Boros: Devouring DeFi, CeFi, and TradFi, Unlocking Pendle's Next Hundredfold Growth Engine

If you were to nominate the most innovative DeFi protocol, who would you choose?

Pendle would certainly make the shortlist.

In 2021, Pendle became the first DeFi protocol to target the interest rate swap market, single-handedly opening up a multi-billion dollar yield trading sector and establishing itself as the clear leader in this space.

By August 2025, Pendle continued its trailblazing innovation with Boros, pioneering the “funding rate” category—a previously unaddressed on-chain yield segment. For the first time, Boros enabled trading, hedging, and arbitrage of funding rates within DeFi, sparking widespread discussion and intense market participation.

According to the latest Pendle data, Boros has been live for two months and has already surpassed $950 million in total notional trading volume, $61.1 million in open interest, over 11,000 users, and more than $730,000 in annualized income.

In just one month, Boros has achieved what takes many projects years, with participants noting that the yield opportunities on Boros can be even more lucrative than speculative tokens.

So, what exactly is Boros? How does it work? What’s next?

Brand visuals frequently feature a whale devouring everything—a nod to the ancient Greek meaning of “Boros.” With Boros 1.0’s release, the referral program launch, and expanding market offerings, Boros’s mission to capture the yield sector is officially underway through funding rates.

Why Is Boros’s First Breakthrough Focused on Funding Rates?

Boros is a structured interest rate derivatives platform that currently centers its innovation on funding rates, aiming to standardize them as tradable assets.

Most derivatives traders are familiar with funding rates—the “invisible hand” of the perpetuals market—balancing contract and spot prices. Here’s how it works:

- When the funding rate is positive, most expect prices to rise; longs dominate, contract prices exceed spot, and longs pay funding rates to shorts—curbing excessive optimism.

- When the funding rate is negative, most expect prices to fall; shorts dominate, contract prices fall below spot, and shorts pay funding rates to longs—curbing excessive pessimism.

Funding rates are not only the key force balancing long and short positions; they’re also a core gauge of market sentiment.

Before Boros, traders simply accepted funding rate adjustments passively, never imagining they could be traded as standalone assets.

Why did Boros choose funding rates for its first product launch?

Because funding rates offer scale, volatility, and returns—Pendle sees huge potential in these characteristics.

- Scale:

Derivatives markets are far larger than spot, and funding rates flow constantly as long as the market is active.

CoinGlass reported that in Q2 2025, total perpetual contract trading volume reached $12 trillion, with daily averages around $130 billion. With most exchanges settling funding rates at 0.01% every eight hours, the daily funding rate market easily exceeds tens of millions, and in extreme conditions, hundreds of millions.

Unlocking the full potential of this vast and stable funding rate market could drive the next big wave of financial innovation.

- Volatility:

