CryptoBully

Aún no hay contenido

CryptoBully

Por debajo del mínimo de ayer en $BTC aquí

Ya he comenzado a llenar ofertas, hay mucha confluencia en esta zona. Aquí mi entrada, tp, sl y razones para cada una:

1. Rango de acumulación prueba VaH tras la ruptura

2. Rebote de alivio de noviembre, ruptura y retest del VWAP alto

3. Bandas VWAP de apertura anual (esperando que la parte baja de la banda se mantenga para continuar hacia arriba)

Rompimos agresivamente con una cantidad decente de liquidaciones cortas en niveles de objetivo muy evidentes y luego retrocedimos. Si todavía hay fuerza en el mercado, necesitamos superar el VaH cerca de 92.

Ya he comenzado a llenar ofertas, hay mucha confluencia en esta zona. Aquí mi entrada, tp, sl y razones para cada una:

1. Rango de acumulación prueba VaH tras la ruptura

2. Rebote de alivio de noviembre, ruptura y retest del VWAP alto

3. Bandas VWAP de apertura anual (esperando que la parte baja de la banda se mantenga para continuar hacia arriba)

Rompimos agresivamente con una cantidad decente de liquidaciones cortas en niveles de objetivo muy evidentes y luego retrocedimos. Si todavía hay fuerza en el mercado, necesitamos superar el VaH cerca de 92.

BTC-2,23%

- Recompensa

- Me gusta

- Comentar

- Republicar

- Compartir

Completado en el $DOGE long parcialmente también

El precio se movió +30% desde el mínimo de 0.11, ahora vuelve a probar la zona de demanda. Se llenaron algunas órdenes de compra a precio bajo que cerré parcialmente, pero estoy dispuesto a arriesgar una exposición larga nuevamente si llenamos la mecha

El objetivo sería una reversión hacia el nivel de $0.135

La relación riesgo/recompensa está justificada aquí, ya que la invalidación está bastante cerca, si el precio pierde el mínimo de hoy puedes cortar en lugar de esperar una invalidación completa (aceptación por debajo de la demanda en verde)

El precio se movió +30% desde el mínimo de 0.11, ahora vuelve a probar la zona de demanda. Se llenaron algunas órdenes de compra a precio bajo que cerré parcialmente, pero estoy dispuesto a arriesgar una exposición larga nuevamente si llenamos la mecha

El objetivo sería una reversión hacia el nivel de $0.135

La relación riesgo/recompensa está justificada aquí, ya que la invalidación está bastante cerca, si el precio pierde el mínimo de hoy puedes cortar en lugar de esperar una invalidación completa (aceptación por debajo de la demanda en verde)

