2025 PAXG Price Prediction: Will Gold-Backed Tokens Soar in a Volatile Market?

Introduction: PAXG's Market Position and Investment Value

PAX Gold (PAXG) as a virtual asset backed by physical gold, has achieved significant recognition since its inception in 2019. As of 2025, PAXG's market capitalization has reached $1.36 billion, with a circulating supply of approximately 333,354 tokens, and a price hovering around $4,086. This asset, hailed as a "digital gold standard," is playing an increasingly crucial role in the realm of tokenized commodities and hedge against economic uncertainties.

This article will comprehensively analyze PAXG's price trends from 2025 to 2030, combining historical patterns, market supply and demand, ecosystem development, and macroeconomic factors to provide investors with professional price predictions and practical investment strategies.

I. PAXG Price History Review and Current Market Status

PAXG Historical Price Evolution

- 2022: Launch of PAX Gold, price fluctuated around $1,800

- 2023: Gold market rally, PAXG reached $2,000 milestone

- 2024: Economic uncertainties, price surged to all-time high of $4,854.86

PAXG Current Market Situation

PAXG is currently trading at $4,086.1, experiencing a 24-hour decline of 2.35%. The token has shown mixed performance across different timeframes, with a 0.03% increase in the past hour and a 2.18% gain over the last week. However, it has seen a 3.08% decrease in the past 30 days. Despite this, PAXG has demonstrated significant growth over the past year, with a remarkable 60.76% increase. The current price is below its all-time high of $4,854.86 recorded on October 16, 2025, but well above its all-time low of $2,986.26 from April 7, 2025. With a circulating supply of 333,354.594 tokens, PAXG has a market capitalization of $1,362,120,206.54.

Click to view the current PAXG market price

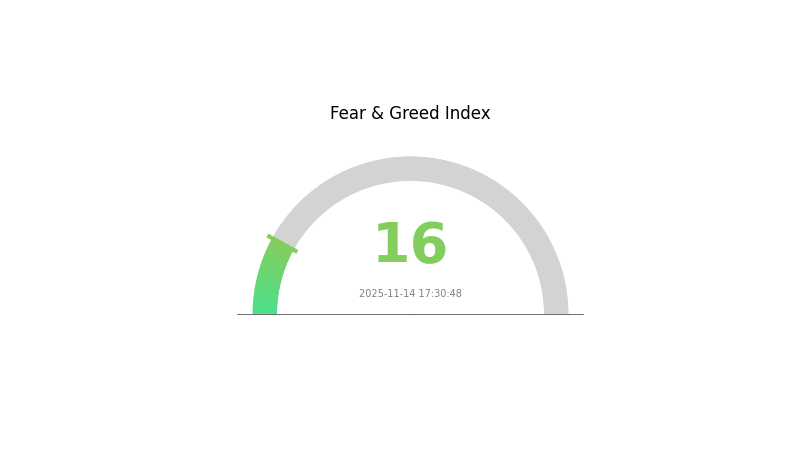

PAXG Market Sentiment Indicator

2025-11-14 Fear and Greed Index: 16 (Extreme Fear)

Click to view the current Fear & Greed Index

The crypto market is gripped by extreme fear, with the Fear and Greed Index plummeting to 16. This indicates a highly pessimistic sentiment among investors. During such periods of intense fear, PAXG often becomes an attractive safe-haven asset. As a gold-backed token, PAXG may see increased demand from risk-averse investors seeking stability amidst market turbulence. However, it's crucial to remember that extreme fear can also present potential buying opportunities for contrarian investors in the broader crypto market.