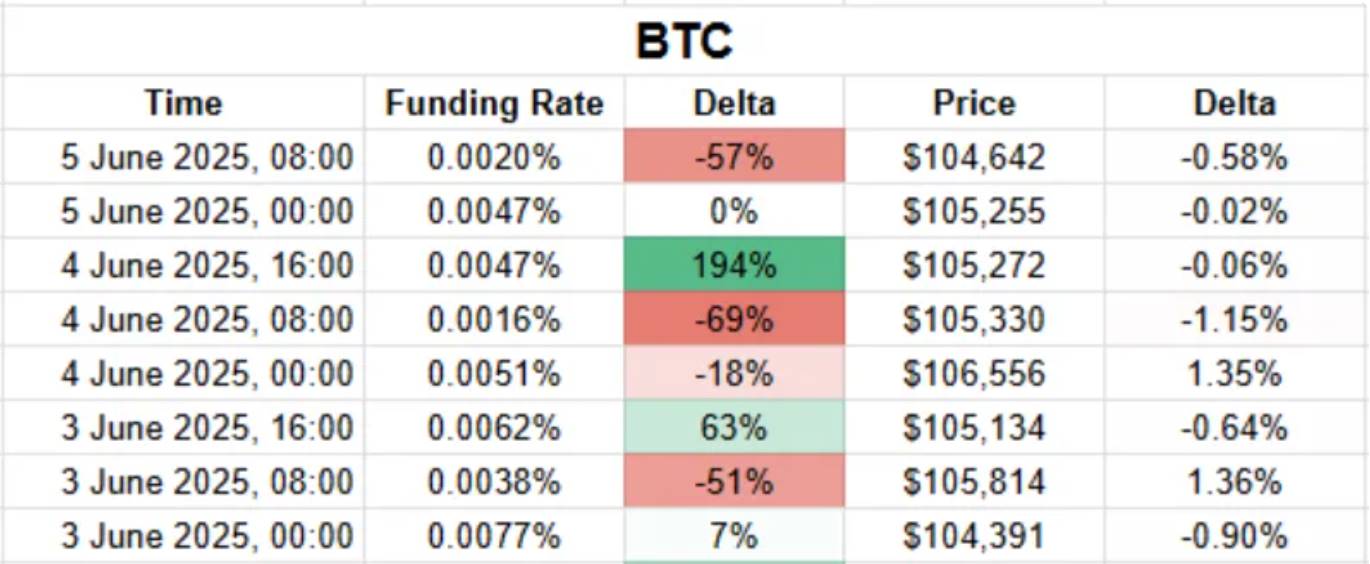

While dramatic token price swings are rare in spot markets, such volatility is routine in funding rate markets.

For example, Coinmarketcap data shows that on September 8, 2025, MYX Finance (MYX) surged 168.00%, topping the crypto market’s top 100 gainers and sparking market buzz. In the tug-of-war between longs and shorts, funding rates constantly fluctuate, especially among altcoins, where swings can reach four or five times—or more. Some traders have paid up to 20,000% annualized funding rate to hold long positions in $TRUMP token.

This volatility enables the refinement of trading strategies and presents yield opportunities.

- Returns:

Volatility is the engine of profit.

With volatility comes the opportunity to buy low and sell high. The highly volatile funding rate market is a crucial avenue for capturing yield.

Standardizing funding rates as assets for trading, profit, hedging, and arbitrage puts product design to the ultimate test.

How Does Boros Let You Bet on Funding Rate Movements?

