Bitcoin Price Prediction: BTC Falls Below $100K as Panic Selling Escalates — Can It Rebound?

Is There Still a Chance for a Crypto Market Rebound?

Recently, Bitcoin dropped below a key $100,000 threshold, triggering widespread panic and a cascade of sell-offs. CryptoQuant’s latest data indicates that this decline wasn’t driven by deteriorating fundamentals, but by a psychological adjustment caused by a collapse in investor sentiment.

Market Sentiment Reversal

Within just a few days, confidence declined, resulting in increased market panic. The Fear & Greed Index plunged to around 20, deep in the fear zone. Analysts who once anticipated a move toward the $150,000–$200,000 range have now shifted to more pessimistic outlooks. These sentiment-driven swings are common in crypto markets, where light market structure and high leverage mean price movements are often dictated by crowd psychology rather than fundamentals.

On-Chain Data Shows Core Structure Remains Stable

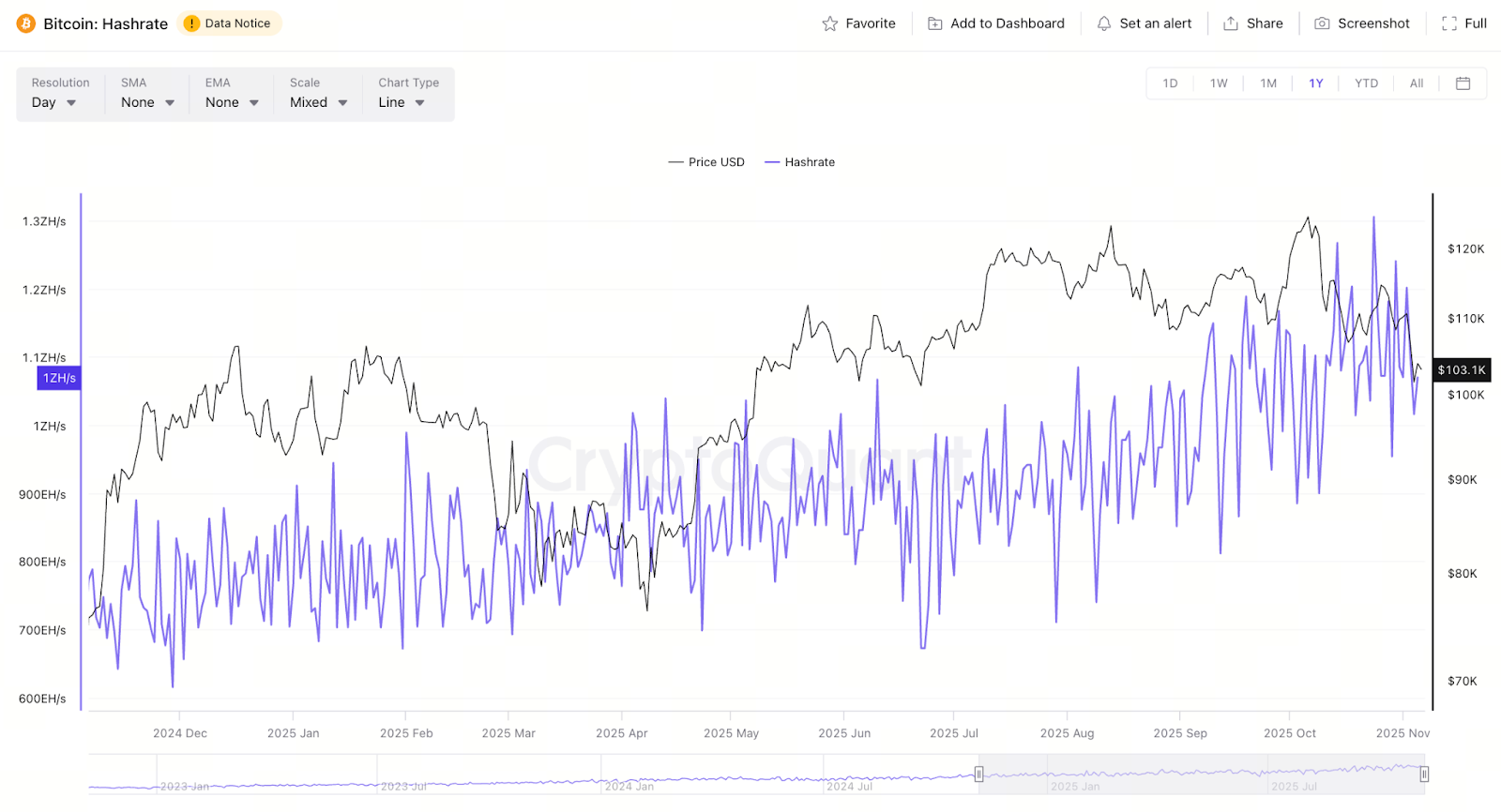

Despite dipping below $100,000, on-chain data signals resilient fundamentals. CryptoQuant’s report shows no signs of network instability or a collapse in miner sentiment.

- BTC withdrawal volumes are rising: More investors are transferring assets off exchanges to self-custody wallets, underscoring strong long-term conviction.

- UTXOs currently at a loss represent about 12%: This highlights short-term pressure, but is still below typical “capitulation” levels.

- Hashrate remains at a record high (approximately 1.1 EH/s), strengthening both network security and miner stability.