DOGE-1,59%

- Recompensa

- Me gusta

- Comentar

- Republicar

- Compartir

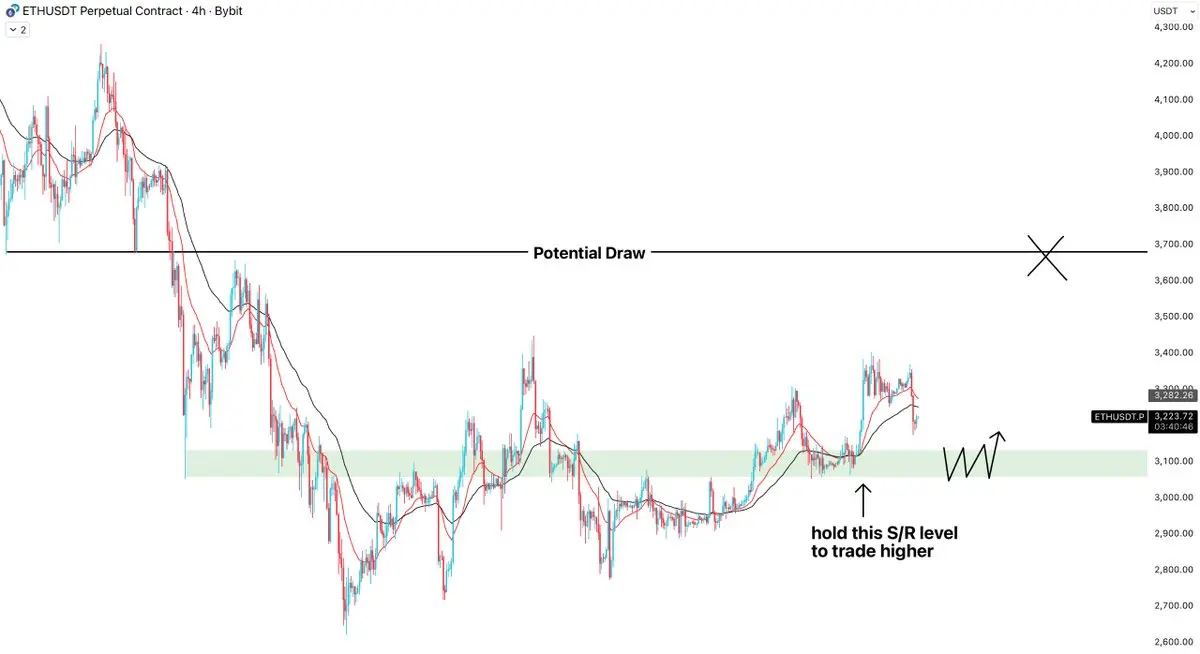

Estoy en largo nuevamente en $ETH y agregaré en una $3100 retest como se indica

Estructuralmente alcista en marcos de tiempo mayores. Tengo órdenes de compra en el nivel S/R verde para un posible movimiento hacia $3600s

Si empezamos a ver cierres por debajo de este nivel en marcos de tiempo mayores, cerraré la posición larga

Estructuralmente alcista en marcos de tiempo mayores. Tengo órdenes de compra en el nivel S/R verde para un posible movimiento hacia $3600s

Si empezamos a ver cierres por debajo de este nivel en marcos de tiempo mayores, cerraré la posición larga

ETH-3,67%

- Recompensa

- 1

- 1

- Republicar

- Compartir

AngryBird :

:

Muy impresionante publicación como siempre sigue actualizándonos con buena información

yoj tiene un gran conocimiento y también un excelente contenido

sigue así

$HYPE (solicitado)

Como era de esperar, VAH resultó en una caída. En la última actualización, mencioné claramente por qué el precio se mantendría en rango por más tiempo a menos que recuperáramos $26

Aún no estoy en largo, pero la reversión a la media está en juego hacia el máximo del rango nuevamente

Como era de esperar, VAH resultó en una caída. En la última actualización, mencioné claramente por qué el precio se mantendría en rango por más tiempo a menos que recuperáramos $26

Aún no estoy en largo, pero la reversión a la media está en juego hacia el máximo del rango nuevamente

HYPE-4,52%

- Recompensa

- Me gusta

- Comentar

- Republicar

- Compartir

$LIT sin reclamación, sin parte

Evitar una bala. Por eso, a veces es mucho mejor simplemente esperar la confirmación de tu operación en lugar de intentar atrapar con un cuchillo.

El precio nunca superó el nivel de soporte/resistencia que marcamos, en cambio actuó como resistencia, resultando en una caída del -17%.

Evitar una bala. Por eso, a veces es mucho mejor simplemente esperar la confirmación de tu operación en lugar de intentar atrapar con un cuchillo.

El precio nunca superó el nivel de soporte/resistencia que marcamos, en cambio actuó como resistencia, resultando en una caída del -17%.

LIT-6,58%

- Recompensa

- Me gusta

- Comentar

- Republicar

- Compartir

Re-extendí, volví a añadir la exposición que eliminé con los TPs de la semana pasada

Más detalles próximamente

Ver originalesMás detalles próximamente

- Recompensa

- Me gusta

- Comentar

- Republicar

- Compartir

$HYPE

Ha sido bastante divertido comerciar con Hype últimamente, ya que el precio siguió en tendencia alcista desde $24 (VAL) y siguió rechazando desde el VAH.

Para que Hype suba de precio, necesita superar el $26 nivel, de lo contrario, operar en este rango de $24-26 parece buena opción

Ha sido bastante divertido comerciar con Hype últimamente, ya que el precio siguió en tendencia alcista desde $24 (VAL) y siguió rechazando desde el VAH.

