2025 WBTC Price Prediction: Bullish Outlook as Bitcoin Adoption Soars and Institutional Interest Grows

Introduction: WBTC's Market Position and Investment Value

Wrapped Bitcoin (WBTC), as a bridge between Bitcoin and Ethereum ecosystems, has achieved significant milestones since its inception in 2019. As of 2025, WBTC's market capitalization has reached $12.3 billion, with a circulating supply of approximately 126,763 tokens, and a price hovering around $97,020. This asset, often referred to as "Bitcoin on Ethereum," is playing an increasingly crucial role in decentralized finance (DeFi) and cross-chain interoperability.

This article will comprehensively analyze WBTC's price trends from 2025 to 2030, considering historical patterns, market supply and demand, ecosystem development, and macroeconomic factors, to provide investors with professional price predictions and practical investment strategies.

I. WBTC Price History Review and Current Market Status

WBTC Historical Price Evolution

- 2019: WBTC launched, price started at $3,139.17 (all-time low)

- 2021: Bull market cycle, price surged to new heights

- 2022: Market downturn, price experienced significant volatility

- 2025: Recovery phase, price reached all-time high of $125,932 on October 7

WBTC Current Market Situation

As of November 14, 2025, WBTC is trading at $97,020.8, experiencing a 6.1% decrease in the last 24 hours. The token's market capitalization stands at $12,298,695,097, ranking 13th in the overall cryptocurrency market. WBTC has seen a 4.62% decline over the past week and a more substantial 13.65% drop in the last 30 days. However, it maintains an 8.5% gain over the past year.

The current price represents a 22.96% decrease from its all-time high of $125,932 set on October 7, 2025. Trading volume in the last 24 hours amounts to $104,924,436, indicating active market participation. The circulating supply of WBTC is 126,763.48883569, which is also its total and maximum supply, reflecting its 1:1 peg to Bitcoin.

The market sentiment for WBTC appears bearish in the short term, as evidenced by the recent price declines across various timeframes. However, the long-term outlook remains positive, considering the year-over-year gain.

Click to view the current WBTC market price

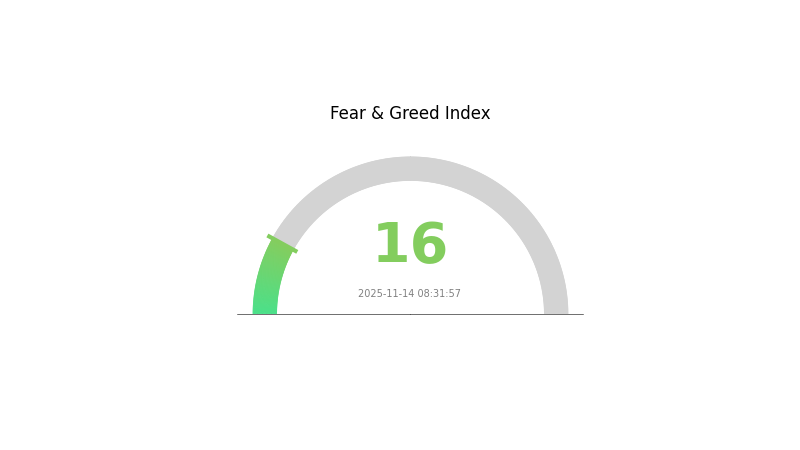

WBTC Market Sentiment Indicator

2025-11-14 Fear and Greed Index: 16 (Extreme Fear)

Click to view the current Fear & Greed Index

The crypto market is currently gripped by extreme fear, with the Fear and Greed Index plummeting to 16. This low reading suggests investors are highly cautious and risk-averse. Such periods of extreme fear often precede potential buying opportunities, as assets may be undervalued. However, traders should exercise caution and conduct thorough research before making any investment decisions. Gate.com offers comprehensive market data to help navigate these turbulent times.

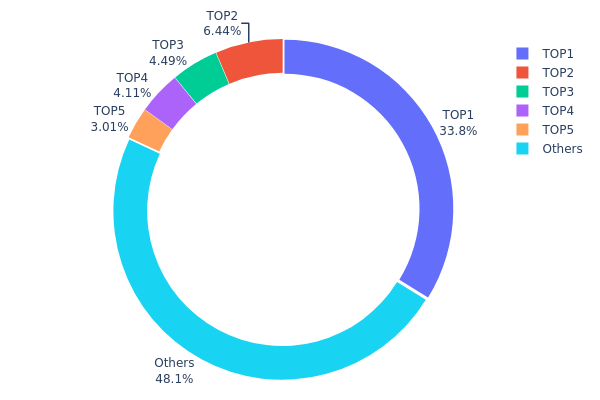

WBTC Holdings Distribution

The address holdings distribution data provides crucial insights into the concentration of WBTC ownership. Analysis of the current data reveals a significant level of centralization in WBTC holdings. The top address holds an overwhelming 33.81% of the total supply, with 42.86K WBTC. This concentration is further emphasized by the fact that the top five addresses collectively control 51.83% of all WBTC in circulation.

