2025 ARK Price Prediction: Expert Analysis and Market Forecast for the Coming Year

Introduction: ARK's Market Position and Investment Value

ARK (ARK) is a cryptocurrency and blockchain-based development platform allowing anyone to create their own fully customizable and interoperable blockchain. Since its launch in 2017, ARK has established itself as a specialized infrastructure solution in the blockchain ecosystem. As of December 2025, ARK boasts a market capitalization of approximately $44.63 million with a circulating supply of 192.13 million tokens, currently trading at $0.2487. This innovative platform, which reduces the industry's dependence on smart contracts through custom transactions and multi-language programming support, continues to play an increasingly important role in enabling accessible blockchain development.

This article will provide a comprehensive analysis of ARK's price trajectory and market dynamics, combining historical patterns, market supply and demand dynamics, ecosystem development, and macroeconomic factors to deliver professional price forecasts and practical investment strategies for 2025 and beyond.

ARK Market Analysis Report

I. ARK Price History Review and Current Market Status

ARK Historical Price Evolution

ARK was launched on May 21, 2017, with an initial price of $0.01. The token has experienced significant price fluctuations throughout its lifecycle:

- 2023: ARK reached its all-time high (ATH) of $1.8623 on November 10, 2023, reflecting peak market sentiment during the period.

- 2025: ARK declined to its all-time low (ATL) of $0.225 on October 10, 2025, marking a substantial correction from previous highs.

The price trajectory from ATH to ATL represents a decline of approximately 87.91%, reflecting the volatile nature of the cryptocurrency market and shifting investor sentiment toward the ARK ecosystem.

ARK Current Market Status

As of December 18, 2025, ARK is trading at $0.2487, with a 24-hour trading volume of 23,514.80 tokens. The token has experienced recent price pressure:

- 1-hour change: -0.24%

- 24-hour change: -4.57%

- 7-day change: -12.32%

- 30-day change: -11.76%

- 1-year change: -57.55%

ARK's market capitalization stands at $47,783,899.39, with a fully diluted valuation of $44,633,305.12. The circulating supply consists of 192,134,698 tokens out of a total supply of 179,466,446 tokens (circulating ratio: 107.06%), indicating there are more tokens in circulation than the fixed total supply, which may reflect token economics adjustments.

The token ranks 513rd by market capitalization with a market dominance of 0.0014%. ARK is currently listed on 15 exchanges, demonstrating reasonable liquidity and accessibility across multiple trading venues.

Access current ARK market pricing

ARK Market Sentiment Index

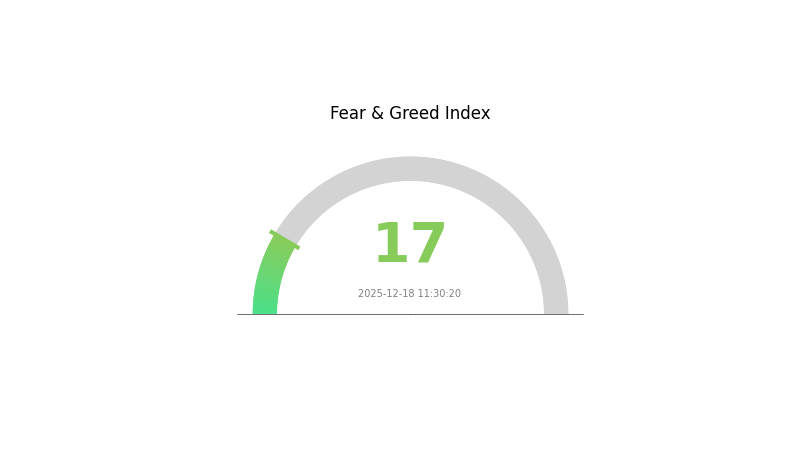

2025-12-18 Fear and Greed Index: 17 (Extreme Fear)

Click to view current Fear & Greed Index

The crypto market is currently experiencing extreme fear, with the Fear and Greed Index plummeting to 17. This historically low reading indicates significant market anxiety and pessimism among investors. During such periods, risk appetite diminishes substantially as traders reassess their positions. However, extreme fear often presents contrarian opportunities for long-term investors, as asset prices may be oversold. Monitor market developments closely and consider your risk tolerance when making investment decisions on Gate.com.

