2025 SOL Price Prediction: Bullish Outlook as Solana Ecosystem Expands

Introduction: SOL's Market Position and Investment Value

Solana (SOL), as a high-performance blockchain protocol, has achieved significant milestones since its inception in 2017. As of 2025, Solana's market capitalization has reached $79.58 billion, with a circulating supply of approximately 554,029,212 tokens, and a price hovering around $143.63. This asset, often referred to as the "Ethereum killer," is playing an increasingly crucial role in decentralized finance (DeFi) and smart contract applications.

This article will comprehensively analyze Solana's price trends from 2025 to 2030, considering historical patterns, market supply and demand, ecosystem development, and macroeconomic factors to provide professional price predictions and practical investment strategies for investors.

I. SOL Price History Review and Current Market Status

SOL Historical Price Evolution

- 2020: Solana launched, price started at $0.22

- 2021: Bull market peak, SOL reached all-time high of $293.31 on January 19

- 2022-2023: Market downturn, price declined significantly

- 2024-2025: Gradual recovery, but still below previous peak

SOL Current Market Situation

As of November 14, 2025, Solana (SOL) is trading at $143.63, ranking 6th by market capitalization. The 24-hour trading volume stands at $75,611,375.97. SOL has experienced a 8.32% decrease in the last 24 hours, with a price range between $138.75 and $157.21.

SOL's current price represents a 51% decline from its all-time high of $293.31 set on January 19, 2025. However, it remains significantly above its all-time low of $0.500801 recorded on May 12, 2020.

The total market capitalization of Solana is $88,183,321,411.96, with a circulating supply of 554,029,211.99 SOL out of a total supply of 613,961,716.99 SOL. The project has a market dominance of 2.53%.

Short-term price trends show mixed signals: while SOL is up 1% in the last hour, it's down 8.42% over the past week and 29.83% over the last month. The long-term trend also indicates a 33.33% decrease over the past year.

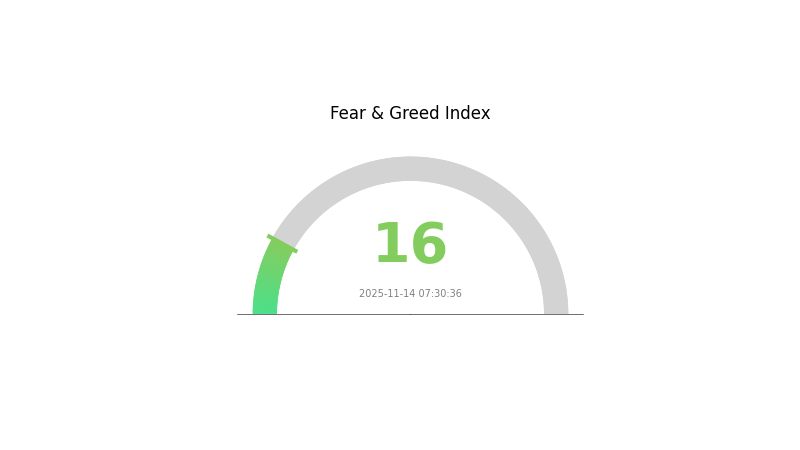

The current market sentiment for cryptocurrencies is characterized as "Extreme Fear" with a VIX index of 16, suggesting a highly cautious investor attitude.

Click to view the current SOL market price

SOL Market Sentiment Indicator

2025-11-14 Fear and Greed Index: 16 (Extreme Fear)

Click to view the current Fear & Greed Index

The crypto market is gripped by extreme fear, with the Fear and Greed Index plummeting to 16. This stark reading suggests investors are highly cautious, potentially creating oversold conditions. While such extreme fear often precedes market bottoms, it's crucial to approach with caution. Savvy traders might see this as an opportunity to "be greedy when others are fearful," but thorough research and risk management remain paramount. Keep a close eye on market developments and consider dollar-cost averaging if you believe in the long-term potential of crypto assets.

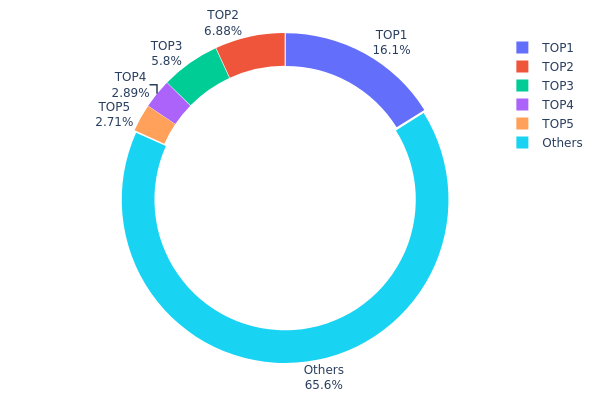

SOL Holdings Distribution

The address holdings distribution data provides insights into the concentration of SOL tokens across different addresses. Based on the provided data, we observe a significant concentration of SOL in the top addresses. The largest holder possesses 16.11% of the total supply, while the top 5 addresses collectively control 34.37% of all SOL tokens.

This level of concentration raises concerns about the decentralization of SOL's network. With over one-third of the supply held by just five addresses, there's potential for these large holders to exert considerable influence on market dynamics. Such concentration could lead to increased price volatility, as large-scale buying or selling by these addresses might significantly impact market prices.

However, it's worth noting that 65.63% of SOL tokens are distributed among "Others," suggesting a degree of broader distribution beyond the top holders. While this indicates some level of decentralization, the significant holdings of the top addresses still pose potential risks to market stability and could affect the overall governance of the Solana ecosystem.

