In about two years, we'll probably look back at this period and realize that the metaverse wasn't just hype—it was the defining trend that reshaped how we think about digital assets, virtual economies, and online interaction. The infrastructure being built right now in Web3, from blockchain scaling solutions to immersive platforms, is laying the groundwork for something much bigger. What seemed speculative today will become the obvious narrative of tomorrow. The metaverse represents the convergence of gaming, finance, and social engagement in ways we're only beginning to understand.

MasterOfChaosTheory

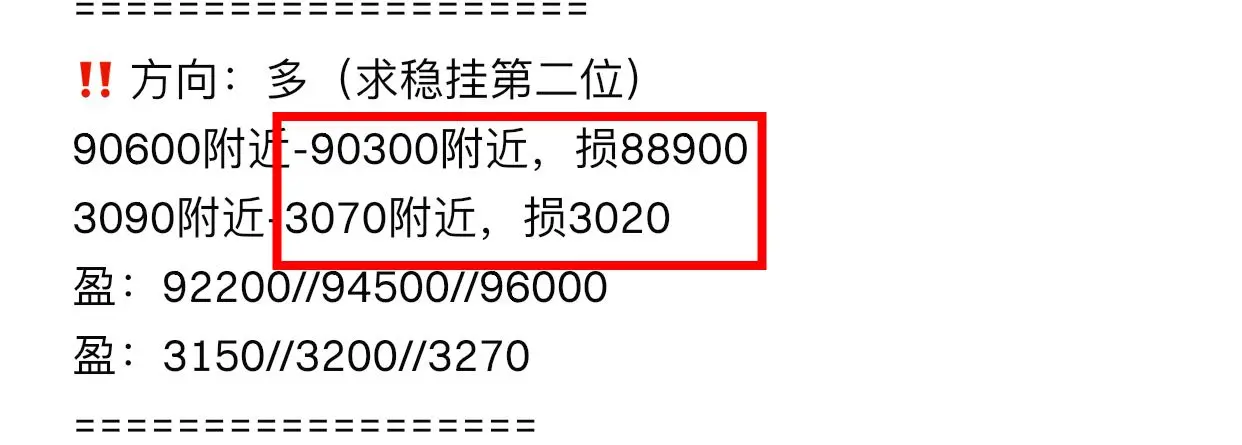

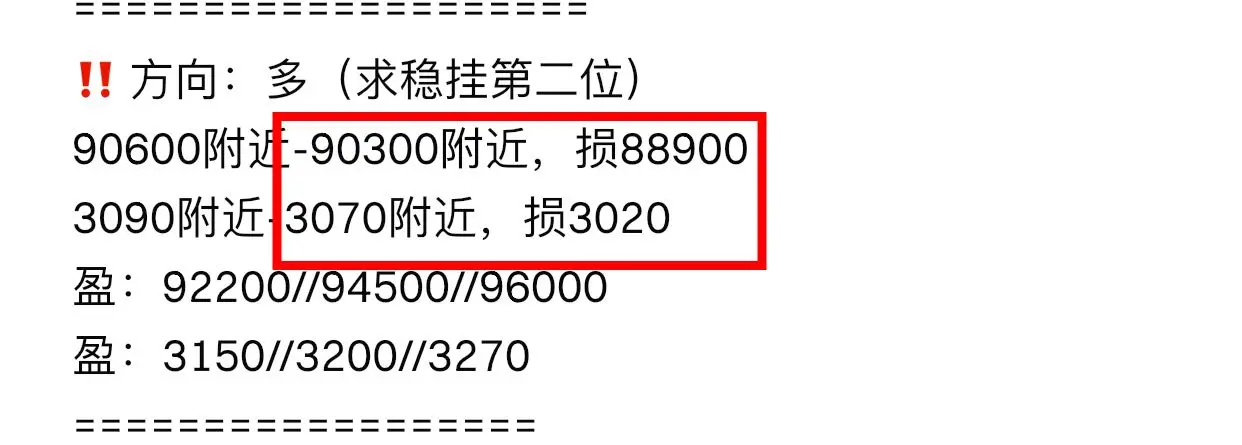

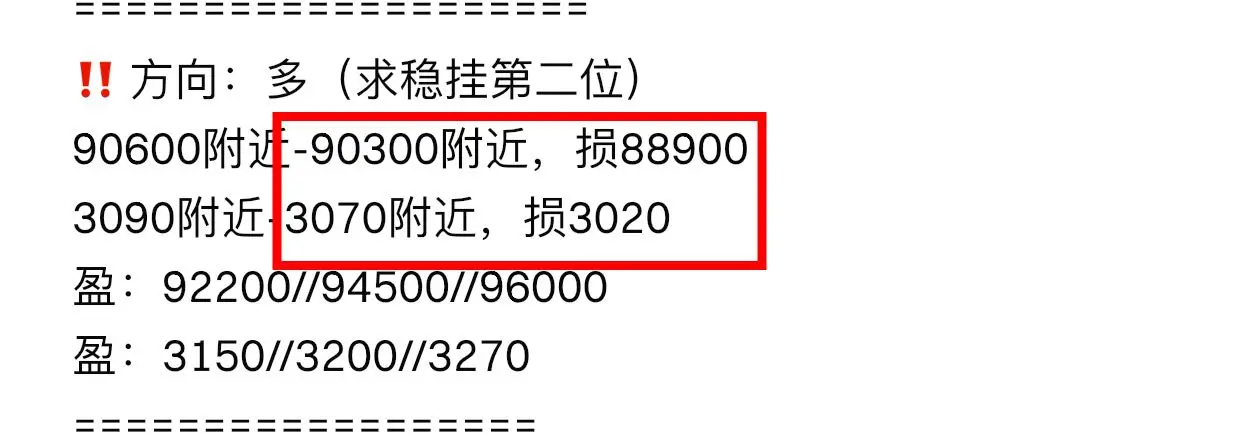

‼️ Guan Peace Wheel Brothers, give U‼️ Contract on the 13th / Spot order has been updated 👇 In the crypto circle, we only follow the right people. Thank you all for your support. The New Year 3.5GT5 discount has already exceeded 140 people. Last 1 person, act quickly if interested‼️ Apple click 👇

https://www.gate.com/zh/profile/ Chanlun Master

🔥 Recently ate over 2 million U‼️ Last week 3060/89700, more yesterday morning 3170/92450, high pressure, earned 150,000 📈 Yesterday morning 3170/92450, high pressure, short in the evening 3065/90050, took home 180,000 📉 Evening reversed to 3070/9

View Originalhttps://www.gate.com/zh/profile/ Chanlun Master

🔥 Recently ate over 2 million U‼️ Last week 3060/89700, more yesterday morning 3170/92450, high pressure, earned 150,000 📈 Yesterday morning 3170/92450, high pressure, short in the evening 3065/90050, took home 180,000 📉 Evening reversed to 3070/9

- Reward

- 10

- 10

- Repost

- Share

BigBigBigBigBigBubbleGum :

:

Hold on tight, we're about to take off 🛫View More

‼️ Guan Peace Wheel Brothers, give U‼️ Contract on the 13th / Spot order has been updated 👇 In the crypto world, only follow the right people. Thank you all for your support. The New Year 3.5GT 5% discount has already exceeded 140 people. Last 1 person, act quickly if interested‼️ Apple click 👇

https://www.gate.com/zh/profile/ Bitcoin King returns