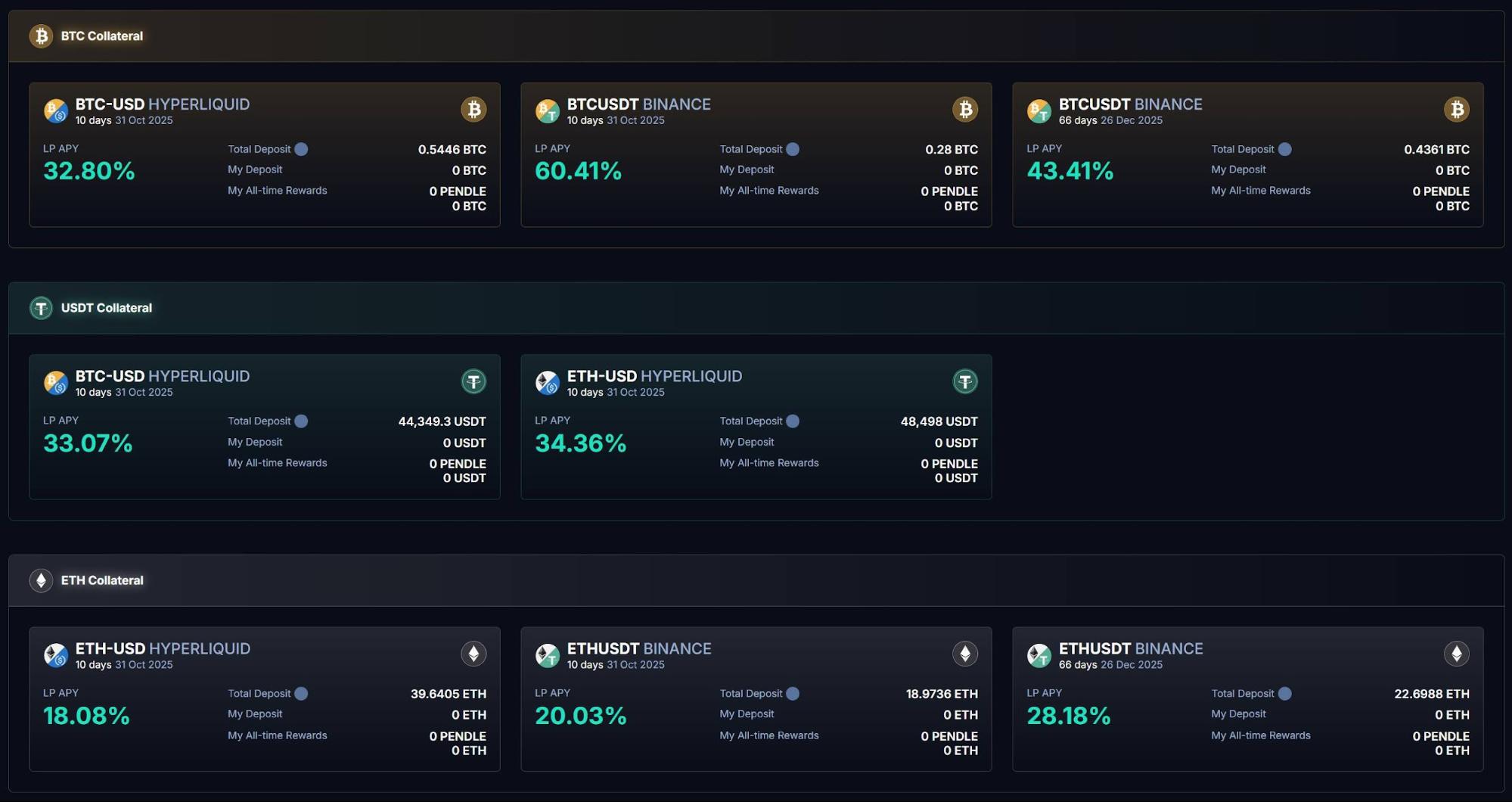

On the Boros dashboard, you’ll see markets for BTC, ETH, and USDT on both Binance and Hyperliquid:

As previously mentioned, funding rates are a key indicator of market sentiment. If you can accurately read sentiment, you can profit from Boros’s funding rate trades.

The process for converting market predictions into returns is as follows.

Boros’s core logic is to lock in the current market funding rate as a benchmark and allow users to bet: if the rate rises, longs profit; if it falls, shorts profit.

