#CryptoMarketStructureUpdate The current crypto market structure is evolving at a rapid pace, shaped by the interaction of institutional participation, shifting liquidity conditions, macroeconomic pressures, and increasingly transparent on-chain behavior. Price action alone no longer provides sufficient insight into market direction, as structural forces now play a dominant role in determining trends. Bitcoin remains the central anchor of the ecosystem, while altcoins are gradually differentiating based on utility and adoption. In this environment, disciplined observation, selective positioning, and risk-aware allocation are essential, as volatility is likely to persist while new structural patterns continue to form.

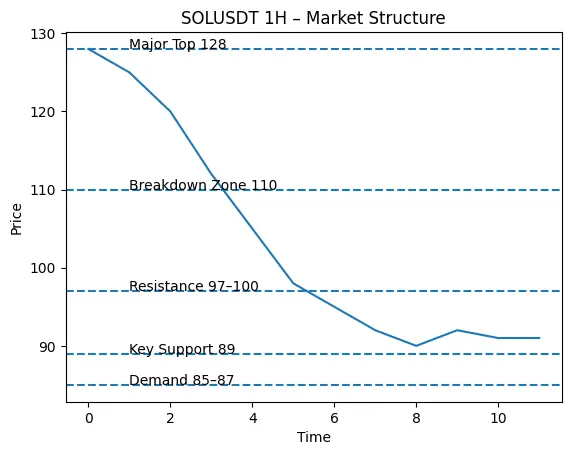

Bitcoin continues to function as the primary barometer of market sentiment and capital flow. Recent breakdowns below important technical thresholds have confirmed that the market is in a corrective and consolidation phase. However, on-chain indicators suggest that long-term holders and institutional participants are steadily accumulating, signaling confidence in Bitcoin’s long-term value proposition. Historically, major accumulation phases often emerge when retail sentiment is weak and volatility remains elevated. This dynamic reinforces the importance of gradual, scaled positioning at key support zones, combined with close monitoring of funding rates, liquidation activity, and transaction volume stabilization.

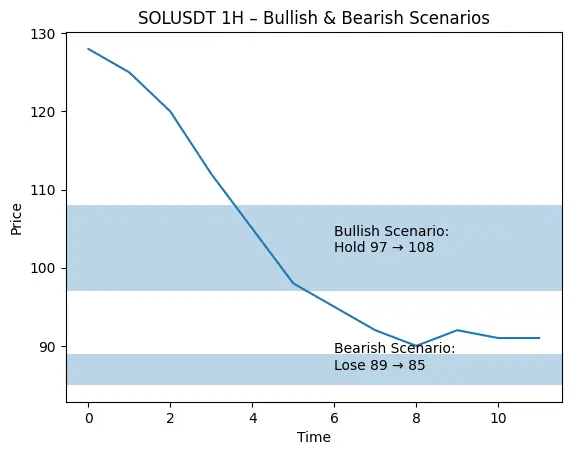

Altcoins remain closely correlated with Bitcoin in the short term, but structural differentiation is becoming more visible. Assets associated with Layer 2 scaling, decentralized finance, infrastructure, and real-world applications are beginning to outperform purely speculative tokens. This reflects a maturing market in which developer engagement, user adoption, and ecosystem integration are gaining importance. Strategic exposure should focus on projects with measurable traction and long-term relevance, while low-liquidity and narrative-driven tokens should be approached with caution due to their vulnerability during market corrections.

