2025 GHO Price Prediction: Analyzing Potential Growth and Market Trends for Aave's Stablecoin

Introduction: GHO's Market Position and Investment Value

GHO (GHO) as a decentralized, over-collateralized stablecoin, has established itself as a significant player in the cryptocurrency market since its inception. As of 2025, GHO's market capitalization has reached $352,680,189, with a circulating supply of approximately 352,821,318 tokens, and a price hovering around $0.9996. This asset, often referred to as the "Aave-native stablecoin," is playing an increasingly crucial role in decentralized finance (DeFi) and lending protocols.

This article will provide a comprehensive analysis of GHO's price trends from 2025 to 2030, considering historical patterns, market supply and demand, ecosystem development, and macroeconomic factors to offer professional price predictions and practical investment strategies for investors.

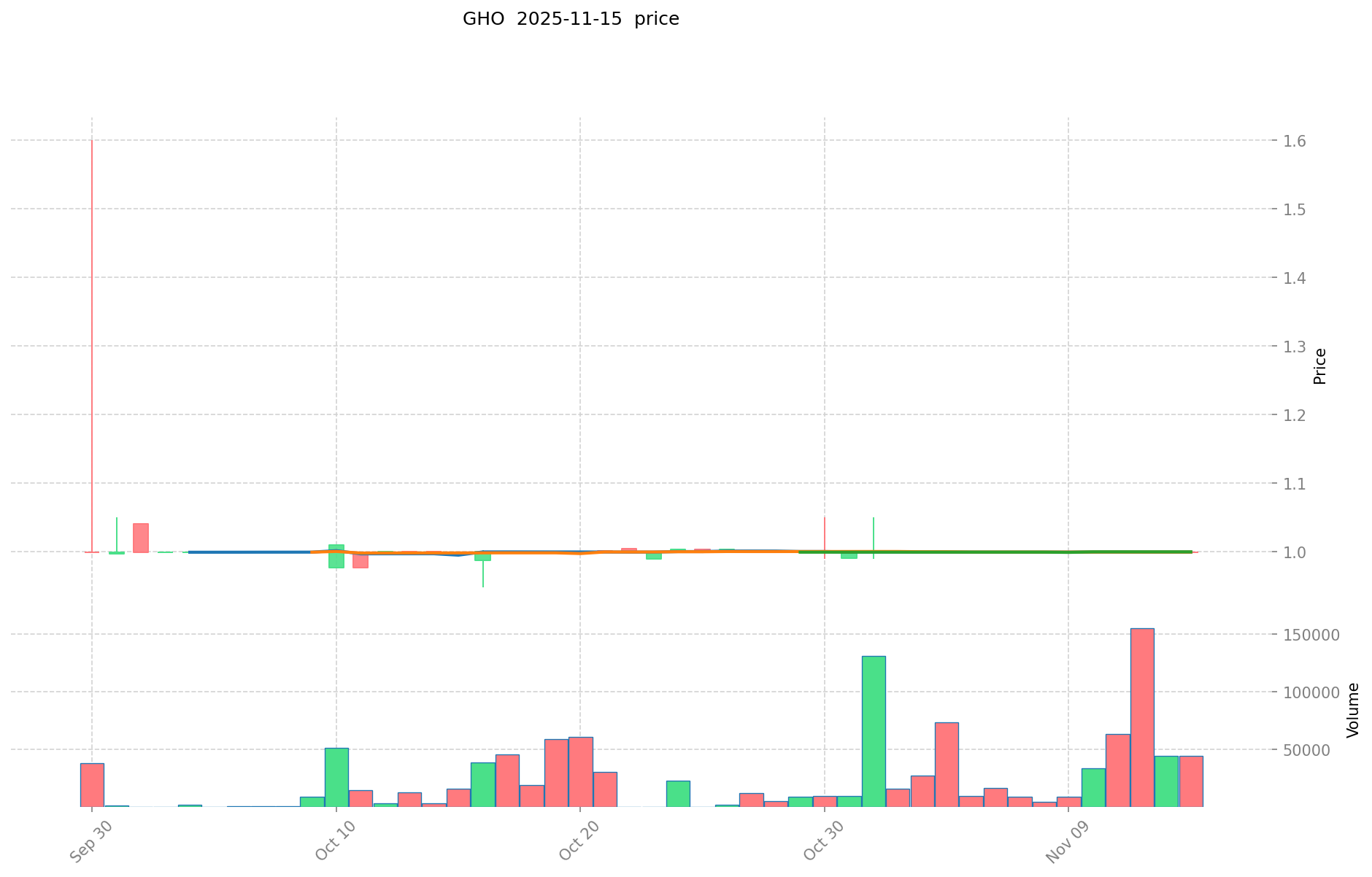

I. GHO Price History Review and Current Market Status

GHO Historical Price Evolution

- 2025: GHO launched, price fluctuated around $1 as designed for stability

- September 30, 2025: GHO reached its all-time high of $1.6

- October 16, 2025: GHO hit its all-time low of $0.9478

GHO Current Market Situation

As of November 15, 2025, GHO is trading at $0.9996, maintaining a stable value close to its $1 peg. The 24-hour trading volume stands at $47,883.51, indicating moderate market activity. GHO's market capitalization is $352,680,189, ranking it 184th in the overall cryptocurrency market.