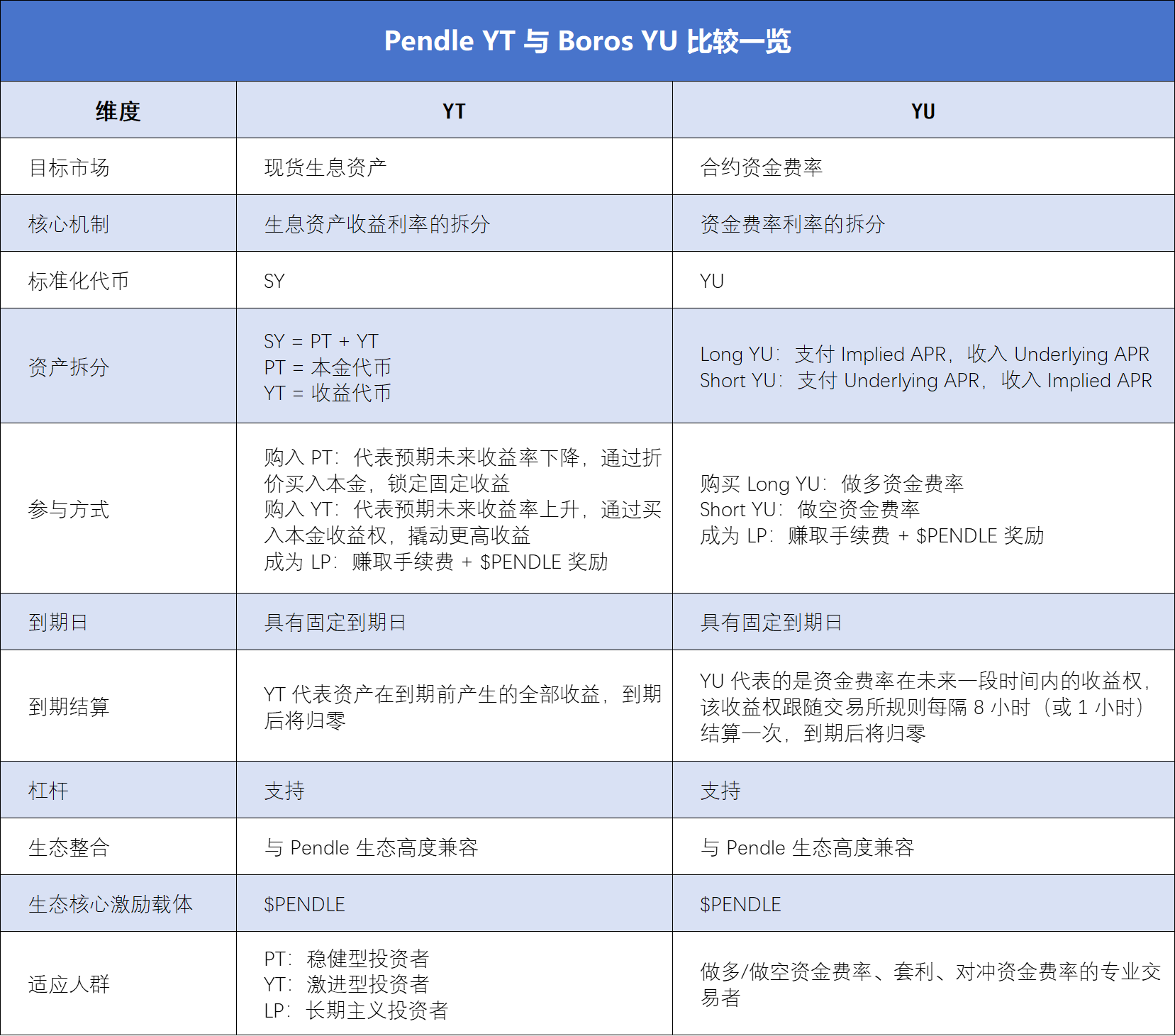

This mechanism revolves around YU.

Users connect their wallets, deposit collateral, and buy YU.

YU standardizes funding rates into tradable assets, representing future funding rate yield rights. It’s also the smallest trading unit for quantifying funding rates. For example, buying 1 YU BTCUSDT Binance entitles you to the funding rate yield for a 1 BTC position on Binance’s BTCUSDT pair.

You calculate returns by subtracting cost from income. YU relies on three data points: Implied APR, Fixed APR, and Underlying APR.

Buying YU means opening a position, which involves two cost components:

First, Implied APR is the locked-in rate at entry—the price of YU and the fixed annualized rate until maturity, serving as the benchmark for future funding rate changes.

Second, transaction fees incurred when opening a position, combined with Implied APR, form the Fixed APR—your total entry cost.

Now, let’s calculate income.

YU locks in a funding rate, but the actual rate on external exchanges is shown by the Underlying APR.

When buying YU, users can go long or short on the funding rate:

- Long YU (betting the rate rises): pay Implied APR, receive Underlying APR during the term

- Short YU (betting the rate falls): pay Underlying APR, receive Implied APR during the term

Your profit is the difference between income and cost—Fixed APR minus Underlying APR.

- If Fixed APR < Underlying APR (Underlying APR > Fixed APR), Long YU earns

- If Fixed APR > Underlying APR, Short YU earns

So:

- Long funding rate: buy Long YU

- Short funding rate: buy Short YU

Boros settles in sync with the perpetual contract platform.

For the BTCUSDT Binance product: Binance settles funding rates every eight hours, and Boros does the same for its BTCUSDT Binance pair.

At each settlement, Boros calculates the difference between Fixed APR and Underlying APR:

- If Fixed APR < Underlying APR: Short YU collateral is deducted, and Long YU users receive profits.

