#VitalikSellsETH

Виталик Бутерин, легендарный соучредитель Ethereum, активно продает ETH в течение февраля 2026 года — и его действия вышли далеко за рамки первоначального плана, вызвав бесконечные споры, ажиотаж по отслеживанию на блокчейне и колебания краткосрочного настроения в криптосообществе! 🚨📉🔍

Проще говоря: «Виталик продает ETH» означает, что Виталик Бутерин переводит и ликвидирует части своих личных запасов Ethereum. Как публичная фигура, чьи каждое движение на кошельке отслеживается тысячами (с помощью таких инструментов, как Lookonchain, Arkham Intelligence и Onchain Lens), эти продажи часто вызывают спекуляции, FUD (страх, неопределенность, сомнения) или даже кратковременные падения цен — потому что люди задаются вопросом, сигнализирует ли это о чем-то большем в будущем Ethereum.

Но давайте погрузимся в ультра-расширенный, полностью детальный разбор только фактов на понятном, увлекательном английском — без переизбытка хайпа, без диких теорий, только настоящая история, основанная на публичных объявлениях, данных из блокчейна и рыночном контексте (идеально для длинного, информативного поста или цепочки в соцсетях):

1. Точные детали: сколько, когда и как это произошло

Виталик впервые объявил об этом 30 января 2026 года: он планировал вывести и продать ровно 16 384 ETH (оцениваемых примерно в $43–$45 миллион по ценам на момент объявления) как свой личный вклад в период «умеренной экономии» для Ethereum Foundation. Цель? финансировать долгосрочные, открытые проекты на несколько лет.

Перенесемся в февраль 2026 года: отслеживание в блокчейне показывает, что он превысил эту цель значительно. Последние подсчеты (по состоянию на поздний 26–27 фев 2026):

Общая проданная сумма: 17 000–19 326 ETH (источники немного различаются — например, Lookonchain/Arkham сообщают около 17 196 ETH или до 19 326 ETH в финальных данных; некоторые кошельки показывают ликвидированные 18 684–19 318 ETH).

Общая реализованная стоимость: примерно $35–$39,36 миллиона (средняя цена продажи колебалась около $2 000–$2 037 за ETH, что ниже первоначальных оценок из-за падения цены ETH за этот период).

Изменения в кошельках: его основные отслеживаемые запасы снизились с ~241 000 ETH в начале февраля до примерно 224 000 ETH сейчас (все еще огромная позиция стоимостью $430–$460+ миллионов при текущих уровнях ~$2 000–$2 050).

Продажи осуществлялись умно, небольшими, постепенными партиями через инструменты, сохраняющие приватность, такие как CoW Protocol (чтобы снизить проскальзывание и влияние на рынок), часто конвертируя обернутый ETH (WETH) в стейбкойны или другие активы со своего кошелька Gnosis Safe. Активность достигла пика в середине-конце февраля (например, крупные транзакции 5–6, 22–23 и 25–26 февраля), но последние данные показывают, что продажи снизились или завершились к 26–27 февраля — в последние часы не зафиксировано новых крупных оттоков.

2. Настоящая причина продаж — прямо от Виталика

Виталик был на 100% прозрачным по этому поводу (как всегда). В своем январском посте он объяснил, что это не связано с личным выводом средств или таймингом рынка — это его способ поддержать экосистему Ethereum в период, когда Фонд сосредоточен на обеспечении устойчивости, эффективности и долгосрочной перспективы протокола, а не на крупном расходовании.

Полученные средства предназначены для инвестиций на несколько лет в:

Технологии, сохраняющие приватность

Безопасное оборудование и операционные системы

Открытое финансирование, коммуникации и инструменты управления

Биотехнологии и другие инновационные области, соответствующие цифровой автономии и видению Ethereum

Это соответствует его долгой истории использования личных средств для благих целей (например, пожертвования на благотворительность, помощь Украине или гранты экосистеме). Это рассматривается как личная экономия, совпадающая с подходом Фонда — не как медвежий сигнал по ETH. Виталик по-прежнему держит одну из крупнейших не биржевых позиций ETH, что свидетельствует о его глубокой приверженности.

