Is GUSD (GUSD) a good investment?: Evaluating the Stability and Potential of Gemini's Stablecoin

Introduction: The Investment Status and Market Prospects of GUSD (GUSD)

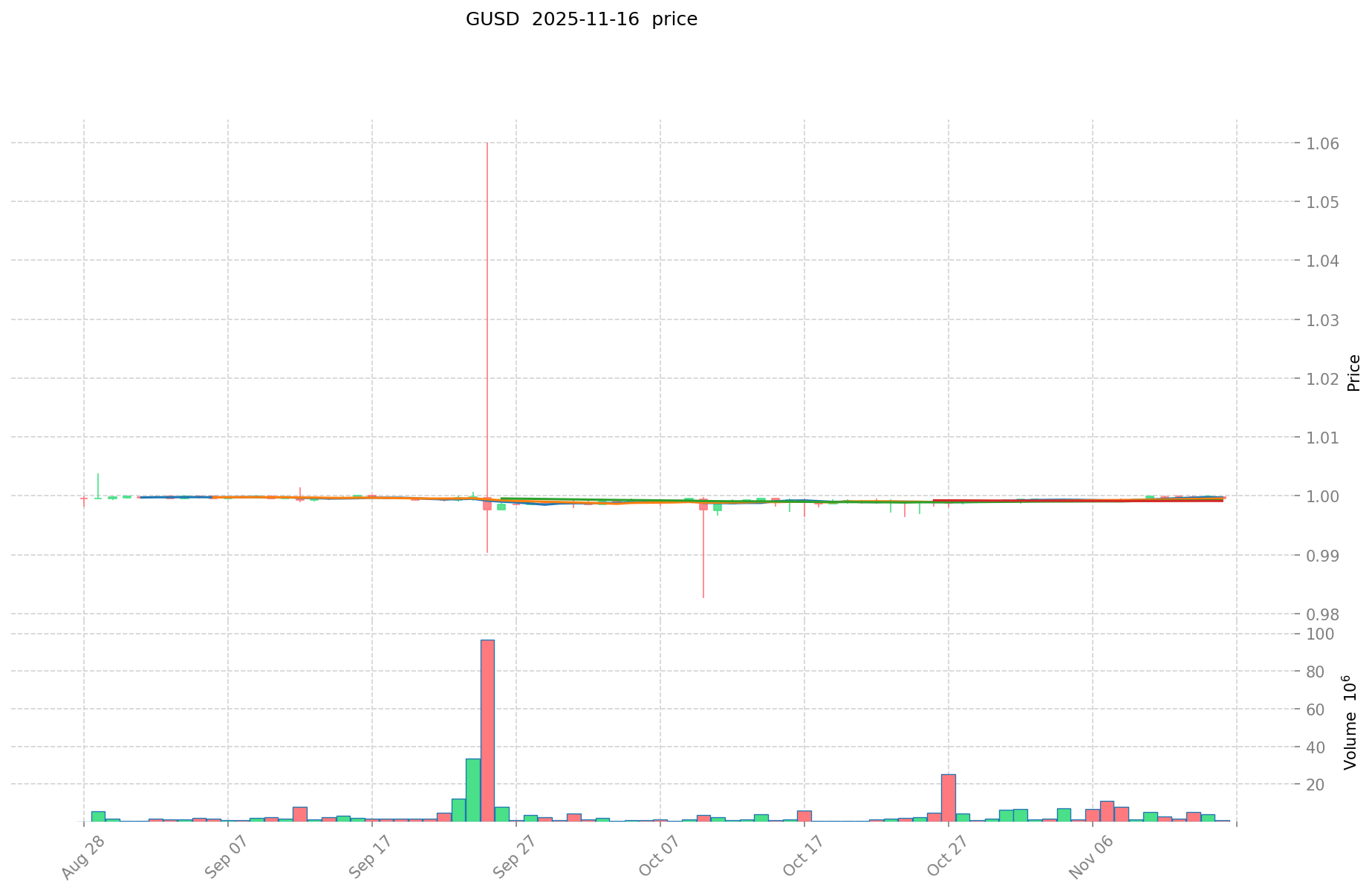

GUSD is an important asset in the cryptocurrency field, having achieved significant success in flexible, principal-protected investment products since its launch. As of 2025, GUSD's market capitalization has reached $149,701,794.81, with a circulating supply of approximately 149,776,683.15 tokens, and a current price maintained at around $0.9995. With its positioning as a "yield-bearing stablecoin", GUSD has gradually become a focal point for investors discussing "Is GUSD (GUSD) a good investment?". This article will comprehensively analyze GUSD's investment value, historical trends, future price predictions, and investment risks, providing a reference for investors.

I. GUSD Price History Review and Current Investment Value

GUSD(GUSD) investment performance

- 2025: Launch → Investors saw initial stability

Current GUSD investment market status (November 2025)

- GUSD current price: $0.9995

- Market sentiment (Fear & Greed Index): 1 (Extreme Fear)

- 24-hour trading volume: $811,167.6784

- Institutional investor holdings: Data not available

Click to view real-time GUSD market price

II. Key Factors Affecting Whether GUSD (GUSD) is a Good Investment

Supply Mechanism and Scarcity (GUSD investment scarcity)

- GUSD is minted by staking USDT/USDC → Impacts price and investment value

- Historical pattern: Supply changes have driven GUSD price movements

- Investment significance: Scarcity is key to supporting long-term investment

Institutional Investment in GUSD

- Institutional holding trend: Data not available

- Adoption by Gate → Enhances its investment value

- Impact of national policies on GUSD investment prospects

Macroeconomic Environment's Impact on GUSD Investment

- Monetary policy and interest rate changes → Alter investment attractiveness

- Hedging role in inflationary environments → "Digital yield-bearing asset" positioning

