Post content & earn content mining yield

placeholder

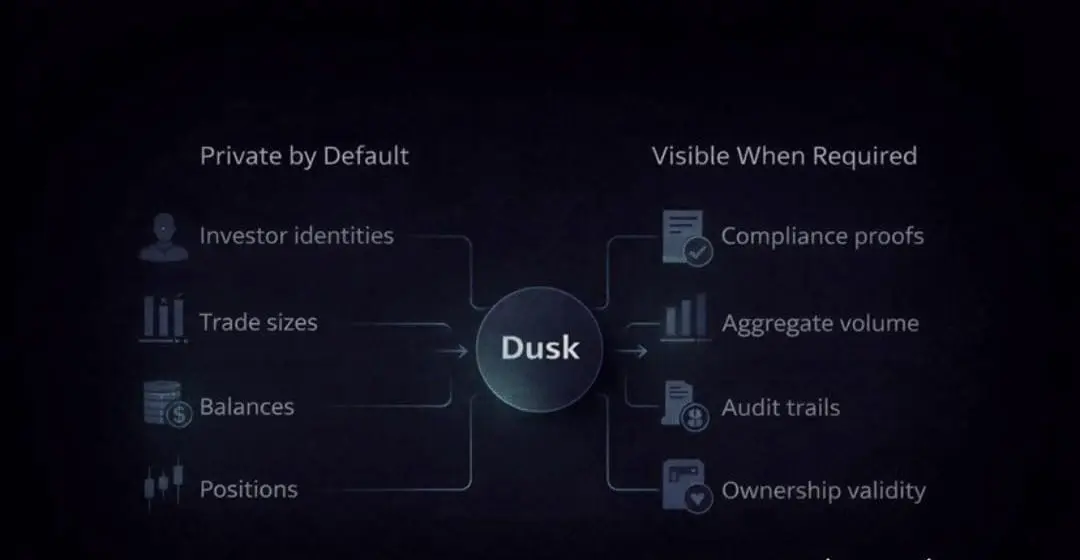

European institutions are entering Web3.