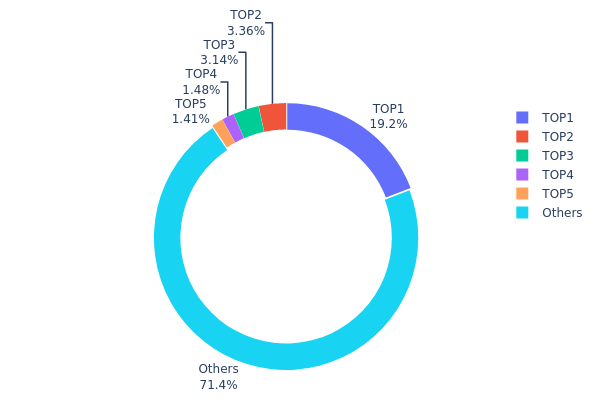

PAXG Holdings Distribution

The address holdings distribution data for PAXG reveals a moderately concentrated ownership structure. The top address holds a significant 19.16% of the total supply, with 63.88K PAXG tokens. The subsequent four largest addresses collectively account for an additional 9.38% of the supply. This concentration level suggests a degree of centralization, albeit not extreme.

However, it's noteworthy that 71.46% of PAXG tokens are distributed among "Others," indicating a long tail of smaller holders. This distribution pattern reflects a balance between large stakeholders and a broader base of smaller investors. While the presence of major holders could potentially influence market dynamics, the substantial distribution among smaller addresses mitigates some risks of market manipulation.

The current distribution suggests a moderate level of decentralization for PAXG. The presence of significant holders may contribute to price stability, as large stakeholders often have long-term investment horizons. Nonetheless, market participants should remain aware of potential volatility that could arise from movements by these major addresses.

Click to view the current PAXG Holdings Distribution

| Top | Address | Holding Qty | Holding (%) |

|---|---|---|---|

| 1 | 0xf977...41acec | 63.88K | 19.16% |

| 2 | 0x7d76...68107d | 11.18K | 3.35% |

| 3 | 0xd2dd...e6869f | 10.47K | 3.14% |

| 4 | 0x264b...5997b5 | 4.95K | 1.48% |

| 5 | 0x7daf...706f83 | 4.71K | 1.41% |

| - | Others | 238.16K | 71.46% |

II. Key Factors Affecting PAXG's Future Price

Supply Mechanism

- Tokenization of Physical Gold: PAXG tokens are backed by physical gold reserves, with each token representing one fine troy ounce of gold.

- Historical Pattern: The supply of PAXG typically correlates with gold market demand and overall economic conditions.

- Current Impact: As global economic uncertainties persist, the demand for gold-backed tokens like PAXG may increase, potentially affecting its supply and price.

Institutional and Whale Dynamics

- Institutional Holdings: Major financial institutions and investment funds have shown increasing interest in gold-backed cryptocurrencies as a digital alternative to physical gold.

- Corporate Adoption: Some companies are exploring PAXG as a treasury reserve asset to hedge against inflation and currency fluctuations.

- National Policies: Several countries are considering regulations for gold-backed cryptocurrencies, which could impact PAXG's adoption and value.

Macroeconomic Environment

- Monetary Policy Impact: Central banks' decisions on interest rates and quantitative easing measures can significantly influence gold prices and, by extension, PAXG.

- Inflation Hedge Properties: PAXG, being backed by gold, is often viewed as a hedge against inflation, potentially increasing in value during high inflationary periods.

- Geopolitical Factors: Global tensions and economic uncertainties tend to drive investors towards safe-haven assets like gold and gold-backed tokens.

III. PAXG Price Prediction for 2025-2030

2025 Outlook

- Conservative prediction: $3,630 - $4,000

- Neutral prediction: $4,000 - $4,200

- Optimistic prediction: $4,200 - $4,528 (requires stable global economic conditions)

2027-2028 Outlook

- Market phase expectation: Potential bullish trend with increased volatility

- Price range forecast:

- 2027: $2,805 - $5,508

- 2028: $5,145 - $7,903

- Key catalysts: Growing institutional adoption, global economic uncertainty

2029-2030 Long-term Outlook

- Base scenario: $6,600 - $7,000 (assuming steady gold market growth)

- Optimistic scenario: $7,000 - $8,500 (with increased cryptocurrency mainstream adoption)

- Transformative scenario: $8,500 - $10,233 (under extreme favorable market conditions)

