2025 ETHW Price Prediction: Navigating the Future of Ethereum's Hard Fork Token

Introduction: ETHW's Market Position and Investment Value

EthereumPoW (ETHW) as a digital currency and global payment technology, has been making waves since its inception in 2022. As of 2025, ETHW's market capitalization has reached $83,214,485, with a circulating supply of approximately 107,818,717 tokens, and a price hovering around $0.7718. This asset, often referred to as the "PoW continuation of Ethereum," is playing an increasingly crucial role in providing an alternative blockchain ecosystem for creators and developers.

This article will comprehensively analyze ETHW's price trends from 2025 to 2030, combining historical patterns, market supply and demand, ecosystem development, and macroeconomic factors to provide investors with professional price predictions and practical investment strategies.

I. ETHW Price History Review and Current Market Status

ETHW Historical Price Evolution

- 2022: ETHW launched after Ethereum's merge, price peaked at $58.54 on September 3

- 2023: Market downturn, price declined significantly

- 2024: Continued bearish trend, price reached low of $0.623237 on October 11

ETHW Current Market Situation

As of November 17, 2025, ETHW is trading at $0.7718, with a market cap of $83,214,485. The token has experienced a 3.19% decrease in the last 24 hours and a substantial 76.7% decline over the past year. The current price represents a significant drop from its all-time high of $58.54, reflecting ongoing challenges in the market. Trading volume in the past 24 hours stands at $329,520, indicating moderate market activity. With a circulating supply of 107,818,717 ETHW, the token's market dominance is relatively low at 0.0024%.

Click to view the current ETHW market price

ETHW Market Sentiment Indicator

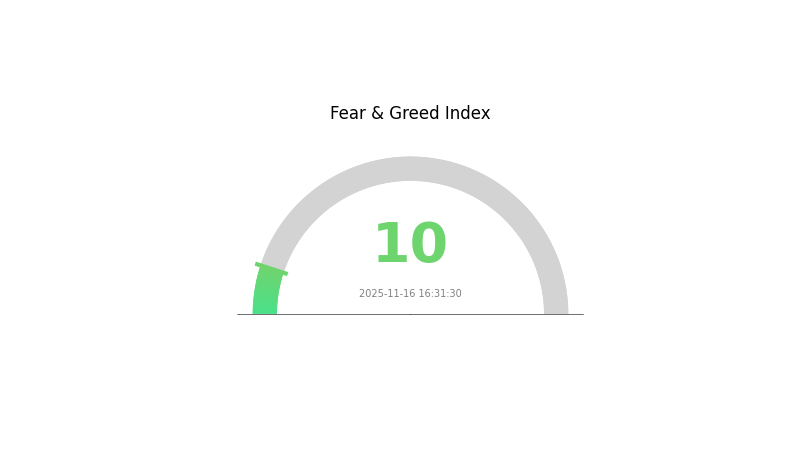

2025-11-16 Fear and Greed Index: 10 (Extreme Fear)

Click to view the current Fear & Greed Index

The cryptocurrency market is currently experiencing a state of extreme fear, with the Fear and Greed Index plummeting to 10. This indicates a significant level of uncertainty and pessimism among investors. During such periods, cautious traders may view this as a potential buying opportunity, adhering to the contrarian investment strategy of "be fearful when others are greedy, and greedy when others are fearful." However, it's crucial to conduct thorough research and exercise caution before making any investment decisions in this volatile market environment.

ETHW Holdings Distribution

The address holdings distribution data for ETHW provides insights into the concentration of token ownership across different addresses. In this case, the absence of specific data points suggests a potential lack of publicly available information or a highly dispersed ownership structure.

Without concrete data on top holders, it's challenging to definitively assess the concentration level of ETHW. This scenario could indicate a relatively decentralized distribution, where no single address holds a significant portion of the total supply. Such a structure would generally be viewed positively in terms of reduced risk of market manipulation and improved overall market stability.

However, the lack of visible large holders doesn't necessarily guarantee a perfectly distributed market. It's possible that major stakeholders may be using multiple addresses to obscure their holdings. Further on-chain analysis and continued monitoring of address distributions would be beneficial to gain a more comprehensive understanding of ETHW's market structure and its implications for price dynamics and ecosystem health.

Click to view the current ETHW Holdings Distribution

| Top | Address | Holding Qty | Holding (%) |

|---|

II. Key Factors Affecting ETHW's Future Price

Supply Mechanism

- Proof of Work Mining: ETHW continues to use the Proof of Work consensus mechanism, which involves miners solving complex mathematical problems to validate transactions and create new blocks.

- Historical Pattern: Changes in mining difficulty and block rewards have historically impacted the price of PoW cryptocurrencies.

- Current Impact: As ETHW maintains the PoW system, its supply is influenced by mining activity, which can affect price based on the balance between new coins mined and market demand.

Institutional and Whale Dynamics

- Institutional Holdings: Limited institutional interest in ETHW compared to mainstream cryptocurrencies like Bitcoin and Ethereum.

- Enterprise Adoption: Minimal enterprise adoption of ETHW due to its status as a fork and limited ecosystem development.

Macroeconomic Environment

- Monetary Policy Impact: Central bank policies, particularly those of the Federal Reserve, can influence risk appetite in crypto markets, potentially affecting ETHW price.

- Inflation Hedging Properties: ETHW's inflation hedging properties are less established compared to more prominent cryptocurrencies.

