2025 BAT Price Prediction: Will the Basic Attention Token Reach $5 in the Next Bull Run?

Introduction: BAT's Market Position and Investment Value

Basic Attention Token (BAT), as a digital asset revolutionizing the digital advertising industry, has made significant strides since its inception in 2017. As of 2025, BAT's market capitalization has reached $268,779,438, with a circulating supply of approximately 1,495,711,956 tokens, and a price hovering around $0.1797. This asset, often hailed as the "attention economy token," is playing an increasingly crucial role in reshaping online advertising and user engagement.

This article will comprehensively analyze BAT's price trends from 2025 to 2030, considering historical patterns, market supply and demand, ecosystem development, and macroeconomic factors to provide investors with professional price predictions and practical investment strategies.

I. BAT Price History Review and Current Market Status

BAT Historical Price Evolution

- 2017: ICO launch, price started at $0.035998

- 2021: Bull market peak, price reached all-time high of $1.9 on November 28

- 2022-2023: Crypto winter, price dropped to lows around $0.2-$0.3

BAT Current Market Situation

As of November 15, 2025, BAT is trading at $0.1797. The token has seen a 5.31% increase in the past 24 hours, with a trading volume of $234,161. BAT's market cap stands at $268,779,438, ranking it 209th among all cryptocurrencies. The token is currently 90.5% below its all-time high of $1.9, but 148% above its all-time low of $0.072394. Short-term price trends show mixed signals, with a 1.70% gain in the last hour but a 16.6% decline over the past week. The 30-day performance indicates a 9.44% decrease, while the year-to-date change is relatively stable at -0.44%.

Click to view the current BAT market price

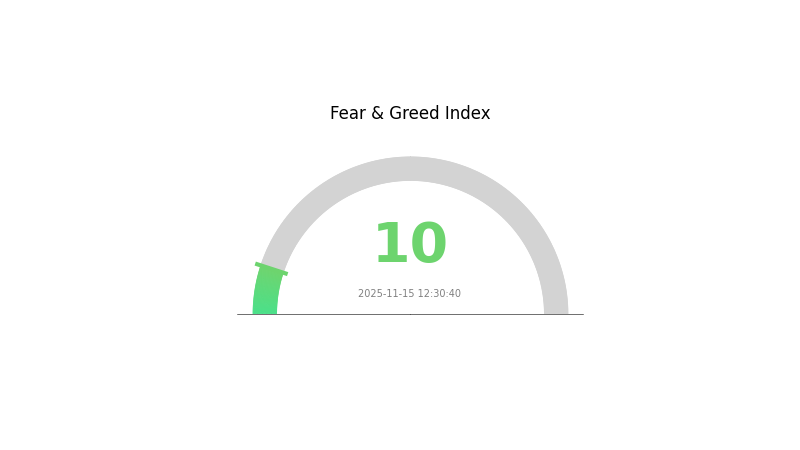

BAT Market Sentiment Indicator

2025-11-15 Fear and Greed Index: 10 (Extreme Fear)

Click to view the current Fear & Greed Index

The crypto market is experiencing extreme fear, with the sentiment index plummeting to 10. This indicates a highly pessimistic outlook among investors. Such extreme fear often presents potential buying opportunities for contrarian investors. However, it's crucial to conduct thorough research and exercise caution. Remember, market sentiment can shift rapidly. Stay informed and consider diversifying your portfolio to mitigate risks in this volatile environment. Gate.com offers tools and resources to help navigate these challenging market conditions.

