Beyond the Basic Bet: Newer Expressions of Prediction Markets

The future of prediction markets could just be Polymarket/Kalshi capturing all the attention and mindshare. But I’d happily wager that we’ll be using newly designed versions of prediction markets that suit each individual and map to their taste and interests.

Think about it, how has trading memecoins evolved?

In 2015: The coin has a dog on it (1000x bagger found)

In 2025: You use a terminal (Axiom), track wallets (Cielo, Nansen, Arkham), and need a group chat with multiple people scouting tokens across Solana, BNB and Base.

I believe each opportunity space that opens up in crypto starts with easy mode. Over time that game either dies out (Hamster racing, NFTs??) or becomes more complex as more participants start playing the game and early edges erode (Memecoins). People and users also want to play more complex games (see the evolution of most video games: God of War, Assassin’s Creed, FIFA). To stay appealing and relevant to your core userbase, games and game-like platforms need to add features and complexity that allows the top players to distinguish themselves against the 99%.

When this story repeats and rhymes with the Prediction Market category, it will not be a single, monolithic platform. It will be a full ecosystem of prediction adjacent applications.

These are standalone products that use the core mechanics of PMs (incentivized forecasting and skin-in-the-game) to create entirely new experiences.

Here are five categories that I’m excited about.

1. Multiverse Finance: @ lightconetrade

This is perhaps the newest and most complex primitive, moving beyond probability to let users trade the impact of an event.

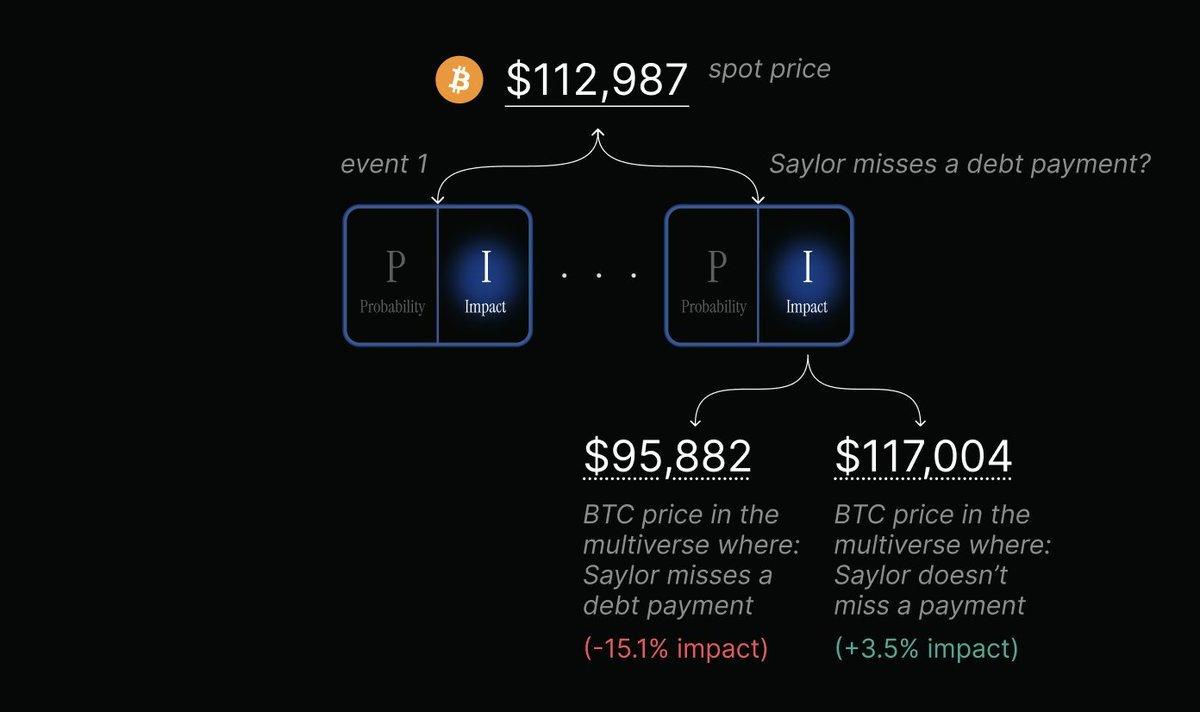

Think of it this way: Prediction markets tell you the Probability (P) of an event & spot markets tell you the Spot Price (S). But “Impact Markets,” a new category defined by Lightcone, aims to isolate and price the Impact (I).

