Is Global Dollar (USDG) a good investment?: Evaluating the Potential and Risks of this Stablecoin in the Crypto Market

Introduction: Investment Status and Market Prospects of Global Dollar (USDG)

Global Dollar (USDG) is an important asset in the cryptocurrency field. As of 2025, USDG's market capitalization has reached $1,057,160,352.24, with a circulating supply of approximately 1,056,315,300 tokens, and the current price hovering around $1.0008. With its positioning as a "US dollar-backed stablecoin", USDG has gradually become a focal point for investors when discussing "Is Global Dollar(USDG) a good investment?". This article will comprehensively analyze USDG's investment value, historical trends, future price predictions, and investment risks, providing a reference for investors.

I. USDG Price History Review and Current Investment Value

Global Dollar (USDG) investment performance

- 2025: Launch of USDG → Initial investor interest

Current USDG investment market status (November 2025)

- USDG current price: $1.0008

- 24-hour trading volume: $319,523.15

- Institutional investor holdings: Data not available

Click to view real-time USDG market price

II. USDG Technical Analysis and Price Prediction

Key technical indicators

- Current price: $1.0008

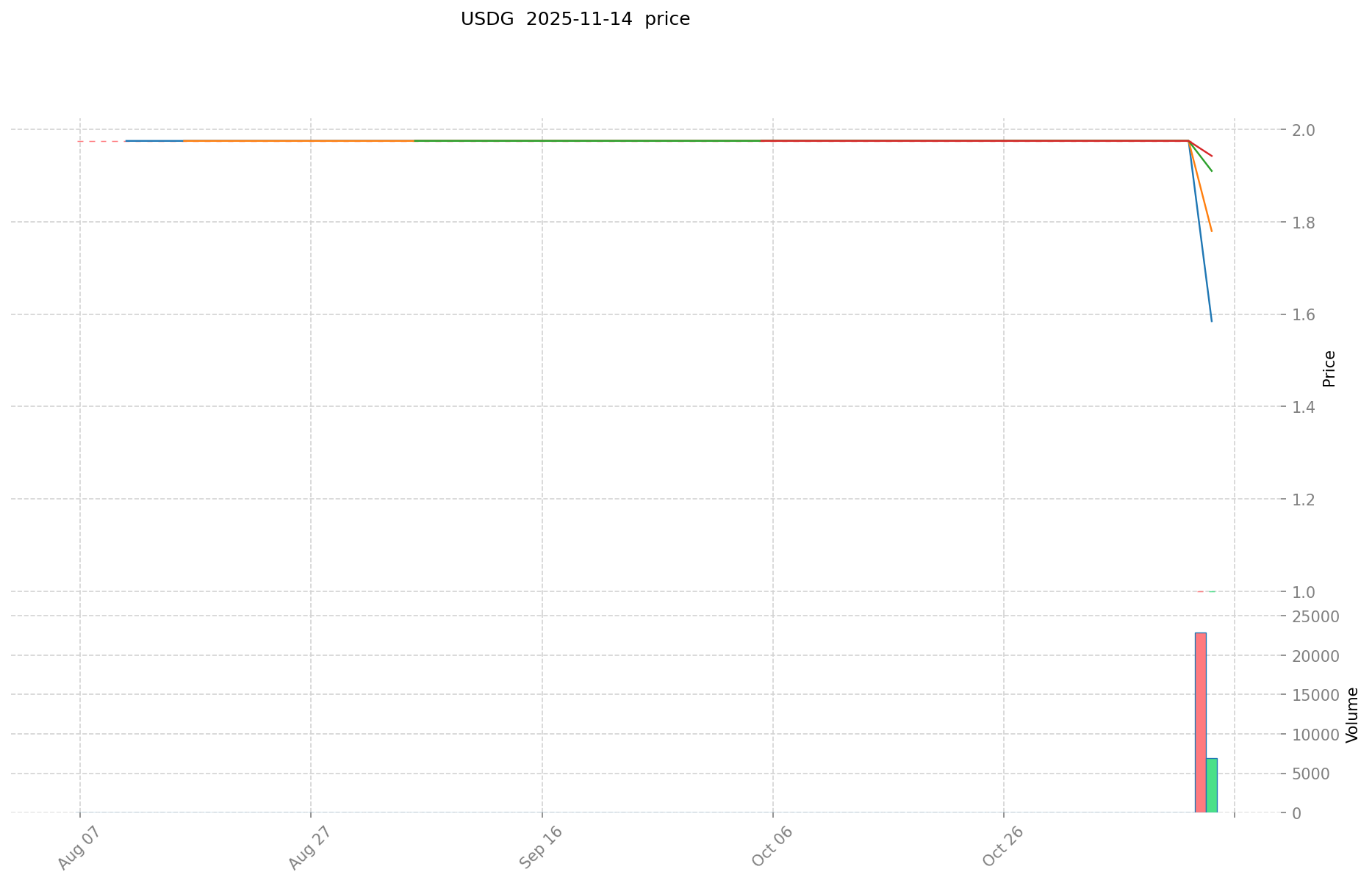

- 24-hour price change: +0.05%

- 7-day price change: -49.30%

- 30-day price change: -49.30%

- All-time high: $1.65 (January 30, 2025)

