2025 AQT Price Prediction: Expert Analysis and Market Outlook for Applied Quantum Computing Stock

Introduction: AQT's Market Position and Investment Value

Alpha Quark (AQT) serves as an ERC-20 compatible token issued on the Ethereum blockchain, designed to facilitate the trading of digital intangible assets such as intellectual property rights. Since its launch in 2021, AQT has established itself within the digital asset ecosystem. As of December 2025, AQT boasts a fully diluted market capitalization of $16.2 million, with approximately 26.8 million tokens in circulation and a current price hovering around $0.54. This innovative token, which enables users to participate in intellectual property auctions, access staking rewards, and gain trading discounts, is playing an increasingly vital role in the digital IP marketplace.

This article will provide a comprehensive analysis of AQT's price dynamics through 2030, integrating historical patterns, market supply-demand dynamics, ecosystem development, and macroeconomic conditions to deliver professional price forecasts and practical investment strategies for investors seeking exposure to this emerging digital asset class.

Alpha Quark (AQT) Market Analysis Report

I. AQT Price History Review and Current Market Status

AQT Historical Price Evolution

- February 26, 2021: AQT reached its all-time high of $15.37, marking the peak of the token's market valuation since launch.

- December 16, 2025: AQT hit its all-time low of $0.504104, representing a significant decline from its historical peak.

AQT Current Market Position

As of December 21, 2025, AQT is trading at $0.54, demonstrating a recovery of approximately 4.37% over the past 24 hours. The token has experienced notable price volatility across different timeframes:

- 1-hour change: +0.73% ($0.003913)

- 24-hour change: +4.37% ($0.022610)

- 7-day change: -4.56% ($0.025801)

- 30-day change: -6.67% ($0.038592)

- 1-year change: -51.12% ($0.564746)

The market capitalization stands at approximately $14.48 million, with a fully diluted valuation of $16.2 million. Trading volume over the past 24 hours reached $15,549.80, with the token trading between $0.5093 and $0.6952 during this period.

Market Metrics:

- Current ranking: #991

- Circulating supply: 26,806,201 AQT (89.35% of total supply)

- Total supply: 30,000,000 AQT

- Token holders: 6,834

- Market dominance: 0.00050%

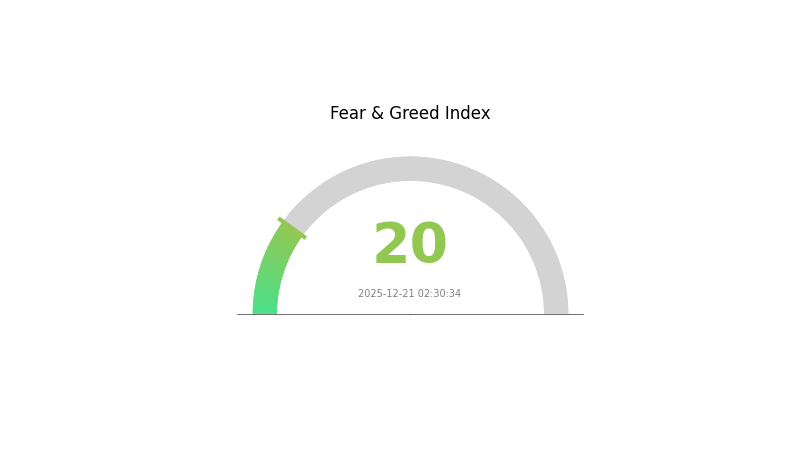

The token exhibits characteristics typical of smaller-cap digital assets, with a market sentiment reflecting "Extreme Fear" (VIX: 20) as of the current date.

