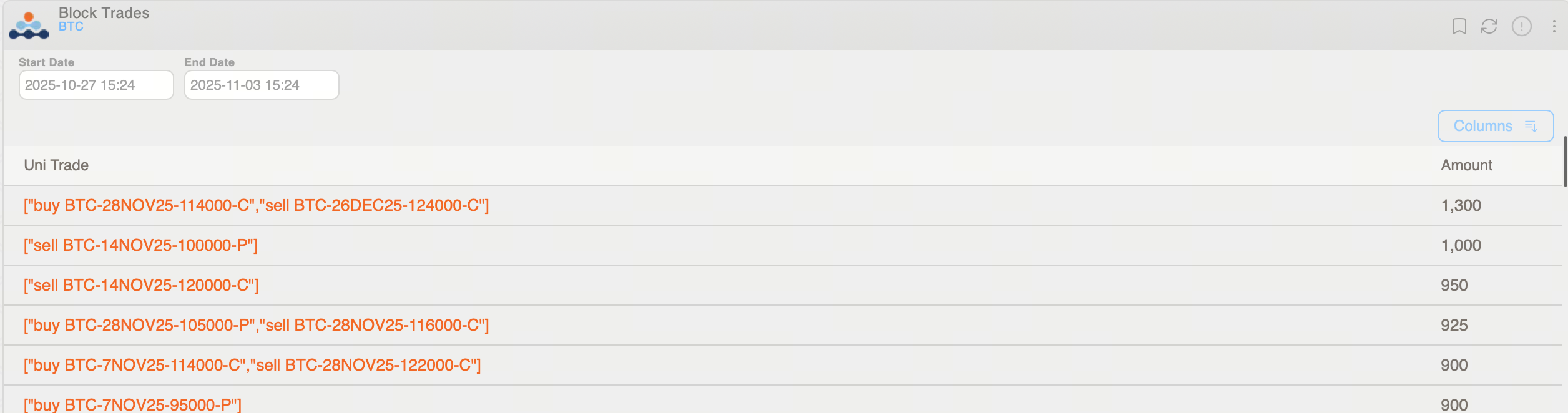

ブロック取引では、今週最も多かった戦略が強気カレンダースプレッドで、取引全体の36.7%を占めました。最大規模のブロック取引はBTC 1,300枚:BTC-281125-114000-C買いとBTC-261225-124000-C売りによる逆強気カレンダースプレッドで、プレミアム支払いは$9,200,000。短期上昇に賭ける一方、ボラティリティをショートする戦略です。

