GateUser-5a8a35al

No content yet

GateUser-5a8a35al

I often advise teachers and interns to read more books, and I really mean it sincerely. Reading more is truly useful; you will learn some knowledge points that just happen to be applicable at certain stages. I now understand why Buffett and Charlie Munger are both referred to as "walking bookshelves." If you are energetic but keep making frequent trades, it can actually lead to losses.

View Original- Reward

- like

- Comment

- Repost

- Share

Understanding starts with reducing trading frequency. Everyone knows to wait for the right opportunity, but it's hard to do so. The market data fluctuates back and forth, seeming to present too many opportunities to make money. It feels like a waste not to jump in and grab some, but once you do, you end up trapped. Once trapped, your mind gets chaotic, and you can't focus on trading rules, let alone wait for the right moment. Your head is filled with negative emotions brought by being trapped, leaving no room to think about anything else. This is usually how losses happen.

View Original

- Reward

- like

- Comment

- Repost

- Share

No one will help a person with no value; you must manage yourself well. Even if you fall to the bottom, you must have chips to exchange with others. This is the law of the strong.

Kazuo Inamori

View OriginalKazuo Inamori

- Reward

- like

- Comment

- Repost

- Share

A very heartfelt statement by Liu Zhenyun:

"When poverty reaches a certain level,

You simply have no ability,

To learn, to think about upbringing, opportunities, and direction. When survival becomes the only luxury,

All the splendor in this world is just a display for you, yet there are still too many ridiculous things.

"Easily praising suffering."

View Original"When poverty reaches a certain level,

You simply have no ability,

To learn, to think about upbringing, opportunities, and direction. When survival becomes the only luxury,

All the splendor in this world is just a display for you, yet there are still too many ridiculous things.

"Easily praising suffering."

- Reward

- like

- Comment

- Repost

- Share

Human nature is interconnected. Just like stock trading, there are many unrealized gains, but very few that can be realized; it's all about unrealized gains plus greater leverage. The stock market has short cycles, so going through a few more cycles and taking some losses will help a bit, allowing for some profit. The real estate market has long cycles; one cycle lasts a lifetime, leaving no chance for a turnaround.

View Original- Reward

- like

- Comment

- Repost

- Share

Turn the things you like into the things you are good at,

Turn what you are good at into something professional,

Turn your professional matters into specialized matters,

Loving work so much, striving for excellence, and continuously improving will inevitably lead to wealth.

Becoming a genius, a master, or a wealthy person is the result of years of focusing on monotonous and tedious work to enhance expertise in a specific niche.

View OriginalTurn what you are good at into something professional,

Turn your professional matters into specialized matters,

Loving work so much, striving for excellence, and continuously improving will inevitably lead to wealth.

Becoming a genius, a master, or a wealthy person is the result of years of focusing on monotonous and tedious work to enhance expertise in a specific niche.

