What is USDG: Understanding the Digital Dollar and Its Impact on Global Finance

Global Dollar's Positioning and Significance

In 2024, Global Dollar (USDG) was introduced as a stablecoin backed by the US dollar, aiming to address the need for a reliable and regulated digital representation of the US dollar in the cryptocurrency space.

As a stablecoin available on both Ethereum and Solana blockchains, Global Dollar plays a crucial role in providing stability and facilitating transactions in the DeFi and cross-chain ecosystems.

As of 2025, Global Dollar has become a significant player in the stablecoin market, with a circulating supply of 1,056,315,300 USDG and a market capitalization of $1,057,054,720.71. It offers users a secure and regulated option for maintaining dollar-pegged value in the volatile cryptocurrency market.

Origin and Development History

Birth Background

Global Dollar (USDG) was created in 2024 to address the need for a regulated and secure stablecoin backed by the US dollar. It emerged in the context of growing demand for reliable digital representations of fiat currencies in the blockchain ecosystem.

Global Dollar's launch aimed to provide a stable, regulated alternative for users seeking to transact and store value in a digital dollar equivalent across multiple blockchain networks.

Important Milestones

- 2024: Launch on Ethereum and Solana blockchains, offering cross-chain functionality.

- 2025: Achieved a market cap of over $1 billion, demonstrating significant adoption.

- 2025: Reached a total supply of 1,056,315,300 USDG, indicating substantial issuance and demand.

With support from its regulated provider and growing user base, Global Dollar continues to enhance its stability, security, and real-world applications in the digital asset space.

How Does Global Dollar Work?

Decentralized Control

While Global Dollar operates on decentralized blockchain networks (Ethereum and Solana), it is issued and managed by a regulated provider. This hybrid model combines the benefits of blockchain technology with regulatory compliance, ensuring transparency and security.

Blockchain Core

Global Dollar transactions are recorded on the Ethereum and Solana blockchains, leveraging their respective security and efficiency features. This multi-chain approach allows for greater flexibility and reach within the cryptocurrency ecosystem.

Ensuring Fairness

As a stablecoin, Global Dollar maintains its 1:1 peg to the US dollar through a combination of secure asset backing and regulatory oversight. This mechanism ensures that each USDG token is fully backed by liquid assets, maintaining its stability and redeemability.

Secure Transactions

Global Dollar utilizes the underlying security features of the Ethereum and Solana blockchains:

- Private keys are used to sign transactions

- Public keys (addresses) are used to receive and verify ownership of USDG tokens

This system ensures secure transactions while maintaining transparency on the blockchain. The regulated nature of Global Dollar adds an extra layer of security and trust for users.

Global Dollar (USDG) Market Performance

Circulation Overview

As of November 15, 2025, Global Dollar (USDG) has a circulating supply of 1,056,315,300 tokens, which is equal to its total supply. The maximum supply is listed as infinite (∞), indicating a potentially inflationary model.

