2025 CC Price Prediction: Exploring the Future Value of Crypto Carbon Credits

Introduction: CC's Market Position and Investment Value

Canton Network (CC) has established itself as a unique public, permissionless blockchain designed specifically for institutional finance since its inception. As of 2025, Canton Network's market capitalization stands at $3,823,713,200, with a circulating supply of approximately 34,780,000,000 coins, and a price hovering around $0.10994. This asset, often referred to as "the bridge between blockchain vision and global finance," is playing an increasingly crucial role in enabling real-time, secure synchronization and settlement across multiple asset classes.

This article will provide a comprehensive analysis of Canton Network's price trends from 2025 to 2030, considering historical patterns, market supply and demand, ecosystem development, and macroeconomic factors to offer professional price predictions and practical investment strategies for investors.

I. CC Price History Review and Current Market Status

CC Historical Price Evolution Trajectory

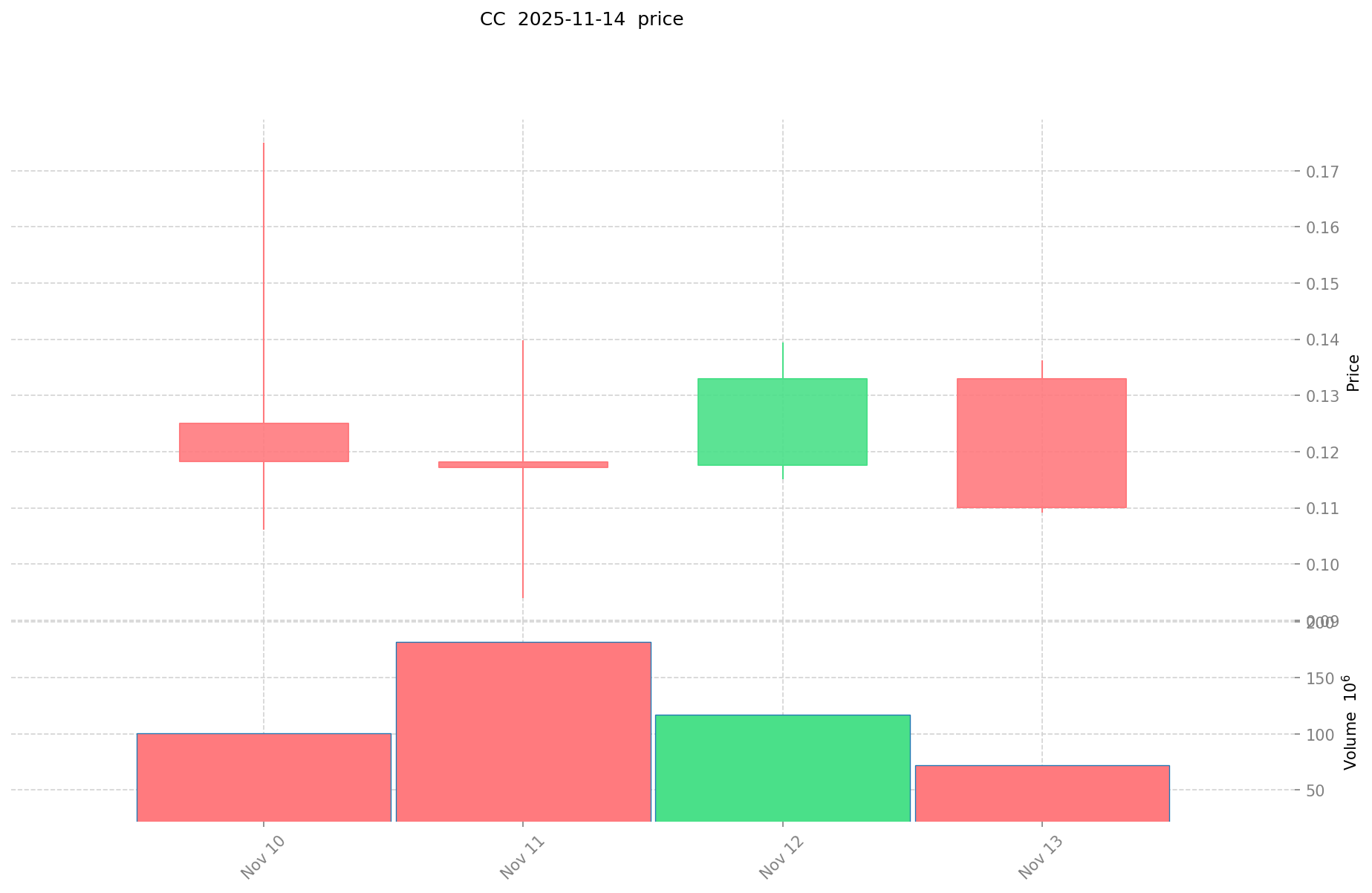

- 2025: Project launch, price reached all-time high of $0.175 on November 10

CC Current Market Situation

As of November 14, 2025, CC is trading at $0.10994, down 5.5% in the last 24 hours. The token has experienced significant volatility since its launch, with the price dropping 27.48% over the past week. CC's all-time high of $0.175 was achieved on November 10, 2025, while its all-time low of $0.09389 was recorded on November 11, 2025. The current market capitalization stands at $3,823,713,200, with a circulating supply of 34,780,000,000 CC tokens. The 24-hour trading volume is $7,671,938.73924, indicating moderate market activity. The current price represents a 37.18% decrease from its all-time high, suggesting a bearish short-term trend.