- Reward

- like

- Comment

- Repost

- Share

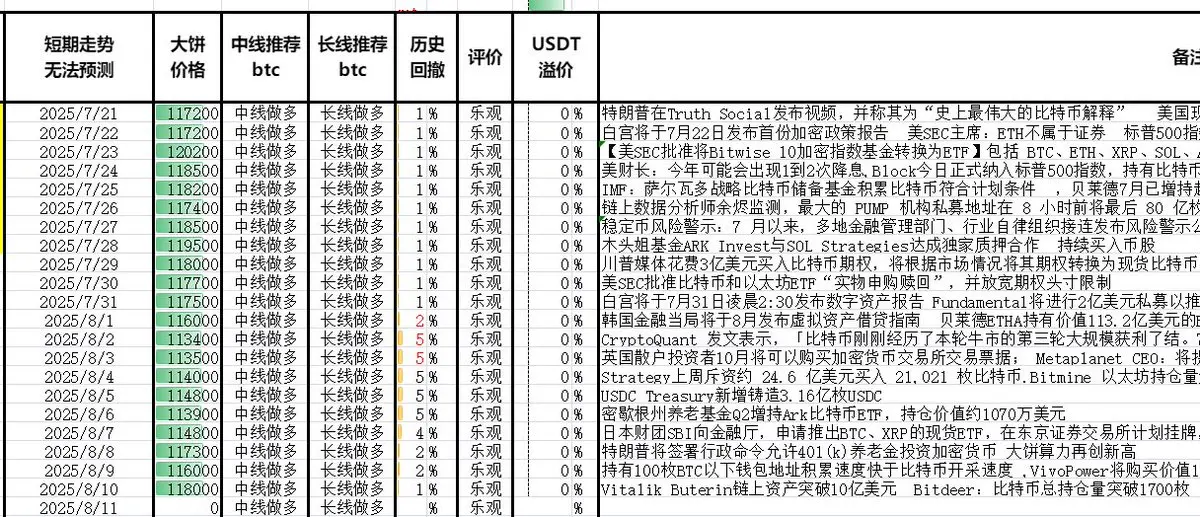

The fluctuations in the US stock market are indeed significant, and without strong psychological resilience, it is difficult to cope. I have also felt very tormented these past few days, but I ultimately persevered. I found that it is very important to distract myself through reading; if I keep staring at the market, it is easy to generate excessive thoughts.

The more you learn and constantly improve yourself, the more money you can truly make. Otherwise, even if you occasionally make a profit by luck, you will ultimately lose it. I have already sent you the trading strategies of several big p

The more you learn and constantly improve yourself, the more money you can truly make. Otherwise, even if you occasionally make a profit by luck, you will ultimately lose it. I have already sent you the trading strategies of several big p