- Exchange stablecoin inflows reached $10.7 billion: Providing ample liquidity for potential buying opportunities.

(Source: CryptoQuant)

In summary, this correction appears to be driven by sentiment rather than a fundamental weakening. Long-term buyers absorbing supply could help Bitcoin build new support around the $100,000 level.

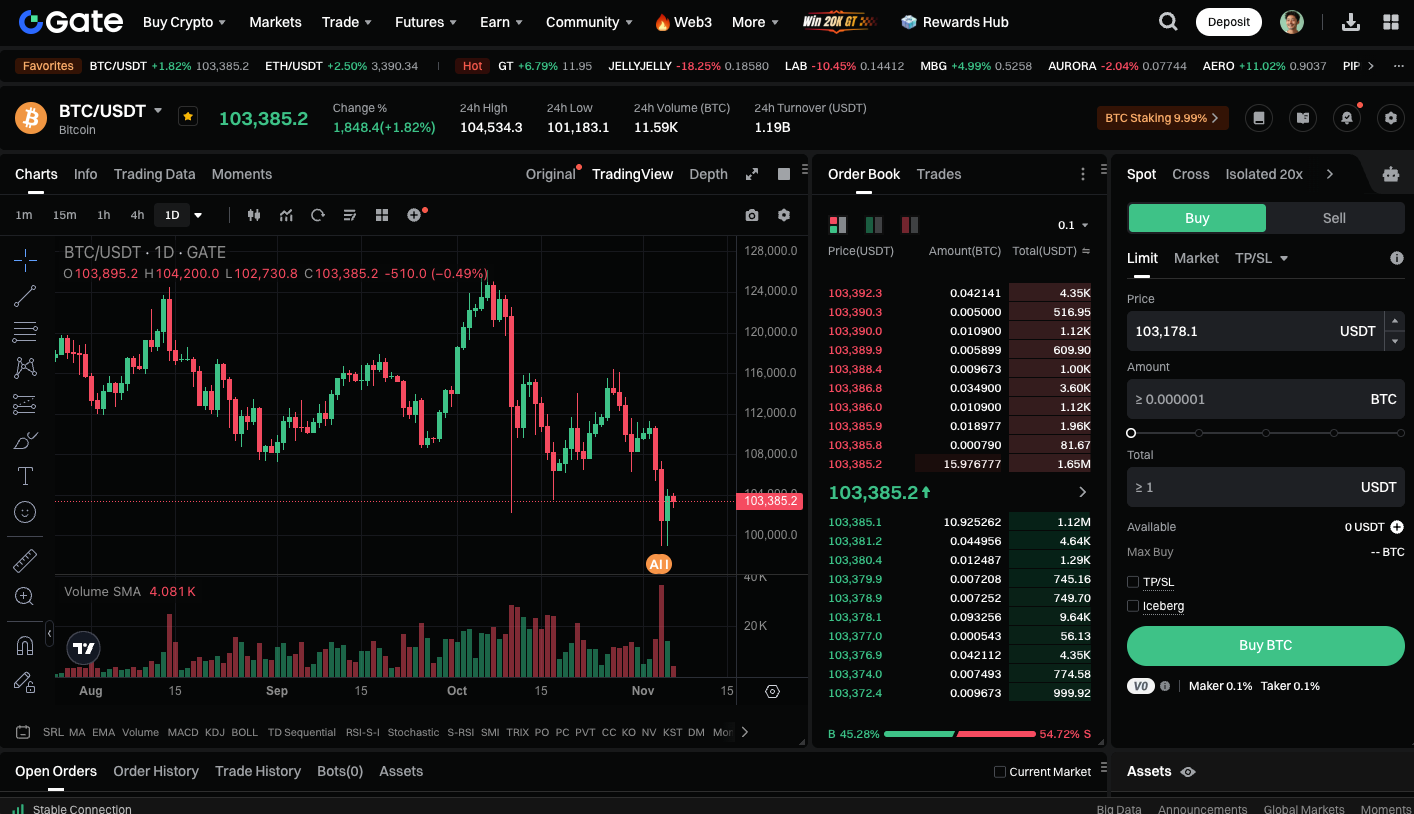

$100,000: The Key Support Level

Technically, since Bitcoin broke below $110,000, both highs and lows have been declining, signaling a short-term bearish trend. If Bitcoin can reclaim the $105,000–$107,000 range, it may alleviate short-term pressure and retest higher resistance. Conversely, if $100,000 support fails, prices could drop to the $95,000–$98,000 region, potentially triggering a deeper shakeout.

You can trade BTC spot here: https://www.gate.com/trade/BTC_USDT

Summary

While market sentiment has deteriorated sharply, both on-chain and fundamental indicators show strong support. This volatility tests investor confidence rather than signaling the end of the bull market. In the short term, stability at the $100,000 level will be the key focus. If sentiment recovers and stablecoin capital flows back in, Bitcoin could regain upward momentum and start a technical rebound.

Related Articles

2025 BTC Price Prediction: BTC Trend Forecast Based on Technical and Macroeconomic Data

Flare Crypto Explained: What Is Flare Network and Why It Matters in 2025

Pi Coin Transaction Guide: How to Transfer to Gate.com

How to Use a Crypto Whale Tracker: Top Tool Recommendation for 2025 to Follow Whale Moves

What is N2: An AI-Driven Layer 2 Solution