- Geopolitical uncertainties → Potentially increase demand for GUSD investment

Technology & Ecosystem for GUSD Investment

- Flexible, principal-protected investment product: Enhances network performance → Increases investment appeal

- Daily reward distribution: Expands ecosystem applications → Supports long-term value

- DeFi applications driving investment value through staking and collateral use

III. GUSD Future Investment Forecast and Price Outlook (Is GUSD(GUSD) worth investing in 2025-2030)

Short-term GUSD investment outlook (2025)

- Conservative estimate: $0.99 - $1.00

- Neutral estimate: $1.00

- Optimistic estimate: $1.00 - $1.01

Mid-term GUSD(GUSD) investment forecast (2027-2028)

- Market phase expectation: Stable growth

- Investment return forecast:

- 2027: $1.00

- 2028: $1.00

- Key catalysts: Consistent performance as a stablecoin

Long-term investment outlook (Is GUSD a good long-term investment?)

- Base scenario: $1.00 (Maintaining stable peg)

- Optimistic scenario: $1.00 - $1.02 (Increased adoption and utility)

- Risk scenario: $0.98 - $1.00 (Potential market stress)

Click to view GUSD long-term investment and price prediction: Price Prediction

2025-11-16 - 2030 Long-term Outlook

- Base scenario: $1.00 - $1.00 (Corresponding to steady progress and gradual mainstream application)

- Optimistic scenario: $1.00 - $1.02 (Corresponding to widespread adoption and favorable market conditions)

- Transformative scenario: Above $1.02 (In case of breakthrough developments in the ecosystem and mainstream adoption)

- 2030-12-31 Forecast high: $1.02 (Based on optimistic development assumptions)

Disclaimer

| 年份 | 预测最高价 | 预测平均价格 | 预测最低价 | 涨跌幅 |

|---|---|---|---|---|

| 2025 | 1 | 1 | 1 | 0 |

| 2026 | 1 | 1 | 1 | 0 |

| 2027 | 1 | 1 | 1 | 0 |

| 2028 | 1 | 1 | 1 | 0 |

| 2029 | 1 | 1 | 1 | 0 |

| 2030 | 1 | 1 | 1 | 0 |

IV. How to invest in GUSD

GUSD investment strategy

- HODL GUSD: Suitable for conservative investors looking for stable returns

- Active trading: Limited potential due to GUSD's stable nature

Risk management for GUSD investment

- Asset allocation ratio: Conservative: Up to 5% of portfolio Moderate: Up to 10% of portfolio Aggressive: Up to 20% of portfolio

- Risk hedging: Diversify across multiple stablecoins and traditional assets

- Secure storage: Use reputable exchanges or hardware wallets for long-term holdings

V. Risks of investing in stablecoins

- Market risk: Minimal price volatility, but potential for depegging

- Regulatory risk: Uncertain regulatory environment for stablecoins in various jurisdictions

- Technical risk: Smart contract vulnerabilities, potential issues with underlying collateral

VI. Conclusion: Is GUSD a Good Investment?

- Investment value summary: GUSD offers stable returns with lower risk compared to volatile cryptocurrencies, but limited upside potential.

- Investor recommendations: ✅ Beginners: Consider as part of a diversified portfolio for stable returns ✅ Experienced investors: Use for yield farming or as a temporary store of value ✅ Institutional investors: Potential for treasury management or as a low-risk crypto asset

⚠️ Note: Cryptocurrency investments carry risks. This article is for informational purposes only and does not constitute investment advice.

VII. FAQ

Q1: What is GUSD and how does it differ from other stablecoins? A: GUSD is a yield-bearing stablecoin that offers investors a stable value pegged to the US dollar while providing daily rewards. Unlike traditional stablecoins, GUSD aims to generate returns for holders through its flexible, principal-protected investment product structure.

Q2: Is GUSD a safe investment? A: While GUSD is designed to maintain a stable value, it still carries risks associated with stablecoins, including potential depegging, regulatory uncertainties, and technical vulnerabilities. However, it is generally considered less volatile than non-stablecoin cryptocurrencies.

Q3: What are the potential returns for investing in GUSD? A: GUSD aims to provide stable returns through its daily reward distribution mechanism. However, as a stablecoin, its price is expected to remain close to $1, limiting potential capital gains. The primary return comes from the yield-bearing aspect of the token.

Q4: How can I invest in GUSD? A: You can invest in GUSD by purchasing it on cryptocurrency exchanges that list the token, such as Gate. It can be held as a stable asset or used in DeFi applications for additional yield opportunities.

Q5: What is the long-term outlook for GUSD? A: The long-term outlook for GUSD is expected to remain stable, with price predictions ranging from $0.98 to $1.02 by 2030. Its success will largely depend on adoption rates, regulatory developments, and the overall growth of the stablecoin market.

Q6: What are the main risks of investing in GUSD? A: The main risks include market risk (potential depegging), regulatory risk (uncertain legal status in some jurisdictions), and technical risk (smart contract vulnerabilities or issues with underlying collateral).

Q7: How much of my portfolio should I allocate to GUSD? A: The allocation depends on your risk tolerance. Conservative investors might allocate up to 5% of their portfolio, moderate investors up to 10%, and aggressive investors up to 20%. Always diversify your investments and consult with a financial advisor for personalized advice.

Share

Content