View Original

- Reward

- like

- Comment

- Repost

- Share

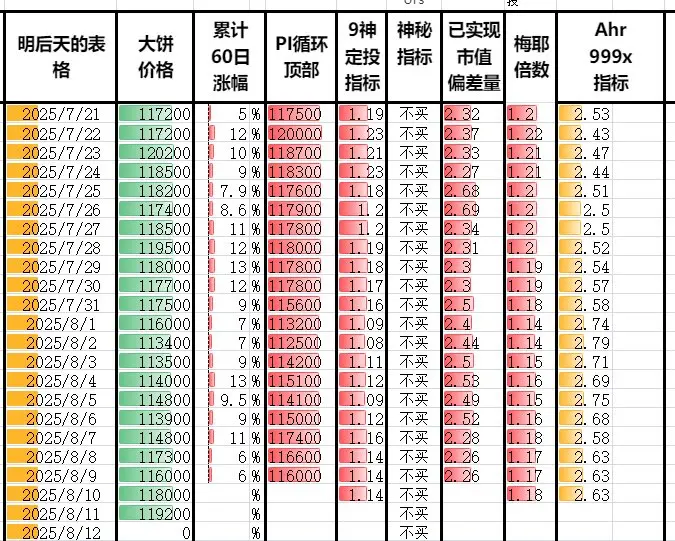

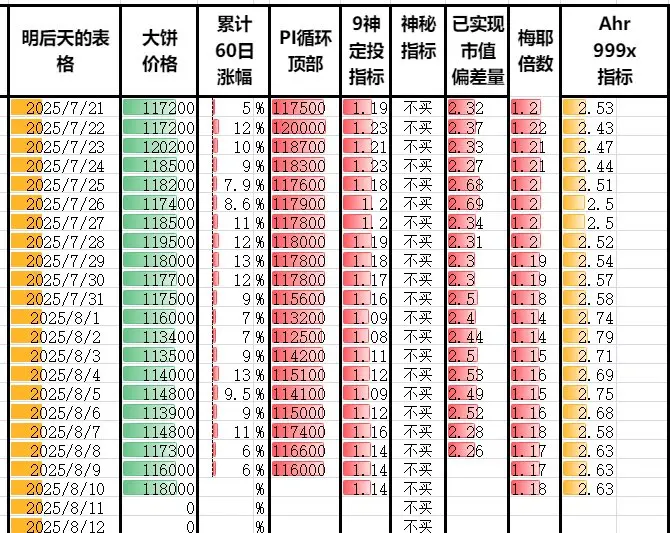

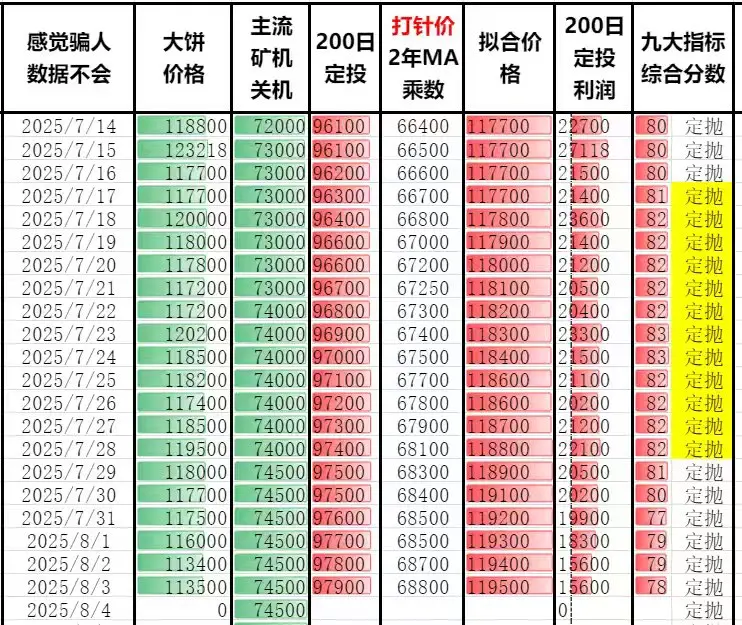

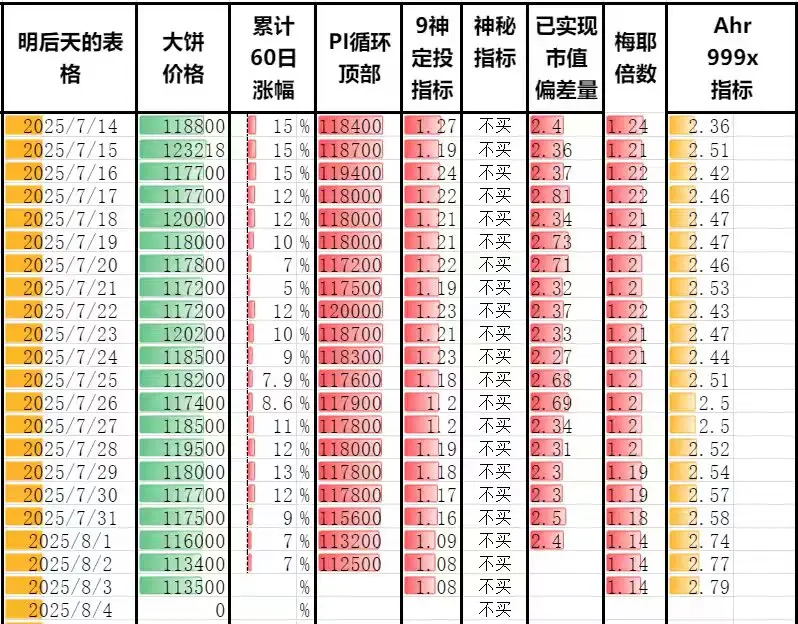

Recently, I had a profound realization that I wanted to share quickly before I forget again. Many pros are using Auto-Invest, which means they are entering positions in batches. They can't guarantee that they will buy at the lowest point. For example, if they want to buy 1 million, they might divide it into five purchases of 200,000 each. This is very important, as even traders cannot do it; there are very few people who can consistently buy at the lowest point or sell at the highest point.

View Original

- Reward

- like

- Comment

- Repost

- Share

- Reward

- like

- Comment

- Repost

- Share

I learned a concept from Professor Tal Ben-Shahar, a professor of positive psychology at Harvard University, called "arrival fallacy."

It means that we often think that as long as we can reach a certain destination, everything will be accomplished, such as when I have money, when I am free, when I have time... Once that moment arrives, happiness will automatically come. But the paradox lies in the fact that if you do not feel happy in the present, then you, arriving at that goal in the future, will not actually be happy either. Because for you at that time, it will just be an ordinary "present

View OriginalIt means that we often think that as long as we can reach a certain destination, everything will be accomplished, such as when I have money, when I am free, when I have time... Once that moment arrives, happiness will automatically come. But the paradox lies in the fact that if you do not feel happy in the present, then you, arriving at that goal in the future, will not actually be happy either. Because for you at that time, it will just be an ordinary "present

- Reward

- like

- Comment

- Repost

- Share

The secret to developing good habits,

is about "within reach."