Visit the current AQT market price on Gate.com

AQT Market Sentiment Indicator

2025-12-21 Fear and Greed Index: 20 (Extreme Fear)

Click to view current Fear & Greed Index

The cryptocurrency market is currently experiencing extreme fear, with the index reading at 20. This indicates heightened market anxiety and pessimism among investors. Such extreme fear levels often present contrarian opportunities, as markets have historically rebounded from panic-driven lows. However, caution remains warranted as downward pressure may persist. Investors should consider their risk tolerance and investment timeframe carefully. On Gate.com, you can monitor real-time market sentiment and make informed trading decisions based on comprehensive market data and analytics tools.

AQT Holdings Distribution

The address holdings distribution chart illustrates the concentration of AQT tokens across the blockchain network by tracking the percentage allocation among the largest holders and the remaining addresses. This metric serves as a critical indicator of token decentralization, market concentration risk, and the potential for price volatility driven by whale movements.

AQT exhibits a pronounced concentration risk, with the top holder commanding 76.25% of all circulating tokens. This level of concentration is substantially elevated, as it places decisive control over the token's supply in a single entity. The distribution pattern becomes increasingly fragmented beyond the top tier: the second and third largest holders maintain 5.32% and 5.07% respectively, while the fourth holder controls 4.81%. Collectively, the top four addresses account for 91.45% of all AQT holdings, leaving only 8.55% distributed among remaining participants. This extreme concentration suggests a highly centralized token structure typical of early-stage projects or those with significant institutional backing where founding teams retain substantial allocations.

The dominance of a single address holding over three-quarters of the token supply presents considerable implications for market dynamics and price stability. Such concentration creates inherent asymmetry in decision-making power, where the primary holder's actions—whether in terms of token releases, liquidations, or long-term lock-up commitments—could materially influence AQT's market trajectory. The minimal diversification across addresses indicates limited decentralization at the current stage, positioning AQT as a project where network effects and broader adoption remain essential for achieving healthier token distribution and reducing single-entity dependency risk.

Click to view current AQT holdings distribution

| Top | Address | Holding Qty | Holding (%) |

|---|---|---|---|

| 1 | 0x0f93...380fbe | 22892.97K | 76.25% |

| 2 | 0x53dd...6fa489 | 1600.00K | 5.32% |

| 3 | 0xdbda...289250 | 1523.80K | 5.07% |

| 4 | 0xef35...9f0d50 | 1445.41K | 4.81% |

| 5 | 0x92e9...3d736f | 484.47K | 1.61% |

| - | Others | 2076.33K | 6.94% |

II. Core Factors Influencing AQT's Future Price

Supply and Demand Dynamics

-

Limited Supply: AQT's price is influenced by supply and demand dynamics within the blockchain and Web3 sectors. Like any cryptocurrency asset, limited supply combined with increasing demand can support price appreciation.

-

Market Adoption: Price fluctuations are tied to the adoption rate of quantum computing technology and related blockchain applications. As enterprise and institutional interest in quantum-resistant security grows, demand for AQT may increase accordingly.

Institutional and Major Player Dynamics

-

Corporate Adoption: Major technology companies including Google and IBM are advancing quantum computing development. Google's Sycamore processor reached 70 quantum bits in 2023, while IBM maintains extensive involvement across quantum systems, cloud platforms, and quantum computing chips. These developments directly impact the quantum computing ecosystem that AQT operates within.

-

Telecommunications Infrastructure: Major telecommunications companies have begun implementing quantum technologies. China Mobile launched its quantum computing cloud platform in August 2023 and established a quantum computing application laboratory. China Telecom established a quantum information technology group with 3 billion yuan in registered capital, while China Unicom developed quantum communication applications. Verizon and Vodafone are collaborating with IBM on quantum-safe network security.

-

Government Policy Support: Governments worldwide prioritize quantum technology development. China's 2024 Industrial Structure Adjustment Directory added quantum computing research and manufacturing. The United States has released multiple "national strategy" level quantum information plans, with significant funding allocated even at the expense of other research budgets.