- If Fixed APR > Underlying APR: Long YU collateral is deducted, and Short YU users receive profits.

YU represents a claim to funding rate yields over a set period. It settles every eight (or one) hours per exchange rules. With each settlement, YU’s value diminishes. At expiry, when rate prediction ends, YU’s value reaches zero.

To unlock higher yield potential, Boros offers up to 3x leverage, letting users open larger positions with less collateral. Higher leverage brings greater liquidation risk, so users should monitor their health factors and adjust collateral proactively.

Users familiar with Pendle YT may observe similarities with YU, facilitating user understanding of YU mechanics. But there are important differences, outlined in the table below:

From Hedging to Arbitrage: Boros—A Trader’s Tool for Cost Reduction and Efficiency

This funding rate long/short mechanism has prompted lively exploration among derivatives traders, institutions, and DeFi pros since Boros launched.

The most direct way to participate is buying YU and betting on funding rate direction:

By choosing Long or Short YU, traders earn the spread between fixed and floating rates. On September 12, 2025, Boros launched funding rate trading on Hyperliquid. Compared to Binance, Hyperliquid’s funding rate is more volatile, offering greater excitement and arbitrage opportunities.

For long-term position holders, Boros provides powerful hedging in high-volatility environments: take an opposite rate position on Boros to your CEX perp position to offset floating rate risk and lock in fixed cost/yield.

For example, holding a long perp position on CEX means paying a floating rate. Buy Long YU on Boros, and the floating rate paid on CEX is offset by floating rate income on Boros.

Conversely, holding a short perp position on CEX means paying a floating rate. Buy Short YU on Boros, and the floating rate paid on CEX is offset by fixed rate income on Boros.

This structure enables more predictable costs and risk—especially attractive for institutions. Take Ethena as an example: as a delta-neutral strategy leader, Ethena’s revenue comes mainly from positive funding rates. When funding rate volatility spikes, Ethena faces significant uncertainty that can threaten sustainability.

By using Boros YU, Ethena can lock in fixed, on-chain rates for predictable yield, boosting protocol stability and efficiency.

The launch of Hyperliquid also unlocks cross-exchange arbitrage:

Arbitrage hinges on price differences between markets. Boros currently supports Binance (with more institutions and 8-hour settlements for stable rates) and Hyperliquid (with more retail traders and 1-hour settlements for higher volatility)—creating new cross-exchange arbitrage opportunities.

Boros also offers multiple products with different maturities, enabling cross-tenor arbitrage: if the Implied APR for shorter-term YU is lower than that for longer-term YU, this signals short-term rates are expected to be lower than long-term rates. Buy short-term YU, sell long-term YU, or vice versa.

For non-directional traders, participation as a liquidity provider (LP) is available.

Boros Vaults let users provide liquidity for YU trading and earn swap fees plus $PENDLE rewards. The Boros Vaults page shows BTCUSDT Binance Vaults APY as high as 60.41%.

Note: Boros Vaults operate like Uniswap V2—LP positions are essentially “YU + collateral” and affected by Implied APR. Being an LP is a mild long YU stance, and when Implied APR falls, users risk significant impermanent loss.

Thanks to Boros’s popularity, Vault quotas are highly sought after, but as Boros moves from soft launch to rapid growth, quotas will continue to expand.

All Resources Flow Back to Pendle: Referral Program Ushers in Next Growth Phase

Boros is the centerpiece of Pendle’s 2025 roadmap, driving the ecosystem forward through both innovation and market expansion.

Pendle’s vision is a “comprehensive yield trading gateway.” Boros extends Pendle’s yield tokenization innovation into the high-scale, high-volatility funding rate market, converting CEX and DEX funding rate tokens into standardized YU assets—expanding the ecosystem from DeFi on-chain to CeFi off-chain.