If one must read books only at specific times, places, and states of mind,

It can be foreseen that,

It's hard to really make reading a habit.

Without habits, it means that each time you have to start with effort.

Frequent "efforts" will ultimately lead to giving up.

There are already too many things in life that require effort.

The significance of good habits,

not an additional burden,

but through day-to-day automation,

Enhancing abilities unconsciously.

View Originalis about "within reach."

If one must read books only at specific times, places, and states of mind,

It can be foreseen that,

It's hard to really make reading a habit.

Without habits, it means that each time you have to start with effort.

Frequent "efforts" will ultimately lead to giving up.

There are already too many things in life that require effort.

The significance of good habits,

not an additional burden,

but through day-to-day automation,

Enhancing abilities unconsciously.

- Reward

- like

- Comment

- Repost

- Share

Why do most ordinary people have a high failure rate in entrepreneurship?

1. Lack of business awareness: Entrepreneurship is by no means just simple buying and selling; it tests a person's overall abilities. Many people enter the market simply because they believe they can succeed. If you don't fail, who will?

2. No precise targeting of the target audience: Clearly define who you are serving? What pain points are you solving? Your product or service must address the real needs of a specific group of people to be valuable; otherwise, it is just self-entertainment.

The main reason for entreprene

View Original1. Lack of business awareness: Entrepreneurship is by no means just simple buying and selling; it tests a person's overall abilities. Many people enter the market simply because they believe they can succeed. If you don't fail, who will?

2. No precise targeting of the target audience: Clearly define who you are serving? What pain points are you solving? Your product or service must address the real needs of a specific group of people to be valuable; otherwise, it is just self-entertainment.

The main reason for entreprene

- Reward

- like

- Comment

- Repost

- Share

The core of this statement is to tie the "threshold" of investment decisions to the "prediction" of the future.

In simple terms, opportunity cost is "the benefits of B that you have to give up because you chose A." Therefore, when making investments, the minimum return rate you can accept actually reflects your speculation about the "B" that you might encounter in the future.

Just as Buffett believes that in the future there is a high probability of encountering good opportunities with returns exceeding 10%. At this time, if he has a project with an 8% return, he is unwilling to invest—because

View OriginalIn simple terms, opportunity cost is "the benefits of B that you have to give up because you chose A." Therefore, when making investments, the minimum return rate you can accept actually reflects your speculation about the "B" that you might encounter in the future.

Just as Buffett believes that in the future there is a high probability of encountering good opportunities with returns exceeding 10%. At this time, if he has a project with an 8% return, he is unwilling to invest—because

- Reward

- like

- Comment

- Repost

- Share

We are speculating about our future opportunity cost. Warren speculates that he will have the opportunity to invest capital at a high return rate, so he is currently unwilling to invest capital at a rate lower than 10%. But if we know that the Intrerest Rate will remain at 1%, we would change. Our barrier reflects our estimation of future opportunity costs.

View Original

- Reward

- like

- Comment

- Repost

- Share

If the technology hadn't changed, they (the newspapers) would still be great enterprises. Online television (in its heyday), anyone could do well. If it were Tom Murphy, you would do well, but even your idiot nephew could do well. Fortunately, carbide cutting tools (such as those made by Iscar) do not have these alternatives.

View Original

- Reward

- like

- Comment

- Repost

- Share

We have strong flexibility and a certain level of discipline, not doing stupid things just for the sake of being proactive-discipline, avoiding just doing any damn thing because you can't stand inaction.