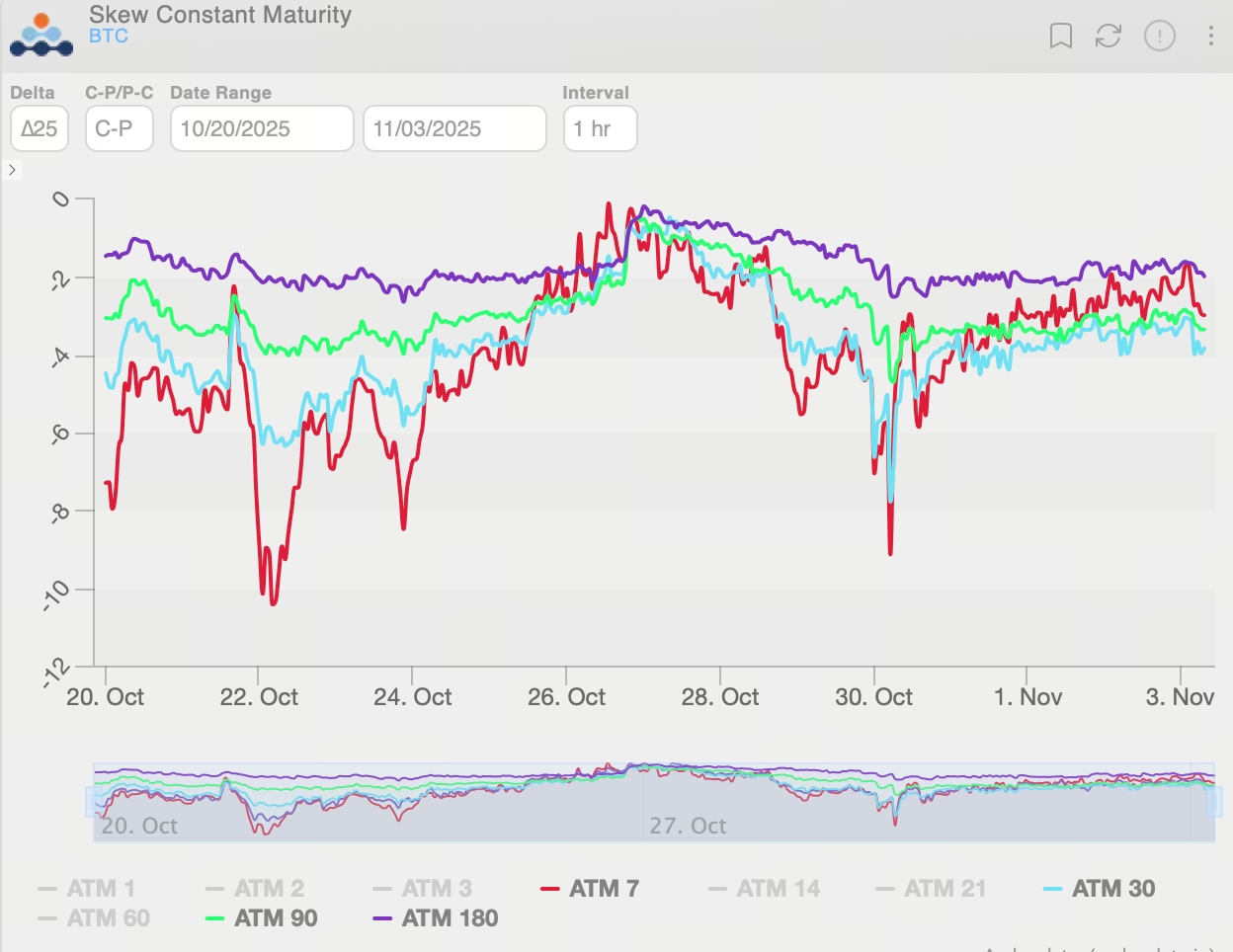

BTCオプションの25デルタ・スキューは週を通じてマイナスを維持し、下落リスクへのヘッジが継続。スキューの期間構造はフラット化し、短期的な弱気ヘッジ需要の増加が見られます。