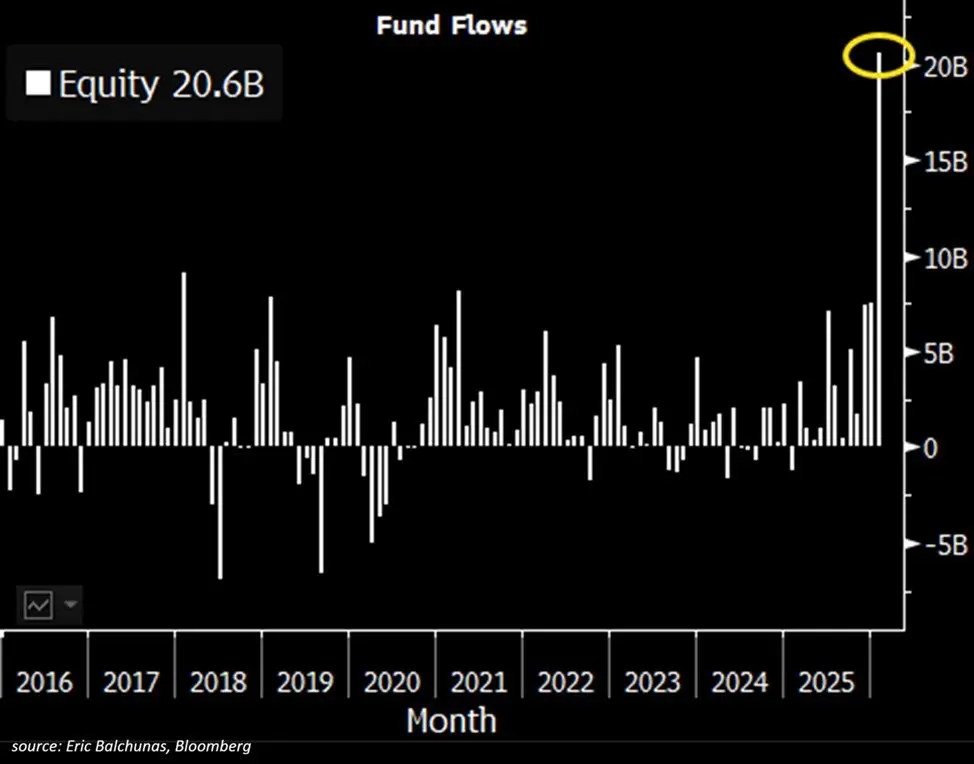

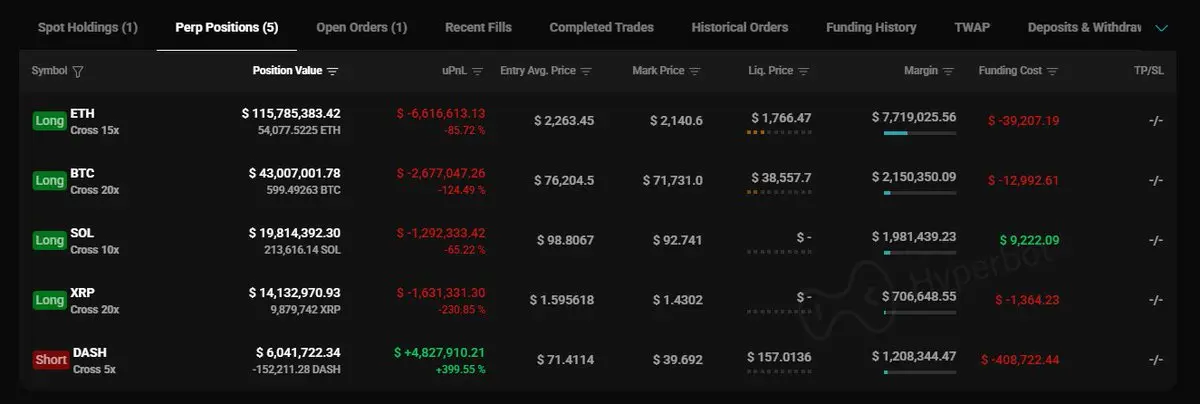

Liquidity dynamics remain a defining factor in short-term market behavior. Funding rates, open interest, leverage ratios, and derivatives positioning offer critical insight into market stress and sentiment extremes. After recent liquidation events, funding conditions have normalized, reducing immediate systemic risk. However, elevated leverage and concentrated positioning still represent latent volatility triggers. Monitoring exchange flows, stablecoin supply movements, and reserve changes provides additional context for identifying accumulation phases and potential stress points.

