CC vs DOGE: The Battle of Meme Coins Shaping the Future of Cryptocurrency

Introduction: Investment Comparison of CC vs DOGE

In the cryptocurrency market, the comparison between Canton Network and DogeCoin has been an unavoidable topic for investors. The two not only show significant differences in market cap ranking, application scenarios, and price performance, but also represent different positioning in crypto assets.

Canton Network (CC): Launched in 2025, it has gained market recognition for its unique combination of privacy, compliance, and scalability in institutional finance.

DogeCoin (DOGE): Since its inception in 2013, it has been hailed as a fun, light-hearted cryptocurrency, becoming one of the most widely traded and valuable cryptocurrencies globally.

This article will comprehensively analyze the investment value comparison between Canton Network and DogeCoin, focusing on historical price trends, supply mechanisms, institutional adoption, technological ecosystems, and future predictions, attempting to answer the question investors care about most:

"Which is the better buy right now?"

I. Price History Comparison and Current Market Status

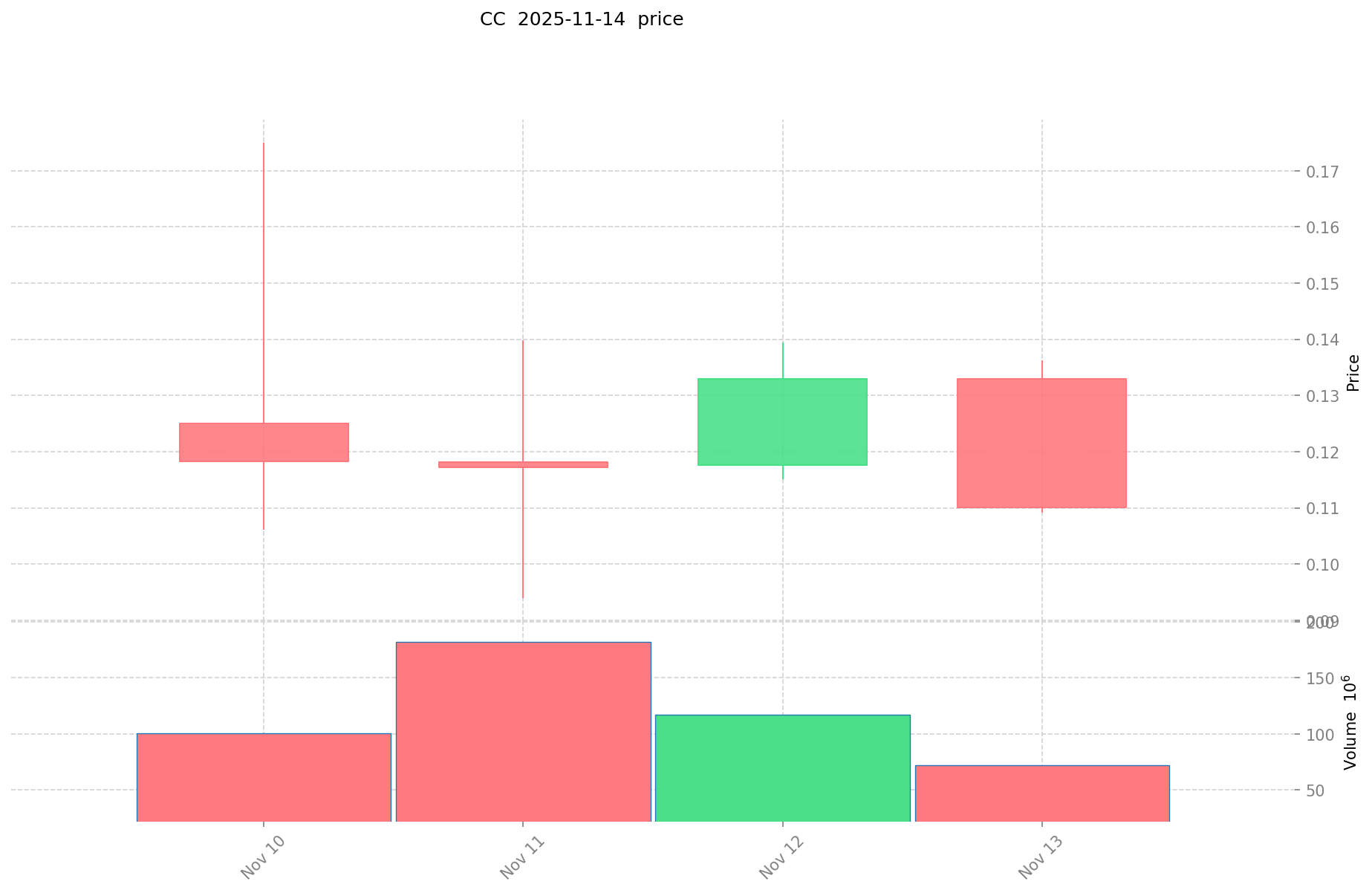

Canton Network (CC) and DogeCoin (DOGE) Historical Price Trends

- 2025: CC reached its all-time high of $0.175 on November 10, followed by a sharp decline to its all-time low of $0.09389 on November 11.