まとめとして、長期BTCオプションは引き続き弱気で、機関投資家は積極的なロングよりリスクヘッジに注力。市場見通しは中長期的に慎重姿勢が続きます。

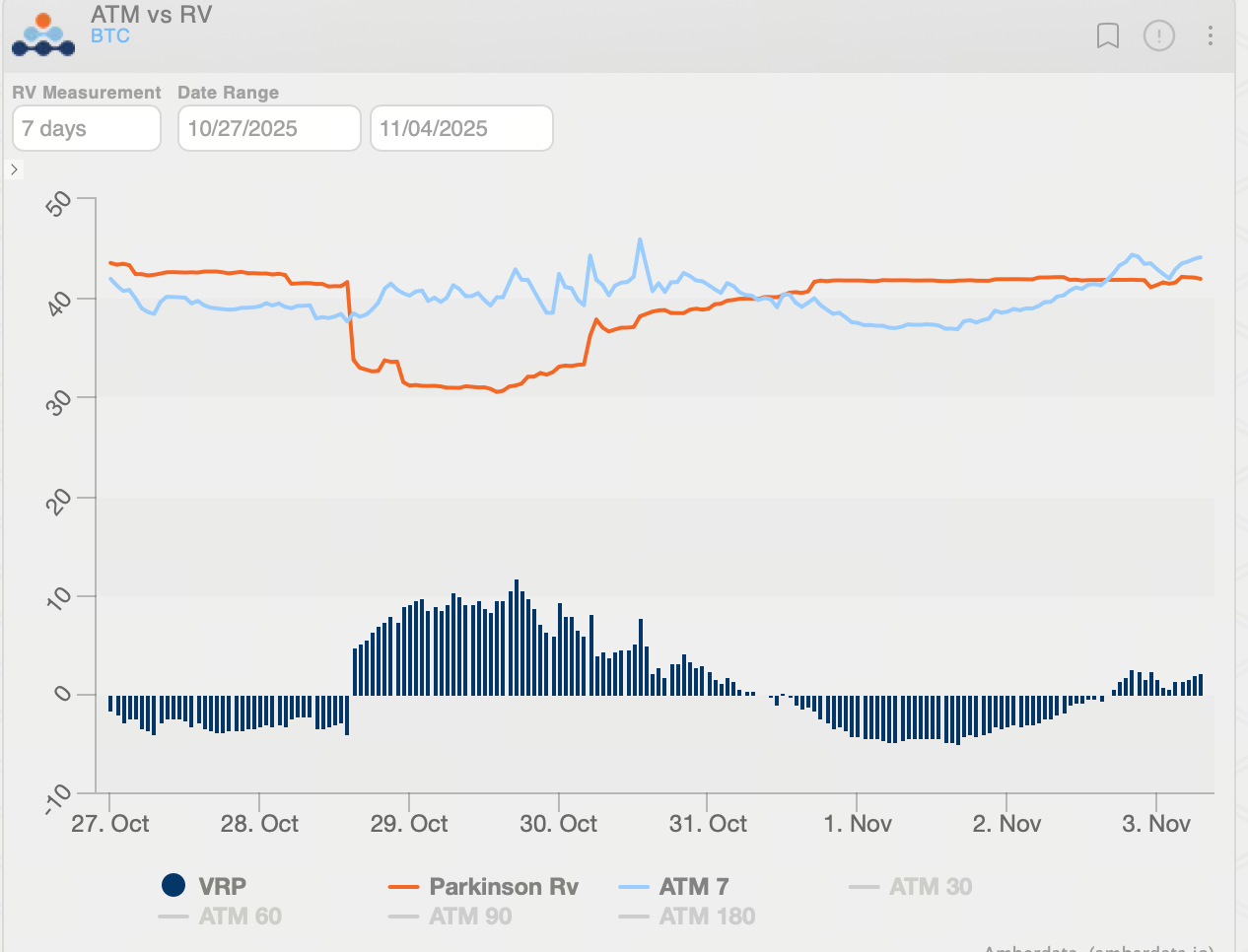

Bitcoin(BTC)の実現ボラティリティは約40まで反発し、VRP(IV−RV)は2.18ボラまで縮小。先週のパニック時の-7.38ボラから大きくフラット化しています。現状ではインプライド・ボラティリティ(IV)がリアライズド・ボラティリティ(RV)を上回り、VRPはプラス。市場は将来のボラティリティ上昇を織り込みつつあり、ショート・ボラティリティ戦略(ショート・ストラドル、ショート・カレンダースプレッド、ショート・ベガ構造など)が有利に働く可能性があります。

Ethereum (ETH) オプション市場サマリー

今サイクル(10月27日〜11月3日)でETHは$3,700〜$4,250のレンジ内で推移しました。週初は$4,250の抵抗接近で売り圧力、週半ばは$3,700付近のサポートまで下落。週末には反発の勢いが鈍り、全体として「レンジ内のもみ合いと反発試行」パターンとなりました。短期トレーダーは$3,700サポートの維持、$4,250〜$4,300抵抗の突破可否に注目し、直近の方向性を見極める必要があります。