The token has shown remarkable stability over various timeframes, with minimal price fluctuations. Over the past 24 hours, the price has remained unchanged. The 7-day and 30-day price changes show minor decreases of 0.06% and 0.02% respectively, demonstrating GHO's ability to maintain its peg even in short-term market movements.

Interestingly, GHO has seen a 0.71% increase in value over the past year, suggesting a slight appreciation against its dollar peg in the long term. The current market sentiment for GHO is characterized as "Extreme Fear," which could be attributed to the broader cryptocurrency market conditions rather than GHO's performance itself.

Click to view the current GHO market price

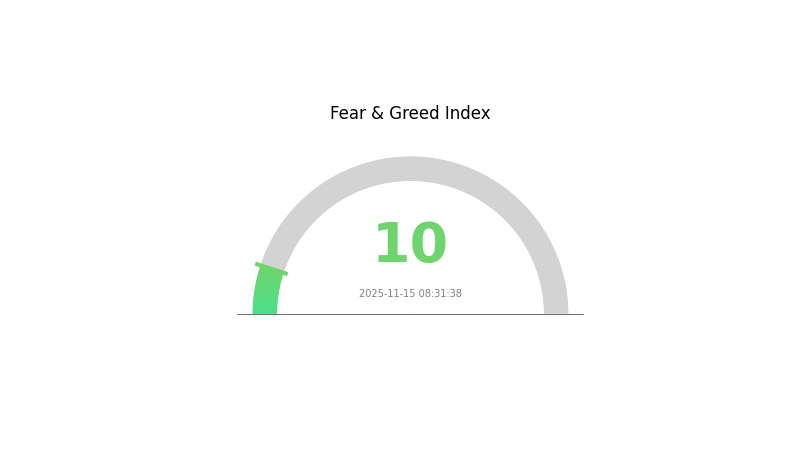

GHO Market Sentiment Indicator

2025-11-15 Fear and Greed Index: 10 (Extreme Fear)

Click to view the current Fear & Greed Index

The crypto market is currently experiencing extreme fear, with the Fear and Greed Index plummeting to 10. This significant drop reflects heightened investor anxiety and market uncertainty. During such periods, experienced traders often view it as a potential buying opportunity, adhering to the adage "be fearful when others are greedy, and greedy when others are fearful." However, caution is advised as market sentiment can shift rapidly. Investors should conduct thorough research and consider their risk tolerance before making any decisions in this volatile environment.