ARK Holdings Distribution

The address holdings distribution chart serves as a critical metric for evaluating the decentralization degree and market structure of ARK tokens. By analyzing the concentration of token holdings across different addresses, this indicator reveals the distribution pattern of token ownership and reflects potential risks related to market manipulation, liquidity fragmentation, and governance participation. A well-distributed holdings landscape typically supports healthier market dynamics, while excessive concentration may indicate vulnerability to coordinated selling pressure or whale-driven price volatility.

Currently, the ARK holdings distribution exhibits characteristics of moderate decentralization. The absence of extreme concentration among top addresses suggests that the token supply is reasonably dispersed across multiple stakeholders, reducing the likelihood of unilateral market control by individual entities. This distribution pattern supports a more resilient market structure where price discovery mechanisms remain relatively independent from the influence of a small number of large holders.

The current address distribution framework contributes positively to market stability and reduces systemic risks associated with sudden liquidations or coordinated token movements. With holdings spread across diverse addresses, the ARK ecosystem demonstrates improved resistance to flash crashes and maintains stronger on-chain governance participation potential. This structural characteristic enhances investor confidence and supports the formation of organic price discovery mechanisms, ultimately fostering a more transparent and sustainable market environment for long-term token value accumulation.

Visit ARK Holdings Distribution on Gate.com for real-time data.

| Top | Address | Holding Qty | Holding (%) |

|---|

II. Core Factors Influencing ARK's Future Price

Macroeconomic Environment

-

Monetary Policy Impact: The Federal Reserve's policy shift is playing a crucial role in ARK's price trajectory. ARK Invest anticipates that with the end of quantitative tightening (QT) and the transition to quantitative easing (QE) policies, approximately $300 billion in liquidity is expected to return to markets over the next 5-6 weeks following the resolution of the U.S. government funding crisis. Additionally, the Federal Reserve's planned shift toward easing policies, combined with the U.S. government's focus on tax reduction and regulatory relaxation, is creating an environment oriented toward productivity-driven growth.

-

Inflation Hedge Properties: Inflation pressures have been brought under control, with labor market weakness prompting the Federal Reserve to gradually adjust its policy stance. This macroeconomic environment supports the overall market conditions that benefit digital assets as alternative investment vehicles.

-

Geopolitical Factors: Global geopolitical situations and political events are expected to significantly impact ARK's price volatility going forward.

Institutional and Whale Dynamics

-

Institutional Holdings: ARK Invest reports that institutional participation in digital assets is accelerating substantially. Through digital asset trusts and spot ETFs, institutional investors now collectively hold approximately 12.2% of total supply, marking a historical record. This represents Bitcoin's deeper integration into traditional capital markets, gradually transitioning from speculative assets to "strategic investment allocations."

-

Whale and Mid-Tier Investor Activity: On-chain metrics show that most Bitcoin (and by extension, digital assets in ARK's framework) remains in profitable positions held by investors not eager to liquidate. Notably, mid-tier investors have been accumulating positions in recent months, while selling pressure from whales has eased, creating a healthier and more organic uptrend. The chip structure demonstrates a "bull-leaning" composition, which historically correlates with bull market phases.

Technology Development and Ecosystem Building

-

Blockchain Infrastructure Evolution: ARK Invest's framework emphasizes three core pillars: Bitcoin as the monetary foundation, Ethereum as the decentralized finance core, and Solana as the performance frontier. ARK reports indicate that public blockchain platforms like Ethereum and Solana are evolving into new-type infrastructure for the global financial system. The core driver of this transformation lies in the trust mechanisms and efficiency improvements provided by blockchain technology, which enable faster settlement and reduced reliance on traditional intermediaries compared to conventional finance.

-

Ecosystem Applications: The advancement of decentralized applications and ecosystem projects related to the blockchain space will significantly influence ARK's price trajectory. ARK Invest is closely monitoring emerging platforms such as Hyperliquid and other innovative projects within the crypto ecosystem.