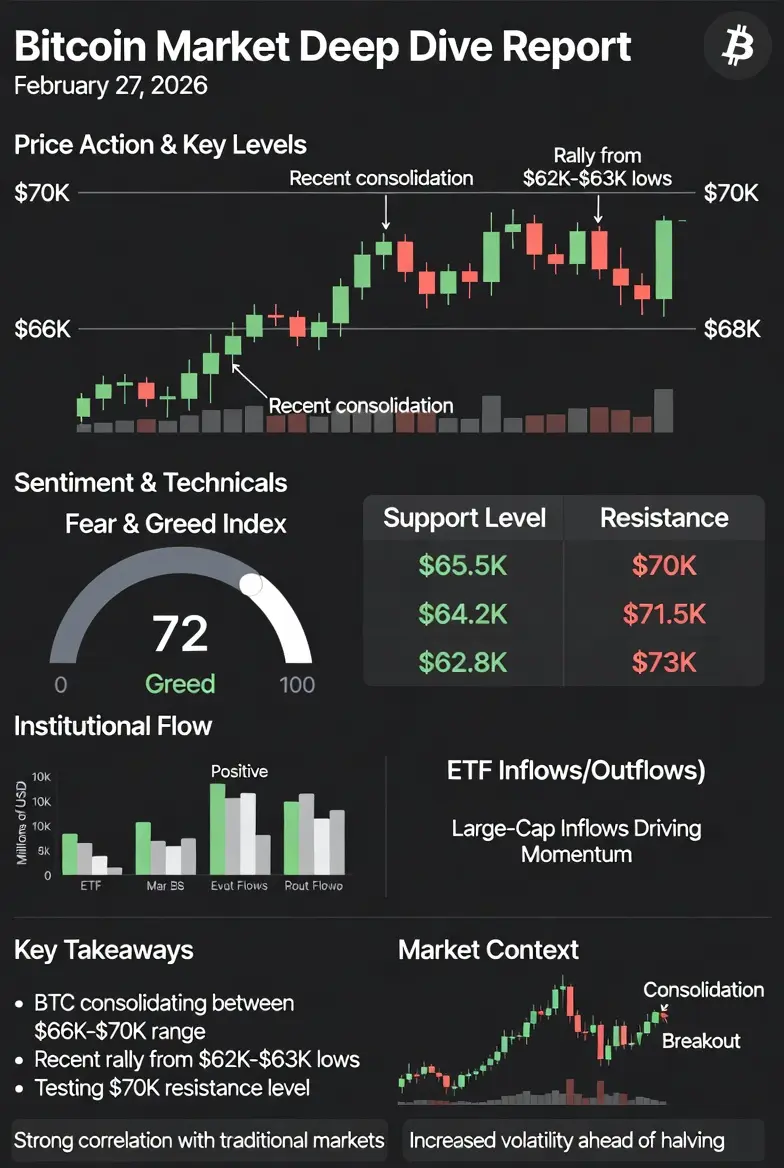

3. Рыночный контекст: почему это ударило сильнее в феврале 2026

ETH пережил один из самых тяжелых стартов года: снижение примерно на 34–37% с начала года в худшие моменты, падение до $1 800–$2 000 на фоне общего давления на крипторынок (макроэкономическая неопределенность, фиксация прибыли после 2025 года, экстремальный страх по индексу Crypto Fear & Greed, достигший однозначных цифр).

Продажи Виталика совпали с этим спадом, поэтому:

Некоторые трейдеры увидели дополнительное давление на продажу (даже если его объем очень мал по сравнению с ежедневной ликвидностью ETH или институциональными потоками).

Примеры из прошлого показывают, что публичные продажи могут вызывать кратковременные падения (например, снижение на 5–22% после определенных партий в предыдущих циклах).

Но реальность такова: продажи были разбросаны и минимизировали влияние через обмены CoW. В конце февраля ETH действительно сильно восстановился (поднявшись на 8–12% за сессии, вернувшись к уровню выше $2 000 в рамках общего рыночного отката с BTC к ~$67k–$70k). Продажи не сорвали ралли — и некоторые считают, что более низкие средние цены продажи отражают покупку на дне, а не его причинение. Основные драйверы (ETF-инвестиции, шорт-сквизы, участие альткоинов) перевешивали любой отдельный крупный трейд.

