2025 AKE Price Prediction: Expert Analysis and Market Forecast for the Coming Year

Introduction: Market Position and Investment Value of AKE

Akedo (AKE), a vibe coding game and content creation engine powered by AI agents, has emerged as an innovative platform in the blockchain space. Since its launch in January 2025, AKE has established itself as a unique solution designed to improve development efficiency 100x over traditional LLM solutions. As of December 22, 2025, AKE has achieved a market capitalization of approximately $8.83 million, with a circulating supply of 22.8 billion tokens out of a total supply of 100 billion. The token is currently trading at $0.0003871, reflecting its early-stage market positioning.

This asset is distinguished by its innovative approach to game creation and content generation, enabling users to create game collections and launch collection tokens with a single click. The AKEDO platform provides multiple revenue streams for both protocol developers and game creators, marking a significant shift in how decentralized gaming and content creation can be monetized.

This article will provide a comprehensive analysis of AKE's price trajectory through 2030, integrating historical price patterns, market supply and demand dynamics, ecosystem development, and macroeconomic factors to deliver professional price forecasts and practical investment strategies for participants in the cryptocurrency market.

Akedo (AKE) Market Analysis Report

I. AKE Price History Review and Current Market Status

AKE Historical Price Movement Trajectory

Based on available market data, AKE has demonstrated the following price dynamics:

- October 3, 2025: All-Time High (ATH) reached at $0.0024262, representing the peak valuation level for the token since its launch.

- December 18, 2025: All-Time Low (ATL) established at $0.0002968, marking the lowest price point in the token's trading history.

- Current Period (December 2025): Token trading in the range between the 24-hour low of $0.0003274 and 24-hour high of $0.0004235.

AKE Current Market Status

As of December 22, 2025, AKE is trading at $0.0003871, representing a 24-hour gain of 8.93%. The token demonstrates positive short-term momentum, with a 1-hour increase of 2.23% and a 7-day gain of 16.1%. However, the token shows longer-term underperformance, declining 26.28% over the past year.

Market Capitalization and Supply Metrics:

- Market Cap: $8,825,880

- Fully Diluted Valuation (FDV): $38,710,000

- Market Cap to FDV Ratio: 22.8%

- Circulating Supply: 22,800,000,000 AKE

- Total Supply: 100,000,000,000 AKE

- Circulation Ratio: 22.8%

Market Position:

- Current Ranking: #1,235 by market capitalization

- 24-Hour Trading Volume: $68,736.14

- Market Dominance: 0.0011%

- Total Token Holders: 33,008

- Exchange Listings: 14 platforms

The token operates on the BEP-20 standard on the Binance Smart Chain (BSC) network, with its contract address: 0x2c3a8ee94ddd97244a93bc48298f97d2c412f7db.

Visit AKE Market Price on Gate.com for real-time pricing information.

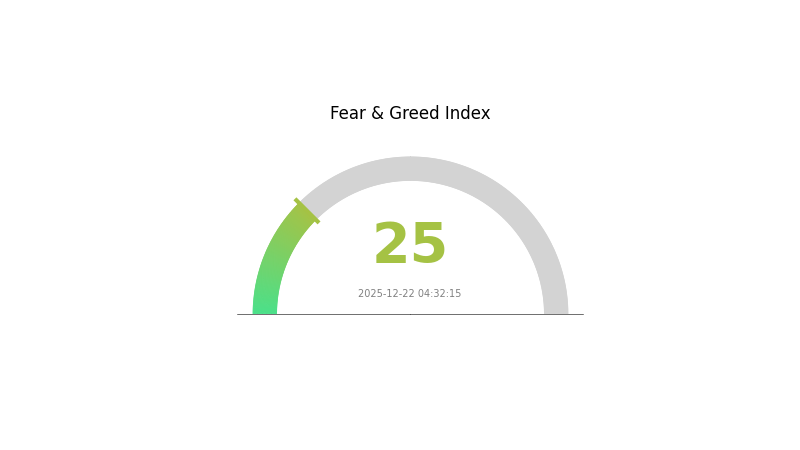

AKE Market Sentiment Index

2025-12-22 Fear and Greed Index: 25 (Extreme Fear)

Click to view current Fear & Greed Index

Market Analysis:

The crypto market is currently experiencing extreme fear with an index reading of 25. This indicates significant bearish sentiment among investors, reflecting heightened uncertainty and risk aversion in the market. When fear reaches extreme levels, it often creates buying opportunities for contrarian investors who believe assets are oversold. However, market participants should exercise caution and conduct thorough research before making investment decisions. Consider dollar-cost averaging strategies or waiting for more stabilized conditions. Monitor key support levels and market indicators closely for potential reversal signals. Diversification remains crucial during volatile periods.