Three, 2025-2030 ARK Price Forecast

2025-2026 Outlook

- Conservative Forecast: $0.13408 - $0.28555

- Neutral Forecast: $0.2483 (average price expectation)

- Bullish Forecast: $0.39238 (requiring sustained market sentiment and positive ecosystem developments)

2027-2028 Medium-term Outlook

- Market Stage Expectation: Transition from early adoption to mainstream recognition phase, with increasing institutional interest and ecosystem maturation driving price discovery.

- Price Range Forecast:

- 2027: $0.2835 - $0.43184

- 2028: $0.22845 - $0.54447

- Key Catalysts: Enhancement of blockchain scalability solutions, increased DeFi integration, strategic partnerships expanding market reach, and growing adoption metrics demonstrating tangible utility.

2029-2030 Long-term Outlook

- Base Case: $0.29107 - $0.6829 (assuming steady ecosystem development and moderate market growth within established regulatory frameworks)

- Bullish Case: $0.6569 - $0.6829 (assuming accelerated adoption, successful technology upgrades, and expanded real-world applications)

- Transformative Case: $0.6829+ (extreme favorable conditions including breakthrough innovation, dominant market position, and paradigm shift in institutional adoption)

- 2030-12-31: ARK projected at $0.6829 average with 125% cumulative gain potential (representing substantial appreciation from 2025 baseline)

| 年份 | 预测最高价 | 预测平均价格 | 预测最低价 | 涨跌幅 |

|---|---|---|---|---|

| 2025 | 0.28555 | 0.2483 | 0.13408 | 0 |

| 2026 | 0.39238 | 0.26692 | 0.14948 | 7 |

| 2027 | 0.43184 | 0.32965 | 0.2835 | 32 |

| 2028 | 0.54447 | 0.38074 | 0.22845 | 53 |

| 2029 | 0.6569 | 0.46261 | 0.24518 | 86 |

| 2030 | 0.6829 | 0.55975 | 0.29107 | 125 |

ARK Professional Investment Strategy and Risk Management Report

IV. ARK Professional Investment Strategy and Risk Management

ARK Investment Methodology

(1) Long-term Hold Strategy

- Suitable Investors: Cryptocurrency believers in blockchain scalability and developers interested in customizable blockchain platforms

- Operational Recommendations:

- Dollar-cost averaging (DCA) approach to accumulate ARK during market downturns, particularly given the -57.55% decline over the past year

- Set a long-term holding period of 3-5 years to allow the ecosystem to mature and attract more enterprise adoption

- Monitor ecosystem development progress through official GitHub repositories and community updates

(2) Active Trading Strategy

- Technical Analysis Tools:

- Support and Resistance Levels: Utilize the 24-hour range ($0.2441 - $0.267) as key technical indicators for short-term trading decisions

- Volume Analysis: Track the 24-hour volume of $23,514.80 to identify liquidity conditions and potential breakout opportunities

- Wave Operation Key Points:

- Consider entry points during weakness phases when the token shows negative momentum (-4.57% in 24 hours)

- Use recent ATL at $0.225 as a strong support floor for risk management purposes

ARK Risk Management Framework

(1) Asset Allocation Principles

- Conservative Investors: 1-2% of portfolio allocation

- Active Investors: 2-5% of portfolio allocation

- Professional Investors: 5-10% of portfolio allocation

(2) Risk Hedging Solutions

- Position Sizing: Limit individual trade size to prevent excessive exposure given ARK's market cap rank of 513 and relatively low market dominance (0.0014%)

- Diversification Strategy: Combine ARK holdings with more established blockchain platforms to balance risk exposure

(3) Secure Storage Solutions

- Hot Wallet Method: Gate Web3 wallet for active trading and frequent transactions

- Cold Storage Approach: Transfer ARK to personal secure wallets for long-term holdings

- Security Precautions: Enable two-factor authentication, use strong passwords, and never share private keys or recovery phrases

V. ARK Potential Risks and Challenges

ARK Market Risk

- High Volatility: ARK has experienced significant price fluctuations, with a -57.55% annual decline and historical highs of $1.8623 (November 2023), indicating substantial volatility that can result in rapid portfolio value changes

- Liquidity Risk: Current 24-hour trading volume of $23,514 may limit large position execution without significant price impact

- Market Cap Concentration: Ranked 513 globally with a market dominance of 0.0014%, ARK faces competition from thousands of alternative blockchain projects