🔥 Recently ate over 2 million U‼️ Last week 3060/89700, more yesterday morning 3170/92450, high pressure, earned 150,000 📈 Yesterday morning 3170/92450, high pressure, short in the evening, 3065/90050, took home 180,000 📉 Evening reversed to 3

View Originalhttps://www.gate.com/zh/profile/ Bitcoin King returns

🔥 Recently ate over 2 million U‼️ Last week 3060/89700, more yesterday morning 3170/92450, high pressure, earned 150,000 📈 Yesterday morning 3170/92450, high pressure, short in the evening, 3065/90050, took home 180,000 📉 Evening reversed to 3

- Reward

- 10

- 10

- Repost

- Share

BigBigBigBigBigBubbleGum :

:

Hold on tight, we're about to take off 🛫View More

‼️ Guan Peace Wheel Brothers, give U‼️ Contract on the 13th / Spot order has been updated 👇 In the crypto world, we only follow the right people. Thank you all for your support. The New Year 3.5GT5 discount has already surpassed 140 people. Only 1 spot left. Act quickly if interested‼️ Apple click 👇 https://www.gate.com/zh/profile/ Little Ghost Daily Contract

🔥 Recently ate over 2 million U‼️ Last week 3060/89700, more than yesterday morning 3170/92450, high pressure, profit of 150,000 📈 Yesterday morning 3170/92450, high pressure, short in the evening, 3065/90050, took home 180,000 📉 Eve

View Original🔥 Recently ate over 2 million U‼️ Last week 3060/89700, more than yesterday morning 3170/92450, high pressure, profit of 150,000 📈 Yesterday morning 3170/92450, high pressure, short in the evening, 3065/90050, took home 180,000 📉 Eve

- Reward

- 10

- 10

- Repost

- Share

BigBigBigBigBigBubbleGum :

:

Hold on tight, we're about to take off 🛫View More

‼️ Guan Peace Wheel Brothers Give U‼️ Contract on the 13th / Spot Orders Updated 👇 In the crypto circle, only follow the right people. Thank you all for your support. The New Year 3.5GT5 discount has already exceeded 140 people. Last 1 person, act quickly if interested‼️ Apple click 👇

https://www.gate.com/zh/profile/ Chan Lang Market Analysis

🔥 Recently ate over 2 million U‼️ Last week 3060/89700+, yesterday morning 3170/92450, high pressure, earned 150,000 📈 Yesterday morning 3170/92450, high pressure, short in the evening 3065/90050, took home 180,000 📉 Evening reversed to 3070/90300+,

