How did AI manage to put the whole world into a bubble?

“The only winning move is not to play.”

In October, Michael Burry posted this quote on social media. It’s from the 1983 film “WarGames,” where a supercomputer, after simulating nuclear war scenarios countless times, concludes with these words.

A few days later, Burry revealed his Q3 portfolio. Renowned for his accurate short bets during the 2008 subprime crisis, he placed nearly 80% of his fund—about $1 billion—on a single direction: shorting NVIDIA and Palantir.

To him, the strongest way to avoid participating in this irrational “long” frenzy is to short it.

Burry’s wager isn’t just against a handful of overvalued companies—it’s a challenge to the era’s dominant consensus. In this consensus, AI is not just a technological revolution, but a form of capital conviction.

But how did this consensus form, and how did it reach its peak? As this machine of belief keeps running, what price are we paying for it?

Gospel

Every financial mania is fueled by a story—retold, believed, and echoed by the masses.

This AI wave is a textbook case in narrative construction. Three forces shape it: tech leaders weave the “myth,” Wall Street supplies the “logic,” and media delivers the “sermon.”

The story’s first writers are the evangelists of the singularity. Tech leaders like Sam Altman (CEO of OpenAI) and Demis Hassabis (co-founder of Google DeepMind) have turned the concept of artificial general intelligence—once remote and confined to sci-fi and academia—into an imminent, tangible “new god” that promises to solve humanity’s most pressing challenges.

Altman, on his global speaking tour, repeatedly asserts that AGI will be humanity’s “greatest technological leap yet,” bringing abundance “far beyond what we can imagine.” Hassabis, with more philosophical phrasing, calls it a tool to help humanity unlock the universe’s deepest mysteries.

Their language is infused with near-religious zeal for “the future” and “intelligence,” giving the movement a significance that transcends commerce—almost sacred.

If tech leaders supply the myth’s script, Wall Street and economists give it a “logical” endorsement.

With global growth slowing and geopolitical conflicts rising, AI was quickly crowned the “growth elixir” to restore capital’s faith in the future.

Goldman Sachs, in a report at the end of 2024, forecasts generative AI will lift global GDP by 7%—about $7 trillion—over the next decade. Meanwhile, Morgan Stanley calls AI the “core of the Fourth Industrial Revolution,” likening its productivity effects to those of the steam engine and electricity.

These figures and metaphors serve to transform imagination into assets, belief into market valuation.

Investors came to believe that a 60x P/E for NVIDIA isn’t irrational—they’re buying the engine of future global growth, not just a chip company.

Since ChatGPT’s debut in November 2022, AI-related stocks have driven 75% of S&P 500 returns, 80% of earnings growth, and 90% of capital expenditure growth. This technology narrative has become the main pillar supporting U.S. equities.

Finally, media and social networks play the role of ultimate amplifiers.

From the dazzling launch of Sora’s text-to-video model to each update from giants like Google and Meta, every milestone is magnified, circulated, and magnified again—algorithms push this faith into everyone’s timeline.

Meanwhile, debates over “AI replacing humans” spread like a shadow—from engineers to teachers, designers to journalists, no one is certain if they’ll belong in the next era.

With fear and awe spreading together, an epic, almost unassailable creation myth takes shape—paving the way for one of the largest capital mobilizations in human history.

Machine

As the “gospel” reaches every corner of the world, the most skilled financial engineers get to work.

Their mission: turn abstract belief into a machine—a self-reinforcing, cyclical capital system. Rather than a bubble, it’s a finely-tuned financial engine, far more complex than the derivatives of 2008.

This machine’s core is built by a handful of tech giants, weaving capital, compute, and revenue into a closed loop—money circulates, amplifies, and recirculates, like a perpetual-motion system driven by algorithms.

First, tech giants like Microsoft channel massive funds into AI research outfits like OpenAI. Betting on infrastructure since the cloud era, Microsoft invested over $13 billion into OpenAI. In a few years, OpenAI’s valuation rocketed from billions to nearly $100 billion, spawning a new capital market legend.

Such giant funding fuels expensive training. To build GPT-4, OpenAI tapped more than 25,000 NVIDIA A100 GPUs, with future models demanding exponentially more compute. These orders all flow to NVIDIA—the market’s monopoly.

NVIDIA’s data center revenue jumped from $4 billion in 2022 to $20 billion in 2025, with profit margins beyond 70%. Its stock price soared, making it the world’s biggest company by market cap.