- All-time low: $0.907561 (November 12, 2024)

Price prediction based on technical analysis

As a stablecoin pegged to the US dollar, USDG is designed to maintain a price close to $1. Significant deviations from this price are not expected under normal market conditions.

III. USDG Project Fundamentals Analysis

Project overview

Global Dollar (USDG) is a stablecoin backed by the US dollar available on the Ethereum and Solana blockchains. Issued by a regulated provider, USDG is backed by secure and liquid assets and is always redeemable 1-to-1 for the US dollar. USDG is available across a range of global exchanges and wallets.

Key features and advantages

- Multi-chain support: Available on Ethereum and Solana blockchains

- Regulated issuance: Issued by a regulated provider

- Asset-backed: Supported by secure and liquid assets

- 1:1 redemption: Always redeemable for US dollars at a 1:1 ratio

- Wide availability: Accessible on various global exchanges and wallets

Market position and competitiveness

- Market capitalization: $1,057,160,352.24

- Circulating supply: 1,056,315,300 USDG

- Market share: 0.030% of the total cryptocurrency market

Recent developments and future plans

No specific recent developments or future plans are mentioned in the provided information.

IV. Investment Risk Analysis

Potential risks

- Regulatory risks: As a stablecoin, USDG may face increased scrutiny from regulators.

- Market competition: The stablecoin market is highly competitive, with established players like USDT and USDC.

- Technical risks: Operating on multiple blockchains may expose USDG to potential technical vulnerabilities.

Risk mitigation measures

- Regulatory compliance: USDG is issued by a regulated provider, which may help mitigate some regulatory risks.

- Asset backing: USDG is backed by secure and liquid assets, providing stability and reducing the risk of depegging.

V. Comprehensive Evaluation and Investment Suggestions

Project strengths

- Multi-chain support enhances accessibility and usability

- Regulated issuance provides a level of trust and legitimacy

- Asset-backed nature and 1:1 redemption offer stability

Project weaknesses

- Relatively small market share compared to major stablecoins

- Limited information on recent developments or future plans

Investment considerations

- USDG may be suitable for users seeking a stable digital asset with multi-chain support

- Consider the project's regulatory compliance and asset backing when evaluating its long-term stability

- Compare USDG with other stablecoins in terms of liquidity, adoption, and use cases before making investment decisions

Disclaimer: This report is for informational purposes only and should not be considered as financial advice. Always conduct your own research and consult with a qualified financial advisor before making any investment decisions.

II. Key Factors Influencing Whether Global Dollar (USDG) is a Good Investment

USDG investment scarcity

- Pegged 1:1 to USD → Stable value proposition

- Historical pattern: Consistently maintained 1:1 peg

- Investment significance: Stability rather than scarcity is key for stablecoin investment

Institutional investment in USDG

- Institutional holding trend: Data not available

- Adoption by regulated providers → Enhances investment credibility

- Regulatory compliance impacts USDG investment prospects

Macroeconomic environment's impact on USDG investment

- Monetary policy and interest rate changes → Affect demand for USD-pegged assets

- Inflation environment → USDG as a potential store of value

- Geopolitical uncertainties → May increase demand for stable digital assets

Technology & Ecosystem for USDG investment

- Multi-chain availability (Ethereum and Solana): Enhances network accessibility → Increases investment attractiveness

- Integration with global exchanges and wallets: Expands ecosystem → Supports long-term value

- DeFi, payments, and cross-border transactions drive investment value in the stablecoin sector

III. USDG Future Investment Forecast and Price Outlook (Is Global Dollar(USDG) worth investing in 2025-2030)

Short-term USDG investment outlook (2025)

- Conservative forecast: $0.62 - $0.80

- Neutral forecast: $0.80 - $1.00

- Optimistic forecast: $1.00 - $1.39

Mid-term Global Dollar(USDG) investment forecast (2027-2028)

- Market phase expectation: Steady growth

- Investment return forecast:

- 2027: $0.82 - $1.70

- 2028: $1.08 - $1.88

- Key catalysts: Increased adoption, regulatory clarity

Long-term investment outlook (Is USDG a good long-term investment?)