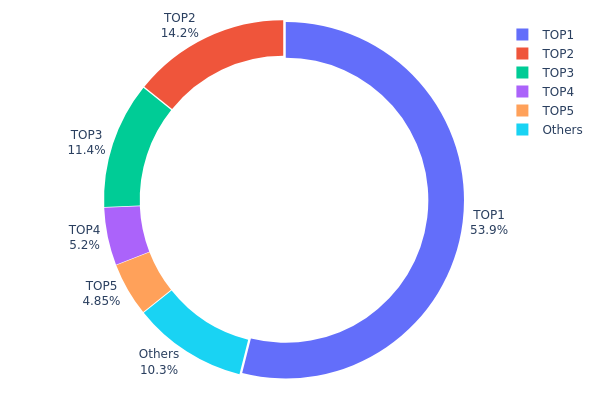

GHO Holdings Distribution

The address holdings distribution data for GHO reveals a highly concentrated ownership structure. The top address holds a staggering 53.93% of the total supply, while the top five addresses collectively control 89.64% of GHO tokens. This level of concentration raises concerns about the token's decentralization and market stability.

Such a concentrated distribution can significantly impact market dynamics. The dominant holders have the potential to exert substantial influence over price movements, potentially leading to increased volatility or market manipulation risks. The large holdings in few addresses may also create liquidity bottlenecks if these holders decide to sell significant portions of their assets.

This distribution pattern suggests that GHO's on-chain structure is currently less decentralized than ideal for a robust and resilient cryptocurrency ecosystem. It highlights the need for broader distribution and increased participation from a more diverse set of stakeholders to enhance market stability and reduce the risk of undue influence from a small number of large holders.

Click to view the current GHO holdings distribution

| Top | Address | Holding Qty | Holding (%) |

|---|---|---|---|

| 1 | 0x1a88...c1885d | 240729.80K | 53.93% |

| 2 | 0x0090...be4977 | 63474.51K | 14.22% |

| 3 | 0x18ef...3ad96a | 51101.97K | 11.44% |

| 4 | 0x0617...28660a | 23230.56K | 5.20% |

| 5 | 0x52aa...f4e497 | 21651.17K | 4.85% |

| - | Others | 46170.76K | 10.36% |

II. Core Factors Affecting GHO's Future Price

Supply Mechanism

- Algorithmic Minting: GHO is minted based on user demand and collateral provided, ensuring a balanced supply.

- Historical Patterns: Supply changes have generally correlated with market demand, influencing price stability.

- Current Impact: The controlled minting mechanism is expected to maintain price stability and prevent excessive volatility.

Institutional and Whale Dynamics

- Institutional Holdings: Major DeFi protocols and DAOs have shown interest in adopting GHO for treasury management.

- Enterprise Adoption: Several fintech companies are exploring GHO integration for cross-border payments.

Macroeconomic Environment

- Monetary Policy Impact: Central banks' ongoing interest rate adjustments may affect GHO's attractiveness as a stable asset.

- Inflation Hedging Properties: GHO's stable design positions it as a potential hedge against inflation in volatile markets.

Technical Development and Ecosystem Building

- Aave Protocol Integration: GHO's deep integration with Aave enhances its utility within the DeFi ecosystem.

- Cross-chain Expansion: Planned support for multiple blockchain networks aims to increase GHO's accessibility and use cases.

- Ecosystem Applications: DeFi lending platforms, decentralized exchanges, and yield farming protocols are actively incorporating GHO.

III. GHO Price Prediction for 2025-2030

2025 Outlook

- Conservative forecast: $0.79968 - $0.9996

- Neutral forecast: $0.9996 - $1.03958

- Optimistic forecast: $1.03958 - $1.07957 (requires positive market sentiment)

2027-2028 Outlook

- Market phase expectation: Potential growth phase

- Price range forecast:

- 2027: $1.03111 - $1.59015

- 2028: $1.07633 - $1.77028

- Key catalysts: Increased adoption and ecosystem expansion

2029-2030 Long-term Outlook

- Base scenario: $1.59325 - $1.76055 (assuming steady market growth)

- Optimistic scenario: $1.76055 - $1.92784 (assuming strong market performance)

- Transformative scenario: $1.92784 - $2.00 (extremely favorable market conditions)