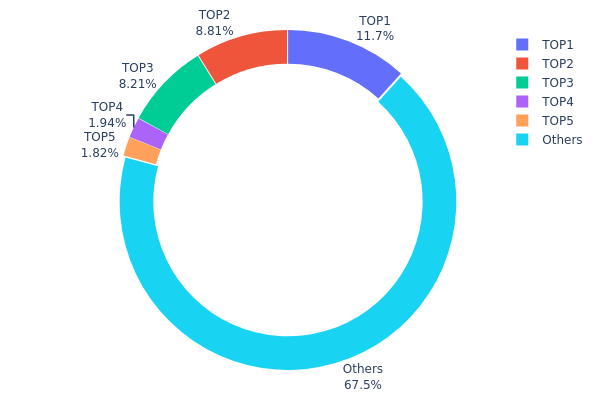

BAT Holdings Distribution

The address holdings distribution data provides valuable insights into the concentration of BAT tokens among various wallet addresses. Analysis of this data reveals a moderate level of centralization in BAT's ownership structure. The top 5 addresses collectively hold 32.46% of the total BAT supply, with the largest address controlling 11.69%. This concentration, while significant, is not extreme compared to some other cryptocurrencies.

The distribution pattern suggests a balanced market structure, where no single entity has overwhelming control. However, the presence of large holders could potentially influence market dynamics. The fact that 67.54% of BAT tokens are distributed among numerous smaller addresses indicates a healthy level of decentralization, which may contribute to market stability and resilience against manipulation attempts.

This distribution reflects a maturing ecosystem for BAT, balancing between institutional interest (represented by larger holders) and widespread adoption among individual users. Such a structure generally supports long-term sustainability and reduces the risk of sudden, large-scale sell-offs that could dramatically impact price volatility.

Click to view the current BAT Holdings Distribution

| Top | Address | Holding Qty | Holding (%) |

|---|---|---|---|

| 1 | 0xfd82...64a00b | 175451.32K | 11.69% |

| 2 | 0x6c8c...d90e4e | 132156.48K | 8.81% |

| 3 | 0xf977...41acec | 123219.37K | 8.21% |

| 4 | 0x3727...866be8 | 29110.87K | 1.94% |

| 5 | 0x4101...2b2293 | 27285.54K | 1.81% |

| - | Others | 1012776.41K | 67.54% |

II. Key Factors Influencing BAT's Future Price

Supply Mechanism

- Token Burn: BAT implements a token burn mechanism to reduce supply over time.

- Historical Pattern: Previous token burns have generally had a positive impact on BAT's price.

- Current Impact: The ongoing token burn is expected to create upward pressure on BAT's price due to reduced supply.

Institutional and Whale Dynamics

- Corporate Adoption: Brave Browser continues to be the primary adopter of BAT, integrating it into its advertising ecosystem.

Macroeconomic Environment

- Inflation Hedging Properties: BAT has shown some resilience during inflationary periods, though not as strong as major cryptocurrencies like Bitcoin.

Technological Development and Ecosystem Building

- Brave Wallet Integration: Enhanced integration of BAT with Brave's native wallet may increase utility and demand.

- Ecosystem Applications: The BAT ecosystem includes Brave Browser, Brave Search, and various DApps built on the Brave platform.

III. BAT Price Prediction for 2025-2030

2025 Outlook

- Conservative prediction: $0.15002 - $0.17

- Neutral prediction: $0.17 - $0.19

- Optimistic prediction: $0.19 - $0.21611 (requires positive market sentiment and increased adoption)

2027-2028 Outlook

- Market phase expectation: Potential growth phase with increased volatility

- Price range forecast:

- 2027: $0.14132 - $0.30192

- 2028: $0.22448 - $0.33801

- Key catalysts: Technological advancements, wider industry adoption, and favorable regulatory developments

2029-2030 Long-term Outlook

- Base scenario: $0.29802 - $0.33378 (assuming steady market growth and continued project development)

- Optimistic scenario: $0.36954 - $0.49066 (assuming strong market performance and significant adoption milestones)

- Transformative scenario: $0.50+ (assuming breakthrough use cases and major mainstream integration)