Leading NVIDIA shareholders are the same tech giants and institutional investors—including Microsoft. Rising NVIDIA shares make their own balance sheets shine.

But the story doesn’t end—training is only the start; deployment is the real battleground for spending.

OpenAI needs cloud hosting for its models, with Microsoft as its key partner. Billions in annual cloud fees flow into Microsoft’s books, boosting Azure’s growth curve.

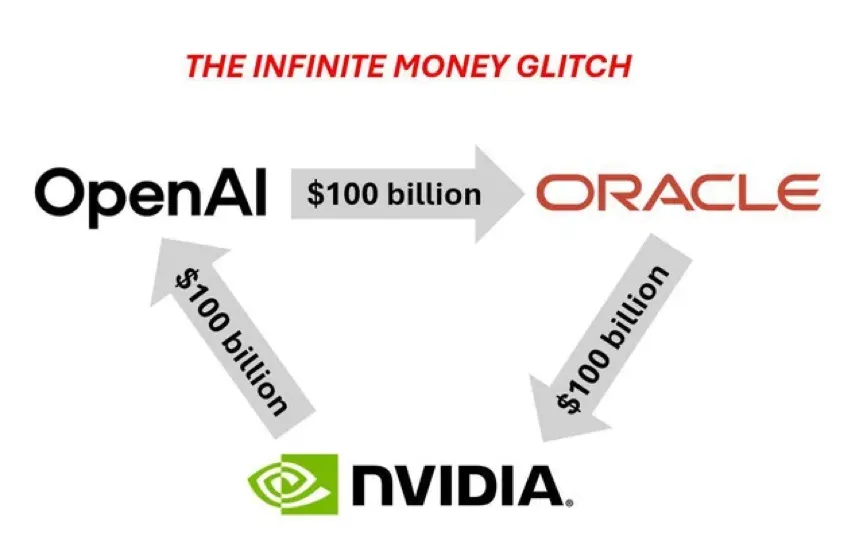

A perfect loop is born: Microsoft invests in OpenAI; OpenAI buys NVIDIA GPUs and Microsoft cloud; NVIDIA and Microsoft’s revenues push stock prices up; rising prices make Microsoft’s investment look even better.

Throughout, funds swirl among a few giants, conjuring vast “income” and “profit” out of thin air—growth on the books reinforces itself, boosting each other’s valuations. The machine feeds itself, needing no real economic demand for this “perpetual motion.”

Soon, this core engine expands to every sector.

Fintech and payments are among the first integrated.

Stripe is a quintessential example. With a valuation over $100 billion, the payment company processed $1.4 trillion in payments in 2024—equal to 1.3% of global GDP. A year later, it announced a partnership with OpenAI to launch “instant checkout” in ChatGPT, embedding payments directly into language model interactions.

Stripe’s role is unique: It buys AI infrastructure to train smarter fraud detection and payment recommendation algorithms, and as a direct AI beneficiary, it creates new payment channels through language models—driving up its own valuation.

PayPal followed suit. In October 2025, the payments giant became the first wallet system fully integrated with ChatGPT.

But the ripple effects go beyond finance. Manufacturing—a traditional sector—was among the first shaken, shifting from hardware automation to paying for algorithms.

In 2025, a German automaker announced a €5 billion, three-year AI transformation plan—most funds going to cloud and GPUs to rewire its production and supply chain “nervous system.” It’s not alone: auto, steel, electronics, and other sectors are using compute as the new fuel.

Retail, logistics, advertising—every industry you can name is experiencing this shift.

They buy AI compute, sign deals with model firms, and tout their “AI strategy” in earnings calls, as if the acronym itself commands a premium. Markets reward them: valuations climb, fundraising gets easier, and the narrative holds together.

Yet all paths lead to the same few companies. Whatever industry the money comes from, it ends up with NVIDIA, Microsoft, OpenAI—the core nodes—flowing into GPUs, clouds, and models. Their revenue keeps climbing, shares keep rising, and the AI story gets stronger.

Cost

This machine isn’t built from nothing. Its fuel comes from real economic and social resources, extracted, transformed, and burned for growth. These costs are often drowned out by capital’s noise, but they reshape the global economy’s skeleton.

The first cost is the opportunity cost of capital.

