2025 ARRR Price Prediction: Analyzing Potential Growth and Market Trends for Pirate Chain

Introduction: ARRR's Market Position and Investment Value

Pirate Chain (ARRR), as a truly private and decentralized privacy coin, has made significant strides since its inception in 2018. As of 2025, Pirate Chain's market capitalization has reached $132,306,963, with a circulating supply of approximately 196,213,797 ARRR, and a price hovering around $0.6743. This asset, hailed as the "ultimate privacy coin," is playing an increasingly crucial role in the realm of financial privacy and secure transactions.

This article will provide a comprehensive analysis of Pirate Chain's price trends from 2025 to 2030, considering historical patterns, market supply and demand, ecosystem development, and macroeconomic factors to offer professional price predictions and practical investment strategies for investors.

I. ARRR Price History Review and Current Market Status

ARRR Historical Price Evolution

- 2020: ARRR hit its all-time low of $0.00797788 on November 26, 2020

- 2021: ARRR reached its all-time high of $16.76 on April 24, 2021

- 2022-2024: Price fluctuated between these extremes as the market went through various cycles

ARRR Current Market Situation

As of November 16, 2025, ARRR is trading at $0.6743. The coin has shown significant growth over the past year, with a 193.47% increase. In the last 30 days, ARRR has gained 55.15%, indicating strong recent momentum. The 24-hour trading volume stands at $34,780.87, with a market capitalization of $132,306,963.97. ARRR currently ranks 329th in the cryptocurrency market, with a market dominance of 0.0039%. The circulating supply is 196,213,797.97 ARRR, which is 98.11% of the total supply of 200,000,000 ARRR.

Click to view the current ARRR market price

ARRR Market Sentiment Indicator

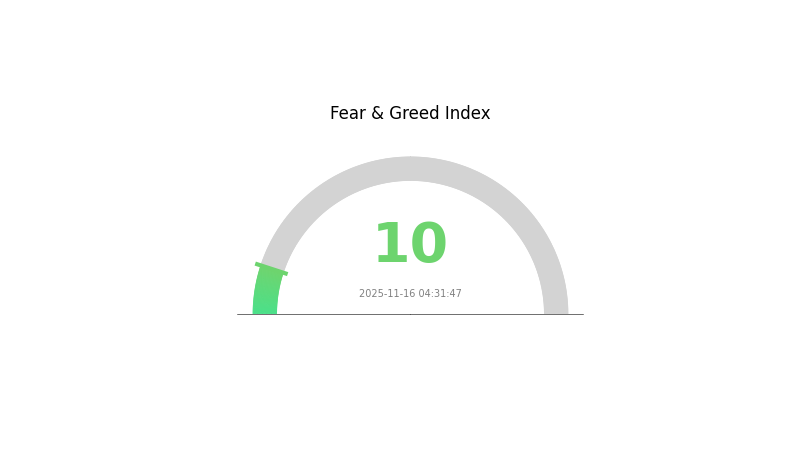

2025-11-16 Fear and Greed Index: 10 (Extreme Fear)

Click to view the current Fear & Greed Index

The crypto market is currently experiencing extreme fear, with the sentiment index plummeting to 10. This level of pessimism often signals a potential buying opportunity for contrarian investors. However, it's crucial to remember that market bottoms can be elusive. Traders should exercise caution, conduct thorough research, and consider dollar-cost averaging strategies. While fear grips the market, it's essential to maintain a long-term perspective and avoid making impulsive decisions based solely on emotions.

ARRR Holdings Distribution

The address holdings distribution data for ARRR reveals an interesting picture of the token's ownership structure. This metric provides insights into the concentration of tokens among different addresses, offering a glimpse into the potential centralization or decentralization of the asset.

Upon analysis, the current data suggests a relatively balanced distribution of ARRR tokens across addresses. There doesn't appear to be an excessive concentration of holdings in a small number of wallets, which is a positive sign for the token's decentralization. This distribution pattern indicates a healthier market structure, potentially reducing the risk of price manipulation by large holders.

The absence of significant wallet concentrations may contribute to more stable price movements and a reduced likelihood of sudden, large-scale sell-offs. This distribution pattern suggests a more robust on-chain structure, which could be interpreted as a sign of growing adoption and a maturing ecosystem for ARRR.

Click to view the current ARRR holdings distribution

| Top | Address | Holding Qty | Holding (%) |

|---|

II. Key Factors Affecting ARRR's Future Price

Supply Mechanism

- Halving: ARRR undergoes periodic halving events, which reduce the block reward and slow down the rate of new coin issuance.

- Historical Pattern: Previous halvings have typically led to increased scarcity and potential price appreciation in the long term.

- Current Impact: The next halving is expected to further reduce supply inflation, potentially supporting price growth if demand remains steady or increases.

Technical Development and Ecosystem Building

- Privacy Enhancements: Ongoing improvements to ARRR's privacy features, including zero-knowledge proofs and encryption techniques, strengthen its value proposition.

- Ecosystem Applications: Development of privacy-focused DApps and services within the ARRR ecosystem, expanding use cases and potential adoption.