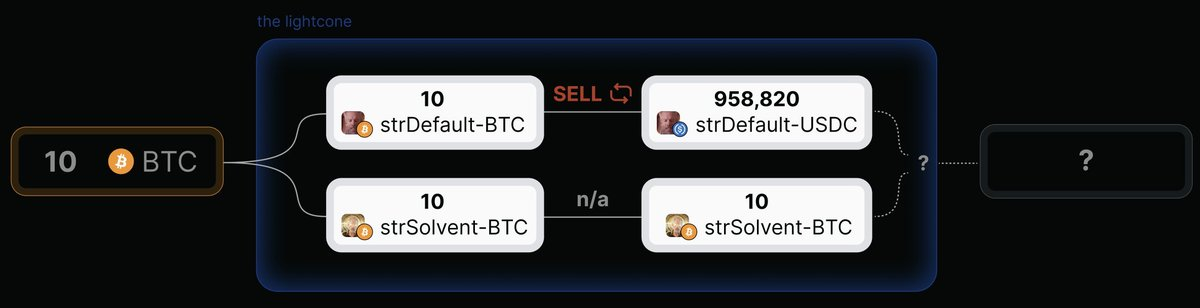

How it works:The platform clones assets into parallel universes based on a future event. A user could’ve deposited 1 BTC ahead of the election and receive two new, tradable tokens:

- 1 Trump-BTC

- 1 Kamala-BTC

These tokens trade in separate, parallel “universes.” When the event is resolved (e.g., Trump wins), all Trump-BTC tokens become redeemable for the real, underlying BTC, and all Kamala-BTC tokens go to zero (and vice-versa).

Why it’s powerful:This creates two novel applications:

- A New Information Machine: It gives us a crystal ball for financial impact. By comparing the price of Trump-BTC (e.g., $130,000) and Kamala-BTC (e.g., $91,000) to the current Spot BTC price ($102,000), the market is explicitly telling us the expected financial impact of each outcome, completely separated from the odds of it happening.

- The “Event-Based” Hedge: A trader can hedge a specific risk without paying a premium unless that risk materializes. For example, a trader worried about a specific credit event (like a Saylor default) can sell their strDefault-BTC for strDefault-USDC while holding their strSolvent-BTC.

If the default happens: Their strDefault-USDC becomes real USDC. They’ve successfully hedged and sold their BTC before the event’s impact. If no default happens: Their strSolvent-BTC becomes redeemable for their original BTC. They are still long, and the hedge cost them nothing.

This is a sophisticated tool. It takes the “probability” variable out of the trade, letting institutions and traders isolate and act on impact alone. It’s a truly a net new financial primitive.

2. Opinion Markets: Betting on Beliefs

This is a fascinating meta-game. Instead of betting on an objective fact (“Will $ETH hit $5k?”), participants bet on what the crowd will believe.

- The Market: “Will over 70% of participants bet ‘Yes’ on this market?”

This model has two huge advantages

- Fast Resolution: The market can settle daily or every few hours, based only on its own internal dynamics. It removes the need for slow external oracles.

- Social Meta-Game: It rewards players who can accurately predict collective psychology, not just facts. It’s a way to directly monetize cultural influence and cultural understanding.

Platforms like @ meleemarkets, @ vpop_wtf, and @ opinionsdotfun are building this, that allows turning social capital into profits.

3. Fantasy Sports: High-Frequency PMs

Fantasy sports is a $25Bn industry that is, at its core, a recurring prediction market.

In games like @ footballdotfun, users are not just making one bet; they are making a combinatorial prediction. Assembling a team is a bet on the collective performance of a squad of players, all subject to a budget constraint (the salary cap).

This model is powerful because:

- It drives sustained, recurring volume (e.g., weekly NFL/NBA/PL tournaments).

- It allows users to monetize niche knowledge (acquired by spending 10+ hours watching games every week)

The crypto-native advantage here is tradable assets. The digital player cards are, themselves, predictions of a player’s in-game value. Crypto native fantasy sports can allow people to monetize via participation in purely trading player cards (similar to gacha boxes, physical collectibles) and also via the recurrent prediction market game.

4. Opportunity Markets: Private Scouting

This is the second novel primitive proposed by the Paradigm team in this design space. It adapts PMs to solve a corporate problem: finding valuable, early information.

