2025 HMT Price Prediction: Expert Analysis and Market Forecast for the Year Ahead

Introduction: Market Position and Investment Value of HMT

HUMAN Protocol (HMT) represents a novel approach to human-computer cooperation, having emerged as a pioneering solution in the AI data labeling and workforce automation ecosystem since its launch in 2021. As of December 2025, HMT has established a market capitalization of approximately $5.61 million, with a circulating supply of around 757.87 million tokens trading at $0.007398. This innovative protocol, recognized as a "bridge between artificial intelligence and human intelligence," is playing an increasingly vital role in enabling automated job markets where human workers engage in meaningful tasks while machines handle repetitive functions.

This comprehensive analysis will examine HMT's price dynamics and market trends through 2025-2030, drawing on historical patterns, supply-demand dynamics, ecosystem development, and macroeconomic factors to provide investors with professional price forecasts and actionable investment strategies. Whether you're seeking to understand HMT's fundamentals or track its performance through Gate.com, this guide offers essential insights for navigating this specialized corner of the cryptocurrency market.

HMT Market Analysis Report

I. HMT Price History Review and Current Market Status

HMT Historical Price Evolution

-

August 2021: Project listing and early adoption phase, HMT reached its all-time high (ATH) of $1.37 on August 14, 2021, reflecting strong market enthusiasm for the Human Protocol ecosystem during the initial launch period.

-

2021-2025: Extended market correction phase, HMT experienced a significant long-term decline of -86.15% over the one-year period, declining from higher historical levels to current trading levels, reflecting market maturation and volatility typical of emerging protocol tokens.

-

December 2025: Recent price consolidation, HMT reached its all-time low (ATL) of $0.00628234 on December 16, 2025, followed by a modest recovery, with the token currently trading near these historical lows.

HMT Current Market Status

As of December 23, 2025, HMT is trading at $0.007398, reflecting a +3.92% gain over the past 24 hours. The token's 24-hour trading range spans from $0.007011 to $0.007984, indicating moderate volatility in the near term.

The market capitalization stands at approximately $5.61 million with a fully diluted valuation of $7.40 million, representing 75.79% of the fully diluted market cap based on current circulating supply. The circulating supply of 757.87 million HMT represents 75.79% of the total supply of 1 billion tokens.

Daily trading volume reached $21,838.51, with the token currently ranked #1462 by market capitalization. The project maintains an active holder base of 4,769 addresses, indicating ongoing network participation.

Short-term price momentum shows mixed signals: the token declined -3.88% in the past hour, faced -5.91% headwinds over the seven-day period, but gained 2% over the past 30 days, suggesting potential stabilization at current levels despite the broader downtrend.

Click to view current HMT market price

HMT Market Sentiment Indicator

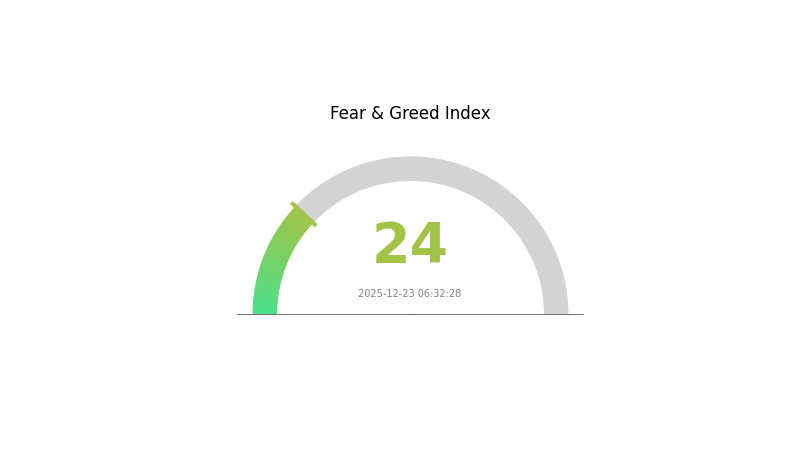

2025-12-23 Fear and Greed Index: 24 (Extreme Fear)

Click to view current Fear & Greed Index

The cryptocurrency market is experiencing extreme fear, with the Fear and Greed Index at 24. This indicates severe market pessimism and heightened investor anxiety. During such periods, panic selling often dominates, creating significant volatility. However, extreme fear can also present contrarian opportunities for long-term investors who believe in market recovery. It's crucial to maintain a rational investment strategy, avoid emotional decision-making, and consider dollar-cost averaging to mitigate risks. Monitor market developments closely on Gate.com for real-time data and insights to guide your trading decisions.