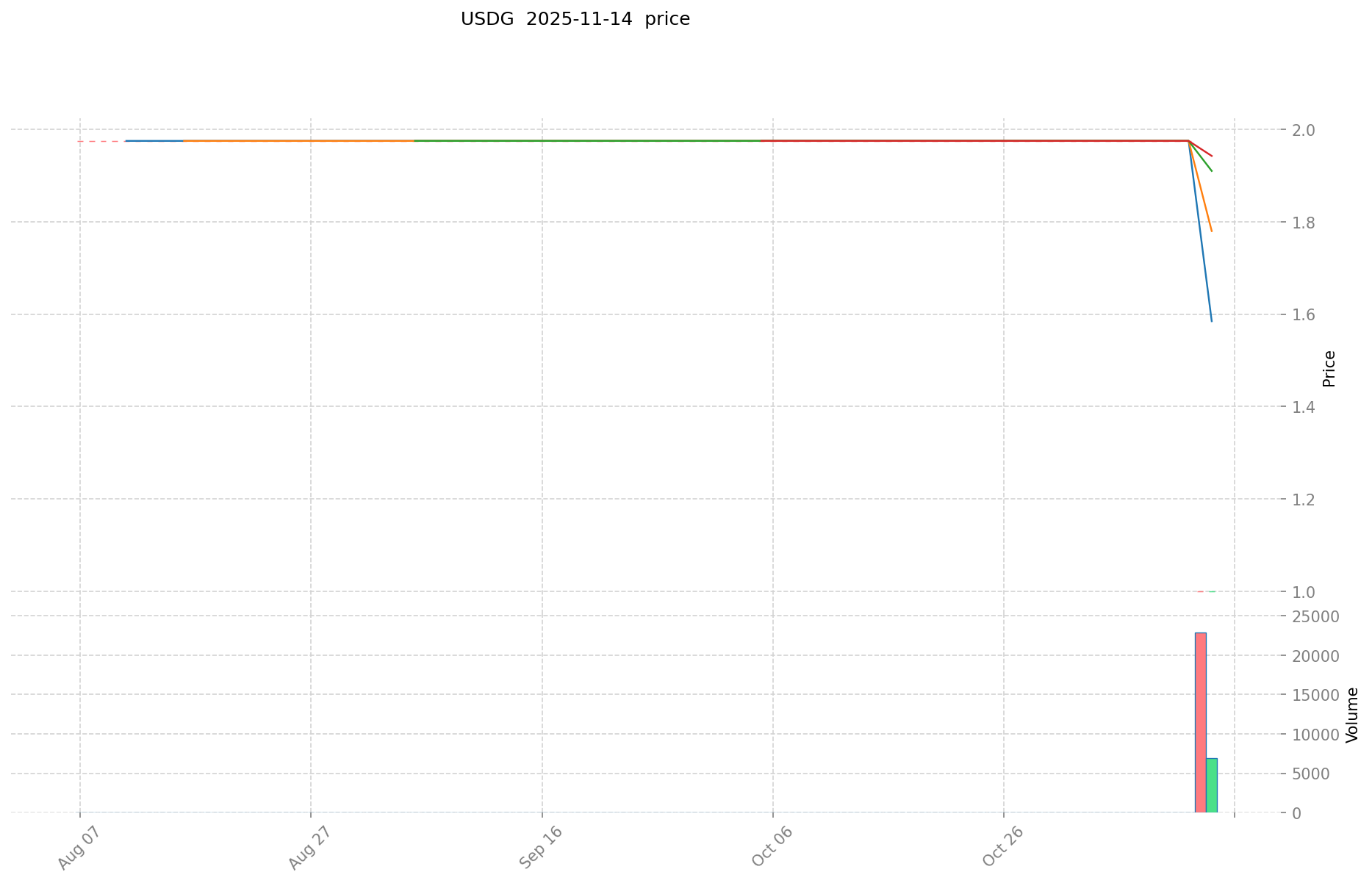

Price Fluctuations

USDG reached its all-time high of $1.65 on January 30, 2025, likely driven by increased demand for stablecoins in the crypto market.

Its lowest price was $0.907561, recorded on November 12, 2024, possibly due to temporary market volatility or a brief loss of peg.

These fluctuations reflect market sentiment, adoption trends, and external factors affecting stablecoin demand.

Click to view the current USDG market price

On-chain Metrics

- Daily Trading Volume: $317,885.11543 (indicating network activity)

- Active Addresses: 7,309 (reflecting user engagement)

USDG Ecosystem Applications and Partnerships

Core Use Cases

USDG's ecosystem supports various applications:

- Stablecoin: USDG serves as a dollar-pegged stablecoin on Ethereum and Solana blockchains.

- Cross-chain Transactions: Facilitates seamless transfers between different blockchain networks.

Strategic Collaborations

USDG has established partnerships with regulated providers to ensure its stability and security. These partnerships provide a solid foundation for USDG's ecosystem expansion and regulatory compliance.

Controversies and Challenges

USDG faces the following challenges:

- Regulatory Scrutiny: As a stablecoin, USDG may face increased regulatory oversight.

- Market Competition: Competition from other stablecoins in the crypto space.

- Adoption Barriers: Challenges in gaining widespread acceptance and use.

These issues drive ongoing discussions within the community and market, pushing USDG towards continuous improvement.

USDG Community and Social Media Atmosphere

Fan Enthusiasm

USDG's community shows growing interest, with 7,309 holders as of November 15, 2025. On X (formerly Twitter), posts and hashtags related to USDG are gaining traction. Factors such as its stability and cross-chain functionality have sparked community interest.

Social Media Sentiment

Sentiment on X presents a mix of opinions:

- Supporters praise USDG's stability and its availability on multiple blockchains.

- Critics may focus on concerns typical to stablecoins, such as transparency and regulatory compliance.

Recent trends show a generally positive outlook due to USDG's consistent performance.

Hot Topics

X users discuss USDG's regulatory compliance, its role in DeFi ecosystems, and its potential for cross-chain transactions. These discussions highlight both its potential for innovation and the challenges it faces in mainstream adoption.

More Information Sources for USDG

- Official Website: Visit USDG's official website for features, use cases, and latest updates.

- Whitepaper: USDG Whitepaper details its technical architecture, objectives, and vision.

- X Updates: On X, USDG uses @global_dollar, covering topics such as technical updates, community events, and partnership news.

USDG Future Roadmap

- Ecosystem Goals: Expand usage across various DeFi platforms and blockchain networks.

- Long-term Vision: Become a leading cross-chain stablecoin solution for global digital transactions.

How to Participate in USDG?

- Purchase Channels: Buy USDG on Gate.com

- Storage Solutions: Use secure wallets supporting Ethereum and Solana networks

- Ecosystem Participation: Utilize USDG in DeFi applications across supported blockchains

- Stay Informed: Follow USDG's official channels for updates and community insights

Summary

USDG redefines digital currency through blockchain technology, offering stability, security, and efficient cross-chain transactions. Its growing community, comprehensive resources, and strong market performance set it apart in the cryptocurrency realm. Despite facing challenges such as regulatory scrutiny and market competition, USDG's innovative spirit and clear roadmap position it as a significant player in the future of decentralized finance. Whether you're a newcomer or an experienced player, USDG is worth watching and participating in.

FAQ

What is the USDG crypto?

USDG is a stablecoin designed for the DeFi ecosystem, pegged to the US dollar. It aims to provide a stable, decentralized alternative to traditional fiat-backed stablecoins, facilitating seamless transactions and yield farming in the crypto space.

What does USDG stand for?

USDG stands for USD Gambit, a stablecoin designed to maintain a value pegged to the US dollar in the decentralized finance (DeFi) ecosystem.

What is USDG in Kraken?

USDG is a stablecoin issued by Kraken exchange, pegged to the US dollar. It's designed for trading and transferring value within the Kraken ecosystem.

Is USDG a safe stablecoin?

USDG is generally considered a safe stablecoin. It's backed by a diverse reserve of assets and maintains a stable 1:1 peg to the US dollar through various mechanisms. However, like all cryptocurrencies, it carries some inherent risks.

Share

Content