Here’s the model:

- The Sponsor (a VC): Provides all liquidity for a private market (e.g., “Will we invest in Startup Y this year?”).

- The Scouts (Experts): Use their own information and expertise to buy “YES” shares.

- The Signal: The rising price becomes a proprietary, aggregated signal for the VC, telling them to investigate/reinvestigate the opportunity.

This is a effectively a decentralized scouting program. It can also be structured in a way to solve the Free-Rider Problem (the signal is private and accessible only to the sponsor) and the Liquidity Problem (the sponsor is the permanent MM).

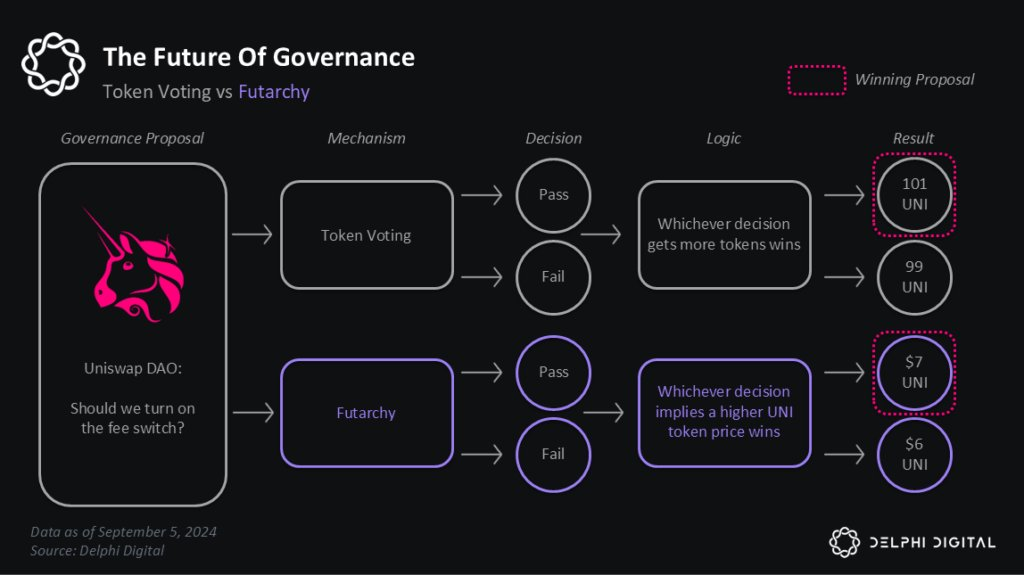

5. Futarchy: Betting on Governance (@ MetaDAOProject)

This is a governance model that delegates policy decisions to the intelligence of the market. The core idea is: “People will vote on values, but bet on beliefs.”

Here’s how it works:

- A DAO agrees on a value or goal (e.g., “maximize monthly active users”).

- A proposal is made (“Proposal 123: Spend 50k tokens on a new incentives campaign”).

Two conditional PMs are created:

Market A (Pass): “What will MAUs be on Dec 31st if Proposal 123 passes?”

- Market B (Fail): “What will MAUs be on Dec 31st if Proposal 123 fails?”

- If Market A’s price (the prediction) is higher than Market B’s, the proposal is automatically adopted.

ty mrink0

It forces participants to put capital behind their beliefs, transforming governance from a subjective popularity contest into an information-driven exercise.

And honestly imo the app level innovation doesn’t stop here at all. We’re seeing ideas like PM-based news platforms (@ _BoringNews) and dedicated PM funds (@ polyfund) being built right now.

The design space for application layer is just getting scratched.

We aren’t Bullish enough!!!

Disclaimer:

- This article is reprinted from [0xdaft]. All copyrights belong to the original author [0xdaft]. If there are objections to this reprint, please contact the Gate Learn team, and they will handle it promptly.

- Liability Disclaimer: The views and opinions expressed in this article are solely those of the author and do not constitute any investment advice.

- Translations of the article into other languages are done by the Gate Learn team. Unless mentioned, copying, distributing, or plagiarizing the translated articles is prohibited.

Related Articles

The Future of Cross-Chain Bridges: Full-Chain Interoperability Becomes Inevitable, Liquidity Bridges Will Decline

Solana Need L2s And Appchains?

Sui: How are users leveraging its speed, security, & scalability?

Navigating the Zero Knowledge Landscape

What is Tronscan and How Can You Use it in 2025?