Technical Development and Ecosystem Building

- Network Upgrades: Potential upgrades to improve scalability and efficiency of the ETHW network.

- Ecosystem Applications: Limited DApp ecosystem compared to the original Ethereum chain, with ongoing efforts to attract developers and projects.

III. ETHW Price Prediction for 2025-2030

2025 Outlook

- Conservative prediction: $0.65 - $0.70

- Neutral prediction: $0.75 - $0.80

- Optimistic prediction: $0.90 - $0.95 (requires positive market sentiment)

2027-2028 Outlook

- Market phase expectation: Potential bull market phase

- Price range forecast:

- 2027: $0.60 - $1.27

- 2028: $0.92 - $1.70

- Key catalysts: Increased adoption, technological improvements

2029-2030 Long-term Outlook

- Base scenario: $1.40 - $1.60 (assuming steady market growth)

- Optimistic scenario: $1.80 - $2.00 (assuming strong market performance)

- Transformative scenario: $2.00 - $2.20 (assuming breakthrough innovations)

- 2030-12-31: ETHW $2.01637 (potential peak)

| 年份 | 预测最高价 | 预测平均价格 | 预测最低价 | 涨跌幅 |

|---|---|---|---|---|

| 2025 | 0.93327 | 0.7713 | 0.65561 | 0 |

| 2026 | 1.20172 | 0.85229 | 0.57955 | 10 |

| 2027 | 1.27349 | 1.02701 | 0.60593 | 33 |

| 2028 | 1.70236 | 1.15025 | 0.9202 | 49 |

| 2029 | 1.5832 | 1.4263 | 1.22662 | 84 |

| 2030 | 2.01637 | 1.50475 | 1.27904 | 94 |

IV. ETHW Professional Investment Strategies and Risk Management

ETHW Investment Methodology

(1) Long-term Holding Strategy

- Suitable for: Risk-tolerant investors with a long-term perspective

- Operational suggestions:

- Accumulate ETHW during market dips

- Set clear long-term price targets

- Store in a secure hardware wallet

(2) Active Trading Strategy

- Technical analysis tools:

- Moving Averages: Use to identify trend directions

- Relative Strength Index (RSI): Gauge overbought/oversold conditions

- Key points for swing trading:

- Monitor ETHW's correlation with ETH price movements

- Set strict stop-loss orders to manage downside risk

ETHW Risk Management Framework

(1) Asset Allocation Principles

- Conservative investors: 1-3%

- Aggressive investors: 5-10%

- Professional investors: Up to 15%

(2) Risk Hedging Solutions

- Diversification: Spread investments across multiple cryptocurrencies

- Options strategies: Use put options for downside protection

(3) Secure Storage Solutions

- Hot wallet recommendation: Gate Web3 Wallet

- Cold storage solution: Hardware wallet for long-term holdings

- Security precautions: Enable two-factor authentication, use strong passwords

V. ETHW Potential Risks and Challenges

ETHW Market Risks

- High volatility: ETHW price can experience extreme fluctuations

- Low liquidity: Limited trading volume may lead to slippage

- Competition: Rivalry from other PoW Ethereum forks

ETHW Regulatory Risks

- Uncertain regulatory landscape: Potential for increased scrutiny

- Cross-border restrictions: Varying legal status in different jurisdictions

- Tax implications: Complex and evolving tax treatment of PoW tokens

ETHW Technical Risks

- Network security: Potential vulnerability to 51% attacks

- Development challenges: Limited developer support compared to Ethereum

- Ecosystem growth: Difficulty in attracting DApps and users

VI. Conclusion and Action Recommendations

ETHW Investment Value Assessment

ETHW presents a high-risk, high-reward opportunity. Long-term value depends on ecosystem growth and adoption, while short-term risks include volatility and regulatory uncertainty.

ETHW Investment Recommendations

✅ Beginners: Allocate only a small portion of portfolio, focus on education ✅ Experienced investors: Consider ETHW as a speculative asset, implement strict risk management ✅ Institutional investors: Approach with caution, conduct thorough due diligence

ETHW Trading Participation Methods

- Spot trading: Direct purchase and sale of ETHW on Gate.com

- Futures trading: Access leveraged exposure through ETHW Futures contracts

- Staking: Participate in ETHW staking programs for potential passive income

Cryptocurrency investment carries extremely high risk. This article does not constitute investment advice. Investors should make decisions carefully based on their own risk tolerance and are advised to consult professional financial advisors. Never invest more than you can afford to lose.

FAQ

Is ETHPoW a good investment?

Yes, ETHPoW could be a good investment. It has potential for growth in the Web3 ecosystem and may offer significant returns as the market evolves.

What is ETHW in crypto?

ETHW is a hard fork of Ethereum that maintains proof-of-work consensus. It was created in 2022 after Ethereum's merge to proof-of-stake, aiming to continue the original mining-based blockchain.

Does Ethereum PoW have a future?

Ethereum PoW's future is uncertain. While it maintains a niche following, its long-term viability is questionable due to Ethereum's successful transition to PoS and the broader industry shift towards more energy-efficient consensus mechanisms.

What happened to Ethereum PoW?

Ethereum PoW (ETHW) forked from Ethereum after the Merge in 2022. It maintained proof-of-work consensus but struggled with adoption and value. By 2025, ETHW's relevance diminished significantly in the crypto ecosystem.

Share

Content