- 2030-12-31: GHO $1.76055 (76% increase from 2025)

| 年份 | 预测最高价 | 预测平均价格 | 预测最低价 | 涨跌幅 |

|---|---|---|---|---|

| 2025 | 1.07957 | 0.9996 | 0.79968 | 0 |

| 2026 | 1.44502 | 1.03958 | 0.54058 | 4 |

| 2027 | 1.59015 | 1.2423 | 1.03111 | 24 |

| 2028 | 1.77028 | 1.41623 | 1.07633 | 41 |

| 2029 | 1.92784 | 1.59325 | 0.92409 | 59 |

| 2030 | 1.90139 | 1.76055 | 1.24999 | 76 |

IV. Professional Investment Strategies and Risk Management for GHO

GHO Investment Methodology

(1) Long-term Holding Strategy

- Suitable for: Conservative investors seeking stability

- Operational suggestions:

- Dollar-cost average into GHO over time

- Monitor Aave protocol updates and governance decisions

- Store GHO in secure, non-custodial wallets

(2) Active Trading Strategy

- Technical analysis tools:

- Moving Averages: Track short-term and long-term trends

- Relative Strength Index (RSI): Identify overbought or oversold conditions

- Key points for swing trading:

- Monitor GHO's peg to USD for potential arbitrage opportunities

- Pay attention to Aave protocol liquidity and utilization rates

GHO Risk Management Framework

(1) Asset Allocation Principles

- Conservative investors: 1-3% of portfolio

- Moderate investors: 3-5% of portfolio

- Aggressive investors: 5-10% of portfolio

(2) Risk Hedging Solutions

- Diversification: Balance GHO with other stablecoins and crypto assets

- Staking: Participate in Aave staking to earn additional yields

(3) Secure Storage Solutions

- Hot wallet recommendation: Gate Web3 Wallet

- Cold storage solution: Hardware wallets for long-term holdings

- Security precautions: Enable two-factor authentication, use unique passwords

V. Potential Risks and Challenges for GHO

GHO Market Risks

- Peg stability: Fluctuations in GHO's value relative to USD

- Liquidity risk: Potential challenges in maintaining sufficient market depth

- Competition: Pressure from other stablecoins in the ecosystem

GHO Regulatory Risks

- Stablecoin regulations: Potential new rules affecting GHO's operations

- Cross-border restrictions: Varying legal status in different jurisdictions

- Compliance requirements: Evolving KYC/AML standards for stablecoin usage

GHO Technical Risks

- Smart contract vulnerabilities: Potential bugs or exploits in the GHO protocol

- Oracle failures: Risks associated with price feed inaccuracies

- Network congestion: Ethereum scalability issues affecting GHO transactions

VI. Conclusion and Action Recommendations

GHO Investment Value Assessment

GHO presents a unique value proposition as a decentralized, overcollateralized stablecoin native to the Aave protocol. While it offers potential for stability and integration within the Aave ecosystem, investors should be aware of the nascent nature of the project and associated risks.

GHO Investment Recommendations

✅ Beginners: Start with small allocations, focus on understanding the Aave ecosystem ✅ Experienced investors: Consider GHO as part of a diversified stablecoin strategy ✅ Institutional investors: Evaluate GHO for potential arbitrage and yield opportunities within the Aave protocol

GHO Participation Methods

- Direct purchase: Buy GHO on Gate.com or other supported exchanges

- Minting: Utilize the Aave protocol to mint GHO using supported collateral assets

- Yield farming: Explore GHO-related liquidity provision and farming opportunities on Aave

Cryptocurrency investments carry extremely high risks, and this article does not constitute investment advice. Investors should make decisions carefully based on their own risk tolerance and are advised to consult professional financial advisors. Never invest more than you can afford to lose.

FAQ

Will hot coin reach $1?

It's unlikely for GHO to reach $1 in the near future, given its current price and market trends. However, crypto markets are highly volatile and unpredictable, so significant price movements are always possible.

What is gho in crypto?

GHO is a decentralized, overcollateralized stablecoin native to the Aave ecosystem, designed to maintain a stable value relative to a specific asset, typically the US dollar.

Can grt coin reach $10?

Yes, GRT could potentially reach $10 in the long term, driven by increased adoption of The Graph protocol and overall growth in the Web3 ecosystem.

What are the risks of buying hoge coin?

Risks include high volatility, lack of regulation, potential for scams, and limited real-world use cases. Always research thoroughly before investing.

Share

Content