Macroeconomic Environment

-

Quantum Computing Market Growth: According to Boston Consulting Group's 2018 predictions, the quantum application market is projected to reach approximately $2 billion by 2035, then surge to over $260 billion by 2050. Market analysis suggests quantum computing commercialization could begin around 2030, with the global market reaching $14.01 billion that year and climbing to $48.97 billion by 2035.

-

Cybersecurity Premium: Quantum computing threatens current encryption standards like RSA cryptography. This creates substantial demand for quantum-safe solutions and quantum key distribution (QKD) technologies, positioning quantum-related tokens as potential hedges against future cybersecurity risks.

-

Post-Moore's Law Computing: As silicon-based integrated circuit technology approaches physical limits, quantum computing represents a critical frontier for exponential computational advancement in the post-Moore's Law era, creating long-term technological necessity.

Technology Development and Ecosystem Building

-

Quantum Algorithm Advancement: Shor's algorithm demonstrates quantum computing's exponential acceleration potential—factoring a 300-digit number requires over 100,000 years on classical computers but only 1 second on quantum computers executing Shor's algorithm. Each additional quantum bit doubles computational power, driving continuous technology improvements.

-

Commercial Viability Milestones: Industry analysis identifies key commercialization thresholds: quantum bit count reaching 100-1000, error rates declining from 0.1% to 0.01%, and quantum coherence time exceeding 1 millisecond. Achieving these benchmarks signals movement toward practical applications.

-

Quantum Communication Infrastructure: Quantum key distribution networks and quantum-secure communication products have begun deployment. China Telecom's "Quantum Cipher Call" service exceeded 1.7 million users, while quantum security services protect over 20 billion data records. Vodafone tested quantum-safe VPN using post-quantum cryptography algorithms developed by NIST.

-

Industrial Ecosystem Expansion: The quantum computing industry chain spans upstream components (environmental support systems, measurement-control systems, optical-electronic components), midstream hardware and software development, and downstream cloud platform services. Multiple technology routes including superconducting, ion trap, photonic, and neutral atom quantum computers are advancing in parallel, creating diverse investment opportunities.

III. AQT Price Forecast for 2025-2030

2025 Outlook

- Conservative Forecast: $0.4275 - $0.5411

- Base Case Forecast: $0.5411

- Optimistic Forecast: $0.7034 (requires sustained market recovery and increased adoption)

2026-2028 Medium-term Outlook

- Market Stage Expectation: Consolidation phase with gradual appreciation, transitioning toward accumulation phase as market maturity increases

- Price Range Forecast:

- 2026: $0.5476 - $0.9210

- 2027: $0.7485 - $0.7948

- 2028: $0.4386 - $0.8850

- Key Catalysts: Ecosystem expansion, institutional adoption, regulatory clarity, and increasing DeFi integration

2029-2030 Long-term Outlook

- Base Scenario: $0.7507 - $0.8925 (assuming steady market development and moderate adoption growth)

- Optimistic Scenario: $0.8341 - $0.8925 (assuming accelerated ecosystem development and expanded market presence)

- Transformative Scenario: $1.0014 (extreme favorable conditions including major institutional backing, protocol innovations, and broader cryptocurrency market adoption)

Note: Price data sourced from major market analysis platforms. Investors are advised to conduct independent research and consult with financial advisors before making investment decisions. Trading on Gate.com or other platforms should be approached with appropriate risk management strategies.

| 年份 | 预测最高价 | 预测平均价格 | 预测最低价 | 涨跌幅 |

|---|---|---|---|---|

| 2025 | 0.70343 | 0.5411 | 0.42747 | 0 |

| 2026 | 0.92095 | 0.62227 | 0.54759 | 15 |

| 2027 | 0.79476 | 0.77161 | 0.74846 | 42 |

| 2028 | 0.885 | 0.78318 | 0.43858 | 45 |

| 2029 | 0.89248 | 0.83409 | 0.75068 | 54 |

| 2030 | 1.00141 | 0.86328 | 0.51797 | 59 |

Alpha Quark (AQT) Professional Investment Strategy and Risk Management Report

IV. AQT Professional Investment Strategy and Risk Management

AQT Investment Methodology

(1) Long-term Holding Strategy

- Suitable investors: Value-focused investors who believe in the intellectual property tokenization ecosystem and are willing to hold through market volatility

