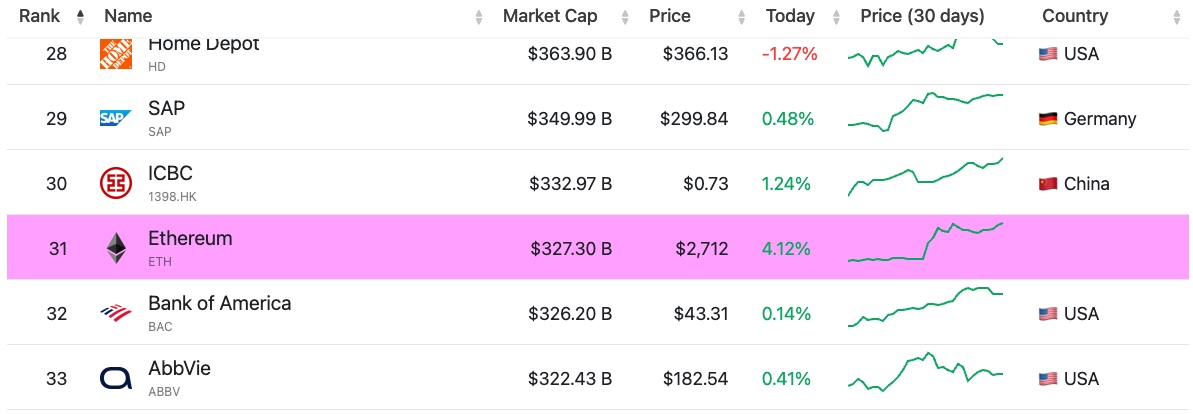

Ethereum market capitalization surpasses Bank of America, Spot ETF single-day inflow exceeds 100 million USD

According to the Gate News bot, CoinGape reports that after a prolonged period of sluggish price movement, Ethereum has finally experienced a strong rebound, with its market capitalization surging to 327 billion dollars earlier today, surpassing Bank of America (BoA). ETH has reached 2,725 dollars for the first time since February. Moreover, the inflow of funds into Ethereum Spot ETF has exceeded 100 million dollars, indicating a strong influx of institutional funds, and all eyes are on whether ETH can return to 3,000 dollars and set a new all-time high.

In the past 15 days, Ethereum’s market capitalization has increased by 100 billion USD, with the price rebounding from a low of 1800 USD to 2700 USD. During this period, its market capitalization has surpassed top giants such as Nestlé, Alibaba, Coca-Cola, and now Bank of America.