4. Краткосрочные и долгосрочные последствия для ETH и настроения сообщества

Краткосрочный шум: такие продажи крупных игроков всегда вызывают спекуляции — «Виталик сливает?», «Еще идут?», «Медвежий знак?» — волны FUD в соцсетях, но данные показывают, что план завершен без бесконечной ликвидации. Нет признаков панической распродажи сверх заявленной цели.

Долгосрочный позитив: Виталик сохраняет крупную долю и активно финансирует инновации, связанные с Ethereum (приватность, масштабирование, безопасность). Это демонстрирует веру в будущее проекта — перераспределение средств на развитие, а не выход. Если восстановление ETH продолжится (поддерживая уровень $2 000, преодолевая его с рыночным импульсом), это можно будет запомнить как «здоровую перезагрузку финансирования» во время перепроданности.

Ключевой вывод: сделки даже основателя (или другого крупного участника) не определяют стоимость в $200+ миллиардов у ETH. Важно сосредоточиться на фундаментальных факторах: обновлениях протокола, принятии, потоках ETF и макроэкономических факторах.

Итог: продажи ETH Виталика были заранее объявлены, прозрачны и целенаправленны — чуть превысили план из-за исполнения, но связаны с поддержкой экосистемы, а не сомнениями в Ethereum. Время их проведения во время коррекции усилило реакции, но восстановление показывает устойчивость. Не стоит паниковать — достаточно внимательно следить за уровнями поддержки, такими как $2 000, и общим рыночным импульсом.

Виталик Бутерин, легендарный соучредитель Ethereum, активно продает ETH в течение февраля 2026 года — и его действия вышли далеко за рамки первоначального плана, вызвав бесконечные споры, ажиотаж по отслеживанию на блокчейне и колебания краткосрочного настроения в криптосообществе! 🚨📉🔍

Проще говоря: «Виталик продает ETH» означает, что Виталик Бутерин переводит и ликвидирует части своих личных запасов Ethereum. Как публичная фигура, чьи каждое движение на кошельке отслеживается тысячами (с помощью таких инструментов, как Lookonchain, Arkham Intelligence и Onchain Lens), эти продажи часто вызывают спекуляции, FUD (страх, неопределенность, сомнения) или даже кратковременные падения цен — потому что люди задаются вопросом, сигнализирует ли это о чем-то большем в будущем Ethereum.

Но давайте погрузимся в ультра-расширенный, полностью детальный разбор только фактов на понятном, увлекательном английском — без переизбытка хайпа, без диких теорий, только настоящая история, основанная на публичных объявлениях, данных из блокчейна и рыночном контексте (идеально для длинного, информативного поста или цепочки в соцсетях):

1. Точные детали: сколько, когда и как это произошло

Виталик впервые объявил об этом 30 января 2026 года: он планировал вывести и продать ровно 16 384 ETH (оцениваемых примерно в $43–$45 миллион по ценам на момент объявления) как свой личный вклад в период «умеренной экономии» для Ethereum Foundation. Цель? финансировать долгосрочные, открытые проекты на несколько лет.

Перенесемся в февраль 2026 года: отслеживание в блокчейне показывает, что он превысил эту цель значительно. Последние подсчеты (по состоянию на поздний 26–27 фев 2026):

Общая проданная сумма: 17 000–19 326 ETH (источники немного различаются — например, Lookonchain/Arkham сообщают около 17 196 ETH или до 19 326 ETH в финальных данных; некоторые кошельки показывают ликвидированные 18 684–19 318 ETH).

Общая реализованная стоимость: примерно $35–$39,36 миллиона (средняя цена продажи колебалась около $2 000–$2 037 за ETH, что ниже первоначальных оценок из-за падения цены ETH за этот период).

Изменения в кошельках: его основные отслеживаемые запасы снизились с ~241 000 ETH в начале февраля до примерно 224 000 ETH сейчас (все еще огромная позиция стоимостью $430–$460+ миллионов при текущих уровнях ~$2 000–$2 050).