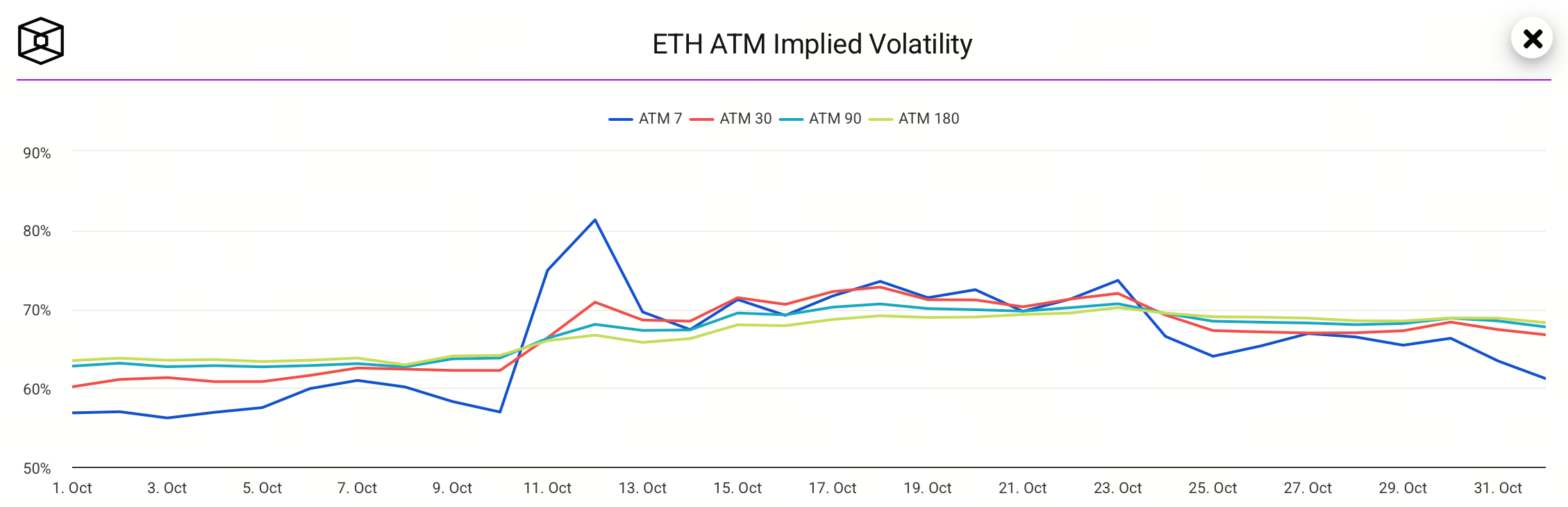

オプション市場:直近公開データによるETHインプライド・ボラティリティ(IV)は約69%で、直近高値からの反落後に安定。市場心理は落ち着き、今後の大きな価格変動期待も低下しています。