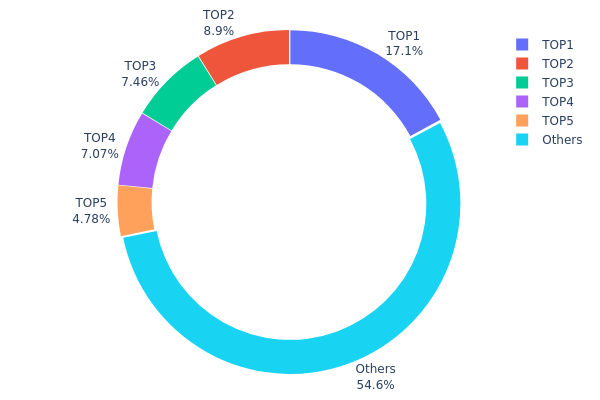

HMT Holdings Distribution

The address holdings distribution map illustrates the concentration of HMT tokens across different wallet addresses on the blockchain. This metric is fundamental for assessing the degree of decentralization, identifying potential holders of influence, and understanding the token's vulnerability to price manipulation or sudden selling pressure. By analyzing the top addresses and their respective holdings percentages, we can evaluate the overall health and resilience of the token's ecosystem.

Current data reveals a moderate concentration pattern in HMT's holder structure. The top five addresses collectively hold 45.33% of all circulating tokens, with the largest holder controlling 17.14% of the total supply. While this concentration level suggests some degree of centralization, it remains below the threshold typically considered excessive in the cryptocurrency market. The dominant position of the leading address warrants monitoring, though the relatively distributed nature of the remaining holdings—with 54.67% dispersed among other addresses—indicates a reasonably fragmented ownership structure that limits single-entity control over significant market movements.

From a market dynamics perspective, this distribution pattern presents a balanced risk profile. The presence of substantial holdings among the top five addresses creates potential for coordinated action or significant price volatility should these holders decide to reposition their stakes. However, the substantial proportion of tokens held by the broader holder base suggests organic participation in the ecosystem. The current configuration indicates that while HMT maintains a respectable level of decentralization, continued monitoring of top holder activities remains essential for assessing long-term market stability and protocol governance health.

Visit to check current HMT Holdings Distribution

| Top | Address | Holding Qty | Holding (%) |

|---|---|---|---|

| 1 | 0xd25e...ca29ec | 171453.82K | 17.14% |

| 2 | 0xa82b...afa4cb | 89000.00K | 8.90% |

| 3 | 0xd342...7bb2e4 | 74580.64K | 7.45% |

| 4 | 0x478f...bf3187 | 70679.67K | 7.06% |

| 5 | 0xd166...a54f41 | 47827.64K | 4.78% |

| - | Others | 546458.23K | 54.67% |

II. Core Factors Affecting HMT Future Price

Macroeconomic Environment

-

Monetary Policy Impact: International monetary policy changes have important effects on HMT price movements. Major central bank policy shifts and interest rate decisions influence capital flows into cryptocurrency markets.

-

Market Sentiment: Investor sentiment and market emotion play crucial roles in price fluctuations. Positive or negative sentiment can significantly amplify or dampen price movements.

-

Policy Regulation: Government-level regulatory policies and oversight mechanisms affect price dynamics. Policy clarity and regulatory frameworks impact market confidence and adoption rates.

