2025 XDC Price Prediction: Potential Growth and Key Factors Influencing XDC Network's Future Value

Introduction: XDC's Market Position and Investment Value

XDC Network (XDC), as a hybrid blockchain platform for global trade and finance, has made significant strides since its inception in 2019. As of 2025, XDC's market capitalization has reached $939,369,104, with a circulating supply of approximately 17,757,449,982 tokens, and a price hovering around $0.0529. This asset, often referred to as the "Enterprise-Ready Blockchain," is playing an increasingly crucial role in digitizing trade transactions and improving liquidity management for financial institutions.

This article will provide a comprehensive analysis of XDC's price trends from 2025 to 2030, combining historical patterns, market supply and demand, ecosystem development, and macroeconomic factors to offer professional price predictions and practical investment strategies for investors.

I. XDC Price History Review and Current Market Status

XDC Historical Price Evolution

- 2019: XDC launched, price reached an all-time low of $0.00039532 on July 22

- 2021: Bull market peak, XDC hit an all-time high of $0.192754 on August 21

- 2022-2023: Crypto winter, price declined significantly from its peak

XDC Current Market Situation

As of November 15, 2025, XDC is trading at $0.0529, ranking 94th by market capitalization. The token has experienced a 4.93% decrease in the past 24 hours, with a trading volume of $1,588,486. XDC's current market cap stands at $939,369,104, with a circulating supply of 17,757,449,981.89999 XDC. The token is showing mixed performance across different timeframes, with a 0.19% increase in the last hour but a 5.89% decrease over the past week and a 12.97% decline in the last 30 days. However, XDC has demonstrated strong long-term growth, with a 72.85% increase over the past year.

Click to view the current XDC market price

XDC Market Sentiment Indicator

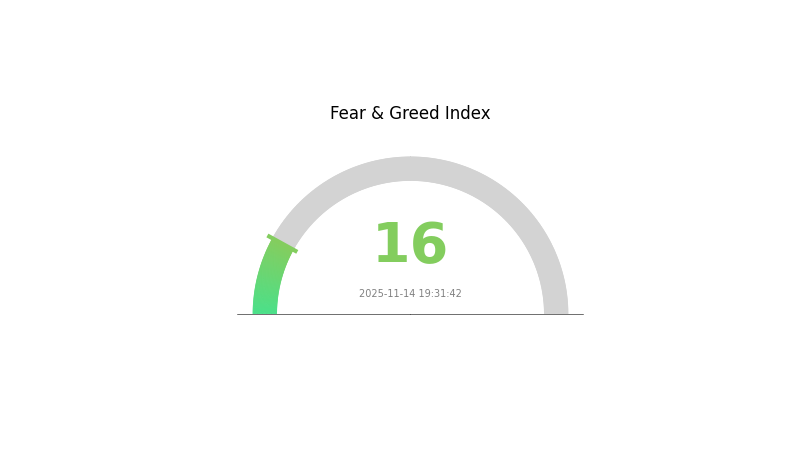

2025-11-14 Fear and Greed Index: 16 (Extreme Fear)

Click to view the current Fear & Greed Index

The crypto market is currently experiencing extreme fear, with the Fear and Greed Index at a low 16. This level of fear often indicates a potential buying opportunity for savvy investors. However, it's crucial to approach with caution and conduct thorough research. Remember, market sentiment can shift rapidly. Gate.com offers comprehensive tools and data to help you make informed decisions in these volatile times. Stay updated and trade wisely.

XDC Holdings Distribution

The address holdings distribution data for XDC is currently unavailable, which limits our ability to conduct a comprehensive analysis of its concentration characteristics. This lack of data presents challenges in assessing the decentralization level, on-chain structural stability, and potential market impacts.

Without specific address holdings information, it's difficult to determine if there are any dominant holders who could significantly influence XDC's market dynamics. The absence of this crucial data also prevents us from evaluating the risk of market manipulation or excessive price volatility that could result from concentrated holdings.

In the absence of concrete distribution data, investors and analysts should exercise caution and seek additional information from reliable sources to make informed decisions regarding XDC's market structure and potential risks.

Click to view the current XDC holdings distribution

| Top | Address | Holding Qty | Holding (%) |

|---|

II. Key Factors Affecting XDC's Future Price

Technical Development and Ecosystem Building

- Ecosystem Applications: XDC Network has developed a robust ecosystem with various DApps and projects built on its blockchain. These include decentralized finance (DeFi) platforms, non-fungible token (NFT) marketplaces, and enterprise blockchain solutions. The growth and success of these applications contribute to the overall value and adoption of XDC.