短期・長期IVの乖離は正常化し、市場参加者の短期ボラティリティ見通しがより合理的になっています。

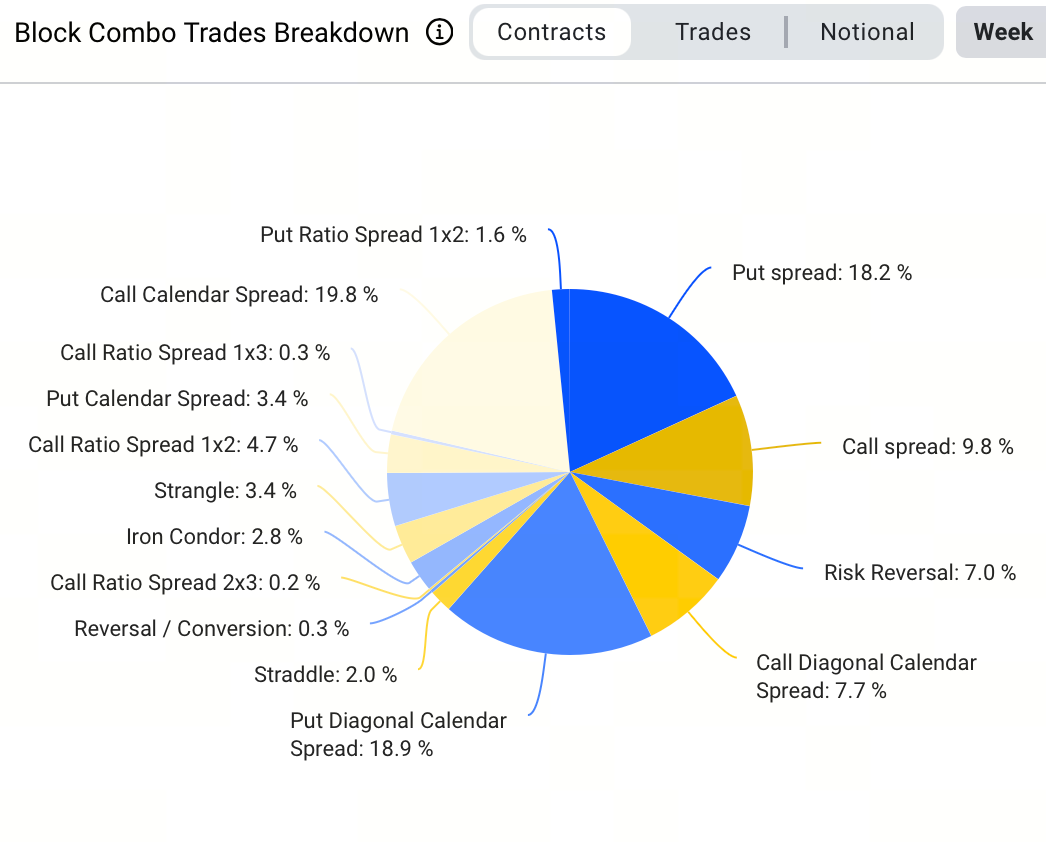

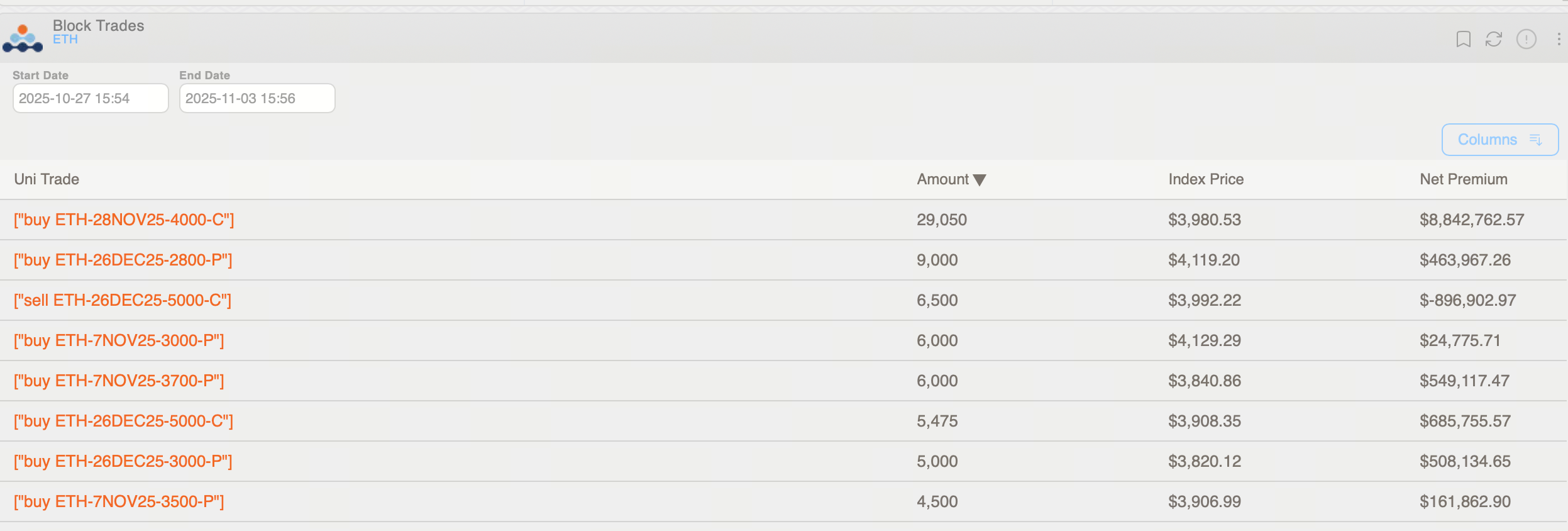

ブロック取引では、今週最も人気だった戦略はカレンダープットスプレッド(取引の18.9%)で、低コストの長期弱気ポジションを志向する投資家が多いことを示しています。最大取引はETH 3,000枚のETH-071125-3700-P売りとETH-261225-3700-P買い。同時に短期強気の取引も活発で、ETH 29,000枚のETH-281125-4000-Cコントラクトが総額$8,840,000のプレミアムで購入されました。

今週、ETHオプションの25デルタ・スキューは短期的に急上昇し、下落ヘッジ需要が強まっています。週末には期間構造がフラット化し弱気心理がやや緩和しましたが、短期プットは依然高いプレミアムを維持。週中はプットIVがコールを約7ボラ上回り、最終的には約5ボラ差に収束。弱気心理が持続しつつも緩やかに和らいでいる状況です。