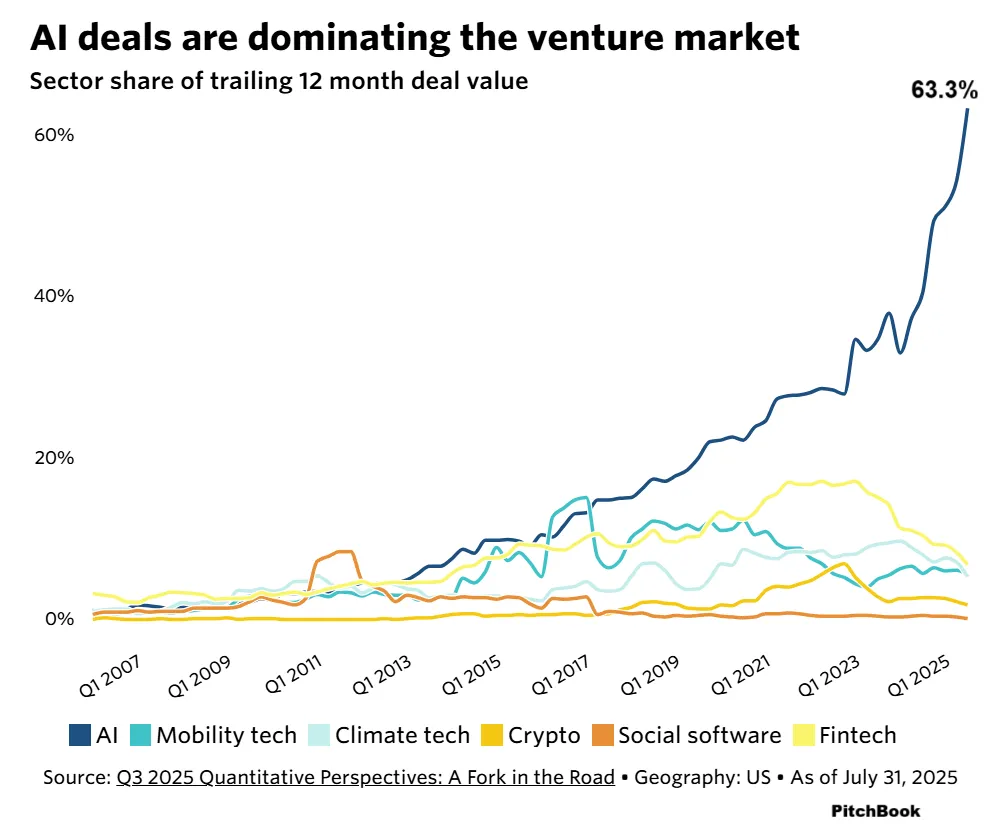

In venture circles, money always chases the highest returns. The AI gold rush has created an unprecedented capital black hole. PitchBook reports that by 2024, one-third of global VC went to AI; by mid-2025, two-thirds in the U.S. flowed into AI.

This means capital that could have supported climate tech, biotech, or clean energy is being pulled disproportionately into one narrative.

When all the smartest money chases one story, innovation’s soil is depleted. Capital concentration isn’t always efficient—it often erodes diversity.

In 2024, clean energy worldwide received just a fifth of the VC funding AI did. Climate change remains humanity’s top threat, yet funds flow to compute and models. Biotech faces similar struggles. Founders admit investors show little interest in their research because “the AI story is sexier, with shorter returns.”

This capital mania is nearing a dangerous inflection point.

