Is Dai (DAI) a good investment?: Analyzing the Pros and Cons of the Leading Stablecoin

Introduction: Investment Status and Market Prospects of Dai (DAI)

DAI is a significant asset in the cryptocurrency realm, having achieved notable success in decentralized finance (DeFi) since its launch. As of 2025, DAI's market capitalization stands at $4,540,937,142, with a circulating supply of approximately 4,541,300,446 tokens, and a current price hovering around $0.99992. With its position as the "largest decentralized stablecoin on Ethereum," DAI has become a focal point for investors pondering, "Is Dai(DAI) a good investment?" This article will comprehensively analyze DAI's investment value, historical trends, future price predictions, and investment risks, providing a reference for investors.

I. DAI Price History Review and Current Investment Value

Dai (DAI) investment performance

- 2020: All-time high of $1.22 reached → Positive returns for investors

- 2023: All-time low of $0.88196 recorded → Price volatility increased

Current DAI investment market status (November 2025)

- DAI current price: $0.99992

- 24-hour trading volume: 401,677.7917267 DAI

- Institutional investor holdings: Data not available

Click to view real-time DAI market price

II. DAI Project Overview and Technical Features

Project background and development history

Dai is the largest decentralized stablecoin on Ethereum, developed and managed by MakerDAO. It serves as the infrastructure for decentralized finance (DeFi). Dai is a decentralized, unbiased, collateral-backed cryptocurrency pegged to the US dollar.

Core technical features and advantages

-

Decentralized stablecoin: Dai maintains a stable value through a complex system of smart contracts and collateralized debt positions.

-

Collateral-backed: Dai is backed by various crypto assets, ensuring its stability and value.

-

Governance through MakerDAO: The Maker protocol is governed by MKR token holders, allowing for community-driven decision-making.

-

Resistance to hyperinflation: Dai's low volatility provides economic freedom and opportunities for users worldwide.

Latest technological upgrades or roadmap

Information not available in the provided context.