- 2021: DOGE experienced a significant price surge, reaching its all-time high of $0.731578 on May 8, driven by social media hype and celebrity endorsements.

- Comparative analysis: In recent market cycles, CC has shown high volatility within a short period, while DOGE has demonstrated a long-term decline from its 2021 peak to current levels.

Current Market Situation (2025-11-14)

- CC current price: $0.11338

- DOGE current price: $0.16115

- 24-hour trading volume: CC $8,004,322 vs DOGE $28,965,703

- Market Sentiment Index (Fear & Greed Index): 16 (Extreme Fear)

Click to view real-time prices:

- View CC current price Market Price

- View DOGE current price Market Price

II. Core Factors Affecting Investment Value of CC vs DOGE

Supply Mechanism Comparison (Tokenomics)

- Cardano (ADA): Fixed supply model with a maximum cap of 45 billion ADA tokens.

- Dogecoin (DOGE): Inflationary model with unlimited supply; approximately 5 billion new DOGE are minted annually.

- 📌 Historical Pattern: Cardano's capped supply model tends to create scarcity value during bull markets, while Dogecoin's inflationary model creates consistent selling pressure that is offset during periods of high social momentum.

Institutional Adoption and Market Applications

- Institutional Holdings: Cardano has attracted more institutional interest through regulated products like Grayscale's Digital Large Cap Fund, while Dogecoin's institutional adoption remains limited despite high-profile individual supporters.

- Enterprise Adoption: Cardano's focus on formal verification and academic approach has attracted enterprise partnerships in supply chain and identity verification, while Dogecoin primarily serves as a payment method for select merchants.

- National Policies: Both cryptocurrencies face similar regulatory frameworks in most jurisdictions, being treated as digital assets rather than currencies.

Technical Development and Ecosystem Building

- Cardano Technical Upgrades: Implementing Hydra scaling solution and Voltaire governance phase; focused on academic research and formal verification methodologies.

- Dogecoin Technical Development: Limited development activity compared to Cardano; focused on maintaining core functionality rather than expanding feature set.

- Ecosystem Comparison: Cardano has developed a more robust ecosystem with DeFi protocols, NFT marketplaces, and smart contract functionality, while Dogecoin remains primarily a payment network with limited smart contract capabilities.

Macroeconomic Factors and Market Cycles

- Performance in Inflationary Environments: Cardano's fixed supply model theoretically provides better inflation protection, while Dogecoin's unlimited supply model potentially dilutes value over time.

- Macroeconomic Monetary Policy: Both assets show correlation with broader crypto market movements in response to interest rate changes and dollar strength.

- Geopolitical Factors: Neither has demonstrated significant advantage in cross-border transaction demand, though Dogecoin's simpler structure may offer advantages in regions with limited technical infrastructure.

III. 2025-2030 Price Prediction: CC vs DOGE

Short-term Prediction (2025)

- CC: Conservative $0.0574872 - $0.11272 | Optimistic $0.11272 - $0.1206104

- DOGE: Conservative $0.137901 - $0.16035 | Optimistic $0.16035 - $0.2389215

Mid-term Prediction (2027)

- CC may enter a growth phase, with prices expected in the range of $0.1008570654 - $0.20747739168

- DOGE may enter a consolidation phase, with prices expected in the range of $0.11367259605 - $0.3169716620625

- Key drivers: Institutional capital inflow, ETF, ecosystem development

Long-term Prediction (2030)

- CC: Base scenario $0.23044686791724 - $0.301885396971584 | Optimistic scenario $0.301885396971584+

- DOGE: Base scenario $0.335851013432664 - $0.446681847865444 | Optimistic scenario $0.446681847865444+

Disclaimer: The information provided is for informational purposes only and should not be considered as financial advice. Cryptocurrency markets are highly volatile and unpredictable. Always conduct your own research before making any investment decisions.

