A Complete Guide to Gate Leveraged ETF: A Strategic Tool for Active Traders

The Evolution and Positioning of Leveraged ETFs

Exchange-Traded Funds (ETFs) were initially created to give investors a straightforward way to access a diversified basket of assets, reducing the volatility risk tied to individual securities. As demand for strategy-driven products has surged, traditional index ETFs have become less effective for users seeking greater efficiency. In response, leveraged ETFs have emerged, allowing investors to amplify market movements by a fixed multiple—without dealing with derivatives—thereby maximizing capital efficiency.

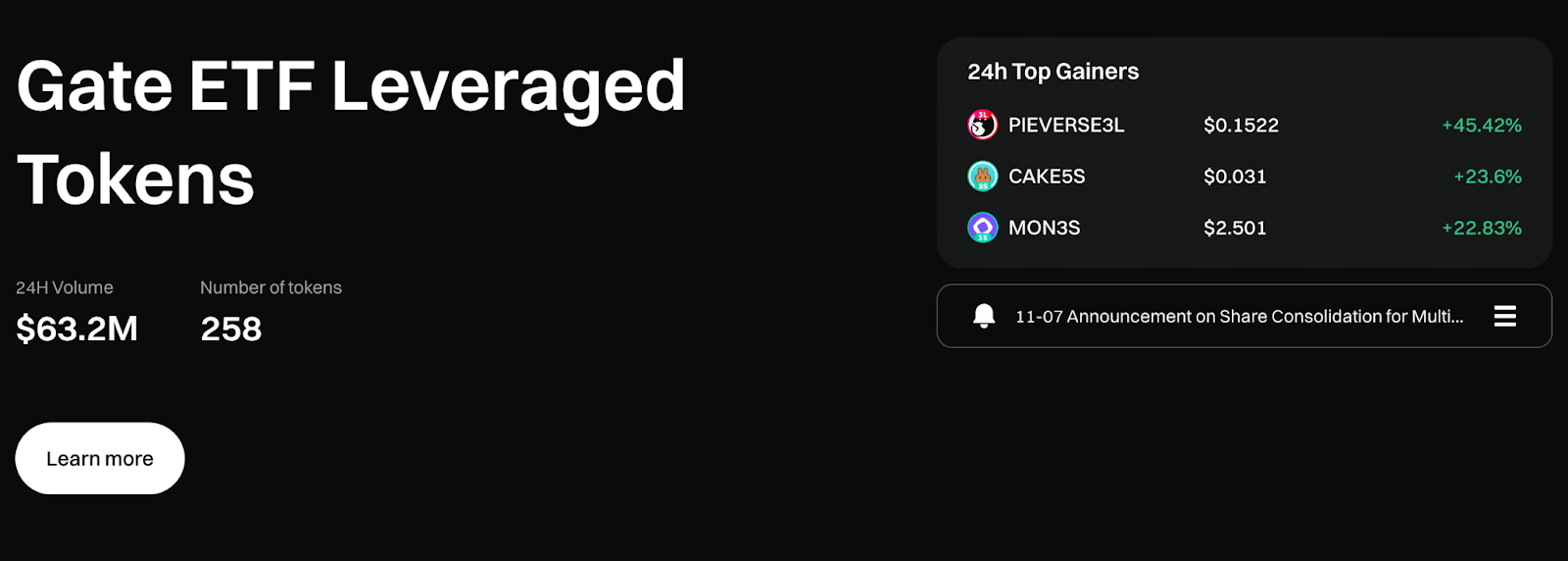

What Are Gate Leveraged ETF Tokens?

Gate’s leveraged ETF tokens are built on perpetual contract positions and managed by an automated system to maintain a stable leverage ratio, such as 3x or 5x. Users can buy or sell these tokens directly on the spot market to gain leveraged exposure—no need for borrowing or margin management. Because the system centrally manages contract positions, investors avoid the liquidation risks common in traditional contract trading. This lowers the psychological barrier to using leverage.

Start trading Gate ETF leveraged tokens now: https://www.gate.com/leveraged-etf

How Leveraged ETFs Work

Gate uses several coordinated mechanisms to keep leverage ratios stable. First, the perpetual contract positions backing each token are set according to the target leverage, minimizing deviations from market volatility. Next, the system automatically rebalances based on price changes to keep leverage within the designated range. Most importantly, users only need to trade on the spot market to establish leveraged positions. Additionally, the platform charges a daily management fee of 0.1% to cover contract adjustments, hedging, and system operations, ensuring long-term product stability.

Advantages and Use Cases of Leveraged ETFs

The biggest advantage of leveraged ETFs is their ability to amplify profits in strong market trends, especially when the underlying asset experiences sustained gains or losses. The leverage ratio significantly increases capital efficiency. Since there’s no risk of forced liquidation from insufficient margin, trading pressure is lower. The rebalancing mechanism can also create a compounding effect during favorable trends, allowing returns to build up over time. With a simple and intuitive interface, leveraged ETFs are accessible to both new strategy users and short-term traders.

Risks and Cost Structure to Know Before Trading

While leveraged ETFs are easy to use, their volatility is magnified. This means sideways markets can lead to rebalancing decay, which may reduce long-term returns. Also, leveraged price movements are not perfectly linear, so actual returns may not exactly match the underlying asset’s multiple. The platform’s daily 0.1% management fee covers contract costs, funding rates, hedging, and slippage management, and can impact long-term pricing as it accumulates. In general, leveraged ETFs are best suited for short-term strategies or strong trending markets.

Conclusion

Leveraged ETFs offer the simplest way to access market leverage—no contracts, no borrowing, and no risk of liquidation. However, traders still need to understand market cycles, risk sources, and the effects of rebalancing to maximize gains during trends and avoid losses from sideways markets. Only with a thorough understanding of product rules can leveraged ETFs become a powerful tool for boosting trading efficiency.

Related Articles

2025 BTC Price Prediction: BTC Trend Forecast Based on Technical and Macroeconomic Data

Flare Crypto Explained: What Is Flare Network and Why It Matters in 2025

Pi Coin Transaction Guide: How to Transfer to Gate.com

How to Use a Crypto Whale Tracker: Top Tool Recommendation for 2025 to Follow Whale Moves

What is N2: An AI-Driven Layer 2 Solution