Bitcoin Price Prediction: BTC Falls Below $100K Psychological Level, Could Drop to $98K or Rebound to $112K

Bitcoin Breaks Below Key Support

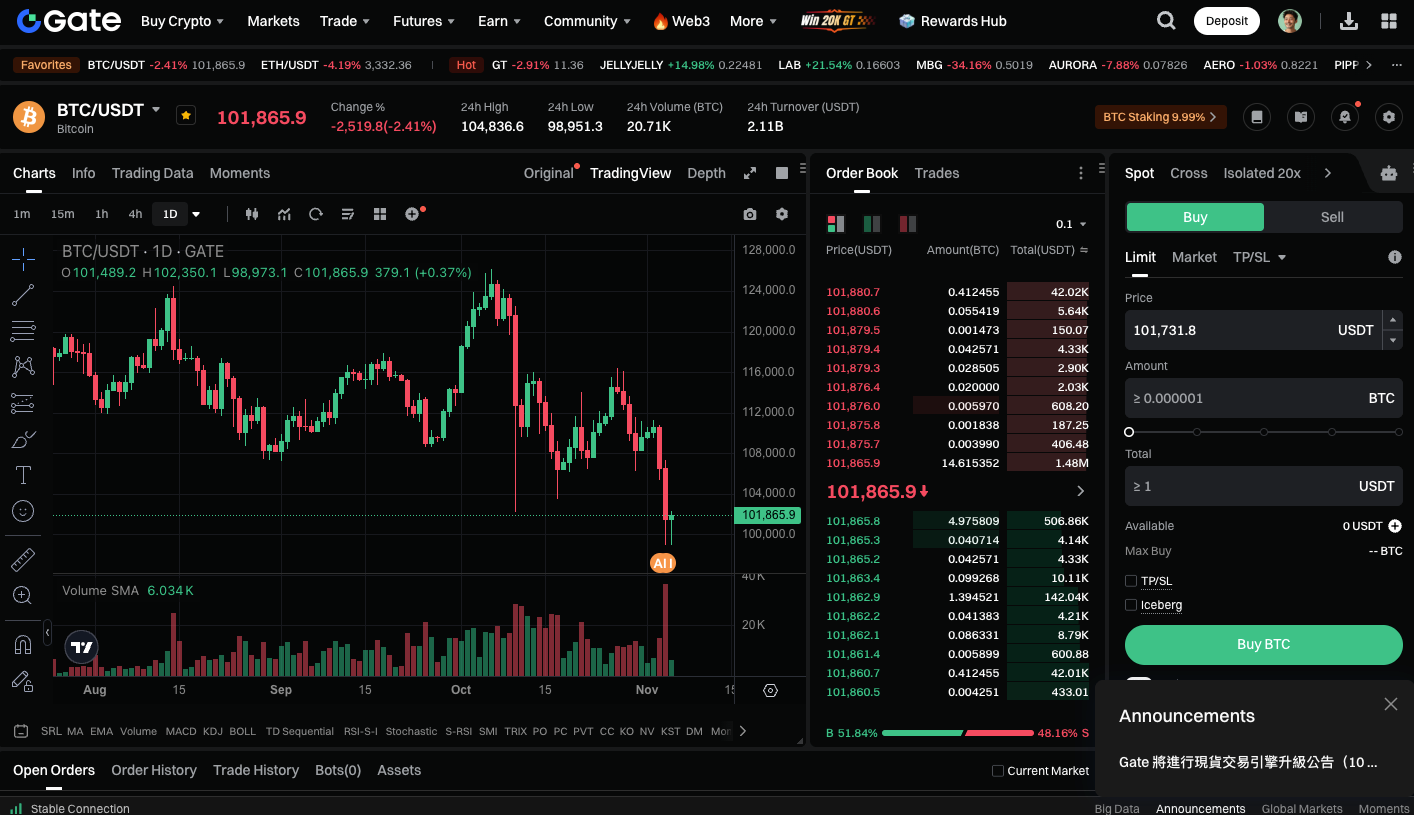

After failing to secure a critical weekly close, Bitcoin (BTC) once again fell to the $100,000 level, making it the center of recent market attention. Multiple analysts highlight that this level could dictate BTC’s direction in the fourth quarter, acting as a key turning point between bullish and bearish trends.

On Tuesday, Bitcoin declined 9% from the weekly open, touching the $100,000 range for the first time since June. Since then, BTC consistently traded above $105,000, moving within a consolidation range from $108,000 to $120,000 over the past four months. During a correction in early October, BTC briefly dipped to $102,000 before recovering. However, it consistently failed to break above the midpoint of the range. Now, with the price once again testing this psychological barrier, market sentiment is now sharply negative.

Technical Analysis

Analyst Ali Martinez takes a relatively optimistic view, suggesting that if BTC maintains its current range, a short-term rebound of 5% to 11% is possible.

(Source: ali_charts)

According to Martinez’s chart, BTC has traded between $101,300 and $124,000 since May, with rebounds each time it tests the lower bound. If this trend continues, BTC may retest the resistance levels at $106,500 or $112,000.

Current Status and Outlook

Currently, BTC trades at around $101,800, down 6% on the day. If the price fails to hold $100,000, the market could test support at $98,000; if a rebound occurs, near-term targets will shift to the $106,000–$112,000 range.

Despite sharp short-term volatility, the broader bullish structure remains intact. If BTC establishes a base near $100,000, it could still potentially reclaim levels above $120,000 by year-end.

Trade BTC spot now: https://www.gate.com/trade/BTC_USDT

Summary

Bitcoin’s current drop below a key psychological level primarily reflects shifts in market sentiment and short-term position adjustments. Technically, the $100,000–$98,000 zone marks the last stronghold for bulls. If this level holds, the rebound potential is significant. While fear is surging in the market, for long-term investors, this period may offer an opportunity to reposition as the market experiences heightened volatility.

Related Articles

Pi Coin Transaction Guide: How to Transfer to Gate.io

Flare Crypto Explained: What Is Flare Network and Why It Matters in 2025

How to Use a Crypto Whale Tracker: Top Tool Recommendation for 2025 to Follow Whale Moves

What is N2: An AI-Driven Layer 2 Solution

Understand Baby doge coin in one article