Продажи осуществлялись умно, небольшими, постепенными партиями через инструменты, сохраняющие приватность, такие как CoW Protocol (чтобы снизить проскальзывание и влияние на рынок), часто конвертируя обернутый ETH (WETH) в стейбкойны или другие активы со своего кошелька Gnosis Safe. Активность достигла пика в середине-конце февраля (например, крупные транзакции 5–6, 22–23 и 25–26 февраля), но последние данные показывают, что продажи снизились или завершились к 26–27 февраля — в последние часы не зафиксировано новых крупных оттоков.

2. Настоящая причина продаж — прямо от Виталика

Виталик был на 100% прозрачным по этому поводу (как всегда). В своем январском посте он объяснил, что это не связано с личным выводом средств или таймингом рынка — это его способ поддержать экосистему Ethereum в период, когда Фонд сосредоточен на обеспечении устойчивости, эффективности и долгосрочной перспективы протокола, а не на крупном расходовании.

Полученные средства предназначены для инвестиций на несколько лет в:

Технологии, сохраняющие приватность

Безопасное оборудование и операционные системы

Открытое финансирование, коммуникации и инструменты управления

Биотехнологии и другие инновационные области, соответствующие цифровой автономии и видению Ethereum

Это соответствует его долгой истории использования личных средств для благих целей (например, пожертвования на благотворительность, помощь Украине или гранты экосистеме). Это рассматривается как личная экономия, совпадающая с подходом Фонда — не как медвежий сигнал по ETH. Виталик по-прежнему держит одну из крупнейших не биржевых позиций ETH, что свидетельствует о его глубокой приверженности.

3. Рыночный контекст: почему это ударило сильнее в феврале 2026

ETH пережил один из самых тяжелых стартов года: снижение примерно на 34–37% с начала года в худшие моменты, падение до $1 800–$2 000 на фоне общего давления на крипторынок (макроэкономическая неопределенность, фиксация прибыли после 2025 года, экстремальный страх по индексу Crypto Fear & Greed, достигший однозначных цифр).

Продажи Виталика совпали с этим спадом, поэтому:

Некоторые трейдеры увидели дополнительное давление на продажу (даже если его объем очень мал по сравнению с ежедневной ликвидностью ETH или институциональными потоками).

Примеры из прошлого показывают, что публичные продажи могут вызывать кратковременные падения (например, снижение на 5–22% после определенных партий в предыдущих циклах).

Но реальность такова: продажи были разбросаны и минимизировали влияние через обмены CoW. В конце февраля ETH действительно сильно восстановился (поднявшись на 8–12% за сессии, вернувшись к уровню выше $2 000 в рамках общего рыночного отката с BTC к ~$67k–$70k). Продажи не сорвали ралли — и некоторые считают, что более низкие средние цены продажи отражают покупку на дне, а не его причинение. Основные драйверы (ETF-инвестиции, шорт-сквизы, участие альткоинов) перевешивали любой отдельный крупный трейд.

4. Краткосрочные и долгосрочные последствия для ETH и настроения сообщества

Краткосрочный шум: такие продажи крупных игроков всегда вызывают спекуляции — «Виталик сливает?», «Еще идут?», «Медвежий знак?» — волны FUD в соцсетях, но данные показывают, что план завершен без бесконечной ликвидации. Нет признаков панической распродажи сверх заявленной цели.

Долгосрочный позитив: Виталик сохраняет крупную долю и активно финансирует инновации, связанные с Ethereum (приватность, масштабирование, безопасность). Это демонстрирует веру в будущее проекта — перераспределение средств на развитие, а не выход. Если восстановление ETH продолжится (поддерживая уровень $2 000, преодолевая его с рыночным импульсом), это можно будет запомнить как «здоровую перезагрузку финансирования» во время перепроданности.

Ключевой вывод: сделки даже основателя (или другого крупного участника) не определяют стоимость в $200+ миллиардов у ETH. Важно сосредоточиться на фундаментальных факторах: обновлениях протокола, принятии, потоках ETF и макроэкономических факторах.

Итог: продажи ETH Виталика были заранее объявлены, прозрачны и целенаправленны — чуть превысили план из-за исполнения, но связаны с поддержкой экосистемы, а не сомнениями в Ethereum. Время их проведения во время коррекции усилило реакции, но восстановление показывает устойчивость. Не стоит паниковать — достаточно внимательно следить за уровнями поддержки, такими как $2 000, и общим рыночным импульсом.