- Operational suggestions:

- Accumulate AQT during price dips below $0.55, particularly when market sentiment remains negative

- Stake AQT to earn AQTD rewards, creating a compounding effect on your position over time

- Participate in staking pool voting to influence protocol governance and maximize long-term value alignment

(2) Active Trading Strategy

- Technical analysis tools:

- Support and resistance levels: Monitor the 24-hour trading range ($0.5093 - $0.6952) to identify entry and exit points for swing trades

- Volume analysis: Track the daily volume ($15,549.80) to confirm breakout movements and identify liquidity conditions

- Wave operation key points:

- Short-term traders should capitalize on the high volatility (24H change of 4.37%) by entering on dips and exiting on rallies

- Monitor the significant negative trend (-51.12% over 1 year) as a contrarian indicator for potential reversal opportunities

AQT Risk Management Framework

(1) Asset Allocation Principles

- Conservative investors: 1-3% of portfolio allocation

- Active investors: 3-7% of portfolio allocation

- Professional investors: 5-15% of portfolio allocation

(2) Risk Hedging Solutions

- Dollar-cost averaging: Spread investments across multiple months to reduce the impact of extreme volatility and downtrend risk

- Portfolio diversification: Balance AQT holdings with more established cryptocurrencies to reduce concentrated risk from the project's niche market positioning

(3) Safe Storage Solutions

- Hot wallet option: Gate.com Web3 wallet for active trading and staking participation, offering convenient access with security features

- Cold storage strategy: Transfer a majority of long-term holdings to secure offline storage to eliminate smart contract and exchange counterparty risks

- Security considerations: Always verify the correct smart contract address (0x2a9bdcff37ab68b95a53435adfd8892e86084f93) on Etherscan before transactions; enable multi-signature authorization for large holdings; never share private keys or seed phrases; use hardware verification for address validation

V. AQT Potential Risks and Challenges

AQT Market Risk

- Extreme price volatility: AQT has experienced a 51.12% decline over one year and reached all-time low recently (December 16, 2025 at $0.504104), indicating significant downside risk and potential further depreciation

- Low trading liquidity: With only $15,549.80 in daily volume and presence on only 6 exchanges, the token faces liquidity constraints that could result in slippage and difficulty exiting large positions

- Highly speculative valuation: The gap between all-time high ($15.37) and current price ($0.54) represents a 96.5% decline, suggesting the project has lost significant market confidence and investor interest

AQT Regulatory Risk

- Intellectual property classification uncertainty: Regulatory treatment of tokenized IP assets remains ambiguous in most jurisdictions, potentially exposing the platform to compliance challenges

- Securities law exposure: Depending on regulatory interpretation, IP auction participation through AQT staking could be classified as security offerings, triggering regulatory constraints in certain regions

- Cross-border compliance complexity: Operating an IP marketplace across multiple countries with varying IP and securities regulations creates ongoing legal exposure

AQT Technology Risk

- Smart contract vulnerability: ERC-20 token implementation on Ethereum carries inherent smart contract risks including potential exploits or upgrades that could adversely affect token functionality

- Platform adoption uncertainty: The project relies on ecosystem growth and adoption of its IP trading platform; low traction could render the token economically obsolete

- Ethereum network dependency: AQT's value proposition is tied to Ethereum's performance and security; major network issues would directly impact the token's utility and accessibility

VI. Conclusion and Action Recommendations

AQT Investment Value Assessment

Alpha Quark operates in a specialized niche of intellectual property tokenization, a theoretically promising segment but one facing significant execution and adoption challenges. The token's 96.5% decline from all-time high, combined with recent all-time low pricing and minimal daily trading volume, reflects substantial loss of market confidence. While the staking mechanism and governance participation offer utility frameworks, the project's unproven market adoption and positioning in an emerging, uncertain regulatory landscape present considerable risks. Current valuation may reflect depressed sentiment, creating potential opportunity for risk-tolerant investors, but long-term viability depends entirely on successful platform adoption and IP market traction.