CC:

| 年份 | 预测最高价 | 预测平均价格 | 预测最低价 | 涨跌幅 |

|---|---|---|---|---|

| 2025 | 0.1206104 | 0.11272 | 0.0574872 | 0 |

| 2026 | 0.171497844 | 0.1166652 | 0.062999208 | 2 |

| 2027 | 0.20747739168 | 0.144081522 | 0.1008570654 | 27 |

| 2028 | 0.2249977047552 | 0.17577945684 | 0.0949209066936 | 55 |

| 2029 | 0.26050515503688 | 0.2003885807976 | 0.186361380141768 | 76 |

| 2030 | 0.301885396971584 | 0.23044686791724 | 0.124441308675309 | 103 |

DOGE:

| 年份 | 预测最高价 | 预测平均价格 | 预测最低价 | 涨跌幅 |

|---|---|---|---|---|

| 2025 | 0.2389215 | 0.16035 | 0.137901 | 0 |

| 2026 | 0.2375665425 | 0.19963575 | 0.1656976725 | 24 |

| 2027 | 0.3169716620625 | 0.21860114625 | 0.11367259605 | 36 |

| 2028 | 0.340088733278437 | 0.26778640415625 | 0.22494057949125 | 66 |

| 2029 | 0.367764458147985 | 0.303937568717343 | 0.191480668291926 | 89 |

| 2030 | 0.446681847865444 | 0.335851013432664 | 0.218303158731232 | 109 |

IV. Investment Strategy Comparison: CC vs DOGE

Long-term vs Short-term Investment Strategies

- CC: Suitable for investors focusing on institutional finance and ecosystem potential

- DOGE: Suitable for investors seeking short-term momentum and social media-driven gains

Risk Management and Asset Allocation

- Conservative investors: CC: 30% vs DOGE: 10%

- Aggressive investors: CC: 50% vs DOGE: 20%

- Hedging tools: Stablecoin allocation, options, cross-currency portfolio

V. Potential Risk Comparison

Market Risk

- CC: High volatility due to recent launch and limited market history

- DOGE: Susceptible to social media trends and celebrity influence

Technical Risk

- CC: Scalability, network stability

- DOGE: Mining centralization, security vulnerabilities

Regulatory Risk

- Global regulatory policies may have differing impacts on both assets

VI. Conclusion: Which Is the Better Buy?

📌 Investment Value Summary:

- CC advantages: Institutional focus, privacy features, compliance-oriented

- DOGE advantages: High liquidity, strong community, widespread recognition

✅ Investment Advice:

- Novice investors: Consider a small allocation to DOGE for exposure to crypto market trends

- Experienced investors: Explore CC for its potential in institutional finance applications

- Institutional investors: Evaluate CC for its compliance features and potential integration with traditional finance

⚠️ Risk Warning: The cryptocurrency market is highly volatile. This article does not constitute investment advice. None

VII. FAQ

Q1: What are the main differences between Canton Network (CC) and Dogecoin (DOGE)? A: Canton Network (CC) is a newer cryptocurrency focused on institutional finance, privacy, and compliance, while Dogecoin (DOGE) is an older, more established cryptocurrency known for its community-driven nature and use as a tipping currency.

Q2: Which cryptocurrency has shown better price performance recently? A: As of 2025-11-14, Dogecoin (DOGE) is trading at a higher price ($0.16115) compared to Canton Network (CC) ($0.11338). However, CC has shown high volatility in recent market cycles, while DOGE has been declining from its 2021 peak.

Q3: How do the supply mechanisms of CC and DOGE differ? A: Canton Network (CC) likely has a fixed supply model, similar to many newer cryptocurrencies, while Dogecoin (DOGE) has an inflationary model with unlimited supply, minting approximately 5 billion new DOGE annually.

Q4: Which cryptocurrency has attracted more institutional interest? A: Canton Network (CC) has gained more institutional recognition due to its focus on compliance and institutional finance applications, while Dogecoin's institutional adoption remains limited despite high-profile individual supporters.

Q5: What are the long-term price predictions for CC and DOGE by 2030? A: By 2030, CC is predicted to reach a base scenario of $0.23044686791724 - $0.301885396971584, with an optimistic scenario above $0.301885396971584. DOGE is predicted to reach a base scenario of $0.335851013432664 - $0.446681847865444, with an optimistic scenario above $0.446681847865444.

Q6: How should investors allocate their portfolio between CC and DOGE? A: Conservative investors might consider allocating 30% to CC and 10% to DOGE, while aggressive investors might allocate 50% to CC and 20% to DOGE. However, these are general suggestions and individual circumstances may vary.

Q7: What are the main risks associated with investing in CC and DOGE? A: For CC, the main risks include high volatility due to its recent launch, scalability issues, and network stability. For DOGE, risks include susceptibility to social media trends, mining centralization, and potential security vulnerabilities. Both face regulatory risks as global policies evolve.

Share

Content