Para que Hype suba de precio, necesita superar el $26 nivel, de lo contrario, operar en este rango de $24-26 parece buena opción

HYPE-4,52%

- Recompensa

- Me gusta

- Comentar

- Republicar

- Compartir

$LIT (Guía de trading para nuevas listas; consulta el tutorial)

Estamos a salvo de caídas ya que el precio desde el TGE ha bajado solo sin muchas señales de fortaleza

Lo que busco aquí es:

- Ruptura de estructura

- Precio por encima de la banda EMA 20/50

- Largo con invalidación por debajo de los mínimos recientes

Estamos a salvo de caídas ya que el precio desde el TGE ha bajado solo sin muchas señales de fortaleza

Lo que busco aquí es:

- Ruptura de estructura

- Precio por encima de la banda EMA 20/50

- Largo con invalidación por debajo de los mínimos recientes

LIT-6,58%

- Recompensa

- Me gusta

- Comentar

- Republicar

- Compartir

$SOL

Yo entré desde las bajas 120s en mi cuenta spot ( compartido en el grupo gratuito de Telegram en tiempo real). Vendí algunas en $146 ya que el precio barrió los máximos y obtuve las ejecuciones en el marco de tiempo diario, lo que podría resultar en alguna corrección.

Así que la zona en la que busco volver a añadir es alrededor de $134 (la media del rango), o alternativamente, si el precio rompe por encima y mantiene los $146, volveré a añadir riesgo para alguna continuación.

Yo entré desde las bajas 120s en mi cuenta spot ( compartido en el grupo gratuito de Telegram en tiempo real). Vendí algunas en $146 ya que el precio barrió los máximos y obtuve las ejecuciones en el marco de tiempo diario, lo que podría resultar en alguna corrección.

Así que la zona en la que busco volver a añadir es alrededor de $134 (la media del rango), o alternativamente, si el precio rompe por encima y mantiene los $146, volveré a añadir riesgo para alguna continuación.

SOL-3,91%

- Recompensa

- Me gusta

- Comentar

- Republicar

- Compartir

Haciendo mi primer tutorial detallado de 2026

300 me gusta y lo publico este fin de semana

Deja tus sugerencias 👇

Ver originales300 me gusta y lo publico este fin de semana

Deja tus sugerencias 👇

- Recompensa

- Me gusta

- Comentar

- Republicar

- Compartir

Si quieres caminar rápido indefinidamente, no llegarás muy lejos en este negocio

Si quieres caminar despacio, pasarás años sin progreso y las narrativas desaparecerán

El trading y cualquier ocupación en cripto es como un atleta. Corre a toda velocidad, entrena duro y descansa. Los que se esfuerzan sin parar no ganan

Ver originalesSi quieres caminar despacio, pasarás años sin progreso y las narrativas desaparecerán

El trading y cualquier ocupación en cripto es como un atleta. Corre a toda velocidad, entrena duro y descansa. Los que se esfuerzan sin parar no ganan