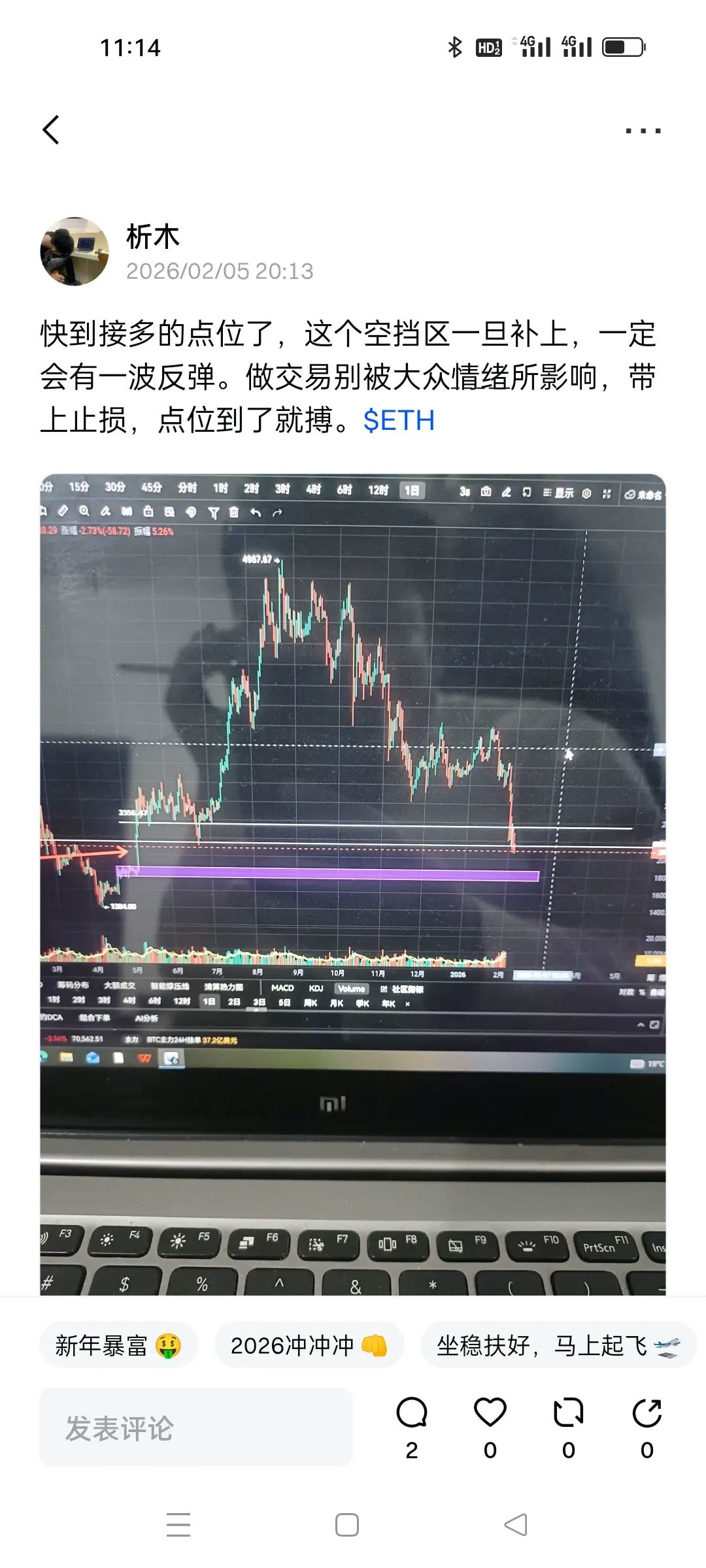

Entry: 0.25 🟩

Target 1: 0.30 🎯

Target 2: 0.35 🎯

Stop loss: 0.22 🛑

$DUSK is the bridge. Regulated markets meet decentralized finance. Institutions can now issue compliant assets on Dusk, leveraging Chainlink's CCIP and DataLink. This unlocks cross-chain liquidity and security. Traditional finance and Web3 are merging. Don't get left behind. This is the future.

Disclaimer: Trading involves risk.

#Dusk #DeFi #Web3 #Crypto $DUSK #美国部分停摆结束

Entry: 0.25 🟩

Target 1: 0.30 🎯

Target 2: 0.35 🎯

Stop loss: 0.22 🛑

$DUSK is the bridge. Regulated markets meet decentralized finance. Institutions can now issue compliant assets on Dusk, leveraging Chainlink's CCIP and DataLink. This unlocks cross-chain liquidity and security. Traditional finance and Web3 are merging. Don't get left behind. This is the future.

Disclaimer: Trading involves risk.

#Dusk #DeFi #Web3 #Crypto $DUSK #美国部分停摆结束

DUSK1.92%

- Reward

- like

- Comment

- Repost

- Share

- Reward

- 1

- Comment

- Repost

- Share

META

METAMORPH

Created By@GateUser-a92a1b14

Listing Progress

0.00%

MC:

$2.47K

Create My Token

POV: You step foot in London for 5 seconds

- Reward

- like

- Comment

- Repost

- Share

#GlobalTechSell-OffHitsRiskAssets

Global markets entered February with a sharp retreat led by technology giants. As investors increasingly question whether the "AI bubble" is reaching its limit, the flight from risky assets has caused deep tremors not only in stock markets but also across the crypto world and commodity markets.

Capex and Spending Concerns Among Tech Titans

At the heart of this turbulence lies the fact that the massive capital expenditures (capex) by giants like Microsoft, Alphabet, and Amazon for AI infrastructure are now perceived as a "risk" by investors. Despite billions o

Global markets entered February with a sharp retreat led by technology giants. As investors increasingly question whether the "AI bubble" is reaching its limit, the flight from risky assets has caused deep tremors not only in stock markets but also across the crypto world and commodity markets.

Capex and Spending Concerns Among Tech Titans

At the heart of this turbulence lies the fact that the massive capital expenditures (capex) by giants like Microsoft, Alphabet, and Amazon for AI infrastructure are now perceived as a "risk" by investors. Despite billions o

- Reward

- 5

- 3

- Repost

- Share

ybaser :

:

2026 GOGOGO 👊View More

#FedLeadershipImpact

Federal Reserve Signals, Crypto Dynamics, and My Trading Insights

The influence of Federal Reserve leadership and monetary policy guidance on global markets has never been more pronounced. Every statement, every tone shift, and every policy decision shapes interest rates, liquidity flows, and market confidence factors that now directly affect cryptocurrencies alongside traditional risk assets.

For traders, investors, and analysts, understanding Fed influence is no longer optional. It is now a core component of market analysis, strategic positioning, and risk management. I

Federal Reserve Signals, Crypto Dynamics, and My Trading Insights

The influence of Federal Reserve leadership and monetary policy guidance on global markets has never been more pronounced. Every statement, every tone shift, and every policy decision shapes interest rates, liquidity flows, and market confidence factors that now directly affect cryptocurrencies alongside traditional risk assets.

For traders, investors, and analysts, understanding Fed influence is no longer optional. It is now a core component of market analysis, strategic positioning, and risk management. I

- Reward

- 2

- 2

- Repost

- Share

ybaser :

:

Buy To Earn 💎View More

#CMEGroupPlansCMEToken Institutional Crypto on the Horizon

The CME Group, one of the world’s largest and most influential derivatives exchanges, is exploring the possibility of issuing a proprietary digital token — a move that could have major implications for institutional crypto infrastructure and digital asset markets.