III. DAI Market Performance Analysis

Market capitalization and ranking

- Current market cap: $4,540,937,142.45

- Ranking: 33rd

Trading volume and liquidity analysis

- 24-hour trading volume: 401,677.7917267 DAI

- Listed on 28 exchanges

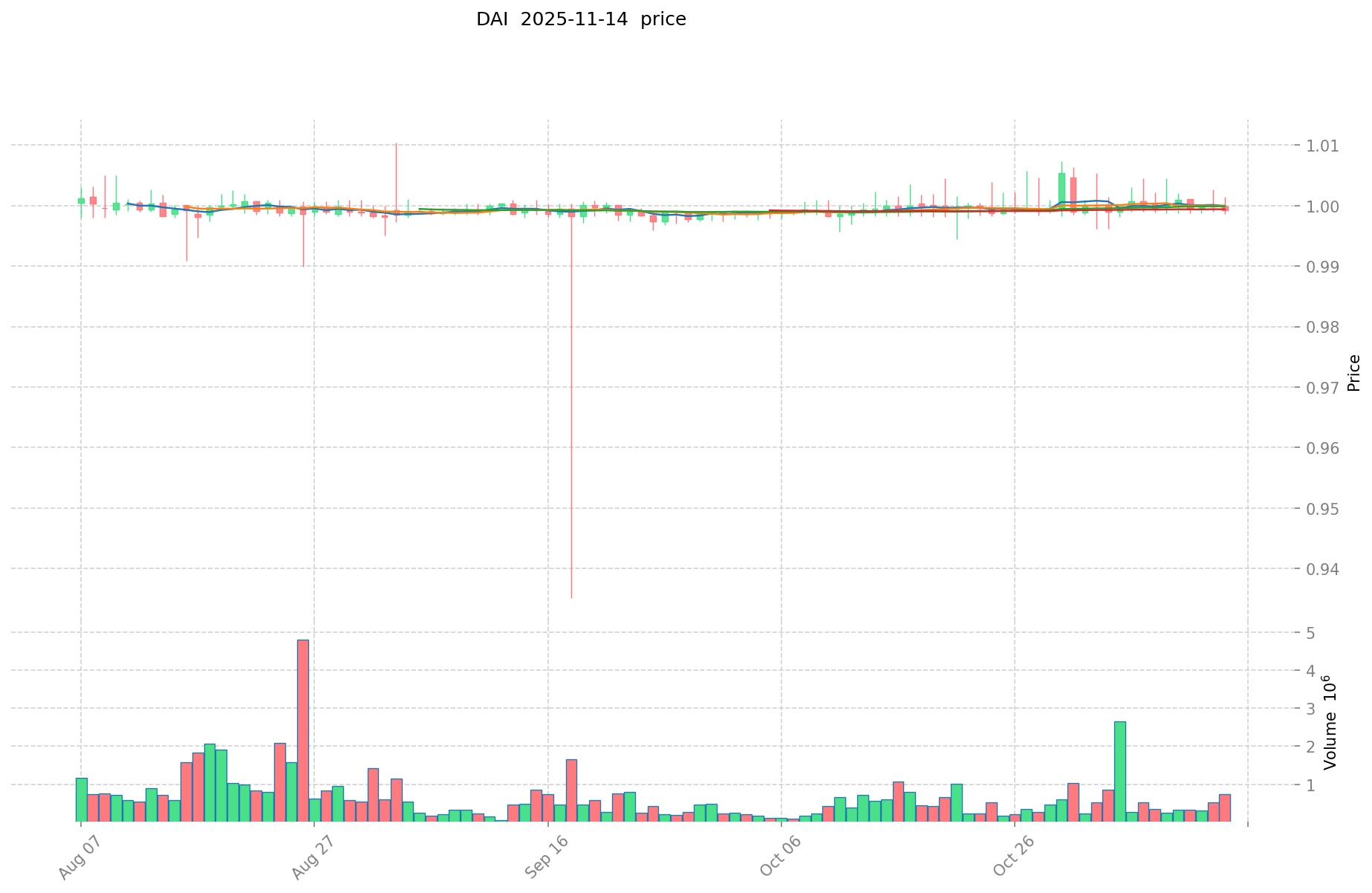

Price trends and volatility

- 1-hour change: +0.01%

- 24-hour change: -0.04%

- 7-day change: -0.13%

- 30-day change: +0.08%

- 1-year change: +0.16%

Comparison with other stablecoins

Data not available for comparison in the provided context.

IV. DAI Ecosystem and Application Scenarios

Current application scenarios and use cases

- DeFi lending and borrowing platforms

- Decentralized exchanges (DEXs) as a trading pair

- Yield farming and liquidity provision

- Store of value and hedge against volatility

Ecosystem partners and collaborations

Information not available in the provided context.

Developer activity and community engagement

- Twitter followers: Data not provided

- Reddit community: Active (r/MakerDAO)

V. Investment Risks and Considerations

Regulatory risks

As a stablecoin, Dai may face increased scrutiny from regulators worldwide. Potential regulatory changes could impact its operation and adoption.

Technical risks

Smart contract vulnerabilities or failures in the collateralization system could pose risks to Dai's stability and value.

Market competition

Dai faces competition from other stablecoins, both centralized and decentralized, which could affect its market share and adoption.

Adoption and scaling challenges

While Dai is widely used in the DeFi ecosystem, broader mainstream adoption may face challenges due to the complexity of the system and general crypto market volatility.

VI. Future Outlook and Development Potential

Potential growth areas

- Expansion into new DeFi protocols and applications

- Increased adoption in cross-border payments and remittances

- Integration with traditional finance systems

Upcoming milestones or events

No specific upcoming events or milestones mentioned in the provided context.

Long-term vision and sustainability

Dai aims to continue providing a stable, decentralized currency option that resists hyperinflation and offers economic freedom to users globally. Its success will depend on continued adoption, technological improvements, and effective governance through MakerDAO.

II. Key Factors Influencing Whether Dai (DAI) is a Good Investment

Supply Mechanism and Scarcity (DAI investment scarcity)

- Collateral-backed supply mechanism → Impacts price and investment value

- Historical pattern: Supply changes have maintained DAI's stability around $1

- Investment significance: Stability rather than scarcity is key for long-term investment

Institutional Investment and Mainstream Adoption (Institutional investment in Dai)

- Institutional holding trend: Limited direct institutional investment due to stablecoin nature

- Notable companies adopting Dai → Enhances its value as a DeFi infrastructure

- Regulatory policies' impact on Dai's investment prospects

Macroeconomic Environment's Impact on Dai Investment

- Monetary policy and interest rate changes → Alter attractiveness of stablecoins

- Role in inflationary environments → "Digital dollar" positioning

- Geopolitical uncertainties → May increase demand for stable digital assets

Technology and Ecosystem Development (Technology & Ecosystem for Dai investment)

- Ethereum network upgrades: Improve performance → Enhance Dai's utility

- MakerDAO governance improvements: Expand ecosystem applications → Support long-term value

- DeFi applications driving investment value and utility of Dai

III. DAI Future Investment Forecast and Price Outlook (Is Dai(DAI) worth investing in 2025-2030)

Short-term DAI investment outlook (2025)

- Conservative forecast: $0.99 - $1.01

- Neutral forecast: $0.99 - $1.01

- Optimistic forecast: $0.99 - $1.01

Mid-term Dai(DAI) investment forecast (2027-2028)

- Market phase expectation: Stable

- Investment return forecast:

- 2027: $0.99 - $1.01

- 2028: $0.99 - $1.01

- Key catalysts: Stablecoin adoption, DeFi growth

Long-term investment outlook (Is DAI a good long-term investment?)