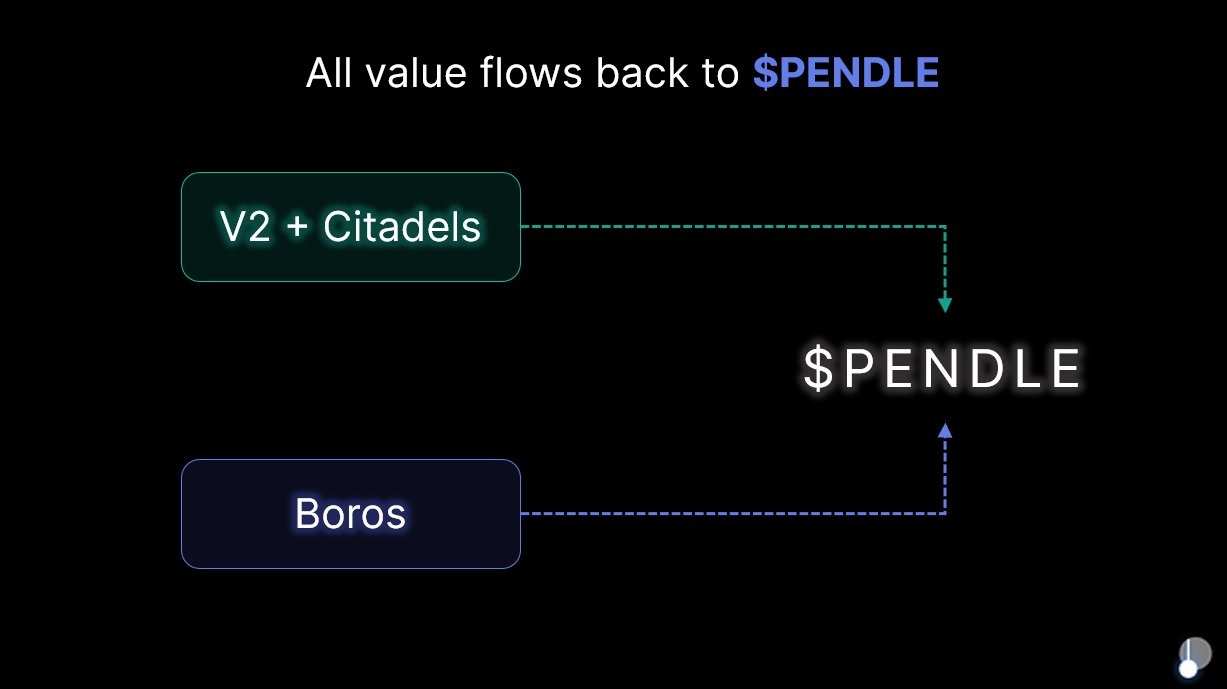

At the launch of Boros 1.0, Pendle made clear: no new tokens will be issued. All protocol revenue flows back to $PENDLE and $vePENDLE, ensuring $PENDLE is the ultimate beneficiary of Pendle V2 and Boros. On August 6, 2025, Boros’s debut sparked a more than 40% weekly surge in $PENDLE, confirming market confidence in Boros’s potential.

Game-changing innovation arises from rediscovering overlooked value. Boros’s focus on funding rates reveals a vast, hidden opportunity in the perpetuals market.

