SBF Speaks Out from Prison: FTX Funds “Were Never Lost,” Rekindling Bankruptcy Repayment Debate

SBF Makes Another Appearance: Addresses Fund Flows and FTX Repayment Status

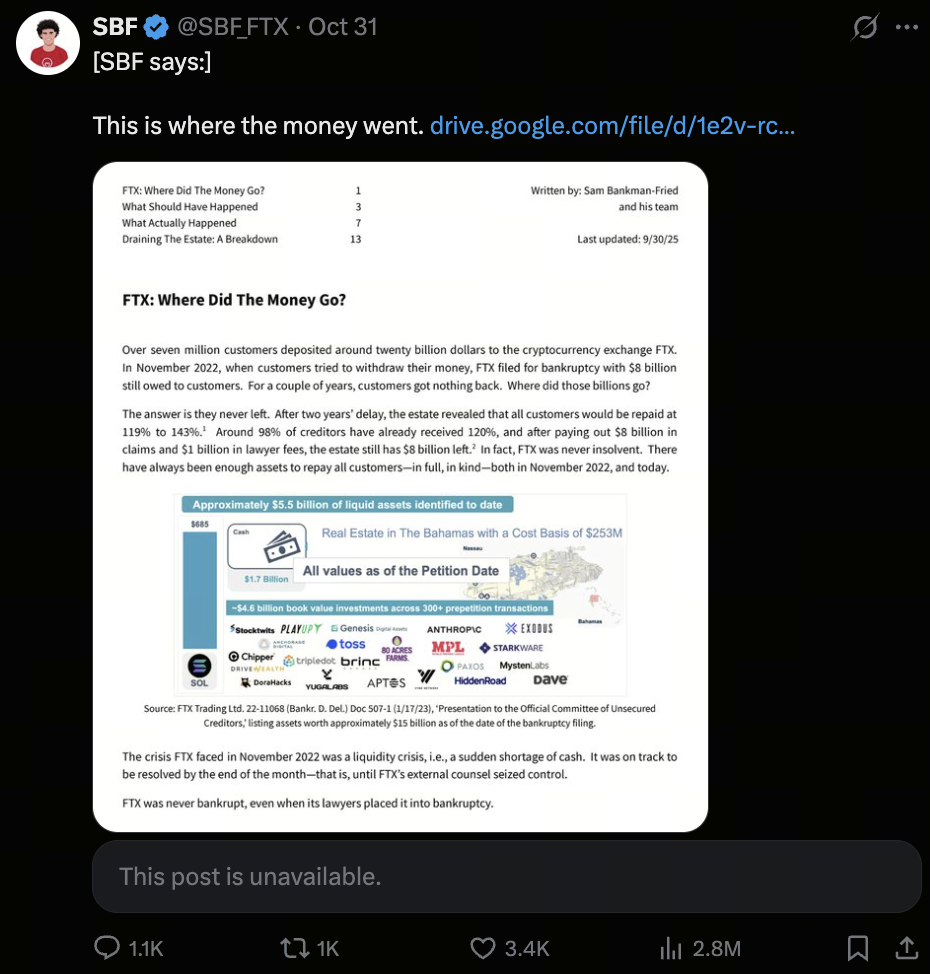

FTX founder Sam Bankman-Fried (SBF) recently released a statement via a monitored X (formerly Twitter) account operated by associates, addressing public concerns over alleged fund misappropriation and the progress of FTX’s bankruptcy proceedings. The controversy, involving approximately $10 billion in lost customer assets, represents a significant event in recent crypto history.

(Source: SBF_FTX)

SBF asserted in his statement that most customer funds never actually vanished, emphasizing that nearly all legitimate claims have received full repayment. He highlighted that, before bankruptcy attorneys became involved, FTX was solvent with sufficient assets to reimburse all users, maintaining a reserve of approximately $6.5 billion for disputed claims.

Bankruptcy Contradictions: Repayment Priorities and Legal Liability

These comments come at a pivotal point in FTX’s bankruptcy restructuring and SBF’s criminal trial. SBF criticized current bankruptcy attorneys for prioritizing multi-billion-dollar fees and settlements for themselves and the U.S. government. This has delayed user reimbursements. He specifically pointed out that Chinese creditors recently achieved a partial legal victory. A judge denied the bankruptcy attorneys’ motion to withhold refunds from creditors in 49 countries. This signals a shift in favor of creditor interests.

An active creditor known as “Will’s Tossing Notes” is leading a coalition of Chinese creditors pushing for every claimant to receive their entitled repayments. SBF backed this position in his statement, asserting FTX’s solvency both before and after filing for bankruptcy, and accusing the current management of withholding funds that could have been returned immediately.

Investigators Uncover $40 Million Transfer

The crypto community has rejected SBF’s narrative. Prominent blockchain investigator ZachXBT revealed that SBF had covertly transferred approximately $40 million to Chinese authorities to unfreeze Alameda Research’s accounts, which at the time were holding nearly $1 billion in frozen cryptocurrency assets.

ZachXBT, citing @DeFiSquared’s on-chain analysis, found that the $40 million was linked to wallet addresses associated with the Multichain attacker, further casting doubt on SBF’s explanation regarding user reimbursement.

SBF Responds: Transfer Was for Asset Recovery

Confronted with these allegations, SBF responded that a Chinese exchange had liquidated roughly $1 billion in cryptocurrency and agreed to return $960 million. He insisted that the transfer was “not a bribe, but rather for the purpose of recovering user assets.” However, ZachXBT countered with a pointed comparison: “If someone embezzled $8 billion from a Bahamian exchange and only returned part of it, would the public still accept it?” This debate underscores ongoing divisions regarding transparency, trust, and accountability in the FTX case.

Voices from Prison: SBF’s Public Narrative

Even behind bars, SBF continues to use social media to shape his public image and present his version of events surrounding FTX. He maintains that he never attempted to conceal funds, instead accusing bankruptcy attorneys of distorting facts and hiding the truth. These statements have brought renewed attention to the FTX case, underscoring unresolved issues in the crypto sector: fund transparency, legal oversight, and the ambiguous nature of cross-border accountability.

To learn more about Web3, register at: https://www.gate.com/

Summary

SBF’s statements have likely provided strategic advantages for his defense, but regulators and the market remain focused on the facts. Regardless of the final outcome, this event has become a landmark case in the crypto industry, raising crucial questions about trust and regulatory boundaries. The FTX bankruptcy is more than a repayment dispute—it is a collective examination of integrity in the crypto market.

Related Articles

Pi Coin Transaction Guide: How to Transfer to Gate.io

Flare Crypto Explained: What Is Flare Network and Why It Matters in 2025

How to Use a Crypto Whale Tracker: Top Tool Recommendation for 2025 to Follow Whale Moves

What is N2: An AI-Driven Layer 2 Solution

2025 BTC Price Prediction: BTC Trend Forecast Based on Technical and Macroeconomic Data