Such a high concentration of holdings in a few addresses poses potential risks to market stability and liquidity. It may lead to increased price volatility, as large movements from these top holders could significantly impact the market. Moreover, this centralization raises concerns about the potential for market manipulation, as these major holders could theoretically coordinate their actions to influence WBTC's price dynamics.

Despite these concerns, it's worth noting that 48.17% of WBTC is distributed among "Others," suggesting a degree of decentralization among smaller holders. This distribution pattern indicates a mixed market structure, balancing between centralized control and wider participation, which may contribute to the overall resilience of the WBTC ecosystem.

Click to view the current WBTC Holdings Distribution

| Top | Address | Holding Qty | Holding (%) |

|---|---|---|---|

| 1 | 0x5ee5...ec6de8 | 42.86K | 33.81% |

| 2 | 0xa3a7...d60eec | 8.16K | 6.43% |

| 3 | 0xbbbb...eeffcb | 5.69K | 4.48% |

| 4 | 0xc3d6...84cdc3 | 5.21K | 4.10% |

| 5 | 0x3ee1...8fa585 | 3.82K | 3.01% |

| - | Others | 61.03K | 48.17% |

II. Key Factors Affecting WBTC's Future Price

Supply Mechanism

- Pegged Supply: WBTC's supply is pegged 1:1 to Bitcoin, meaning its supply is directly tied to the amount of Bitcoin held in reserve.

- Historical Pattern: Changes in Bitcoin's supply have historically influenced WBTC's price due to their direct correlation.

- Current Impact: Any changes in Bitcoin's supply or market dynamics are expected to have a proportional effect on WBTC's price.

Institutional and Whale Dynamics

- Institutional Holdings: Major institutions holding Bitcoin indirectly affect WBTC holdings and price movements.

- Corporate Adoption: Companies adopting Bitcoin as a reserve asset or for transactions indirectly impact WBTC's demand and value.

Macroeconomic Environment

- Monetary Policy Impact: Central bank policies affecting Bitcoin, such as interest rate decisions, will likely influence WBTC's price.

- Inflation Hedge Properties: WBTC inherits Bitcoin's perceived role as an inflation hedge, potentially attracting investors during inflationary periods.

- Geopolitical Factors: Global political and economic events impacting Bitcoin will have a corresponding effect on WBTC's market performance.

Technical Development and Ecosystem Building

- Bitcoin Network Upgrades: Any significant upgrades or changes to the Bitcoin network may influence WBTC's utility and value.

- Ecosystem Applications: DeFi platforms and applications utilizing WBTC for Bitcoin-backed transactions and liquidity provision on Ethereum.

III. WBTC Price Prediction for 2025-2030

2025 Outlook

- Conservative prediction: $76,687.99 - $90,000

- Neutral prediction: $90,000 - $97,073.40

- Optimistic prediction: $97,073.40 - $104,839.27 (requires favorable market conditions and increased institutional adoption)

2027-2028 Outlook

- Market stage expectation: Potential bull market phase with increased volatility

- Price range forecast:

- 2027: $115,569.77 - $176,395.96

- 2028: $77,492.57 - $156,475.38

- Key catalysts: Halving event, global economic recovery, and wider crypto integration in traditional finance

2030 Long-term Outlook

- Base scenario: $150,000 - $200,000 (assuming steady adoption and regulatory clarity)

- Optimistic scenario: $200,000 - $264,501.51 (assuming widespread institutional acceptance and technological breakthroughs)

- Transformative scenario: $300,000+ (extreme favorable conditions such as global economic paradigm shift towards crypto)