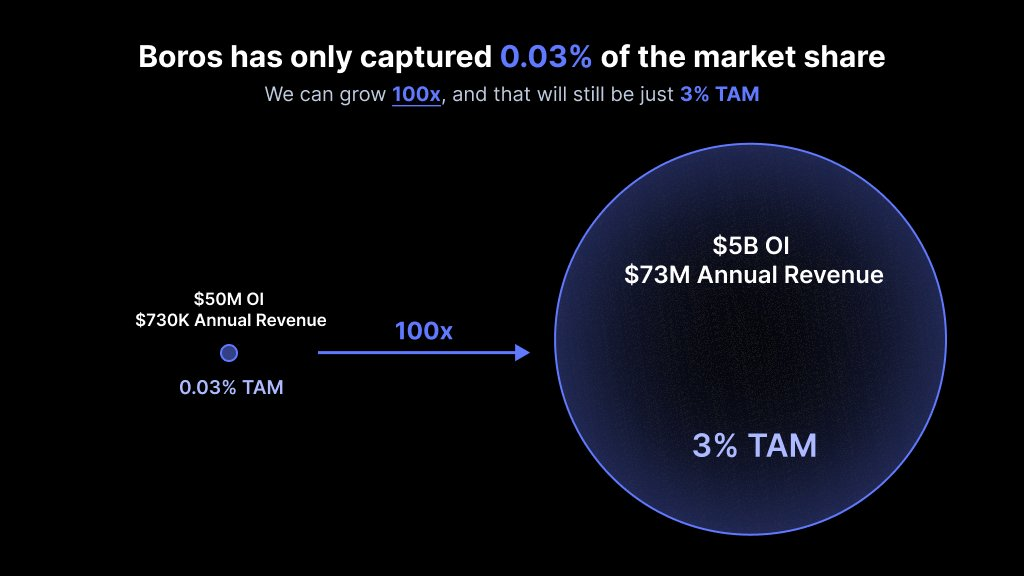

Today, perpetual contract markets see daily open interest over $200 billion and daily volumes above $250 billion. Boros has reached nearly $1 billion in notional trading and $730,000 in annualized income in just two months—still only 0.03% market share.

This means the market is vast and untapped. For Boros, growing its share to 3% would be a 100x leap.

To seize this $100 billion opportunity, Boros has launched key initiatives for future growth.

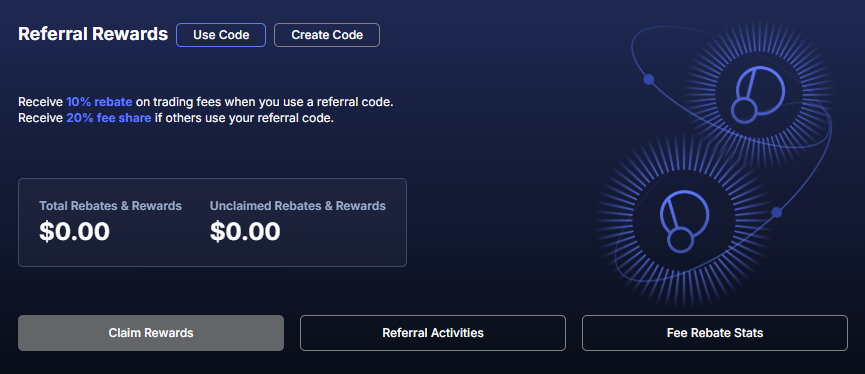

After extensive testing and refinement, Boros 1.0 is live and the referral program has launched, marking the transition to full-scale development. New addresses with over $100,000 in notional trading qualify for referral codes. Referrers earn 20% of settlement and trading fees from referred users, while referred users enjoy a 10% trading fee discount.

Each referral code is valid for one year; once the notional trading volume exceeds $1 billion, the 10% discount ends.

Boros will continue to optimize features and products, supporting more assets, platforms, and higher leverage: BTC and ETH are live, with SOL, BNB, and more to come; Binance and Hyperliquid are supported, with Bybit, OKX, and additional platforms on the roadmap; higher leverage and increased OI/vault limits are planned.

Notably, Boros’s extensible framework allows tokenization of yields from DeFi, TradFi, bonds, stocks, and other RWAs.

This aligns perfectly with Pendle’s mission: “Wherever there is yield, there is Pendle.” As Pendle’s flagship release for 2025, Boros will bridge crypto and traditional finance, rapidly advancing the comprehensive yield trading gateway vision alongside the Citadels compliant PT initiative.

As Boros continues to evolve, the platform is emerging as a comprehensive yield solution for all user segments.

Statement:

- This article is reprinted from [TechFlow] and is the property of the original author [TechFlow]. For reprint objections, please contact the Gate Learn team for prompt action according to our procedures.

- Disclaimer: The views and opinions expressed are solely those of the author and do not constitute investment advice.

- Other language versions are translated by the Gate Learn team and may not be copied, distributed, or plagiarized without crediting Gate.

Related Articles

In-depth Explanation of Yala: Building a Modular DeFi Yield Aggregator with $YU Stablecoin as a Medium

Sui: How are users leveraging its speed, security, & scalability?

What is Stablecoin?

Dive into Hyperliquid

Arweave: Capturing Market Opportunity with AO Computer