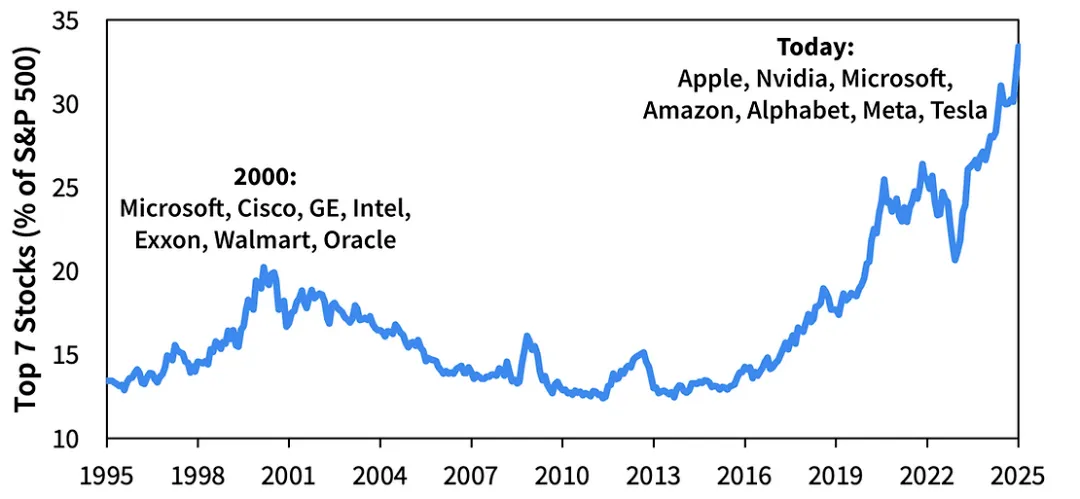

U.S. tech capex growth is now almost at the peak seen in the 1999-2000 dot-com bubble. Back then, everyone talked “new paradigms,” companies expanded before profits, investors chased “change the world” dreams—until the bubble burst and Nasdaq lost two-thirds of its value, plunging Silicon Valley into a long winter.

Twenty-five years later, the mood has reignited—AI is the new protagonist. Capex curves steepen, giants pour billions into data centers and compute clusters, as if spending alone assures the future.

History’s echoes are unsettling; outcomes may differ, but such concentrated capital means society bears the cost if the tide turns.

The second cost is the intellectual cost of talent.

This AI boom is causing global brain drain. The world’s best engineers, mathematicians, and physicists are being pulled from humanity’s toughest problems into one direction.

In Silicon Valley, the rarest resource is now top scientists for large model teams. Google, Meta, OpenAI, and others offer salaries that eclipse all other science and engineering fields.

Industry data shows experienced AI researchers can easily earn over $1 million a year, while a leading university physics professor often makes less than a fifth of that.

The pay gap signals a shift: the brightest minds are leaving long-horizon fields like basic science, energy innovation, and biology, clustering in a highly commercialized track. Knowledge flows faster than ever, but its channel narrows.

The third cost is strategic risk for industry.

Caught in the AI surge, nearly every traditional company now faces anxious pressure. They’re forced into a costly AI arms race, building teams and spending big, even though most lack a clear roadmap for returns.

Dell’Oro Group estimates 2025 global data center capex will hit $500 billion, mostly for AI; Amazon, Meta, Google, and Microsoft alone plan over $200 billion in investment. The frenzy goes well beyond tech.

A major retailer reported plans to spend tens of millions over three years on AI compute for better recommendations and inventory management.

But MIT research shows most such corporate AI projects bring returns far short of their costs. For these companies, AI isn’t a tool—it’s a statement. Often, the spending is driven by fear of “falling behind” rather than strategic need.

Upheaval

Yet viewing the AI surge only as a bubble or misallocation misses the deeper story. Whatever markets do, profound, irreversible structural changes are quietly unfolding.

“Intelligence” and the compute powering it are replacing capital and labor as fundamental production drivers.

They’re as crucial as electricity in the 19th century or the internet in the 20th—irreversible, indispensable. They’re infiltrating every industry, rewriting cost structures and competitive dynamics.

S&P 500: combined weight of top 7 stocks at each moment | Source: Sparkline

The race for compute is now the modern oil rush. Control over advanced semiconductors and data centers is no longer just industrial rivalry—it’s national security.

The U.S. CHIPS Act, EU export bans, and subsidies across East Asia form new geoeconomic frontlines—a global battle for “compute sovereignty” is accelerating.

Meanwhile, AI is setting a new baseline for every sector.

Whether a company has a clear AI strategy now determines its credibility in capital markets and its future viability. Like it or not, we must learn to speak AI’s language—it’s the new grammar of business and survival.

Michael Burry hasn’t always been right; he’s misjudged markets many times in recent years. This bet may prove his vision again—or make him a casualty of the times.

But whatever the outcome, AI has permanently changed the world. Compute is the new oil, AI strategy is a business essential, and global capital, talent, and innovation are all converging here.

Even if the bubble bursts and the wave recedes, these changes won’t disappear—they’ll keep shaping our world as this era’s irreversible foundation.

Statement:

- This article is republished from [动察Beating] and copyright belongs to the original author [Sleepy.txt]. If you object to its republication, please contact the Gate Learn team; we will process your request as required.

- Disclaimer: The views and opinions expressed in this article are solely those of the author and do not constitute investment advice.

- Other language versions are translated by the Gate Learn team; do not copy, distribute, or plagiarize the translated article unless Gate is cited.

Related Articles

Arweave: Capturing Market Opportunity with AO Computer

The Upcoming AO Token: Potentially the Ultimate Solution for On-Chain AI Agents

AI Agents in DeFi: Redefining Crypto as We Know It

Dimo: Decentralized Revolution of Vehicle Data

What is AIXBT by Virtuals? All You Need to Know About AIXBT