- 2030-12-31: WBTC $178,717.24 (average prediction, subject to market dynamics)

| 年份 | 预测最高价 | 预测平均价格 | 预测最低价 | 涨跌幅 |

|---|---|---|---|---|

| 2025 | 104839.27 | 97073.4 | 76687.99 | 0 |

| 2026 | 142348.43 | 100956.34 | 69659.87 | 4 |

| 2027 | 176395.96 | 121652.38 | 115569.77 | 25 |

| 2028 | 156475.38 | 149024.17 | 77492.57 | 53 |

| 2029 | 204684.7 | 152749.78 | 140529.79 | 57 |

| 2030 | 264501.51 | 178717.24 | 94720.14 | 84 |

IV. WBTC Professional Investment Strategies and Risk Management

WBTC Investment Methodology

(1) Long-term Holding Strategy

- Suitable for: Conservative investors seeking Bitcoin exposure with Ethereum functionality

- Operation suggestions:

- Accumulate WBTC during market dips

- Hold for extended periods to benefit from Bitcoin's long-term appreciation

- Store in a secure non-custodial wallet

(2) Active Trading Strategy

- Technical analysis tools:

- Moving Averages: Use to identify trends and potential entry/exit points

- Relative Strength Index (RSI): Gauge overbought/oversold conditions

- Key points for swing trading:

- Monitor Bitcoin price movements as WBTC closely follows BTC

- Pay attention to Ethereum gas fees which can impact profitability

WBTC Risk Management Framework

(1) Asset Allocation Principles

- Conservative investors: 1-5% of portfolio

- Moderate investors: 5-10% of portfolio

- Aggressive investors: 10-20% of portfolio

(2) Risk Hedging Solutions

- Diversification: Spread investments across different cryptocurrencies and traditional assets

- Stop-loss orders: Set predetermined exit points to limit potential losses

(3) Secure Storage Solutions

- Hot wallet recommendation: Gate Web3 Wallet

- Cold storage solution: Hardware wallet for long-term holdings

- Security precautions: Use two-factor authentication, backup private keys, and be cautious of phishing attempts

V. Potential Risks and Challenges for WBTC

WBTC Market Risks

- Price volatility: WBTC is subject to Bitcoin's high price fluctuations

- Liquidity risk: Potential challenges in converting large amounts quickly

- Correlation risk: High correlation with Bitcoin may limit diversification benefits

WBTC Regulatory Risks

- Regulatory uncertainty: Changing cryptocurrency regulations could impact WBTC's usage and value

- Compliance challenges: Potential issues with KYC/AML requirements for large transactions

- Tax implications: Evolving tax laws may affect WBTC holders

WBTC Technical Risks

- Smart contract vulnerabilities: Potential bugs in the WBTC smart contract

- Custodian risk: Reliance on custodians to maintain Bitcoin reserves

- Bridge security: Risks associated with cross-chain bridges used for minting/burning WBTC

VI. Conclusion and Action Recommendations

WBTC Investment Value Assessment

WBTC offers a way to gain Bitcoin exposure with Ethereum's functionality, providing long-term value for investors seeking to bridge these ecosystems. However, it carries short-term risks associated with both Bitcoin's volatility and potential Ethereum network congestion.

WBTC Investment Recommendations

✅ Beginners: Start with small positions, focus on learning about WBTC's mechanics ✅ Experienced investors: Consider WBTC for portfolio diversification, actively manage positions ✅ Institutional investors: Explore WBTC for large-scale Bitcoin exposure on Ethereum, conduct thorough due diligence

WBTC Participation Methods

- Spot trading: Purchase WBTC on Gate.com

- DeFi participation: Use WBTC in Ethereum-based decentralized finance protocols

- OTC trading: For large volume transactions, consider over-the-counter services

Cryptocurrency investments carry extremely high risks, and this article does not constitute investment advice. Investors should make decisions carefully based on their own risk tolerance and are advised to consult professional financial advisors. Never invest more than you can afford to lose.

FAQ

Why is WBTC being delisted?

WBTC is not being delisted. It remains a popular Bitcoin-backed token on Ethereum, offering Bitcoin exposure in DeFi. Any delisting rumors are likely unfounded.

Is WBTC at risk?

WBTC is generally considered low-risk as it's fully backed by Bitcoin. However, like all cryptocurrencies, it's subject to market volatility and smart contract risks.

Is WBTC equal to BTC?

No, WBTC is not equal to BTC. WBTC is a tokenized version of Bitcoin on the Ethereum blockchain, backed 1:1 by BTC. While they have the same value, they exist on different networks.

How much will $1 Bitcoin be worth in 2025?

Based on current trends and expert predictions, $1 Bitcoin could be worth approximately $100,000 to $150,000 by 2025, reflecting significant growth in the cryptocurrency market.

Share

Content