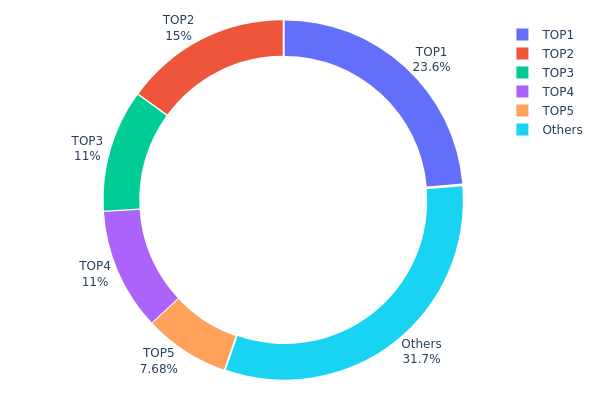

AKE Holdings Distribution

The address holdings distribution map illustrates the concentration of AKE tokens across different wallet addresses on the blockchain. It provides a quantitative breakdown of how token ownership is distributed among the top holders and the broader holder base, serving as a critical indicator for assessing the degree of decentralization and potential market concentration risks within the AKE ecosystem.

The current holdings distribution reveals moderate concentration characteristics in AKE's token ownership structure. The top five addresses collectively hold 68.28% of the total supply, with the largest holder commanding 23.63% of all tokens. While the top holder's dominance is substantial, the remaining 31.72% distributed among other addresses suggests that ownership is not entirely centralized in a single entity. However, the concentration threshold warrants attention, as the top two addresses alone represent 38.63% of the circulating supply, indicating that significant price movements could potentially be influenced by the decisions of a limited number of stakeholders.

The current address distribution pattern presents both structural considerations and market dynamics implications for AKE. The presence of substantial holdings concentrated among the top addresses creates potential vulnerabilities to large-scale liquidation events or coordinated selling pressure, which could trigger adverse price volatility. Conversely, the diversification among the remaining holders demonstrates broader participation in the token's ecosystem. From a market structure perspective, this distribution suggests moderate decentralization with identifiable whale concentration, reflecting a maturation stage where institutional or significant early adopters maintain considerable influence alongside an emerging retail holder base.

Click to view current AKE Holdings Distribution

| Top | Address | Holding Qty | Holding (%) |

|---|---|---|---|

| 1 | 0x2733...d1f42c | 23635952.38K | 23.63% |

| 2 | 0xd229...4da457 | 15000000.00K | 15.00% |

| 3 | 0xe73b...584370 | 11000000.00K | 11.00% |

| 4 | 0xaf66...3508ce | 10980596.00K | 10.98% |

| 5 | 0xb7c7...7fad62 | 7677600.00K | 7.67% |

| - | Others | 31705851.62K | 31.72% |

II. Core Factors Influencing AKE's Future Price

Market Liquidity and Exchange Listings

- Primary Exchange Launch: AKE was officially listed on Gate.com on September 28, 2025, at 17:00 (UTC+8) for spot trading with the AKE/USDT trading pair. This listing provided significant liquidity injection and market exposure for the token.

- Price Impact from Listings: The exchange listing has contributed to increased trading activity and market attention. As of September 29, AKE was trading at $0.0495 on Gate.com, with a 24-hour increase of 0.95%.

- Historical Pattern: Major exchange listings typically result in short-term price volatility, with AKE experiencing a 42% surge following its token generation event, followed by a 32% technical correction.

Ecosystem Adoption and Development Activity

- Gaming Industry Integration: Akedo's core value proposition centers on AI-driven development efficiency enhancements. The platform's ability to attract game developers and content creators will directly drive demand for AKE tokens.

- Ecosystem Growth: If Akedo successfully builds an active ecosystem of developers and creators, token demand is expected to grow proportionally, supporting long-term price appreciation.

Token Distribution and Community Incentives

- Airdrop Activities: Gate.com's 57th Gate Alpha airdrop distributed 15,500 AKE tokens to users holding at least 160 Gate Alpha points. Such distribution activities typically provide short-term market support and increase user participation.

- Community Engagement: Airdrop campaigns generate increased market attention and user engagement, contributing to price stability during distribution periods.

Macroeconomic Environment

- Market Correlation: Cryptocurrency markets are increasingly correlated with traditional financial markets. Changes in the macroeconomic environment may have spillover effects on AKE pricing.

- Overall Market Sentiment: Regulatory changes and shifts in broader cryptocurrency market sentiment play crucial roles in determining AKE's price trajectory.