- Recompensa

- Me gusta

- Comentar

- Republicar

- Compartir

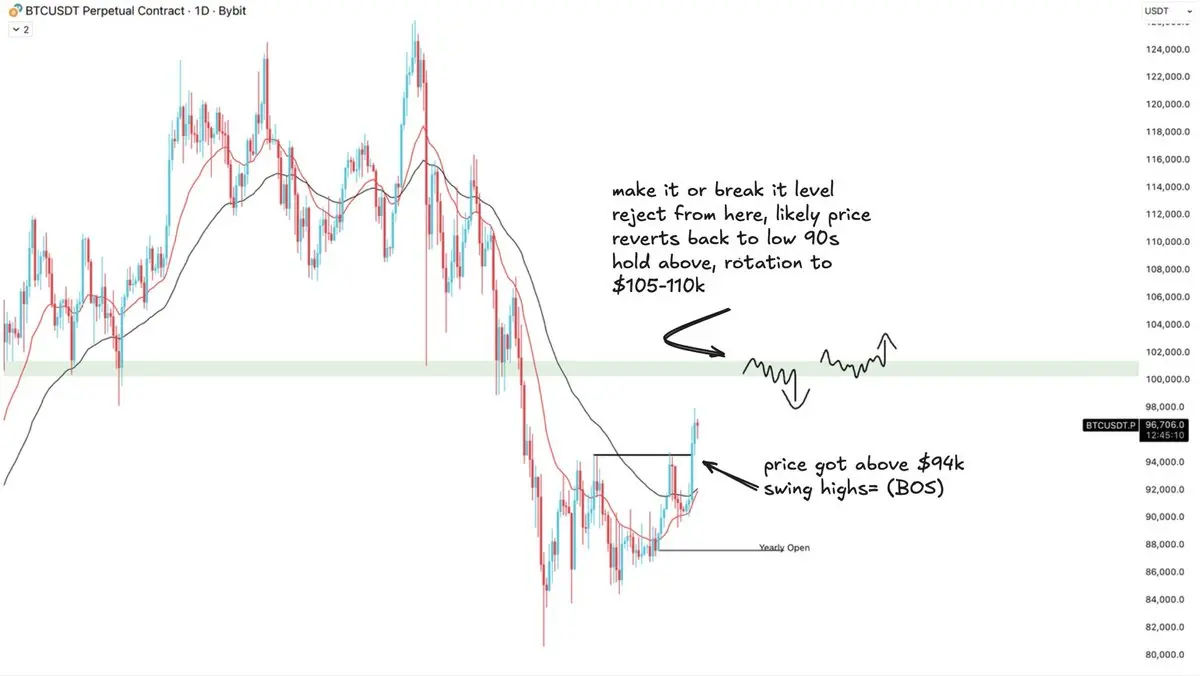

$BTC

- La primera toma de beneficios en largos se alcanzó ayer alrededor de 97k

- Cuanto más tiempo operamos por encima de 94-95 con el OI estabilizándose (Los largos de Breakout fueron liquidados)

Cuanto más probable es que esto sea un cambio de tendencia macro

- Los niveles clave hacia el alza están por encima de 100k o en el flujo de órdenes en una prueba de retesteo

- 370M en liquidaciones ayer, la primera gran victoria para los toros desde octubre de '25. No creo que sea solo un squeeze de cortos, la magnitud sería completamente diferente si lo fuera

- La primera toma de beneficios en largos se alcanzó ayer alrededor de 97k

- Cuanto más tiempo operamos por encima de 94-95 con el OI estabilizándose (Los largos de Breakout fueron liquidados)

Cuanto más probable es que esto sea un cambio de tendencia macro

- Los niveles clave hacia el alza están por encima de 100k o en el flujo de órdenes en una prueba de retesteo

- 370M en liquidaciones ayer, la primera gran victoria para los toros desde octubre de '25. No creo que sea solo un squeeze de cortos, la magnitud sería completamente diferente si lo fuera

BTC-2,23%

- Recompensa

- Me gusta

- Comentar

- Republicar

- Compartir

Tomé algo de ganancia en spot en todos los largos, he estado manteniendo esto desde alrededor de 87k y por debajo de 2.7k

Escala en y escala fuera.

Dos reglas de oro para el trading de swing rentable:

1. Escala en, no tengas un ego tan grande como para pensar que puedes pillar los fondos bajos

2. Escala fuera, sigue reservando ganancias y también retirando fondos. No tengas un ego tan grande como para pensar que puedes pillar los máximos

Ver originalesEscala en y escala fuera.

Dos reglas de oro para el trading de swing rentable:

1. Escala en, no tengas un ego tan grande como para pensar que puedes pillar los fondos bajos

2. Escala fuera, sigue reservando ganancias y también retirando fondos. No tengas un ego tan grande como para pensar que puedes pillar los máximos

- Recompensa

- Me gusta

- Comentar

- Republicar

- Compartir

$ETH

Configuración similar a la de BTC.

$3200-3300 ha estado limitando el precio durante un tiempo. Si vemos una ruptura con volumen, abriré una posición larga buscando continuación.

Por otro lado, si el precio se mantiene en rango por más tiempo, la probabilidad de barrido de los mínimos alrededor de $2600 es significativa, lo que debería ser una buena oportunidad de compra.

Ver originalesConfiguración similar a la de BTC.

$3200-3300 ha estado limitando el precio durante un tiempo. Si vemos una ruptura con volumen, abriré una posición larga buscando continuación.

Por otro lado, si el precio se mantiene en rango por más tiempo, la probabilidad de barrido de los mínimos alrededor de $2600 es significativa, lo que debería ser una buena oportunidad de compra.