III. XDC Price Prediction for 2025-2030

2025 Outlook

- Conservative forecast: $0.02806 - $0.05295

- Neutral forecast: $0.05295 - $0.06566

- Optimistic forecast: $0.06566 - $0.07837 (requires favorable market conditions and increased XDC adoption)

2027-2028 Outlook

- Market phase expectation: Potential growth phase with increasing adoption

- Price range forecast:

- 2027: $0.0748 - $0.1118

- 2028: $0.07785 - $0.13937

- Key catalysts: Expansion of XDC network usage, technological advancements, and potential partnerships

2029-2030 Long-term Outlook

- Base scenario: $0.11774 - $0.14482 (assuming steady growth and adoption)

- Optimistic scenario: $0.14482 - $0.17190 (with accelerated ecosystem development)

- Transformative scenario: $0.17190 - $0.19116 (with widespread institutional adoption and major technological breakthroughs)

- 2030-12-31: XDC $0.19116 (potential peak price under highly favorable conditions)

| 年份 | 预测最高价 | 预测平均价格 | 预测最低价 | 涨跌幅 |

|---|---|---|---|---|

| 2025 | 0.07837 | 0.05295 | 0.02806 | 0 |

| 2026 | 0.0952 | 0.06566 | 0.06303 | 24 |

| 2027 | 0.1118 | 0.08043 | 0.0748 | 52 |

| 2028 | 0.13937 | 0.09612 | 0.07785 | 81 |

| 2029 | 0.1719 | 0.11774 | 0.08242 | 122 |

| 2030 | 0.19116 | 0.14482 | 0.11875 | 173 |

IV. XDC Professional Investment Strategies and Risk Management

XDC Investment Methodology

(1) Long-term Holding Strategy

- Suitable for: Long-term investors seeking exposure to enterprise blockchain solutions

- Operation suggestions:

- Accumulate XDC during market dips

- Set aside a portion of holdings for staking to earn passive income

- Store XDC in a secure hardware wallet for long-term holding

(2) Active Trading Strategy

- Technical analysis tools:

- Moving Averages: Use 50-day and 200-day MAs to identify trends

- RSI: Monitor overbought/oversold conditions for entry and exit points

- Key points for swing trading:

- Set stop-loss orders to limit potential losses

- Take profits at predetermined price targets

XDC Risk Management Framework

(1) Asset Allocation Principles

- Conservative investors: 1-3% of crypto portfolio

- Aggressive investors: 5-10% of crypto portfolio

- Professional investors: Up to 15% of crypto portfolio

(2) Risk Hedging Solutions

- Diversification: Spread investments across different blockchain projects

- Stop-loss orders: Implement to limit potential losses

(3) Secure Storage Solutions

- Hardware wallet recommendation: Gate Web3 Wallet

- Software wallet option: Official XDC wallet

- Security precautions: Enable two-factor authentication, use strong passwords, and keep private keys offline

V. Potential Risks and Challenges for XDC

XDC Market Risks

- Volatility: Cryptocurrency markets are highly volatile

- Competition: Increasing competition in the enterprise blockchain space

- Adoption: Slow adoption rate by enterprises could impact growth

XDC Regulatory Risks

- Global regulations: Changing regulatory landscape for cryptocurrencies

- Security classification: Potential classification as a security token

- Compliance: Ensuring compliance with evolving international standards

XDC Technical Risks

- Network security: Potential vulnerabilities in the blockchain infrastructure

- Scalability: Challenges in maintaining performance as network usage grows

- Interoperability: Issues with cross-chain compatibility and integration

VI. Conclusion and Action Recommendations

XDC Investment Value Assessment

XDC Network shows potential in the enterprise blockchain space with its hybrid architecture and low transaction costs. However, it faces significant competition and adoption challenges in the short term.

XDC Investment Recommendations

✅ Beginners: Consider small, long-term positions as part of a diversified crypto portfolio

✅ Experienced investors: Implement dollar-cost averaging strategy and explore staking opportunities

✅ Institutional investors: Evaluate XDC as part of a broader enterprise blockchain investment thesis

XDC Trading Participation Methods

- Spot trading: Buy and hold XDC on reputable exchanges like Gate.com

- Staking: Participate in network validation to earn passive income

- DeFi: Explore decentralized finance opportunities within the XDC ecosystem

Cryptocurrency investments carry extremely high risks, and this article does not constitute investment advice. Investors should make decisions carefully based on their own risk tolerance and are advised to consult professional financial advisors. Never invest more than you can afford to lose.

FAQ

Will XDC reach $1 dollar?

Yes, XDC has the potential to reach $1. With its growing adoption in trade finance and increasing partnerships, XDC could hit this milestone by 2026-2027, driven by its utility and market expansion.

Can XDC reach $5?

Yes, XDC could potentially reach $5 in the long term with increased adoption and network growth. However, it would require significant market expansion and technological advancements.

How much will XDC be worth in 2025?

Based on market trends and expert predictions, XDC could potentially reach a value of $0.50 to $0.75 by 2025, driven by increased adoption and network growth.

Is XDC better than XRP?

XDC and XRP have different strengths. XDC offers faster transactions and lower fees, while XRP has wider adoption. Both have potential in cross-border payments and DeFi.

Share

Content