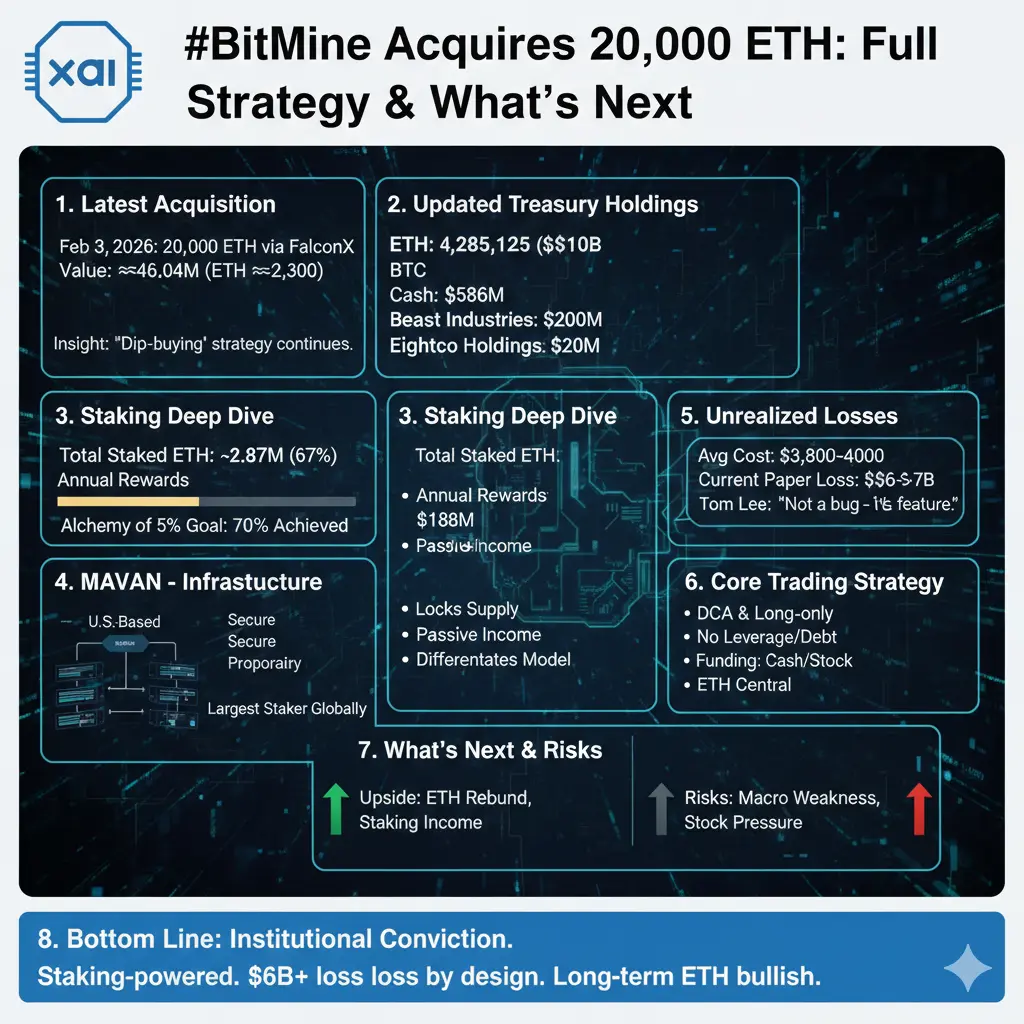

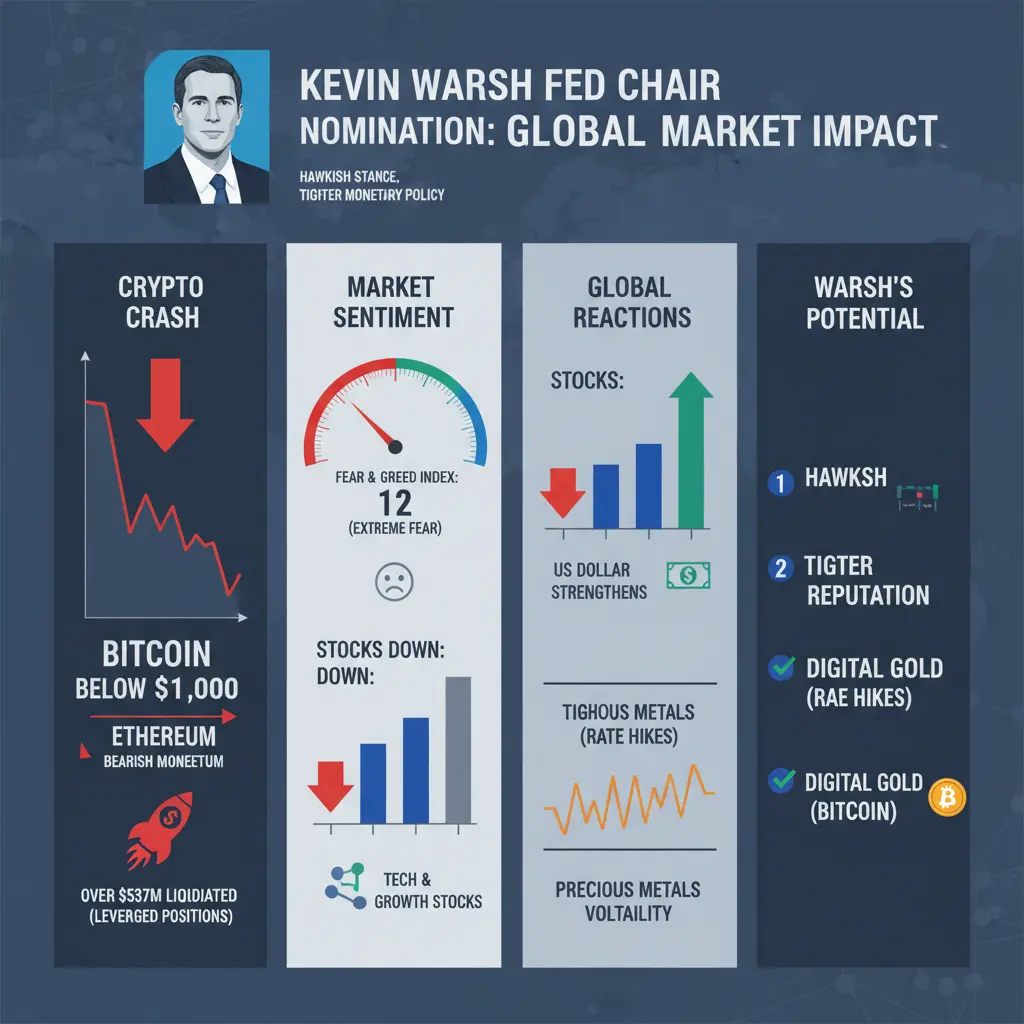

Macro correlations now exert significant influence over crypto market trends. Interest rate expectations, inflation data, currency strength, and geopolitical developments increasingly shape investor behavior. Crypto assets have become integrated into the broader risk-asset ecosystem, responding quickly to changes in global liquidity and monetary policy outlooks. Successful positioning therefore requires continuous integration of macro signals into technical and on-chain analysis, avoiding isolated interpretations that ignore broader economic conditions.

On-chain metrics offer deep insight into market psychology and capital distribution. Exchange inflows and outflows, wallet age analysis, dormant supply activity, and realized profit and loss metrics reveal where conviction is strengthening or weakening. Declining exchange inflows combined with increased long-term holder accumulation suggests growing confidence among patient participants. Meanwhile, spikes in realized losses and short-term holder capitulation often coincide with transitional phases. Integrating these signals allows for more precise timing and position sizing.