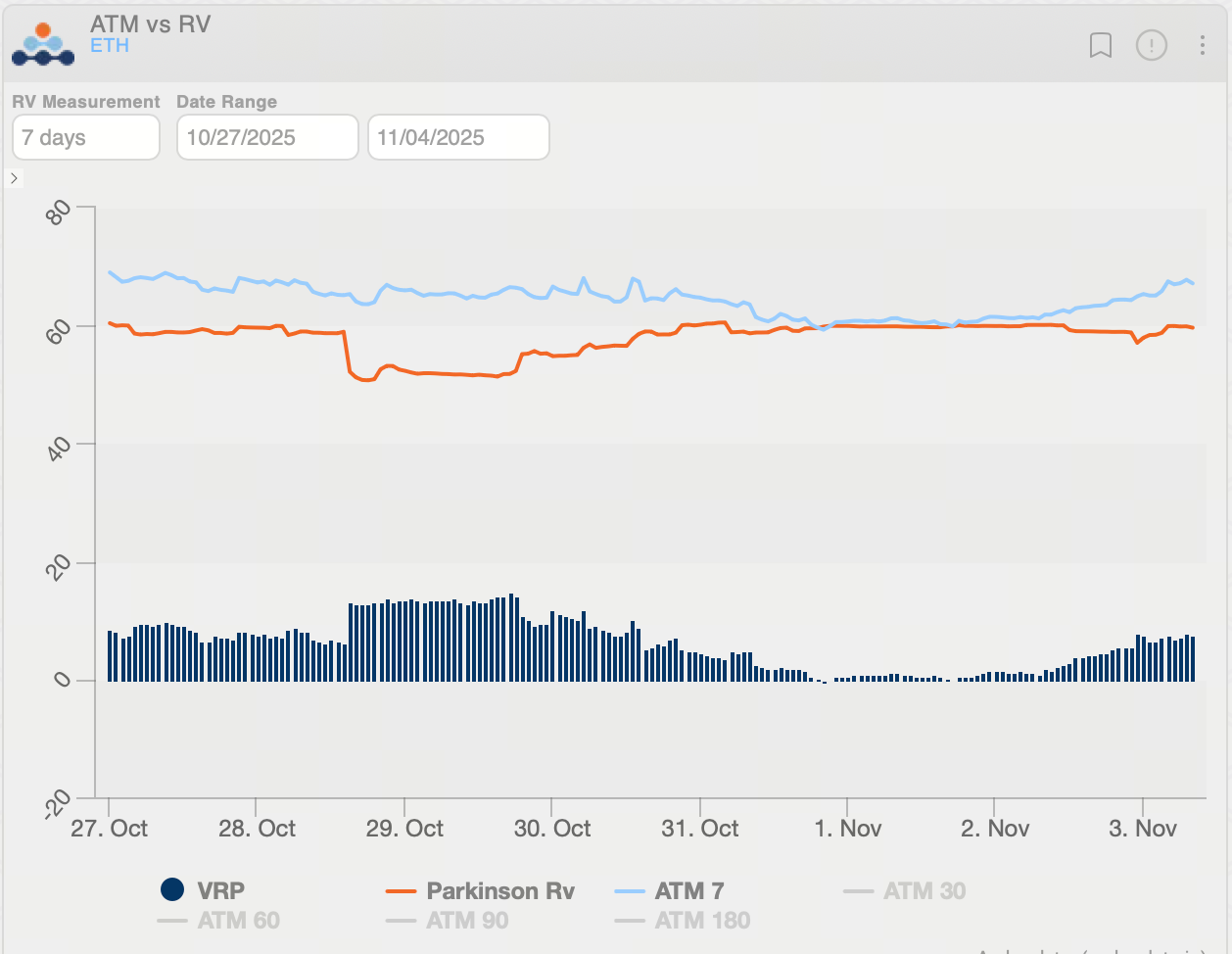

Ethereum(ETH)の実現ボラティリティは約60まで低下し、VRP(IV−RV)は7.52ボラまで上昇。この局面はリスク選好の回復とともに短期IVが上昇していることを示します。IVがRVを上回る中、市場は将来のボラティリティにプレミアムを付与。オプション構造の売却やショートベガ戦略によるTheta収益獲得など、ボラティリティ・セール戦略が相対的に優位です。

政策イベントと市場インパクト概観

1. 米国政府閉鎖リスクの高まり。11月3日時点で連邦政府閉鎖は約35日継続し、第4四半期GDPへの影響が懸念されています。雇用・インフレなどのデータ発表が遅れ、市場は流動性・政策期待の不透明さに直面しています。

2. FRB12月利下げ期待の後退。10月末、FRBはフェデラル・ファンド金利を25ベーシスポイント引き下げ3.75〜4.00%とし、12月追加利下げは「事前決定ではない」と明言。12月の利下げ確率は90%以上から約70%へ低下し、「流動性改善」余地が狭まり、暗号資産を含むリスク資産の重しとなっています。

3. 貿易緊張緩和は限定的ながら注目。釜山での協議を経て米中は貿易緩和局面入り。米国は一部関税を削減、中国は農産品輸入再開・希土類規制の一時停止など短期的な市場心理改善に寄与。しかし構造的な隔たりが残り、「戦術的緩和であり本質的解決ではない」状況です。

4. 暗号市場ファンドフローが慎重姿勢を示唆。利下げ期待の低下と流動性改善の明確な進展がない中、Bitcoinや関連ETFは直近1週間で約$800,000,000の純流出が発生。暗号市場の資本動向は慎重姿勢となり、価格は資本フローにより敏感な展開です。

関連記事

今買うべき暗号資産: SOL, XRP, BTC, HBAR

LUNA/USDT 日次市場分析

XRP (XRP) 価格予測: 価格のトレンドと影響要因

Neverending Options: トレーディングオプション:無限と向こうへ

Typusとは何ですか?