AQT Investment Recommendations

✅ Beginners: Avoid direct investment; if interested in IP tokenization trends, start with minimal allocation (under 1% portfolio) only after thorough project research and understanding the extreme risk profile

✅ Experienced investors: Consider opportunistic small positions using dollar-cost averaging strategies; allocate only capital you can afford to lose completely; emphasize staking rewards to offset downside risk

✅ Institutional investors: Conduct extensive due diligence on platform adoption metrics, regulatory correspondence, and technical audits before considering even modest allocations; structure any investment through risk-hedging derivatives strategies

AQT Trading Participation Methods

- Direct purchase on Gate.com: Trade AQT/USDT pairs on Gate.com, which supports this token and provides secure trading infrastructure

- Staking participation: Lock AQT tokens to earn AQTD rewards and participate in governance voting through the protocol's designated staking pools

- IP auction participation: Hold and use AQT for preferential auction bidding on intellectual property assets, leveraging token utility beyond speculation

Cryptocurrency investments carry extreme risk. This report does not constitute investment advice. Investors must make decisions based on their individual risk tolerance and should consult professional financial advisors. Never invest more capital than you can afford to lose completely. The crypto market is highly volatile and speculative; past performance does not guarantee future results.

FAQ

How much is the AQT token?

The AQT token is currently priced at $0.54176 as of December 21, 2025. The token has experienced a 2.36% decline over the past 24 hours. This price reflects current market conditions for the Alpha Quark Token.

What is the AQT price prediction for 2025?

Based on current market analysis, Alpha Quark Token (AQT) is predicted to reach approximately $0.5729 by the end of 2025, representing an 8.58% increase from current levels. This forecast reflects technical indicators and market trends through December 28, 2025.

What factors affect AQT token price?

AQT token price is influenced by supply and demand dynamics, market sentiment, and blockchain sector trends. Its utility in governance and exclusive services within the Alpha Quark ecosystem also impacts its value.

What was the highest price AQT has reached historically?

The highest price Alpha Quark Token (AQT) reached historically is $4.5, achieved on January 8, 2025. This represents the peak value recorded for the year.

Is AQT a good investment for long-term price growth?

AQT demonstrates strong fundamentals and market potential for long-term appreciation. With growing adoption and ecosystem development, AQT is positioned for sustained price growth. Early investors may capitalize on significant upside as the project matures and gains mainstream recognition.

SEI Staking Analysis: 60-70% Supply Locked and Its Price Impact

SWELL vs RUNE: Comparing Two Leading DeFi Protocols in the Cross-Chain Liquidity Race

2025 ALCX Price Prediction: Future Outlook and Market Analysis for Alchemix Token

Is Haedal Protocol (HAEDAL) a good investment?: Analyzing the Potential and Risks of This Emerging Cryptocurrency

2025 CAKE Price Prediction: Bullish Trends and Key Factors Driving PancakeSwap's Token Value

Is Eigenlayer (EIGEN) a good investment?: Analyzing the potential and risks of this emerging crypto project

Comparing Blockchain Platforms: Sui and Solana for Developers

Explore CAT Gold Miner: Availability Dates, Price Insights & Purchase Guide

Giới thiệu Capybara Coin (CAPY) — Liệu Token Meme Tiếp Theo Của Solana Có Xuất Hiện?

OGC Coin: Price Forecast and Market Insights

Exploring Licensed Event Prediction Platforms: Bridging Real-World Events with Blockchain