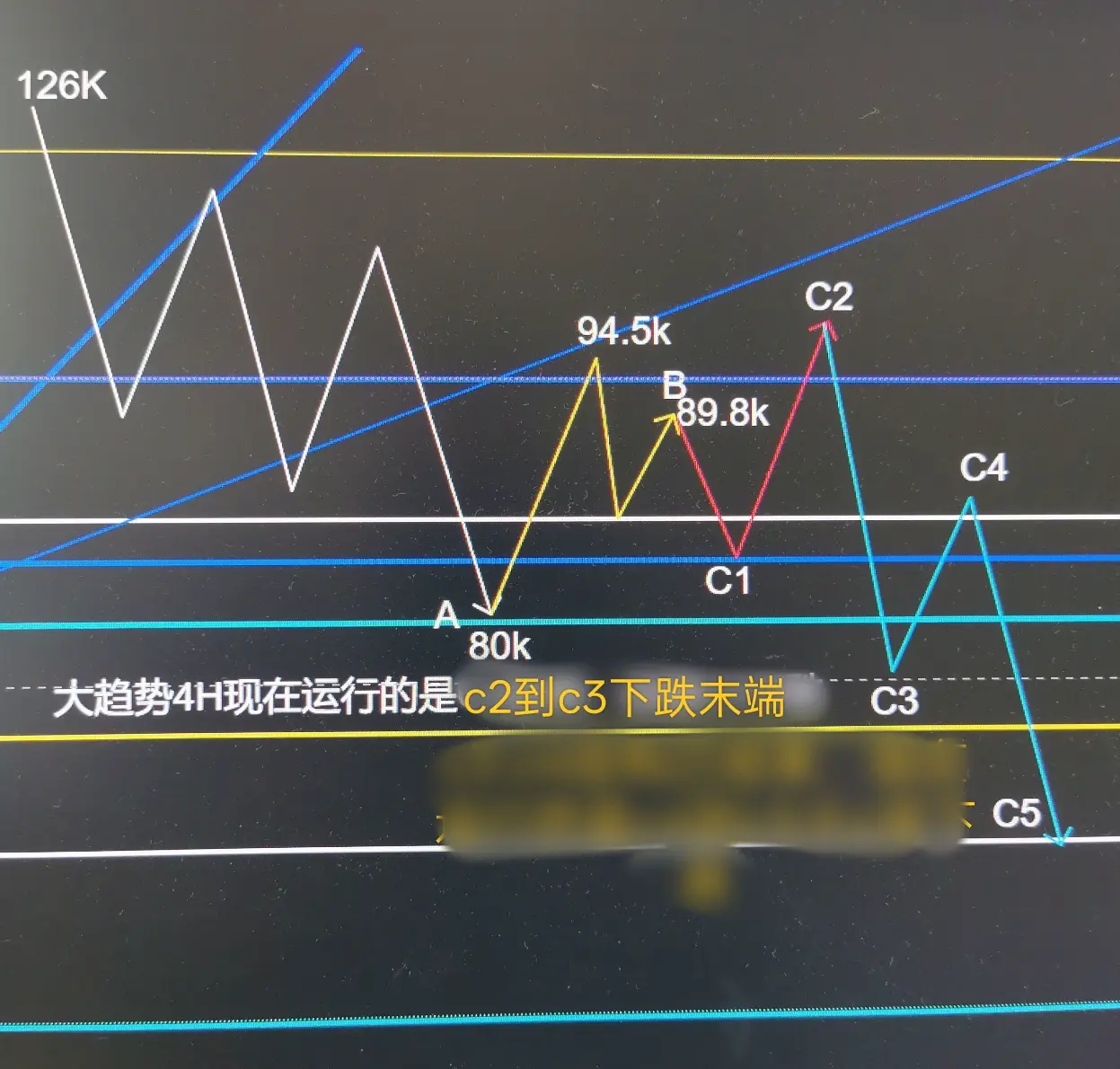

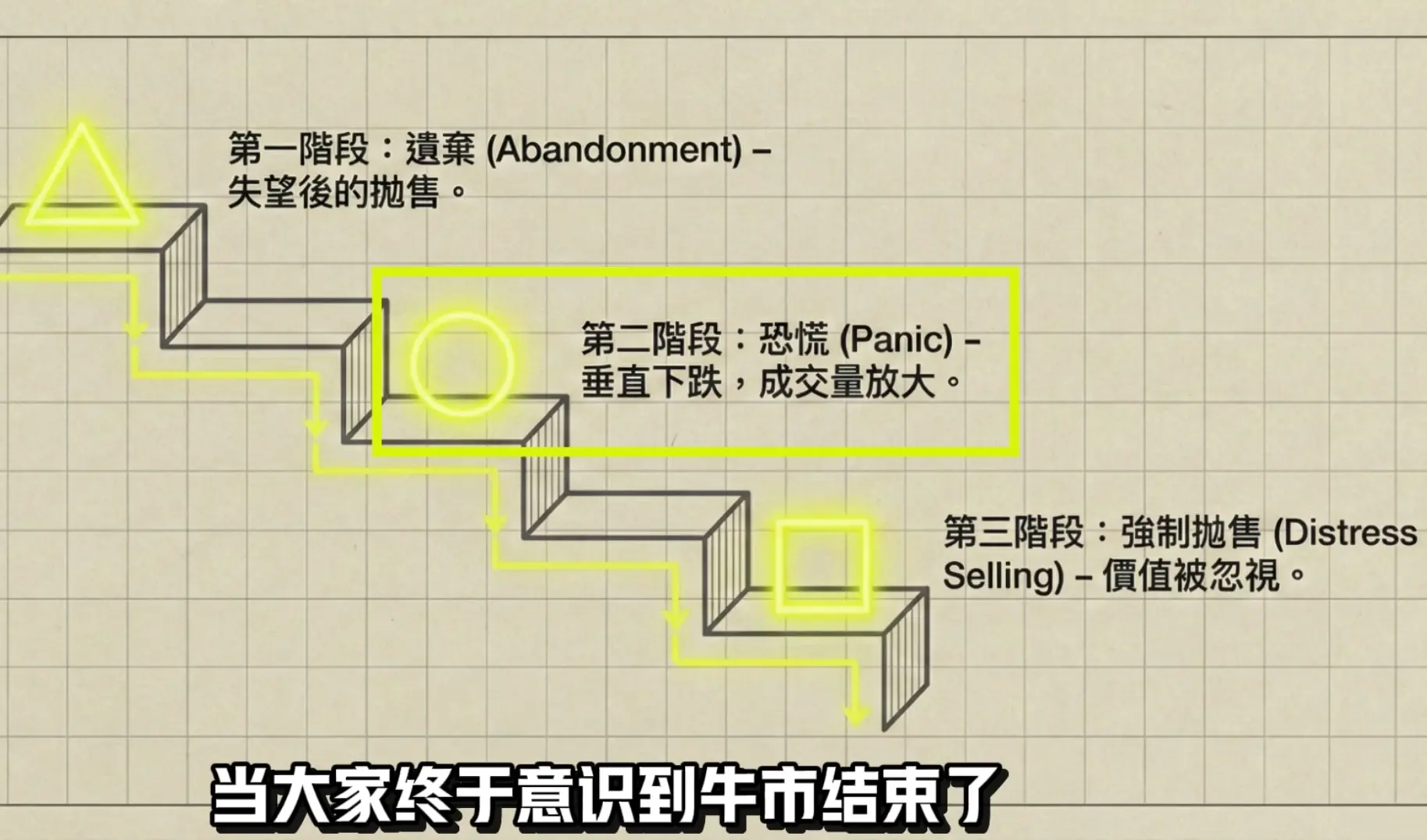

Several structural patterns are becoming increasingly evident across the ecosystem. Long-term accumulation indicates that the market is transitioning from panic-driven selling toward base formation. Selective altcoin outperformance reflects growing emphasis on real adoption and infrastructure relevance. Liquidity conditions are gradually stabilizing following periods of stress, reducing immediate liquidation risk. At the same time, macro sensitivity continues to rise, highlighting crypto’s deepening integration into global financial systems.

Strategic positioning in this environment requires a disciplined, multi-layered approach. Bitcoin exposure should be built gradually at structurally significant levels, guided by funding trends, exchange flows, and long-term holder behavior. Altcoin allocation should prioritize fundamental strength, developer activity, and sustainable adoption. Macro variables such as interest rates, yield curves, and dollar strength should be incorporated into timing decisions. Risk control remains essential through liquidity buffers, defined stop-loss structures, and avoidance of excessive leverage.

Time horizon alignment is another critical component of successful navigation. Structural transitions unfold over months rather than weeks, and short-term volatility is an inherent feature of these phases. Medium- to long-term positioning allows investors to benefit from accumulation cycles while reducing the impact of short-term noise. Emotional trading and headline-driven reactions undermine consistency and increase exposure to unfavorable risk-reward conditions.

Overall, the current crypto market reflects a shift from speculative excess toward structural maturity. Institutional participation, selective adoption, on-chain transparency, and macro integration are reshaping how trends develop. Understanding market structure is now as important as analyzing price. Investors who focus on disciplined positioning, selective exposure, liquidity management, and integrated analysis are better positioned to manage downside risk while preparing for the next phase of sustainable growth. Patience, insight, and strategic consistency remain the defining advantages in this evolving landscape.