III. AKE Price Forecast 2025-2030

2025 Outlook

- Conservative Forecast: $0.00030 - $0.00039

- Neutral Forecast: $0.00039 (average expected price)

- Optimistic Forecast: $0.00042 (requiring sustained market momentum and positive ecosystem developments)

2026-2028 Medium-term Outlook

- Market Stage Expectation: Gradual accumulation and consolidation phase with incremental growth trajectory

- Price Range Forecasts:

- 2026: $0.00029 - $0.00053

- 2027: $0.00032 - $0.00056

- 2028: $0.00037 - $0.00057

- Key Catalysts: Enhanced protocol functionality, increased institutional adoption, ecosystem expansion, and integration with major platforms like Gate.com

2029-2030 Long-term Outlook

- Base Case Scenario: $0.00029 - $0.00069 (assuming steady technological development and moderate market growth)

- Optimistic Scenario: $0.00045 - $0.00076 (contingent on significant technological breakthroughs and accelerated mainstream adoption)

- Transformational Scenario: $0.00076+ (under extreme favorable conditions including paradigm shifts in blockchain utility and widespread institutional deployment)

- 2030-12-22: AKE trading at $0.00076 maximum (reflecting cumulative 58% appreciation from baseline projections through 2030)

| 年份 | 预测最高价 | 预测平均价格 | 预测最低价 | 涨跌幅 |

|---|---|---|---|---|

| 2025 | 0.00042 | 0.00039 | 0.0003 | 1 |

| 2026 | 0.00053 | 0.0004 | 0.00029 | 4 |

| 2027 | 0.00056 | 0.00047 | 0.00032 | 20 |

| 2028 | 0.00057 | 0.00051 | 0.00037 | 31 |

| 2029 | 0.00069 | 0.00054 | 0.00029 | 39 |

| 2030 | 0.00076 | 0.00061 | 0.00045 | 58 |

AKE Investment Analysis Report

IV. Professional Investment Strategy and Risk Management for AKE

AKE Investment Methodology

(1) Long-Term Holding Strategy

- Target Investors: Long-term believers in AI-driven game development, content creators seeking passive income opportunities, and investors with 1-3 year+ investment horizons

- Operational Recommendations:

- Accumulate AKE during price dips below $0.0003, particularly during market corrections

- Hold positions through market volatility cycles, as the platform's development may drive long-term value appreciation

- Reinvest any platform rewards or staking returns to compound positions over time

(2) Active Trading Strategy

- Technical Analysis Indicators:

- RSI (Relative Strength Index): Monitor for oversold conditions below 30 and overbought conditions above 70 on 4-hour and daily charts to identify potential reversal points

- Moving Averages: Track 20-day and 50-day moving averages to identify trend direction; trade in the direction of the trend for higher probability setups

- Swing Trading Key Points:

- Capitalize on recent volatility patterns; AKE has shown +16.1% over 7 days and +8.93% over 24 hours, suggesting momentum opportunities

- Set profit targets at psychological resistance levels ($0.0004, $0.0005) and cut losses at support levels ($0.0003)

AKE Risk Management Framework

(1) Asset Allocation Principles

- Conservative Investors: 1-3% portfolio allocation to AKE

- Active Investors: 3-8% portfolio allocation to AKE

- Professional Investors: 5-15% portfolio allocation to AKE with dynamic rebalancing quarterly

(2) Risk Hedging Strategies

- Position Sizing: Never allocate more than 2-5% of total portfolio to any single speculative asset; use stop-loss orders at 15-20% below entry price

- Diversification: Balance AKE holdings with established cryptocurrency assets and traditional investments to reduce concentration risk

(3) Secure Storage Solutions

- Hardware Security Approach: Store AKE tokens on a secure hardware wallet or hardware security module for long-term holdings exceeding $10,000 equivalent

- Exchange Storage: For active traders, maintain 30-day trading volumes on Gate.com with remaining positions in cold storage

- Security Considerations:

- Never share private keys or recovery phrases; use multi-signature wallets for amounts exceeding $50,000

- Enable two-factor authentication (2FA) on all exchange accounts

- Regularly audit wallet addresses and transaction history for unauthorized activity

- Test recovery procedures in a safe environment before storing significant amounts

V. Potential Risks and Challenges for AKE

AKE Market Risks

- Liquidity Risk: With only $68,736 in 24-hour trading volume across 14 exchanges, AKE exhibits low liquidity, making large trades potentially move prices significantly and creating difficulty exiting positions during market downturns

- Price Volatility: The token has experienced a -26.28% decline over the past year while showing short-term volatility (+16.1% in 7 days); extreme price swings could result in rapid capital loss

- Market Capitalization Concentration: At $8.8 million market cap with circulating supply representing only 22.8% of total supply, future token inflation could significantly dilute existing holder value

AKE Regulatory Risks

- Evolving Gaming Regulations: As AKEDO operates in the game and content creation space, future regulatory restrictions on in-game tokenomics or NFT-based mechanisms could impact platform utility

- Jurisdictional Uncertainty: Different countries continue to develop cryptocurrency and gaming token regulations; adverse regulatory developments could restrict AKE trading in major markets