- Base scenario: $0.99 - $1.01 (Assuming continued stability)

- Optimistic scenario: $0.99 - $1.01 (Assuming wider adoption)

- Risk scenario: $0.98 - $1.02 (In case of extreme market volatility)

Click to view DAI long-term investment and price prediction: Price Prediction

2025-11-14 - 2030 Long-term Outlook

- Base scenario: $0.99 - $1.01 (Corresponding to steady progress and gradual increase in mainstream applications)

- Optimistic scenario: $0.99 - $1.01 (Corresponding to large-scale adoption and favorable market conditions)

- Transformative scenario: Above $1.01 (In case of breakthrough progress in the ecosystem and mainstream popularization)

- 2030-12-31 Predicted high: $1.01 (Based on optimistic development assumptions)

Disclaimer

| 年份 | 预测最高价 | 预测平均价格 | 预测最低价 | 涨跌幅 |

|---|---|---|---|---|

| 2025 | 1 | 1 | 1 | 0 |

| 2026 | 1 | 1 | 1 | 0 |

| 2027 | 1 | 1 | 1 | 0 |

| 2028 | 1 | 1 | 1 | 0 |

| 2029 | 1 | 1 | 1 | 0 |

| 2030 | 1 | 1 | 1 | 0 |

IV. How to invest in Dai

Dai investment strategy

- HODL Dai: Suitable for conservative investors seeking stability

- Active trading: Relies on technical analysis and swing trading

Risk management for Dai investment

- Asset allocation ratio: Conservative / Aggressive / Professional investors

- Risk hedging strategies: Multi-asset portfolio + risk mitigation tools

- Secure storage: Cold and hot wallets + recommended hardware wallets

V. Risks of investing in stablecoins

- Market risks: Potential de-pegging events, liquidity issues

- Regulatory risks: Policy uncertainties in different countries

- Technical risks: Smart contract vulnerabilities, network security issues

VI. Conclusion: Is Dai a Good Investment?

- Investment value summary: Dai offers stability as a stablecoin but may have limited upside potential.

- Investor recommendations: ✅ Beginners: Use as a store of value or for DeFi applications ✅ Experienced investors: Utilize in yield farming or liquidity provision ✅ Institutional investors: Consider as a cash management tool or for treasury operations

⚠️ Note: Cryptocurrency investments carry high risks. This article is for informational purposes only and does not constitute investment advice.

VII. FAQ

Q1: What is Dai (DAI) and how does it work? A: Dai is the largest decentralized stablecoin on Ethereum, developed by MakerDAO. It maintains a stable value pegged to the US dollar through a system of smart contracts and collateralized debt positions backed by various crypto assets.

Q2: Is Dai a good investment in 2025? A: Dai is designed to maintain a stable value around $1, so it's not typically considered an investment for price appreciation. However, it can be a useful tool for storing value, participating in DeFi protocols, or as a hedge against market volatility.

Q3: What are the main risks of investing in Dai? A: The main risks include potential de-pegging events, regulatory uncertainties, smart contract vulnerabilities, and market competition from other stablecoins.

Q4: How can I invest in Dai? A: You can acquire Dai by purchasing it on cryptocurrency exchanges, participating in DeFi protocols, or by creating it through the MakerDAO system by locking up collateral.

Q5: What is the long-term outlook for Dai? A: The long-term outlook for Dai is generally stable, with prices expected to remain close to $1. Its success will depend on continued adoption in DeFi, technological improvements, and effective governance through MakerDAO.

Q6: How does Dai compare to other stablecoins? A: Dai is unique as a decentralized, crypto-collateralized stablecoin, offering more transparency and resistance to centralized control compared to fiat-backed stablecoins. However, it may face more complexity in maintaining its peg.

Q7: Can Dai be used for yield farming or liquidity provision? A: Yes, Dai is widely used in DeFi protocols for yield farming and liquidity provision, making it an attractive option for experienced investors looking to generate returns in the DeFi ecosystem.

Share

Content