- Trending TopicsView More

22 Popularity

13.2K Popularity

25.5K Popularity

308.3K Popularity

164.6K Popularity

- Pin

- 💥 Gate Square Event: #Post0GWinUSDT# 💥

Post original content on Gate Square related to 0G or the ongoing campaigns (Earn, CandyDrop, or Contract Trading Competition) for a chance to share 200 USDT rewards!

📅 Event Period: Sept 25, 2025, 18:00 – Oct 2, 2025, 16:00 UTC

📌 Related Campaigns:

Earn: Enjoy stable earnings

👉 https://www.gate.com/announcements/article/47290

CandyDrop: Claim 0G rewards

👉 https://www.gate.com/announcements/article/47286

Contract Trading Competition: Trade to win prizes

👉 https://www.gate.com/announcements/article/47221

📌 How to Participate:

1️⃣ Post original cont - 🚀 #GateNewbieVillageEpisode2# ✖️ @独领风骚必暴富

💰 Share your first profit on Gate | 🎉 Recall your most unexpected gain | 🤝 Grow with the community

⏰ Event Date:Sept 24 04:00 – Sept 30 16:00 UTC+8

How to Join:

1️⃣ Follow Gate_Square + @独领风骚必暴富

2️⃣ Post on Gate Square with the hashtag #GateNewbieVillageEpisode2#

3️⃣ Share your first pot of gold or your most surprising profit on Gate—more detailed and interesting posts have a higher chance to win!

🎁 Rewards

3 lucky winners → Gate X RedBull Tumbler + $20 Futures Trial Voucher

If merchandise cannot be shipped, it will be replaced with a $30 Futures - 🚗 #GateSquareCommunityChallenge# Round 2 — Which coin is not listed on Gate Launchpad❓

Time to prove if you’re a true Gate veteran!

💰 Join the challenge — 5 lucky winners will share $50 in GT!

👉 How to participate:

1️⃣ Follow Gate_Square

2️⃣ Like this post

3️⃣ Comment with your answer

🗓️ Deadline: October 8, 2025, 24:00 (UTC+8) - 🥊 You’ve entered the Trading PK Arena, matching your opponent now...

One click to place an order and jump into the battle! Who will climb the leaderboard and claim the 👑?

Gate’s brand-new Indicators Radar feature is live! Here you can:

📈 Share your trades on the live candlestick chart to [Square] 👉️ https://www.gate.com/post

👀 Watch others’ trading moves in real time;

💬 Go head-to-head with fellow traders in the community!

Don’t just read—follow the tutorial below and get started 👇

📌 Note: This feature is available only on app version 7.20.5 or above.

Navigating the Cryptocurrency Sideways Market: Strategies and Insights

###Ethereum's Sideways Grind: Prelude to a Major Move?

The cryptocurrency market has been witnessing Ethereum (ETH) in a state of sideways consolidation. However, this apparent calm could be the precursor to significant price action. Let's analyze the current market setup and potential scenarios.

###Critical Support Levels Under Scrutiny

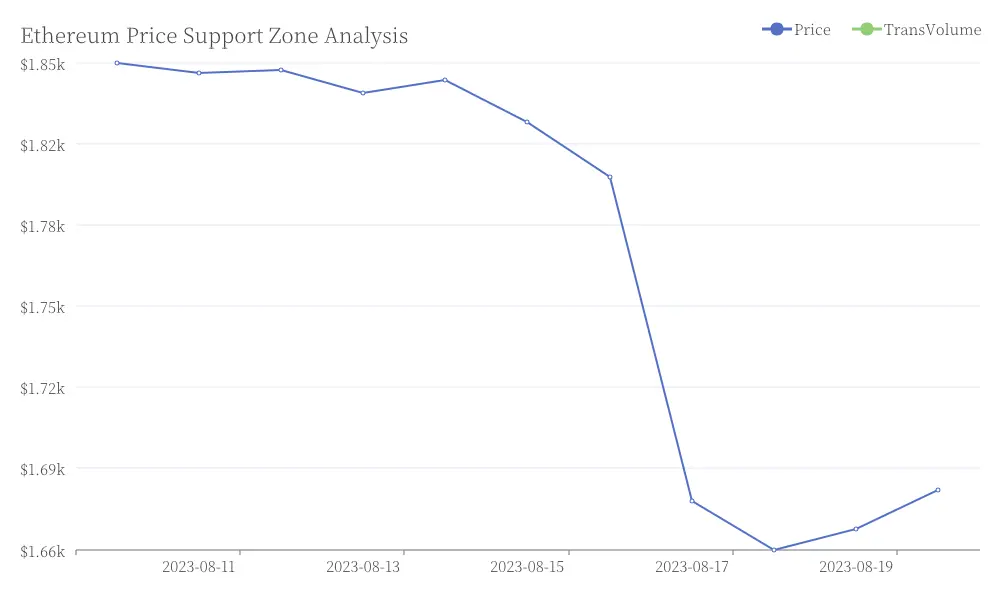

ETH is currently testing a crucial pullback zone between $3,374 and $4,061. The $4,060 level aligns with 23.6% Fibonacci retracement and has acted as a reaction point in mid-August, while $3,374 forms the lower boundary of the range, providing cushion for further retracements. Ethereum Price Support Zone Analysis