View Original- Reward

- like

- Comment

- Repost

- Share

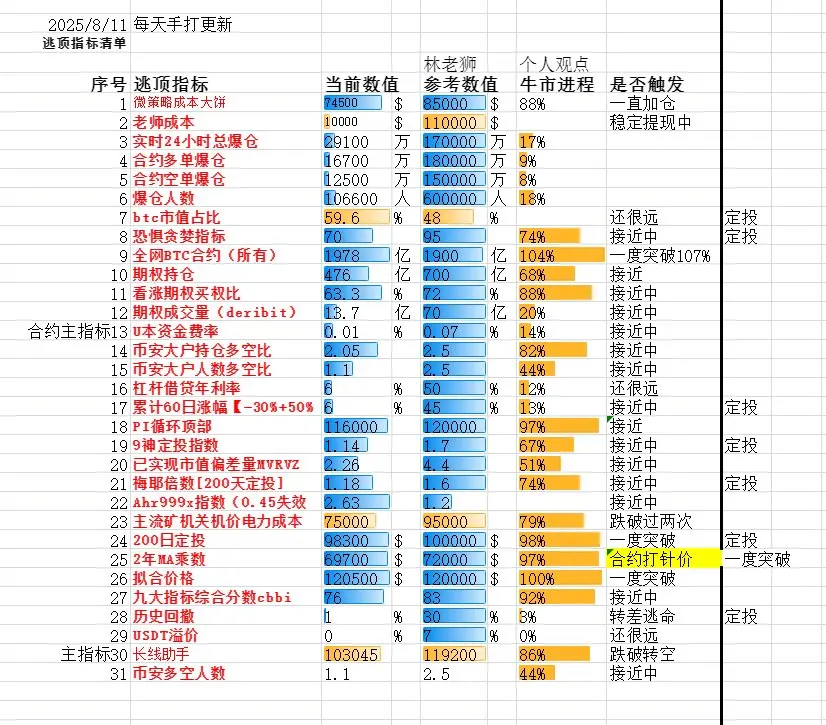

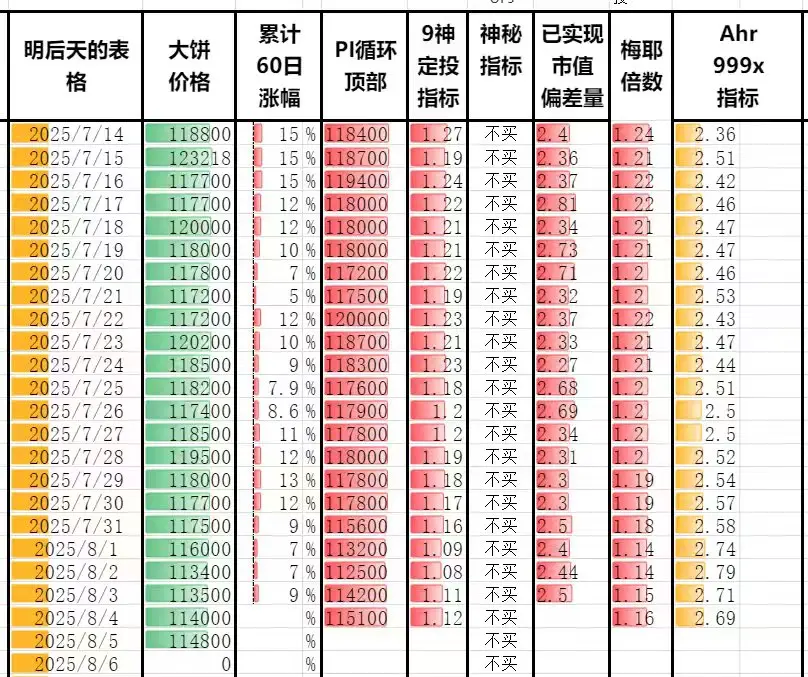

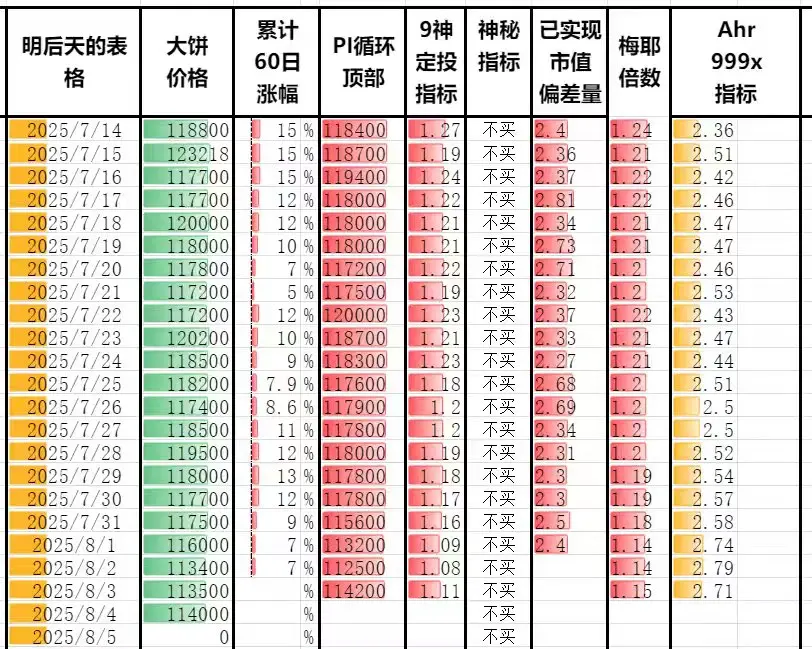

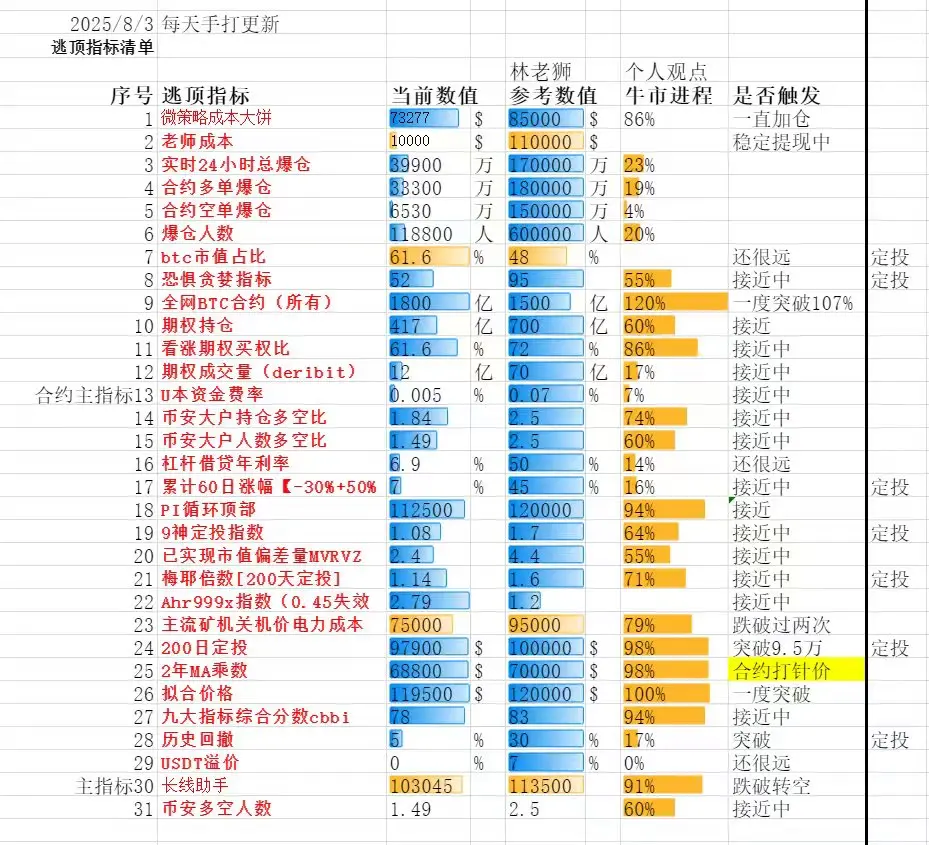

"Topping out" simply means selling an investment (such as stocks or funds) in a timely manner before the price rises to its peak, to avoid subsequent price falls that could lead to a decrease in profits or even losses.

View Original- Reward

- like

- Comment

- Repost

- Share

Dividing it into the whole concept of "value" and "rise" makes me feel quite bored. For a group of pension fund advisors, this is a convenient way for them to earn fees through casual conversations and to distinguish one advisor from another. However, for me, all wise investments are value investments.

View Original

- Reward

- like

- Comment

- Repost

- Share

The relationship between happiness and desire: happiness has no absolute relationship with the absolute value of possession; when ability exceeds desire, there is happiness; conversely, there is suffering.

View Original

- Reward

- like

- Comment

- Repost

- Share

The secret to happiness is to drop your expectations... that is your experience. If your expectations and standards are high, and you only allow yourself to be happy when things are exquisite, you will never be happy or grateful. There will always be flaws. However, when you compare your experiences with lower expectations, especially with some not-so-good things, you will find that there is so much to love, cherish, and enjoy in your experiences of this world, every moment.

View Original- Reward

- like

- Comment

- Repost

- Share