ARK Regulatory Risk

- Regulatory Uncertainty: Blockchain platforms and development tools operate in evolving regulatory landscapes that could impact the project's operations and token valuation

- Classification Ambiguity: ARK's status as a development platform rather than a specific application creates regulatory classification uncertainty across different jurisdictions

- Compliance Requirements: Future regulatory changes could impose operational constraints on the platform's functionality

ARK Technical Risk

- Adoption Dependency: The project's success relies on developer adoption and ecosystem growth, which remain uncertain

- Competitive Pressure: Emerging blockchain platforms with enhanced features or better developer experience could diminish ARK's market position

- Technology Evolution: Rapid innovation in blockchain infrastructure may render ARK's current technology stack obsolete if not continuously updated

VI. Conclusion and Action Recommendations

ARK Investment Value Assessment

ARK presents a niche investment opportunity within the blockchain development platform sector. The project offers genuine utility as a customizable blockchain platform that reduces reliance on smart contracts through custom transactions and multiple programming language support. However, the significant 57.55% annual decline and rank 513 market position indicate investor skepticism about long-term viability. The platform's success depends heavily on developer adoption and ecosystem expansion, which remain unproven at scale. Investors should view ARK as a speculative, high-risk venture capital investment rather than a defensive holding.

ARK Investment Recommendations

✅ Beginners: Start with minimal allocations (0.5-1% of total crypto portfolio) through dollar-cost averaging on Gate.com to reduce timing risk and test understanding of the project dynamics

✅ Experienced Investors: Consider 2-5% portfolio allocation if you have strong conviction in the customizable blockchain narrative and can actively monitor ecosystem developments and technical progress

✅ Institutional Investors: Conduct comprehensive due diligence on development team capabilities, developer adoption metrics, and competitive positioning before considering positions

ARK Trading Participation Methods

- Spot Trading on Gate.com: Direct purchase and holding of ARK tokens for position building

- Gate.com Trading Features: Utilize limit orders to establish positions at predetermined price levels, reducing emotional decision-making

- Grid Trading Strategy: Implement automated trading on Gate.com's platform to systematize entry and exit points within defined price ranges

Cryptocurrency investment carries extreme risk. This report does not constitute investment advice. Investors should make decisions based on their individual risk tolerance and are strongly advised to consult professional financial advisors. Never invest funds you cannot afford to lose completely.

FAQ

What is the price prediction for ARK crypto in 2030?

By 2030, ARK crypto is predicted to reach a maximum of $27, representing a significant increase from current levels. This projection is based on expert analysis and market trend evaluation.

What is the prediction for ARK stock?

ARK is predicted to reach $0.3096 by December 22, 2025, representing a 2.65% increase from current levels. Long-term forecasts for 2026 and beyond remain uncertain based on available data.

What is Cathie Wood's ethereum prediction?

Cathie Wood predicts Ethereum could reach approximately $180,000 by 2026. This forecast reflects her bullish outlook on Ethereum's long-term growth potential and market adoption within the next cycle.

Is ARKK a good investment?

ARKK focuses on disruptive innovation across tech and biotech sectors. For growth-oriented investors with higher risk tolerance, ARKK offers significant upside potential through exposure to transformative companies and emerging technologies in the crypto and blockchain space.

Gate Launchpad Welcomes Ika (IKA): The Future of Privacy Computing on Sui

2025 ARK Price Prediction: Analyzing Market Trends and Potential Growth Factors

Is Contentos (COS) a Good Investment?: Analyzing the Potential and Risks of This Blockchain Content Platform

Is Gems (GEMS) a good investment?: Analyzing the potential and risks of this crypto token

Is Aventus (AVT) a Good Investment? Analyzing Its Market Potential and Long-Term Value Proposition

What Is Mainnet?

What is PROPC: A Comprehensive Guide to Process-Oriented Programming and Control Structures

What is KRL: A Comprehensive Guide to the KUKA Robot Language and Its Applications in Industrial Automation

What is ALU: Understanding the Arithmetic Logic Unit and Its Role in Computer Processing

What is HEMI: A Comprehensive Guide to Chrysler's Revolutionary Engine Technology

What is GALFAN: A Revolutionary Coating Technology for Enhanced Corrosion Protection and Durability