- 2030-12-31: BAT $0.33378 (potential 85% increase from 2025 levels)

| 年份 | 预测最高价 | 预测平均价格 | 预测最低价 | 涨跌幅 |

|---|---|---|---|---|

| 2025 | 0.21611 | 0.1786 | 0.15002 | 0 |

| 2026 | 0.2309 | 0.19735 | 0.1638 | 9 |

| 2027 | 0.30192 | 0.21413 | 0.14132 | 18 |

| 2028 | 0.33801 | 0.25802 | 0.22448 | 43 |

| 2029 | 0.36954 | 0.29802 | 0.22053 | 65 |

| 2030 | 0.49066 | 0.33378 | 0.23031 | 85 |

IV. Professional BAT Investment Strategies and Risk Management

BAT Investment Methodology

(1) Long-term Holding Strategy

- Suitable for: Long-term investors with high risk tolerance

- Operation suggestions:

- Accumulate BAT tokens during market dips

- Set price targets and stick to your investment plan

- Store tokens in a secure hardware wallet

(2) Active Trading Strategy

- Technical analysis tools:

- Moving Averages: Use to identify trends and potential reversal points

- Relative Strength Index (RSI): Helps determine overbought/oversold conditions

- Key points for swing trading:

- Monitor BAT's correlation with broader crypto market trends

- Pay attention to Brave browser adoption rates and user growth

BAT Risk Management Framework

(1) Asset Allocation Principles

- Conservative investors: 1-3% of crypto portfolio

- Aggressive investors: 5-10% of crypto portfolio

- Professional investors: Up to 15% of crypto portfolio

(2) Risk Hedging Solutions

- Diversification: Spread investments across different crypto assets

- Stop-loss orders: Set predetermined exit points to limit potential losses

(3) Secure Storage Solutions

- Hot wallet recommendation: Gate Web3 wallet

- Cold storage solution: Hardware wallets for long-term holdings

- Security precautions: Enable two-factor authentication, use strong passwords

V. Potential Risks and Challenges for BAT

BAT Market Risks

- Volatility: BAT price can experience significant fluctuations

- Competition: Other attention-based tokens may emerge

- Adoption risk: Slow growth of Brave browser user base could impact BAT demand

BAT Regulatory Risks

- Advertising regulations: Changes in digital advertising laws could affect BAT's utility

- Token classification: Potential for BAT to be classified as a security in some jurisdictions

- Privacy concerns: Increased scrutiny on data collection practices

BAT Technical Risks

- Smart contract vulnerabilities: Potential for exploits in the BAT token contract

- Scalability issues: Ethereum network congestion could impact BAT transactions

- Browser integration problems: Technical issues with Brave browser could affect BAT distribution

VI. Conclusion and Action Recommendations

BAT Investment Value Assessment

BAT presents a unique value proposition in the digital advertising space, with potential for long-term growth. However, short-term volatility and adoption risks should be considered.

BAT Investment Recommendations

✅ Beginners: Start with small positions, focus on understanding the Brave ecosystem ✅ Experienced investors: Consider BAT as part of a diversified crypto portfolio ✅ Institutional investors: Evaluate BAT's potential in reshaping digital advertising models

BAT Trading Participation Methods

- Spot trading: Purchase BAT tokens on Gate.com

- Staking: Explore BAT staking options if available

- Brave browser usage: Earn BAT by viewing ads while browsing

Cryptocurrency investments carry extremely high risks. This article does not constitute investment advice. Investors should make decisions cautiously based on their own risk tolerance and are advised to consult professional financial advisors. Never invest more than you can afford to lose.

FAQ

Is bat a good crypto?

Yes, BAT is a promising crypto with strong fundamentals and growing adoption in the digital advertising space. Its integration with the Brave browser and potential for disrupting online ads make it a solid investment option.

How high can bat crypto go?

BAT could potentially reach $5-$10 by 2025, driven by increased adoption of the Brave browser and growing demand for privacy-focused digital advertising solutions.

What is the price prediction for bat in 2035?

Based on current trends and potential growth, BAT could reach $10-$15 by 2035, driven by increased adoption of the Brave browser and expansion of the attention-based ecosystem.

What is the forecast for bat shares?

BAT shares are expected to show moderate growth, potentially reaching $1.50-$2.00 by end of 2025, driven by increased adoption of the Brave browser and expanding partnerships in the digital advertising space.

Share

Content