AKE Technology Risks

- AI Agent Implementation Risk: AKEDO's core value proposition depends on successful AI agent development delivering claimed 100x efficiency improvements over traditional LLM solutions; failure to deliver could undermine project fundamentals

- Smart Contract Vulnerability: As a BEP-20 token on BSC, any security flaws in AKEDO's smart contracts or connected protocols could result in fund loss or exploitation

- Platform Adoption Risk: The success of AKE depends on game creators and developers actively using AKEDO's platform; low adoption rates could limit token utility and demand

VI. Conclusion and Action Recommendations

AKE Investment Value Assessment

AKEDO presents an interesting but speculative opportunity targeting the intersection of AI, gaming, and decentralized content creation. The project's value proposition—delivering AI-powered game development 100x faster than traditional solutions—addresses a genuine market need. However, significant uncertainties remain regarding technology execution, platform adoption, and regulatory environment. The token's current market position (ranked #1235) reflects early-stage status with limited trading liquidity. Investors should view AKE as a high-risk, high-reward allocation suitable only for portfolios that can absorb potential total loss.

AKE Investment Recommendations

✅ Beginners: Start with minimal positions (1-2% of crypto portfolio) through Dollar-Cost Averaging (DCA) over 2-3 months on Gate.com; focus on understanding AKEDO's technology roadmap before increasing exposure

✅ Experienced Investors: Establish 3-8% allocations with defined entry/exit rules; use technical analysis to trade volatility while maintaining a core long-term position; actively monitor development milestones

✅ Institutional Investors: Consider 5-15% specialized fund allocations with rigorous due diligence on team credentials and technical benchmarks; negotiate OTC pricing on Gate.com for large positions

AKE Trading Participation Methods

- Spot Trading on Gate.com: Purchase AKE directly using USDT or other trading pairs; ideal for long-term holders and swing traders seeking exposure without leverage

- Limit Orders: Set automated buy orders 5-10% below current price levels to accumulate during dips; place sell orders at predetermined target prices to lock in gains

- Dollar-Cost Averaging (DCA): Invest fixed amounts weekly or monthly regardless of price to reduce timing risk and manage volatility exposure systematically

Disclaimer: Cryptocurrency investments carry extreme risk. This report does not constitute investment advice. Investors must assess their own risk tolerance and financial situation before making decisions. Never invest more than you can afford to lose. Consult qualified financial advisors before making significant investment decisions. Past performance does not guarantee future results.

FAQ

What is the prediction for Akedo?

Akedo is predicted to reach an all-time high of $0.00364 by 2028, suggesting significant growth potential for the cryptocurrency in the coming years.

Is Akedo crypto a good investment?

Akedo (AKE) is a promising long-term investment for risk-tolerant investors. Powered by AI-driven Web3 gaming technology, AKE presents strong growth potential. Current market trends and adoption metrics suggest it could offer significant opportunities for those seeking exposure to innovative blockchain gaming solutions.

What factors influence AKE token price movements?

AKE token price is influenced by market liquidity, supply and demand dynamics, investor sentiment, and trading volume. Automated Market Makers determine prices based on token supply in liquidity pools. Network adoption and project developments also impact price movements.

What is Akedo (AKE) and what is its use case?

Akedo (AKE) is a game and content creation engine powered by AI agents that dramatically boosts development efficiency. It functions as a launchpad platform for new blockchain projects, enabling creators to build and launch applications more effectively.

What are the risks associated with AKE price prediction and investment?

AKE price prediction involves high market volatility and fluctuation risk. Prices may change dramatically, potentially resulting in significant losses. Conduct thorough research and understand market dynamics before investing.

Is Neuron (NRN) a good investment?: Analyzing the potential and risks of this emerging cryptocurrency

2025 ARIA Price Prediction: Analyzing Market Trends and Growth Potential for this Emerging Cryptocurrency

What is the Current Price of ARIA and Why Has it Dropped 8.62% in 24 Hours?

2025 SOPHIA Price Prediction: Will AI Tokens Surge in the Next Bull Market?

Is Xyro (XYRO) a good investment?: Analyzing the Potential and Risks of This Emerging Cryptocurrency

Is AriaAI (ARIA) a good investment?: Analyzing the Potential and Risks of this AI-Powered Cryptocurrency

Exploring Key Takeaways from Solana Breakpoint 2023 Conference

Is AC Milan Fan Token (ACM) a good investment?: A Comprehensive Analysis of Market Potential, Risk Factors, and Investment Prospects

Innovative Hub for Aspiring Developers

Is Gather (GAT) a good investment?: A Comprehensive Analysis of Market Performance, Tokenomics, and Future Potential

Is Star Atlas (ATLAS) a good investment?: A Comprehensive Analysis of the Metaverse Gaming Token's Potential and Risks