What CME Is Exploring

CME is in the exploratory phase of creating its own digital token, sometimes referred to as a “CME Token.” This token would be primarily designed for institutional use, including:

Supporting collateral and margin management for crypto derivatives

Stream

The CME Group, one of the world’s largest and most influential derivatives exchanges, is exploring the possibility of issuing a proprietary digital token — a move that could have major implications for institutional crypto infrastructure and digital asset markets.

What CME Is Exploring

CME is in the exploratory phase of creating its own digital token, sometimes referred to as a “CME Token.” This token would be primarily designed for institutional use, including:

Supporting collateral and margin management for crypto derivatives

Stream

- Reward

- like

- Comment

- Repost

- Share

Bitwise CEO Hunter Horsley stated that Bitcoin has fallen nearly 30% this year, with double-digit declines in a single day entering bear market territory. However, he believes that the current correction is more influenced by macroeconomic factors, as cryptocurrencies are being sold off alongside high-liquidity assets like US stocks and gold. Meanwhile, long-term holders' confidence is wavering, but new institutional entrants see this as a "second entry opportunity after missing out."

During this turbulent transition phase, do you think this is the start of a deep bear market or a window for l

During this turbulent transition phase, do you think this is the start of a deep bear market or a window for l

BTC9.8%

- Reward

- 1

- 2

- Repost

- Share

HaonanChen :

:

Hold on tight, we're about to take off 🛫View More

When the market declines, jokesters make more money than analysts

When the market drops, jokes outperform strategies.

Some draw pie charts, some draw doors,

And others directly draw stop-loss lines.

But the real trading logic is simple:

When the trend is unclear, doing less is winning.

🔹Risk Control

I only take action at key structural levels,

Let the market perform on its own the rest of the time.

Trading isn’t a 24/7 job; it’s a profession based on opportunities.

🔹Mindset Management

Blindly bottom-fishing often stems from two illusions:

Thinking you got a bargain,

T

View OriginalWhen the market drops, jokes outperform strategies.

Some draw pie charts, some draw doors,

And others directly draw stop-loss lines.

But the real trading logic is simple:

When the trend is unclear, doing less is winning.

🔹Risk Control

I only take action at key structural levels,

Let the market perform on its own the rest of the time.

Trading isn’t a 24/7 job; it’s a profession based on opportunities.

🔹Mindset Management

Blindly bottom-fishing often stems from two illusions:

Thinking you got a bargain,

T

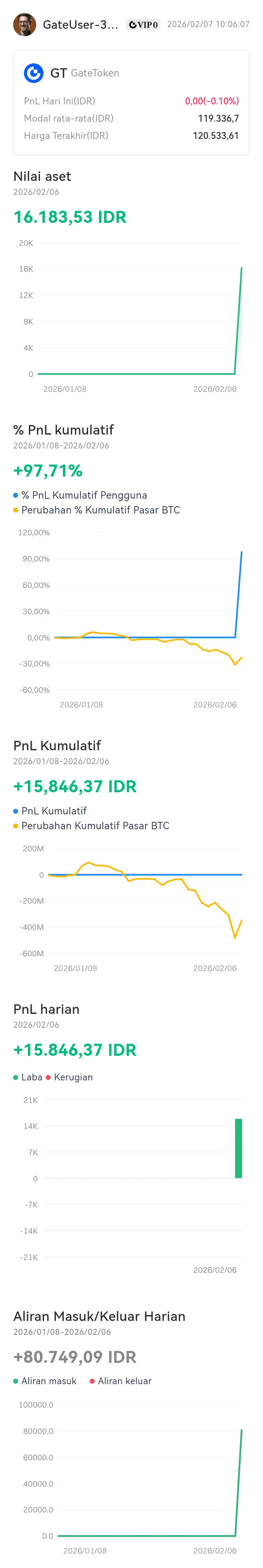

[The user has shared his/her trading data. Go to the App to view more.]

- Reward

- 1

- Comment

- Repost

- Share

🚨 JUST IN | ARENAR INTEL:🇺🇸 President Trump predicts the US stock market will double by the end of his term, driven by great tariffs.#Trump #StockMarket #Tariffs #USEconomy #Breaking

- Reward

- like

- Comment

- Repost

- Share

#BitcoinDropsBelow$65K — Panic, Rebound, and Reality Check

Bitcoin’s recent dip below $65,000 triggered extreme fear across the market. However, the sharp rebound that followed tells a deeper story. BTC has now recovered near $70,586, accompanied by strong intraday volatility — a clear sign of aggressive positioning on both sides.