- Base scenario: $1.35 - $2.04 (Assuming continued market acceptance)

- Optimistic scenario: $2.04 - $2.42 (Assuming widespread adoption)

- Risk scenario: $0.62 - $1.00 (Extreme market volatility)

Click to view USDG long-term investment and price prediction: Price Prediction

2025-11-15 - 2030 Long-term Outlook

- Base scenario: $1.35 - $2.04 (Corresponding to steady progress and gradual mainstream application)

- Optimistic scenario: $2.04 - $2.42 (Corresponding to large-scale adoption and favorable market conditions)

- Transformative scenario: Above $2.42 (In case of breakthrough developments in the ecosystem and mainstream popularization)

- 2030-12-31 Predicted high: $2.19 (Based on optimistic development assumptions)

Disclaimer

| 年份 | 预测最高价 | 预测平均价格 | 预测最低价 | 涨跌幅 |

|---|---|---|---|---|

| 2025 | 1.391112 | 1.0008 | 0.620496 | 0 |

| 2026 | 1.24379424 | 1.195956 | 0.88500744 | 19 |

| 2027 | 1.6956264168 | 1.21987512 | 0.8173163304 | 21 |

| 2028 | 1.880498491236 | 1.4577507684 | 1.078735568616 | 45 |

| 2029 | 2.4202307132361 | 1.669124629818 | 1.15169599457442 | 66 |

| 2030 | 2.187805108533943 | 2.04467767152705 | 1.349487263207853 | 104 |

IV. How to invest in Stablecoins

Global Dollar (USDG) investment strategy

- HODL Global Dollar (USDG): Suitable for conservative investors seeking stable value preservation

- Active trading: Limited opportunities due to stable price, mainly for arbitrage between exchanges

Risk management for Global Dollar (USDG) investment

- Asset allocation ratio: Conservative: 5-10% of portfolio Moderate: 10-20% of portfolio Professional: 20-30% of portfolio

- Risk hedging: Diversify across multiple stablecoins and traditional assets

- Secure storage: Use reputable exchanges and wallets supporting Solana blockchain

V. Risks of investing in Stablecoins

- Market risk: De-pegging events, though rare for regulated stablecoins

- Regulatory risk: Potential changes in stablecoin regulations across jurisdictions

- Technical risk: Smart contract vulnerabilities, blockchain network issues

VI. Conclusion: Is Global Dollar (USDG) a Good Investment?

- Investment value summary: USDG offers stability and liquidity, but limited potential for price appreciation.

- Investor recommendations: ✅ Beginners: Use as a store of value or for crypto trading pairs ✅ Experienced investors: Utilize for liquidity management and arbitrage opportunities ✅ Institutional investors: Consider for treasury management and crypto market exposure

⚠️ Disclaimer: Cryptocurrency investments carry risks. This report is for informational purposes only and does not constitute investment advice.

VII. FAQ

Q1: What is Global Dollar (USDG) and how does it differ from other stablecoins? A: Global Dollar (USDG) is a US dollar-backed stablecoin available on the Ethereum and Solana blockchains. It's issued by a regulated provider and is always redeemable 1-to-1 for US dollars. USDG differs from other stablecoins by offering multi-chain support and being issued by a regulated entity, which may provide additional trust and legitimacy.

Q2: Is USDG a good investment for long-term value preservation? A: USDG can be considered a good investment for long-term value preservation due to its stability and 1:1 peg to the US dollar. However, it's important to note that as a stablecoin, it's not designed for price appreciation but rather for maintaining a stable value.

Q3: What are the main risks associated with investing in USDG? A: The main risks of investing in USDG include regulatory risks (potential changes in stablecoin regulations), market competition from established stablecoins like USDT and USDC, and technical risks associated with operating on multiple blockchains.

Q4: How can I invest in USDG? A: You can invest in USDG by purchasing it on various global exchanges that support the token. It's available on platforms that support Ethereum and Solana blockchains. Always ensure you're using reputable exchanges and secure wallets for storing your USDG.

Q5: What is the expected price range for USDG in 2030? A: Based on long-term forecasts, the expected price range for USDG in 2030 is between $1.349487263207853 and $2.187805108533943, with an average predicted price of $2.04467767152705. However, as a stablecoin, significant deviations from its $1 peg are not expected under normal market conditions.

Q6: How does USDG compare to traditional savings accounts for storing value? A: USDG offers similar stability to traditional savings accounts as it's pegged to the US dollar. However, it provides the advantages of blockchain technology, such as faster transactions and potential integration with decentralized finance (DeFi) applications. Unlike savings accounts, USDG typically doesn't offer interest, but it may provide more flexibility in terms of global accessibility and use in crypto ecosystems.

Share

Content