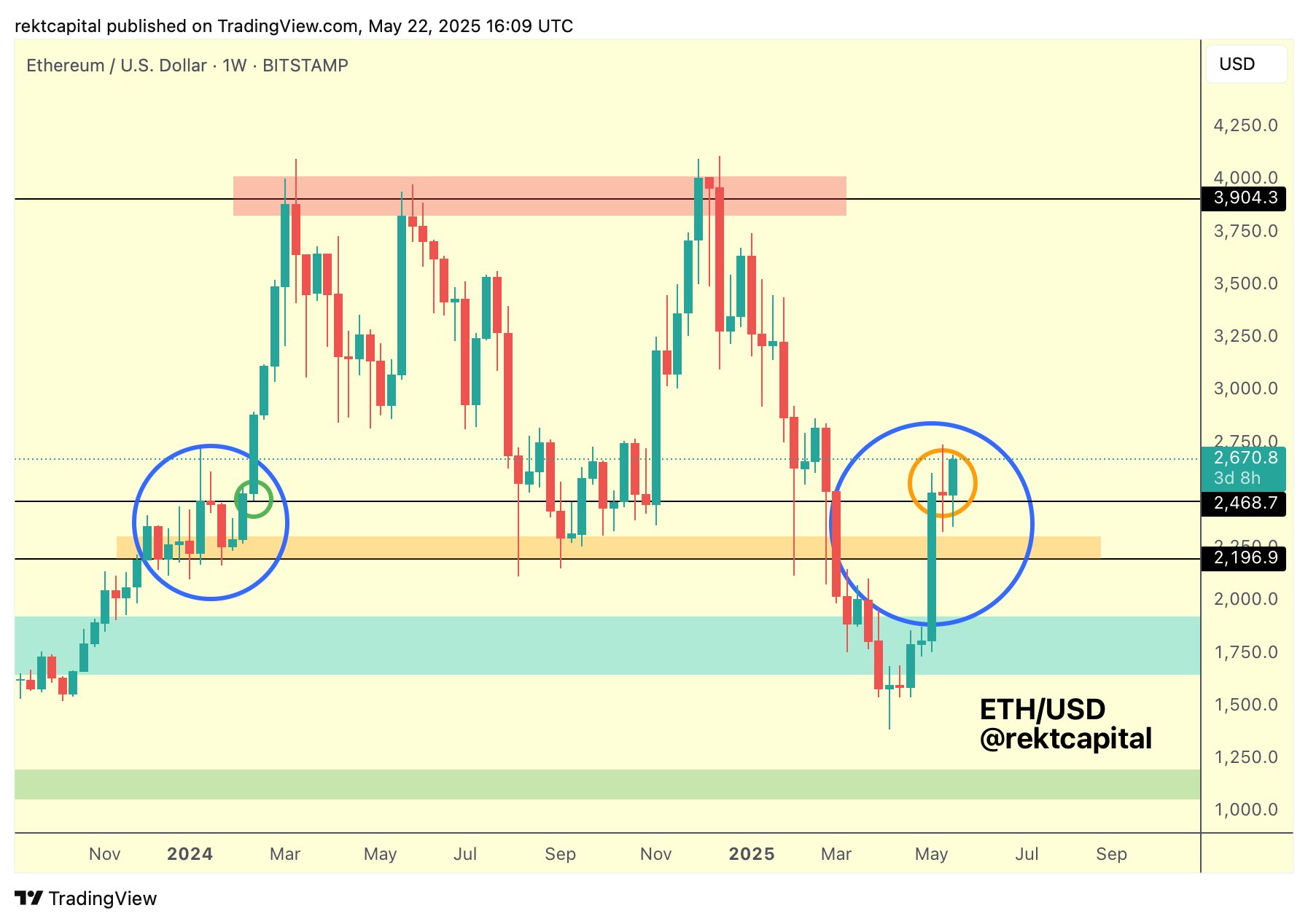

Cryptocurrency analyst Kyledoops stated that the Ethereum price has surpassed the realized price of $1,900, marking a return to profitability for general holders. Additionally, the trading price of ETH is also above the true market mean of $2,400, which is a key threshold in previous market cycles (Note: The true market mean reflects the average price at which all market participants acquired ETH over a period of time).

The analyst added that the next level to watch is the Active Realized Price of $2900. A return to this level could reignite confidence and attract more capital into the market.

In the past 15 days, the price of ETH has risen by 50%, attracting widespread attention from both institutional and retail investors. Additionally, Coinglass data shows that the open interest in ETH futures has also increased by 5%, exceeding $34 billion, indicating strong bullish sentiment among traders.

Additionally, well-known cryptocurrency analyst Rekt demonstrated how Ethereum successfully rebounded from the key support level of $2,468 and is preparing to initiate the next round of price movement, thereby challenging the higher target of $3,900.

On Thursday, the U.S. Securities and Exchange Commission (SEC) delayed its decision on the staking of the 21Shares Spot Ethereum ETF. However, this has not stopped new funds from flowing into this investment product.

Farside Investors data shows that the inflow of Ethereum Spot ETF has surpassed $100 million for the first time in a month. The main contributors to yesterday’s fund inflow were Grayscale Ether ETF, with an inflow amount of $43.7 million; followed by Fidelity FETH, with an inflow amount of $42.2 million; and Grayscale mini-Ether ETF, with an inflow amount of $18.7 million.