- 2030-12-31: PAXG $6,867.60 (68% increase from 2025)

| 年份 | 预测最高价 | 预测平均价格 | 预测最低价 | 涨跌幅 |

|---|---|---|---|---|

| 2025 | 4528.16 | 4079.42 | 3630.68 | 0 |

| 2026 | 5896.19 | 4303.79 | 4131.64 | 5 |

| 2027 | 5507.99 | 5099.99 | 2804.99 | 24 |

| 2028 | 7902.94 | 5303.99 | 5144.87 | 29 |

| 2029 | 7131.74 | 6603.47 | 5084.67 | 61 |

| 2030 | 10232.73 | 6867.6 | 4601.29 | 68 |

IV. PAXG Professional Investment Strategies and Risk Management

PAXG Investment Methodology

(1) Long-term Holding Strategy

- Suitable for: Conservative investors seeking gold exposure

- Operation suggestions:

- Accumulate PAXG during market dips

- Set a target allocation and rebalance periodically

- Store in a secure hardware wallet

(2) Active Trading Strategy

- Technical analysis tools:

- Moving Averages: Monitor 50-day and 200-day MAs for trend direction

- RSI: Use overbought/oversold levels for entry/exit signals

- Key points for swing trading:

- Track gold market news and economic indicators

- Set stop-loss orders to manage downside risk

PAXG Risk Management Framework

(1) Asset Allocation Principles

- Conservative investors: 5-10%

- Moderate investors: 10-15%

- Aggressive investors: 15-20%

(2) Risk Hedging Solutions

- Diversification: Combine PAXG with other asset classes

- Options strategies: Use put options for downside protection

(3) Secure Storage Solutions

- Hardware wallet recommendation: Gate Web3 Wallet

- Cold storage solution: Paper wallet for long-term holdings

- Security precautions: Use multi-factor authentication, backup private keys securely

V. Potential Risks and Challenges for PAXG

PAXG Market Risks

- Gold price volatility: PAXG value fluctuates with gold market movements

- Liquidity risk: Potential challenges in large-volume trading during market stress

- Counterparty risk: Reliance on Paxos for gold backing and redemptions

PAXG Regulatory Risks

- Changing cryptocurrency regulations: Potential impact on PAXG's legal status

- Gold market regulations: Changes in gold trading rules could affect PAXG operations

- Tax implications: Evolving tax treatment of tokenized assets

PAXG Technical Risks

- Smart contract vulnerabilities: Potential for exploitation of contract weaknesses

- Blockchain network congestion: Transaction delays during high network activity

- Custody risks: Importance of secure storage practices for private keys

VI. Conclusion and Action Recommendations

PAXG Investment Value Assessment

PAXG offers a unique blend of gold exposure and blockchain technology benefits. Long-term value lies in its gold backing, while short-term risks include market volatility and regulatory uncertainties.

PAXG Investment Recommendations

✅ Beginners: Start with small allocations, focus on long-term holding ✅ Experienced investors: Consider active trading with proper risk management ✅ Institutional investors: Explore PAXG for portfolio diversification and gold exposure

PAXG Participation Methods

- Spot trading: Buy and sell PAXG on Gate.com

- DeFi integration: Explore yield farming opportunities with PAXG

- Physical redemption: Convert PAXG to physical gold (subject to minimum amounts)

Cryptocurrency investments carry extremely high risks. This article does not constitute investment advice. Investors should make decisions based on their own risk tolerance and are advised to consult professional financial advisors. Never invest more than you can afford to lose.

FAQ

Is PaXG a good investment?

Yes, PAXG can be a good investment. It's backed by physical gold, offering stability and potential for growth as gold prices rise. It combines the benefits of gold with the convenience of cryptocurrency.

How high can PaXG go?

PAXG could potentially reach $3,000 per token by 2026, given its gold-backed nature and increasing demand for digital gold assets in the crypto market.

How much is gold worth in 2025?

Based on market trends and expert predictions, gold is expected to be worth around $2,500 to $3,000 per ounce in 2025.

Is PaXG really backed by gold?

Yes, PAXG is fully backed by physical gold. Each token represents one fine troy ounce of gold stored in professional vaults, ensuring its value is tied to real gold reserves.

Share

Content