Ethereum Price Support Zone Analysis

###Potential for Deeper Retracements

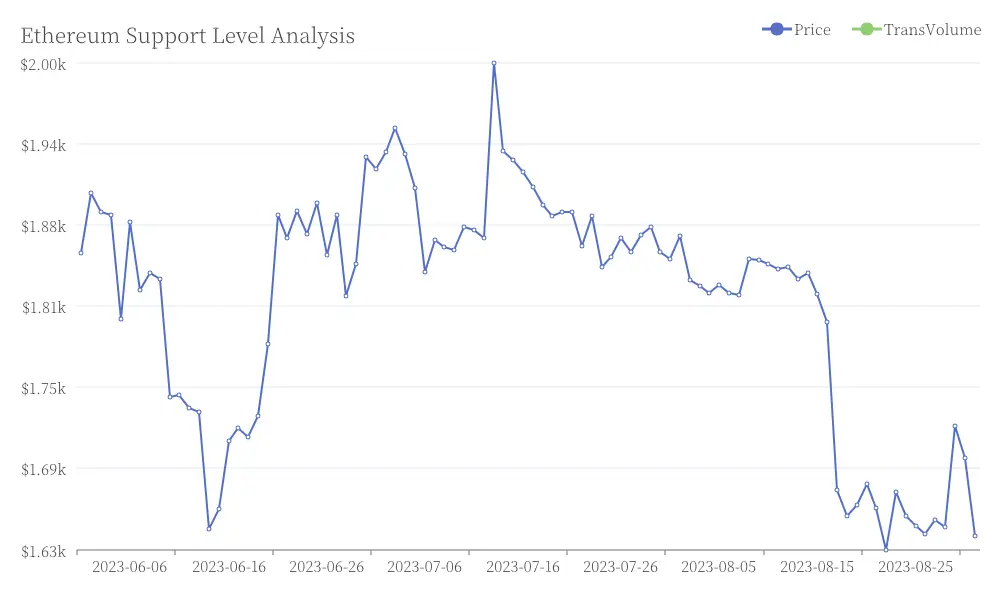

Should a more pronounced pullback materialize, we should monitor several key areas. The $3,665 level represents the 38.2% Fibonacci retracement and often proves pivotal during corrections. Additionally, the ascending trendline that served as support since June remains significant. Ethereum's relationship with its 200-day SMA and EMA is also worth watching, as these dynamic moving averages serve as trend filters, with ETH historically remaining above them during strong uptrends. Ethereum Support Level Analysis

Ethereum Support Level Analysis

###Short-Term Range-Bound Action

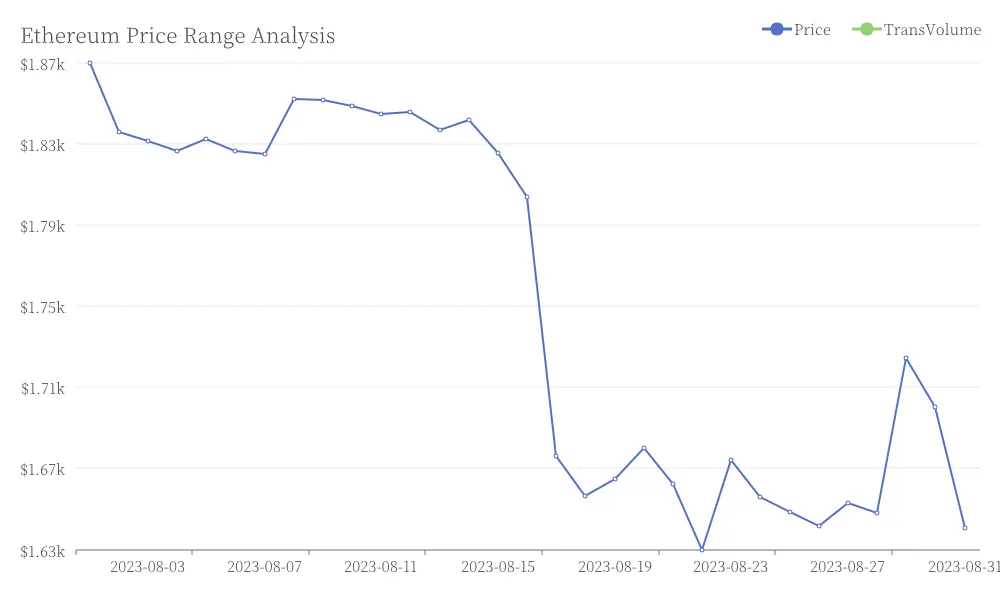

Currently, ETH is oscillating within a defined range bounded by $4,500 as resistance (with no breakout signal yet) and $4,211 as support (where price is holding steady but not rallying). While ETH remains within this range, focusing on capital preservation appears prudent. Ethereum Price Range Analysis

Ethereum Price Range Analysis

###Ethereum's Potential Trajectories

Ethereum's near-term future presents two main scenarios. In the bullish case, maintaining support levels and breaching $4,500 could ignite the next upward wave. Conversely, failing to hold current levels may lead to a retest of $3,665 or even $3,374 before a robust rebound can occur. Market dynamics show ETH's market dominance has been waning, indicating temporary outperformance by some alternative cryptocurrencies.

As the market navigates this period of consolidation, traders and investors should remain vigilant, watching for key breakouts or breakdowns that could signal the next significant move in Ethereum's price action.