Bitcoin continues to function as the primary barometer of market sentiment and capital flow. Recent breakdowns below important technical thresholds have confirmed that the market is in a corrective and consolidation phase. However, on-chain indicators suggest that long-term holders and institutional participants are steadily accumulating, signaling confidence in Bitcoin’s long-term value proposition. Historically, major accumulation phases often emerge when retail sentiment is weak and volatility remains elevated. This dynamic reinforces the importance of gradual, scaled positioning at key support zones, combined with close monitoring of funding rates, liquidation activity, and transaction volume stabilization.

Altcoins remain closely correlated with Bitcoin in the short term, but structural differentiation is becoming more visible. Assets associated with Layer 2 scaling, decentralized finance, infrastructure, and real-world applications are beginning to outperform purely speculative tokens. This reflects a maturing market in which developer engagement, user adoption, and ecosystem integration are gaining importance. Strategic exposure should focus on projects with measurable traction and long-term relevance, while low-liquidity and narrative-driven tokens should be approached with caution due to their vulnerability during market corrections.

Liquidity dynamics remain a defining factor in short-term market behavior. Funding rates, open interest, leverage ratios, and derivatives positioning offer critical insight into market stress and sentiment extremes. After recent liquidation events, funding conditions have normalized, reducing immediate systemic risk. However, elevated leverage and concentrated positioning still represent latent volatility triggers. Monitoring exchange flows, stablecoin supply movements, and reserve changes provides additional context for identifying accumulation phases and potential stress points.

Macro correlations now exert significant influence over crypto market trends. Interest rate expectations, inflation data, currency strength, and geopolitical developments increasingly shape investor behavior. Crypto assets have become integrated into the broader risk-asset ecosystem, responding quickly to changes in global liquidity and monetary policy outlooks. Successful positioning therefore requires continuous integration of macro signals into technical and on-chain analysis, avoiding isolated interpretations that ignore broader economic conditions.

On-chain metrics offer deep insight into market psychology and capital distribution. Exchange inflows and outflows, wallet age analysis, dormant supply activity, and realized profit and loss metrics reveal where conviction is strengthening or weakening. Declining exchange inflows combined with increased long-term holder accumulation suggests growing confidence among patient participants. Meanwhile, spikes in realized losses and short-term holder capitulation often coincide with transitional phases. Integrating these signals allows for more precise timing and position sizing.

Several structural patterns are becoming increasingly evident across the ecosystem. Long-term accumulation indicates that the market is transitioning from panic-driven selling toward base formation. Selective altcoin outperformance reflects growing emphasis on real adoption and infrastructure relevance. Liquidity conditions are gradually stabilizing following periods of stress, reducing immediate liquidation risk. At the same time, macro sensitivity continues to rise, highlighting crypto’s deepening integration into global financial systems.

Strategic positioning in this environment requires a disciplined, multi-layered approach. Bitcoin exposure should be built gradually at structurally significant levels, guided by funding trends, exchange flows, and long-term holder behavior. Altcoin allocation should prioritize fundamental strength, developer activity, and sustainable adoption. Macro variables such as interest rates, yield curves, and dollar strength should be incorporated into timing decisions. Risk control remains essential through liquidity buffers, defined stop-loss structures, and avoidance of excessive leverage.

Time horizon alignment is another critical component of successful navigation. Structural transitions unfold over months rather than weeks, and short-term volatility is an inherent feature of these phases. Medium- to long-term positioning allows investors to benefit from accumulation cycles while reducing the impact of short-term noise. Emotional trading and headline-driven reactions undermine consistency and increase exposure to unfavorable risk-reward conditions.

Overall, the current crypto market reflects a shift from speculative excess toward structural maturity. Institutional participation, selective adoption, on-chain transparency, and macro integration are reshaping how trends develop. Understanding market structure is now as important as analyzing price. Investors who focus on disciplined positioning, selective exposure, liquidity management, and integrated analysis are better positioned to manage downside risk while preparing for the next phase of sustainable growth. Patience, insight, and strategic consistency remain the defining advantages in this evolving landscape.