📈 Key Market Data

Current BTC/USDT: $70,586.90

24H Low / High: $59,980.60 / $70,700.00

24H Change: +5.54%

24H Volatility: ~15%

Fear & Greed Index: 9 (Extreme Fear)

Technical Signals:

RSI above 80 (Overbought)

MACD: Bullish

Price testing major resistance

💡 Market In

Bitcoin’s recent dip below $65,000 triggered extreme fear across the market. However, the sharp rebound that followed tells a deeper story. BTC has now recovered near $70,586, accompanied by strong intraday volatility — a clear sign of aggressive positioning on both sides.

📈 Key Market Data

Current BTC/USDT: $70,586.90

24H Low / High: $59,980.60 / $70,700.00

24H Change: +5.54%

24H Volatility: ~15%

Fear & Greed Index: 9 (Extreme Fear)

Technical Signals:

RSI above 80 (Overbought)

MACD: Bullish

Price testing major resistance

💡 Market In

BTC9.8%

- Reward

- like

- Comment

- Repost

- Share

💧

Zss

Created By@NineBrother'sWine

Listing Progress

0.00%

MC:

$0.1

Create My Token

After a global market sell-off on Thursday, the cryptocurrency market staged a dramatic rebound on Friday (February 6). Leading the charge, Bitcoin surged by as much as 13%, reaching a high of $71,469, nearly fully recovering all the losses from the previous day's crash. Ethereum also rebounded strongly, with an intraday increase of over 11%, regaining levels above $2,067. This rebound is widely interpreted by the market as a "relief rally after exhaustion of selling." Analysts pointed out that Bitcoin showed strong support near $60,000, while extremely low market liquidity meant that small bu

View Original

- Reward

- like

- Comment

- Repost

- Share

- Reward

- 3

- 4

- Repost

- Share

TheMostAffectionateIn :

:

The contract cannot be finalized. There are issues preventing the agreement from proceeding smoothly. Please review the terms and conditions carefully, ensure all necessary documentation is submitted, and address any outstanding concerns with the relevant parties to facilitate the successful completion of the contract process.View More

- Reward

- like

- Comment

- Repost

- Share

Live Trading and Learning with Chillzzz

- Reward

- like

- Comment

- Repost

- Share

Gold and silver markets are surging, and the High-Multiplier Trading Challenge is officially live. Simply sign up to instantly claim 10 USDT, then start trading futures to unlock a variety of rewards... https://www.gate.com/id/campaigns/3968?ref=VVFHU1GLVA&ref_type=132

- Reward

- 1

- Comment

- Repost

- Share

Check out Gate and join me in the hottest event! https://www.gate.com/id/campaigns/3994?ref=VVFHU1GLVA&ref_type=132

- Reward

- 2

- 1

- Repost

- Share

ybaser :

:

2026 GOGOGO 👊On February 7, 2026, the China Securities Regulatory Commission announced Document [2026] No. 1: "Regulatory Guidelines on the Overseas Issuance of Asset-Backed Securities Tokens Based on Domestic Assets" (hereinafter referred to as the "Guidelines"). The Guidelines took effect immediately upon announcement. They adopt a "strict regulatory" stance towards the issuance of RWA (Real World Asset) tokenized products based on domestic assets and issued overseas (especially asset-backed securities tokens). Essentially, this is part of the "strict overseas regulation" aimed at preventing speculation,

RWA3.51%

- Reward

- like

- Comment

- Repost

- Share

🔹 Bitcoin extends its rally, briefly breaking above $70,000 overnight — How will the weekend trend unfold?

- Reward

- like

- Comment

- Repost

- Share

Load More

Join 40M users in our growing community

⚡️ Join 40M users in the crypto craze discussion

💬 Engage with your favorite top creators

👍 See what interests you

Trending Topics

View More120.72K Popularity

23.42K Popularity

389.66K Popularity

9.59K Popularity

7.94K Popularity

Hot Gate Fun

View More- MC:$2.47KHolders:10.00%

- MC:$2.47KHolders:00.00%

- MC:$2.51KHolders:20.06%

- MC:$2.47KHolders:00.00%

- MC:$2.47KHolders:20.06%

News

View MoreSu Zhu: Not optimistic about the prospects of privacy coins. The most noteworthy altcoin in China is BCH.

13 m

Project Hunt: The compliant blockchain ecosystem Rayls is the project with the most new followers in the past 7 days.

19 m

Data: 294.24 BTC transferred out from Anchorage Digital, then relayed to another anonymous address

21 m

Exchange shifts under liquidity pressure, Gate's full-asset deployment shows initial results

21 m

Gate DEX launches Meme Go weekly trading challenge on BNB Chain, with trading sharing prize of 20,000 USDT

35 m