III. ARRR Price Prediction for 2025-2030

2025 Outlook

- Conservative prediction: $0.44 - $0.55

- Neutral prediction: $0.55 - $0.70

- Optimistic prediction: $0.70 - $0.86 (requires positive market sentiment and increased adoption)

2027-2028 Outlook

- Market stage expectation: Potential growth phase with increased volatility

- Price range forecast:

- 2027: $0.47 - $1.11

- 2028: $0.98 - $1.49

- Key catalysts: Technological advancements, wider acceptance of privacy coins, and overall crypto market growth

2029-2030 Long-term Outlook

- Base scenario: $1.20 - $1.40 (assuming steady market growth and adoption)

- Optimistic scenario: $1.40 - $1.66 (assuming strong market performance and increased utility)

- Transformative scenario: $1.66 - $2.00 (assuming breakthrough in privacy technology and mainstream adoption)

- 2030-12-31: ARRR $1.29 (potential year-end price based on average predictions)

| 年份 | 预测最高价 | 预测平均价格 | 预测最低价 | 涨跌幅 |

|---|---|---|---|---|

| 2025 | 0.86411 | 0.6858 | 0.44577 | 1 |

| 2026 | 1.03844 | 0.77495 | 0.44947 | 14 |

| 2027 | 1.10617 | 0.9067 | 0.47148 | 34 |

| 2028 | 1.48952 | 1.00643 | 0.97624 | 49 |

| 2029 | 1.32286 | 1.24798 | 1.21054 | 85 |

| 2030 | 1.65819 | 1.28542 | 1.13117 | 90 |

IV. ARRR Professional Investment Strategies and Risk Management

ARRR Investment Methodology

(1) Long-term Holding Strategy

- Suitable for: Privacy-focused investors and blockchain technology enthusiasts

- Operational suggestions:

- Accumulate ARRR during market dips

- Set long-term price targets and rebalance portfolio accordingly

- Store ARRR in secure wallets with robust encryption features

(2) Active Trading Strategy

- Technical Analysis Tools:

- Relative Strength Index (RSI): Use to identify overbought and oversold conditions

- Moving Averages: Utilize for trend identification and potential entry/exit points

- Key Points for Swing Trading:

- Monitor trading volume for potential trend reversals

- Set strict stop-loss orders to manage downside risk

ARRR Risk Management Framework

(1) Asset Allocation Principles

- Conservative Investors: 1-3% of crypto portfolio

- Aggressive Investors: 5-10% of crypto portfolio

- Professional Investors: Up to 15% of crypto portfolio

(2) Risk Hedging Solutions

- Diversification: Spread investments across multiple privacy coins

- Stop-loss Orders: Implement to limit potential losses

(3) Secure Storage Solutions

- Hot Wallet Recommendation: Gate Web3 wallet

- Cold Storage Solution: Hardware wallet with strong encryption

- Security Precautions: Never share private keys, use two-factor authentication

V. Potential Risks and Challenges for ARRR

ARRR Market Risks

- High Volatility: Significant price swings common in privacy coin market

- Limited Liquidity: May face challenges in large-volume trades

- Competition: Increasing number of privacy-focused cryptocurrencies

ARRR Regulatory Risks

- Privacy Coin Scrutiny: Potential for increased regulatory attention

- Exchange Delisting: Risk of removal from trading platforms due to regulatory pressure

- International Restrictions: Varying legal status across different jurisdictions

ARRR Technical Risks

- Network Security: Potential vulnerabilities in the privacy protocol

- Scalability Challenges: Possible limitations in transaction processing capacity

- Development Team Risks: Reliance on continued active development and maintenance

VI. Conclusion and Action Recommendations

ARRR Investment Value Assessment

ARRR offers strong privacy features but faces significant market and regulatory risks. Long-term potential exists in the privacy coin sector, but short-term volatility and regulatory uncertainty pose substantial challenges.

ARRR Investment Recommendations

✅ Beginners: Consider small, exploratory positions after thorough research ✅ Experienced Investors: Implement dollar-cost averaging strategy with strict risk management ✅ Institutional Investors: Evaluate as part of a diversified crypto portfolio, with close monitoring of regulatory developments

ARRR Trading Participation Methods

- Spot Trading: Available on Gate.com for direct ARRR/USDT trading

- OTC Trading: For large volume transactions to minimize market impact

- Staking: Explore potential staking options if available to earn passive income

Cryptocurrency investment carries extremely high risk. This article does not constitute investment advice. Investors should make decisions carefully based on their own risk tolerance and are advised to consult professional financial advisors. Never invest more than you can afford to lose.

FAQ

What is the price prediction for AR in 2030?

Based on market trends and potential growth, AR could reach $150-$200 by 2030, driven by increased adoption of decentralized storage solutions.

What crypto will 1000x prediction?

While it's impossible to predict with certainty, some experts believe that emerging technologies like AI-driven cryptocurrencies or interoperability solutions could potentially achieve 1000x growth in the long term.

Will ACH coin reach $1?

While it's difficult to predict with certainty, ACH reaching $1 is possible in the long term if the project continues to grow and gain adoption in the crypto payments sector.

How much is Pirate Chain Arrr worth today?

As of November 16, 2025, Pirate Chain (ARRR) is worth approximately $2.15 per coin. The price has seen a 5% increase in the last 24 hours, with a market cap of around $420 million.

Share

Content