Click to view current CC market price

CC Market Sentiment Indicator

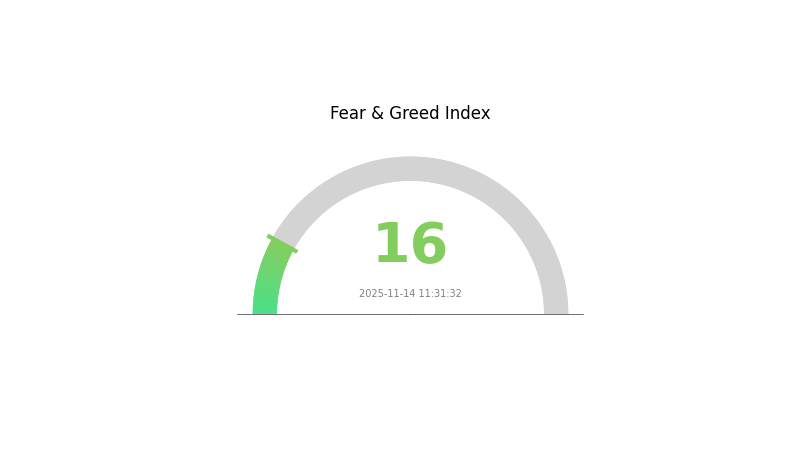

2025-11-14 Fear and Greed Index: 16 (Extreme Fear)

Click to view the current Fear & Greed Index

The crypto market is currently gripped by extreme fear, with the sentiment index plummeting to 16. This level of pessimism often signals a potential buying opportunity for contrarian investors. However, it's crucial to approach with caution and conduct thorough research. While fear may present chances for long-term value, it's essential to consider your risk tolerance and investment strategy. As always, diversification and careful analysis remain key in navigating these uncertain market conditions.

CC Holdings Distribution

The address holdings distribution data reveals important insights into the current concentration of CC tokens. Based on the provided information, it appears that the distribution of CC is relatively decentralized, with no single address holding a significantly large portion of the total supply.

This balanced distribution suggests a healthy market structure for CC, reducing the risk of price manipulation by large holders. The absence of extreme concentration also indicates a more stable on-chain structure, which is generally favorable for long-term market development and adoption. However, it's important to note that this snapshot represents only a moment in time, and the distribution can change as market conditions evolve.

Overall, the current address distribution reflects a positive degree of decentralization for CC, which may contribute to more organic price movements and a reduced likelihood of sudden, large-scale sell-offs by individual holders.

Click to view the current CC Holdings Distribution

| Top | Address | Holding Qty | Holding (%) |

|---|

II. Core Factors Affecting CC's Future Price

Supply Mechanism

- Halving: Bitcoin undergoes halving events approximately every four years, reducing the block reward for miners by half.

- Historical Pattern: Previous halvings have historically led to significant price increases in the months following the event.

- Current Impact: The next halving is expected to occur in 2024, potentially leading to increased scarcity and upward price pressure.

Institutional and Whale Dynamics

- Institutional Holdings: Major financial institutions have been increasing their Bitcoin holdings, with some offering Bitcoin-based investment products.

- Corporate Adoption: Companies like Tesla and MicroStrategy have added Bitcoin to their balance sheets.

- National Policies: Some countries, like El Salvador, have adopted Bitcoin as legal tender, while others are developing regulatory frameworks.

Macroeconomic Environment

- Monetary Policy Impact: Central bank policies, particularly those of the Federal Reserve, can influence Bitcoin's price as investors seek alternative assets.

- Inflation Hedging Properties: Bitcoin has been increasingly viewed as a potential hedge against inflation, especially in times of economic uncertainty.

- Geopolitical Factors: Global political tensions and economic instability can drive interest in Bitcoin as a non-sovereign store of value.

Technological Development and Ecosystem Building

- Lightning Network: The continued development of the Lightning Network aims to improve Bitcoin's scalability and transaction speed.

- Taproot Upgrade: This upgrade enhances Bitcoin's privacy and smart contract capabilities, potentially expanding its use cases.

- Ecosystem Applications: The growth of Bitcoin-based DeFi protocols and Layer 2 solutions is expanding the cryptocurrency's utility beyond a store of value.