Three、2025-2030 HMT Price Forecast

2025 Outlook

- Conservative Forecast: $0.00609 - $0.00743

- Neutral Forecast: $0.00743

- Optimistic Forecast: $0.00832 (requires sustained market stability and increased adoption)

2026-2028 Mid-term Outlook

- Market Stage Expectation: Gradual recovery phase with steady accumulation pressure, characterized by incremental growth as ecosystem development progresses

- Price Range Forecast:

- 2026: $0.00614 - $0.00953

- 2027: $0.00827 - $0.01244

- 2028: $0.00782 - $0.01343

- Key Catalysts: Expansion of protocol functionality, increased institutional interest in utility tokens, broader market sentiment improvement, and integration developments within the Web3 ecosystem

2029-2030 Long-term Outlook

- Base Case Scenario: $0.0066 - $0.01572 (assumes continued ecosystem growth with moderate market participation and steady token utility expansion)

- Optimistic Scenario: $0.00873 - $0.01580 (assumes accelerated adoption, significant partnerships, and strengthened market fundamentals)

- Transformative Scenario: $0.01386 - $0.01580 (assumes breakthrough technological developments, substantial enterprise adoption, and major ecosystem milestones being achieved)

- 2030-12-31: HMT achieves 87% cumulative appreciation (reflects long-term value accumulation potential)

Note: All forecasts are based on historical data analysis and market trends. Investors should conduct thorough due diligence through platforms like Gate.com before making investment decisions. Cryptocurrency markets remain volatile and subject to regulatory changes.

| 年份 | 预测最高价 | 预测平均价格 | 预测最低价 | 涨跌幅 |

|---|---|---|---|---|

| 2025 | 0.00832 | 0.00743 | 0.00609 | 0 |

| 2026 | 0.00953 | 0.00787 | 0.00614 | 6 |

| 2027 | 0.01244 | 0.0087 | 0.00827 | 17 |

| 2028 | 0.01343 | 0.01057 | 0.00782 | 42 |

| 2029 | 0.01572 | 0.012 | 0.0066 | 62 |

| 2030 | 0.0158 | 0.01386 | 0.00873 | 87 |

HUMAN Protocol (HMT) Professional Investment Analysis Report

I. Executive Summary

HUMAN Protocol (HMT) represents an innovative approach to human-computer cooperation, creating an automated labor market where artificial intelligence and human workers collaborate efficiently. As of December 23, 2025, HMT trades at $0.007398 with a market capitalization of approximately $5.6 million and a 24-hour trading volume of $21,838.51.

Key Metrics Overview:

- Current Price: $0.007398

- 24h Change: +3.92%

- Market Cap Rank: #1,462

- Circulating Supply: 757,866,509 HMT (75.79% of total supply)

- All-Time High: $1.37 (August 14, 2021)

- All-Time Low: $0.00628234 (December 16, 2025)

II. Project Overview & Technology Foundation

Project Core Concept

HUMAN Protocol introduces a novel framework for human-artificial intelligence collaboration. The protocol addresses the fundamental limitation that machines cannot answer certain questions without human assistance. For example, when AI systems learn to recommend products like shoes, they require human input to understand which items are similar or relevant.

Core Functionality

The protocol enables:

- Problem Submission: Companies can submit complex tasks requiring human judgment

- Data Contribution: Users provide datasets and insights to support AI model training

- Automated Compensation: Intelligent reward systems compensate workers for their contributions

- Verification Mechanisms: Network validators are rewarded for maintaining service quality and accuracy

Use Cases

- AI model training and refinement

- Product search optimization

- Data labeling and classification

- Content moderation and quality assurance

- AI recommendation system development

Token Utility

HMT serves as the protocol's native utility token, functioning as:

- Payment mechanism for labor services via intelligent bounties

- Validator reward distribution token

- Network participation incentive

III. Market Analysis & Performance Metrics

Price Performance Analysis

Short-term Performance:

- 1-hour change: -3.88% (down $0.000299)

- 24-hour change: +3.92% (up $0.000279)

- 7-day change: -5.91% (down $0.000465)

- 30-day change: +2.00% (up $0.000145)

- 1-year change: -86.15% (down $0.046017)

Price Range (24h):

- High: $0.007984

- Low: $0.007011

Market Valuation Metrics

| Metric | Value |

|---|---|

| Total Market Cap | $7,398,000 |

| Circulating Market Cap | $5,606,696 |

| Fully Diluted Valuation (FDV) | $7,398,000 |

| Market Cap to FDV Ratio | 75.79% |

| Market Dominance | 0.00023% |

| Active Holders | 4,769 |

Liquidity Analysis

- 24h Trading Volume: $21,838.51

- Volume to Market Cap Ratio: 0.39 (indicating moderate liquidity)