- Recompensa

- Me gusta

- Comentar

- Republicar

- Compartir

$BTC

El precio ha estado en este rango de $80-94k desde el último trimestre. Cada movimiento hacia la región de $92-94k resultó en precios más bajos.

Como este nivel ha sido probado varias veces, me inclino más por comprar la ruptura de este nivel ( si es que llegara a ocurrir.

Alternativamente, si seguimos fluctuando y logramos bajar por debajo de la apertura anual, los mínimos en $80k parecen buenos para un rebote.

El precio ha estado en este rango de $80-94k desde el último trimestre. Cada movimiento hacia la región de $92-94k resultó en precios más bajos.

Como este nivel ha sido probado varias veces, me inclino más por comprar la ruptura de este nivel ( si es que llegara a ocurrir.

Alternativamente, si seguimos fluctuando y logramos bajar por debajo de la apertura anual, los mínimos en $80k parecen buenos para un rebote.

BTC-2,23%

- Recompensa

- Me gusta

- Comentar

- Republicar

- Compartir

- Recompensa

- Me gusta

- Comentar

- Republicar

- Compartir

Rendimiento de la cuenta de trading en 3 meses: ~+50%

- Comencé esta cuenta después de que uno de mis estudiantes se rindiera

- El intento era mostrarle que el swing trading con un apalancamiento de 0.3-1.5x es suficiente para obtener buenos retornos

Estadísticas:

- 24 operaciones en 90 días

- Máximo 1.5x de apalancamiento (principalmente $BTC)

- Operaciones en ambas direcciones

- Restricciones estrictas de drawdown, flexibilizadas a medida que la cuenta va más y más en beneficios

- Mantenerse plano cuando no hay sesgo direccional

No son retornos astronómicos. Pero esta es mi forma disciplinad

- Comencé esta cuenta después de que uno de mis estudiantes se rindiera

- El intento era mostrarle que el swing trading con un apalancamiento de 0.3-1.5x es suficiente para obtener buenos retornos

Estadísticas:

- 24 operaciones en 90 días

- Máximo 1.5x de apalancamiento (principalmente $BTC)

- Operaciones en ambas direcciones

- Restricciones estrictas de drawdown, flexibilizadas a medida que la cuenta va más y más en beneficios

- Mantenerse plano cuando no hay sesgo direccional

No son retornos astronómicos. Pero esta es mi forma disciplinad

BTC-2,23%

- Recompensa

- Me gusta

- Comentar

- Republicar

- Compartir

$BTC El comercio al contado todavía activo

Los números de NFP deberían teóricamente aumentar las posibilidades de un recorte de tasas. Si las acciones mantienen el soporte durante la apertura de EE. UU.

Creo que BTC sigue subiendo lentamente ahora. Con la ayuda de Dios, no tomaremos ganancias en esto hasta los 100k

Los números de NFP deberían teóricamente aumentar las posibilidades de un recorte de tasas. Si las acciones mantienen el soporte durante la apertura de EE. UU.

Creo que BTC sigue subiendo lentamente ahora. Con la ayuda de Dios, no tomaremos ganancias en esto hasta los 100k

BTC-2,23%

- Recompensa

- Me gusta

- Comentar

- Republicar

- Compartir

He pasado buena parte de los últimos 2 días seleccionando mis destacados para que sean un recurso educativo (más organizado que desplazarse por toda la sección)

Echa un vistazo a los destacados y la publicación fijada y dime qué piensan. Prometo que saldrán de esto con más conocimientos

Ver originalesEcha un vistazo a los destacados y la publicación fijada y dime qué piensan. Prometo que saldrán de esto con más conocimientos

- Recompensa

- Me gusta

- Comentar

- Republicar

- Compartir

Long Squeezes: Acción del precio + Flujo de órdenes

¿Cómo detectarlos?

- Observar la estructura del mercado

- Interés abierto

- Liquidaciones y movimientos relativos del OI

Ver originales¿Cómo detectarlos?

- Observar la estructura del mercado

- Interés abierto

- Liquidaciones y movimientos relativos del OI

- Recompensa

- Me gusta

- Comentar

- Republicar

- Compartir