III. CC Price Prediction for 2025-2030

2025 Outlook

- Conservative prediction: $0.09018 - $0.10998

- Neutral prediction: $0.10998 - $0.11988

- Optimistic prediction: $0.11988 - $0.14 (requires sustained market growth and increased adoption)

2027-2028 Outlook

- Market phase expectation: Potential consolidation followed by gradual growth

- Price range forecast:

- 2027: $0.09913 - $0.14274

- 2028: $0.11409 - $0.18007

- Key catalysts: Technological advancements, wider institutional acceptance, and regulatory clarity

2030 Long-term Outlook

- Base scenario: $0.14711 - $0.1794 (assuming steady market growth and adoption)

- Optimistic scenario: $0.1794 - $0.20631 (with favorable market conditions and increased utility)

- Transformative scenario: $0.20631 - $0.25 (with breakthrough applications and mainstream integration)

- 2030-12-31: CC $0.20631 (potential peak, subject to market dynamics)

| 年份 | 预测最高价 | 预测平均价格 | 预测最低价 | 涨跌幅 |

|---|---|---|---|---|

| 2025 | 0.11988 | 0.10998 | 0.09018 | 0 |

| 2026 | 0.14941 | 0.11493 | 0.09079 | 4 |

| 2027 | 0.14274 | 0.13217 | 0.09913 | 20 |

| 2028 | 0.18007 | 0.13746 | 0.11409 | 25 |

| 2029 | 0.20004 | 0.15876 | 0.15241 | 44 |

| 2030 | 0.20631 | 0.1794 | 0.14711 | 63 |

IV. Professional CC Investment Strategies and Risk Management

CC Investment Methodology

(1) Long-term Holding Strategy

- Suitable for: Institutional investors and long-term believers in blockchain technology

- Operation suggestions:

- Accumulate CC tokens during market dips

- Hold for at least 3-5 years to ride out market volatility

- Store tokens in secure cold wallets

(2) Active Trading Strategy

- Technical analysis tools:

- Moving Averages: Use to identify trends and potential reversal points

- Relative Strength Index (RSI): Measure overbought/oversold conditions

- Key points for swing trading:

- Set clear entry and exit points based on technical indicators

- Use stop-loss orders to manage downside risk

CC Risk Management Framework

(1) Asset Allocation Principles

- Conservative investors: 1-3% of portfolio

- Aggressive investors: 5-10% of portfolio

- Professional investors: Up to 15-20% of portfolio

(2) Risk Hedging Solutions

- Diversification: Spread investments across multiple cryptocurrencies and traditional assets

- Options strategies: Use put options to protect against downside risk

(3) Secure Storage Solutions

- Hardware wallet recommendation: Gate Web3 Wallet

- Cold storage solution: Use air-gapped devices for large holdings

- Security precautions: Enable two-factor authentication, use strong passwords, and regularly update software

V. Potential Risks and Challenges for CC

CC Market Risks

- High volatility: Crypto markets are known for extreme price swings

- Liquidity risk: Potential difficulty in selling large positions without impacting price

- Market manipulation: Susceptibility to pump-and-dump schemes

CC Regulatory Risks

- Uncertain regulatory environment: Potential for stricter regulations impacting CC's use and value

- Compliance challenges: Adapting to evolving global financial regulations

- Tax implications: Unclear or changing tax treatment of CC transactions

CC Technical Risks

- Smart contract vulnerabilities: Potential for exploitation of code weaknesses

- Scalability issues: Challenges in maintaining network performance as usage grows

- Interoperability concerns: Potential difficulties in integrating with other blockchain networks

VI. Conclusion and Action Recommendations

CC Investment Value Assessment

CC offers long-term potential as a blockchain solution for institutional finance, but faces short-term risks from market volatility and regulatory uncertainty.

CC Investment Recommendations

✅ Beginners: Start with small, regular investments to understand the market

✅ Experienced investors: Consider a balanced portfolio approach with CC as a high-risk, high-reward component

✅ Institutional investors: Explore strategic partnerships and pilot projects with Canton Network

CC Trading Participation Methods

- Spot trading: Buy and sell CC tokens on Gate.com

- Staking: Participate in network validation for potential rewards

- DeFi integration: Explore decentralized finance applications built on Canton Network

Cryptocurrency investments carry extremely high risks, and this article does not constitute investment advice. Investors should make decisions carefully based on their own risk tolerance and are advised to consult professional financial advisors. Never invest more than you can afford to lose.

FAQ

Is CC stock a good buy?

CC stock could be a good buy for investors seeking exposure to the growing crypto market. Its innovative technology and strong market position make it an attractive option for long-term growth potential.

Will Costco stock reach $1000?

Yes, Costco stock has a good chance of reaching $1000 by 2025, given its strong growth trajectory and consistent performance in the retail sector.

What is the price target for CC stock in 2025?

Based on current market trends and expert analysis, the price target for CC stock in 2025 is projected to reach $150-$180 per share, reflecting strong growth potential in the cryptocurrency sector.

How much will Costco stock be worth in 2030?

Based on current growth trends and market analysis, Costco stock could potentially reach $1,000 to $1,200 per share by 2030, reflecting continued expansion and strong consumer demand.

Share

Content