- Listed on 2 major exchanges

IV. HMT Professional Investment Strategy & Risk Management

HMT Investment Methodology

(1) Long-term Hold Strategy

-

Suitable For: Investors with extended time horizons (2-5+ years) who believe in the long-term potential of human-AI cooperation frameworks and are willing to endure significant volatility

-

Operational Recommendations:

- Establish positions gradually through dollar-cost averaging to mitigate price volatility

- Maintain a minimum holding period of 12-24 months to capture potential protocol adoption growth

- Regularly monitor project development milestones and community engagement metrics

- Consider accumulating during periods of significant price weakness if project fundamentals remain intact

-

Storage Solutions:

- Utilize Gate Web3 Wallet for secure self-custody of HMT tokens

- Implement hardware wallet solutions for amounts exceeding personal risk tolerance thresholds

- Enable two-factor authentication on all trading and custody platforms

(2) Active Trading Strategy

-

Technical Analysis Tools:

- Moving Average Convergence Divergence (MACD): Monitor for trend confirmation and potential reversal signals in HMT price action

- Relative Strength Index (RSI): Identify overbought conditions (>70) and oversold conditions (<30) for entry/exit optimization

- Support and Resistance Levels: Track key price points at $0.007398 (current support), $0.008000 (nearby resistance), and historical reference points

-

Swing Trading Key Points:

- Capitalize on the observed volatility pattern (±5-6% weekly movements) through position sizing of 2-5% of total portfolio

- Execute stop-loss orders at 10-15% below entry points to contain downside risk

- Maintain profit-taking discipline at 15-25% gains to secure returns before potential reversals

HMT Risk Management Framework

(1) Asset Allocation Principles

- Conservative Investors: 0.5% - 2% portfolio allocation maximum

- Moderate Investors: 2% - 5% portfolio allocation

- Aggressive Investors: 5% - 10% portfolio allocation

(2) Risk Hedge Solutions

- Portfolio Diversification Strategy: Combine HMT holdings with established cryptocurrencies (Bitcoin, Ethereum) and traditional assets to reduce concentration risk

- Stablecoin Reserves: Maintain 30-50% of speculative capital in USDT/USDC to capitalize on sudden price dislocations and margin buy opportunities

(3) Secure Storage Solutions

- Hot Wallet Recommendation: Gate Web3 Wallet for active trading and frequent transactions, offering user-controlled custody with institutional-grade security infrastructure

- Cold Storage Approach: Transfer holdings exceeding $50,000 notional value to hardware-secured solutions for enhanced protection against exchange compromises

- Security Considerations: Never share private keys or seed phrases; enable IP whitelisting on exchange accounts; use unique, complex passwords; verify all withdrawal addresses before confirming transactions

V. HMT Potential Risks & Challenges

HMT Market Risks

- Extreme Volatility Exposure: HMT has declined 86.15% over the past year, with a historical peak of $1.37 versus current price of $0.007398. This 99% drawdown from all-time highs demonstrates severe price instability characteristic of early-stage protocol tokens

- Liquidity Constraints: Daily trading volume of approximately $21,838 relative to a $5.6 million market cap creates potential slippage risk for large transactions and limits exit liquidity during market stress

- Limited Holder Base: With only 4,769 active token holders, HMT faces concentration risk and vulnerability to large holder liquidations that could trigger cascading price declines

HMT Regulatory Risks

- Token Classification Uncertainty: Regulatory authorities globally have not established consistent frameworks for protocol tokens supporting labor marketplaces, creating potential compliance risks if jurisdictions reclassify HMT as a security or commodity with different treatment

- Data Privacy Regulations: As HUMAN Protocol operates an automated labor market involving human data providers, compliance with GDPR, CCPA, and emerging AI governance frameworks presents ongoing regulatory challenges that could restrict operational scope

- International Jurisdiction Conflicts: Different regulatory approaches across EU, Asia-Pacific, and North American markets could fragment protocol adoption and create compliance complexity for global operations

HMT Technology Risks

- Smart Contract Vulnerabilities: Automated bounty distribution and validator reward systems depend on secure code execution; historical vulnerabilities in DeFi protocols demonstrate ongoing technical risk exposure

- Scalability Limitations: Current Ethereum-based infrastructure may face congestion during high-volume labor market activity, potentially increasing transaction costs and reducing protocol competitiveness versus alternative platforms