Click to view the current SOL Holdings Distribution

| Top | Address | Holding Qty | Holding (%) |

|---|---|---|---|

| 1 | 4ZJhPQ...oekbPY | 98938.76K | 16.11% |

| 2 | 2RH6rU...aEFFSK | 42249.96K | 6.88% |

| 3 | 9WzDXw...YtAWWM | 35623.49K | 5.80% |

| 4 | 6iQKfE...e9pVSS | 17738.28K | 2.88% |

| 5 | AVzP2G...NWQK49 | 16631.90K | 2.70% |

| - | Others | 402779.56K | 65.63% |

II. Key Factors Affecting SOL's Future Price

Technical Development and Ecosystem Building

- Solana Mobile Stack: Solana has introduced its mobile stack, which includes the Saga phone, aimed at enhancing Web3 accessibility on mobile devices.

- Ecosystem Applications: Solana's ecosystem continues to grow with various DApps and projects, particularly in areas such as DeFi, NFTs, and gaming.

III. SOL Price Prediction for 2025-2030

2025 Outlook

- Conservative prediction: $104.86 - $143.64

- Neutral prediction: $143.64 - $155.13

- Optimistic prediction: $155.13 - $166.62 (requires continued ecosystem growth and market recovery)

2027-2028 Outlook

- Market phase expectation: Potential bull market with increased adoption

- Price range forecast:

- 2027: $94.47 - $200.35

- 2028: $161.64 - $227.02

- Key catalysts: Technological advancements, institutional adoption, and overall crypto market growth

2029-2030 Long-term Outlook

- Base scenario: $204.32 - $243.14 (assuming steady ecosystem expansion)

- Optimistic scenario: $243.14 - $281.96 (with widespread adoption and favorable regulatory environment)

- Transformative scenario: $281.96 - $300+ (with groundbreaking technological innovations and mass market penetration)

- 2030-12-31: SOL $257.73 (potential peak before year-end consolidation)

| 年份 | 预测最高价 | 预测平均价格 | 预测最低价 | 涨跌幅 |

|---|---|---|---|---|

| 2025 | 166.62 | 143.64 | 104.86 | 0 |

| 2026 | 170.64 | 155.13 | 138.07 | 8 |

| 2027 | 200.35 | 162.89 | 94.4749 | 13 |

| 2028 | 227.02 | 181.62 | 161.64 | 26 |

| 2029 | 281.96 | 204.32 | 194.11 | 42 |

| 2030 | 257.73 | 243.14 | 187.22 | 69 |

IV. Professional Investment Strategies and Risk Management for SOL

SOL Investment Methodology

(1) Long-term Holding Strategy

- Suitable for: Long-term investors with high risk tolerance

- Operation suggestions:

- Accumulate SOL during market dips

- Hold for at least 2-3 years to ride out market volatility

- Store in a secure non-custodial wallet

(2) Active Trading Strategy

- Technical analysis tools:

- Moving Averages: Use to identify trends and potential reversal points

- RSI: Monitor overbought/oversold conditions

- Key points for swing trading:

- Set clear entry and exit points

- Use stop-loss orders to limit downside risk

SOL Risk Management Framework

(1) Asset Allocation Principles

- Conservative investors: 1-3%

- Aggressive investors: 5-10%

- Professional investors: Up to 15%

(2) Risk Hedging Solutions

- Diversification: Spread investments across multiple cryptocurrencies

- Stop-loss orders: Implement to limit potential losses

(3) Secure Storage Solutions

- Hardware wallet recommendation: Gate Web3 Wallet

- Software wallet option: Official Solana wallet

- Security precautions: Enable two-factor authentication, use strong passwords

V. Potential Risks and Challenges for SOL

SOL Market Risks

- High volatility: Significant price swings can lead to substantial losses

- Competition: Emerging blockchain platforms may challenge Solana's market position

- Market sentiment: Negative news can rapidly impact SOL's price

SOL Regulatory Risks

- Uncertain regulations: Changing government policies may affect Solana's operations

- Global regulatory differences: Varying international regulations can impact adoption

- Compliance challenges: Potential difficulties in meeting evolving regulatory requirements

SOL Technical Risks

- Network congestion: High transaction volumes could lead to slowdowns

- Smart contract vulnerabilities: Potential for exploits in DApps built on Solana

- Scalability challenges: Future growth may test the network's capacity

VI. Conclusion and Action Recommendations

SOL Investment Value Assessment

Solana presents a high-potential investment with its scalable blockchain technology, but carries significant short-term volatility and competitive risks.

SOL Investment Recommendations

✅ Beginners: Start with small, regular investments to build a position over time

✅ Experienced investors: Consider a balanced approach with both long-term holding and active trading

✅ Institutional investors: Evaluate Solana's technology for potential strategic partnerships or integrations

SOL Trading Participation Methods

- Spot trading: Buy and sell SOL directly on Gate.com

- Futures trading: Engage in leveraged trading with caution on Gate.com

- Staking: Participate in Solana's proof-of-stake system for passive income

Cryptocurrency investments carry extremely high risks, and this article does not constitute investment advice. Investors should make decisions carefully based on their own risk tolerance and are advised to consult professional financial advisors. Never invest more than you can afford to lose.

FAQ

What is Solana going to be worth in 2025?

Based on current trends and market analysis, Solana (SOL) is projected to reach a value of around $500 by 2025, driven by increased adoption and network upgrades.

Can Sol reach $1000 USD?

Yes, SOL could potentially reach $1000 USD in the long term, given its strong ecosystem growth and increasing adoption in the Web3 space.

What will Solana be worth in 2030?

Based on current trends and potential growth, Solana could reach $500-$1000 per coin by 2030, driven by increased adoption and technological advancements in the blockchain space.

Can Sol reach $300?

Yes, SOL could potentially reach $300 by 2025, given its strong ecosystem growth and increasing adoption in the Web3 space.

Share

Content