- AI Model Accuracy Dependencies: The protocol's value proposition depends fundamentally on human-provided data quality; insufficient quality control mechanisms could result in degraded AI model performance and reduced demand for protocol services

VI. Conclusion & Action Recommendations

HMT Investment Value Assessment

HUMAN Protocol presents a conceptually innovative approach to human-AI collaboration with genuine utility potential in data labeling and AI training workflows. However, the project faces significant execution risks evidenced by its 86% one-year decline, minimal market liquidity, and concentrated holder base. The protocol's long-term viability depends on demonstrating sustained adoption growth, regulatory clarity, and competitive advantages over alternative labor platforms. Current valuation metrics suggest either severe market pessimism or justified concern regarding commercial traction. Investors should conduct thorough due diligence on adoption metrics and development progress before committing capital.

HMT Investment Recommendations

✅ Newcomers: Limit initial exposure to 0.5-1% of total portfolio through micro-positions on Gate.com; focus on understanding protocol mechanics and monitoring adoption metrics before increasing exposure

✅ Experienced Investors: Consider 2-5% portfolio allocation using dollar-cost averaging strategy across 6-12 month periods; implement disciplined stop-loss protocols at 15-20% below entry points and profit-taking targets at 30-50% gains

✅ Institutional Investors: Evaluate protocol through fundamental analysis of labor market activity metrics, validator economics, and competitive positioning; structure positions with risk management overlays and establish clear exit criteria tied to development milestones

HMT Trading Participation Methods

- Spot Trading: Purchase HMT directly on Gate.com through fiat on-ramps or cryptocurrency swaps; suitable for longer-term holders

- Active Trading: Execute swing trades on Gate.com leveraging technical analysis; optimal for 24-48 hour holding periods during volatile periods

- Staking/Yield Programs: Monitor for protocol-native staking opportunities that may emerge as HUMAN Protocol matures, potentially offering yield compensation for token lockup

Cryptocurrency investments carry extreme risk. This report does not constitute investment advice. Investors must make decisions based on personal risk tolerance and should consult professional financial advisors. Never invest more than you can afford to lose completely. Past performance does not guarantee future results. HMT specifically presents heightened risk due to extreme historical volatility, concentrated holder base, and uncertain protocol adoption trajectory.

FAQ

What is the future potential of HMT?

HMT shows strong future potential driven by its role in decentralized labor markets and Web3 integration. With growing DeFi adoption and blockchain innovation, analysts project significant long-term growth through 2030. Market trends support optimistic price predictions as the protocol expands its ecosystem.

Will Hamster Kombat coin reach $1?

Yes, Hamster Kombat has potential to reach $1 by 2028 based on market predictions. This growth would be driven by blockchain gaming adoption, BTC halvings, and continued market developments in the crypto sector.

What is the price prediction for the Humanity Protocol coin in 2025?

The Humanity Protocol coin is predicted to reach between $0.40724 and $1.31169 in 2025. Bullish forecasts suggest potential highs around $1.00, while bearish estimates indicate lows near $0.017841.

What is the value of HMT coin?

The current value of HMT coin is $0.0075 USD as of December 23, 2025. Five HMT coins cost approximately $0.0377 USD. HMT price fluctuates based on market demand and supply dynamics in the cryptocurrency market.

What is the Current Market Overview of Artificial Superintelligence Alliance (FET) in 2025?

What is the Current Market Overview for COAI (ChainOpera AI) in 2025?

What Is the Current Price of TAO and How Has It Changed in 2025?

SKYAI vs BAT: The Next Generation AI Battle in China's Tech Landscape

What Is COAI Price Volatility: Why Did ChainOpera AI Crypto Fluctuate From $25 to $0.45 in 2025?

NKN (NKN) price soaring: What is the driving force behind the 2025 craze?

TapSwap Updates and Insights Today | Latest News

Understanding Crypto Faucets: How They Work and What You Need to Know

Understanding Crypto Faucets: How They Work and Their Benefits

What is PUBLIC: Understanding the Concept, Importance, and Real-World Applications in Modern Society

What is MYRO: A Comprehensive Guide to the Decentralized Social Platform and Its Native Token