View Originalhttps://www.gate.com/zh/profile/ Chan Lang Market Analysis

🔥 Recently ate over 2 million U‼️ Last week 3060/89700+, yesterday morning 3170/92450, high pressure, earned 150,000 📈 Yesterday morning 3170/92450, high pressure, short in the evening 3065/90050, took home 180,000 📉 Evening reversed to 3070/90300+,

- Reward

- 10

- 10

- Repost

- Share

BigBigBigBigBigBubbleGum :

:

Hold on tight, we're about to take off 🛫View More

- Reward

- 12

- 7

- Repost

- Share

NFT_Therapy_Group :

:

To be honest, who knows what will happen in two years? No matter how loud the talk is now, it all depends on whether it can be implemented.View More

Certain crypto hubs have become notorious for a particular pattern: devs launch projects, accumulate LP rewards in the early phase, then quietly exit—leaving token holders to face the consequences. This cycle of liquidity farming followed by abandonment repeats itself constantly in major trading centers. It's become a defining feature of some ecosystems where quick profits trump project sustainability.

- Reward

- 7

- 7

- Repost

- Share

GasFeeCry :

:

Hmm... it's the same old trick. The golden cycle for LP farm owners has long been seen through.View More

Goldman Sachs portfolio manager survey reveals a sobering picture: fewer than one in six respondents expect Trump administration policies to deliver positive outcomes for the United States and the rest of the world. This skepticism among institutional money managers reflects broader concerns about policy direction and its ripple effects on global markets. For crypto investors tracking macro trends, such sentiment readings matter—they signal potential shifts in risk appetite and capital allocation strategies that could influence asset flows in the months ahead.

- Reward

- 6

- 7

- Repost

- Share

NFT_Therapy_Group :

:

Institutions are so pessimistic, so retail investors like us should buy the dip even more.View More

A major exchange has recently started using the stop-loss hunting tactic. XMR was directly hammered down to 1144, nearly doubling. Fortunately, I hold spot holdings and won't get wiped out. But if you're trading futures, the guys shorting are probably wiped out entirely; no one can escape. Is the exchange trying to eat retail traders' stop-losses? It's really ruthless.

View Original

- Reward

- 15

- 7

- Repost

- Share

WealthCoffee :

:

Coming back with this again? The guys in the contract are really unlucky; one spike and they were wiped out.View More

Overview of Spot Trading行情 in the Past 15 Minutes

📈 Top 3 Gainers:

$MTL (Metal DAO) leads with a 5.53% increase

$LSK (Lisk) follows closely with a 1.51% rise

$ID (Space ID) also records a 1.47% increase

📉 Top 3 Losers:

$DOLO (Dolomite) leads with a 4.89% decline

$KAITO (Kaito) drops by 2.28%

Another coin drops by 2.42%

The spot market has experienced quite a bit of volatility, mainly small-cap tokens in these 15 minutes, while large investors are still observing.

View Original📈 Top 3 Gainers:

$MTL (Metal DAO) leads with a 5.53% increase

$LSK (Lisk) follows closely with a 1.51% rise

$ID (Space ID) also records a 1.47% increase

📉 Top 3 Losers:

$DOLO (Dolomite) leads with a 4.89% decline

$KAITO (Kaito) drops by 2.28%

Another coin drops by 2.42%

The spot market has experienced quite a bit of volatility, mainly small-cap tokens in these 15 minutes, while large investors are still observing.

- Reward

- 12

- 7

- Repost

- Share

MevHunter :

:

MTL has risen again. Is this wave about to take off? I feel like it's time to get on board.View More

#密码资产动态追踪 The privacy coin $DASH, which has been overlooked by the market, has recently regained attention. After months of silence, trading activity has significantly increased, and the price has already been at a relatively low level. From a technical perspective, there are clear signs of a rally—exactly the kind of entry opportunity many traders have been waiting for. Looking at the bottom range, there is still room for upward movement, and short-term bulls have plenty of operational space. For investors looking to seize the opportunity, this current time window is worth serious considerat

DASH18,73%

- Reward

- 8

- 7

- Repost

- Share

YieldChaser :

:

Dash hasn't had any activity for a while, and suddenly it's active again? Feels like it's always fooling people like this.View More

Ever notice how the same players pumping meme coin narratives today were the ones who crushed faith in them yesterday? It's a cycle—hype it up, then flip and trash it. That's how you keep retail guessing and chasing. The narrative shifts, but the players stay the same.

- Reward

- 12

- 7

- Repost

- Share

TestnetNomad :

:

This strategy is really clever. After one wave of profit-taking, another wave comes, and the retail investors will never wake up, haha.View More

Why stick with traditional financial advisors when algorithms can handle it better? Software-driven solutions and automated trading strategies are reshaping how people manage their portfolios. From DeFi protocols to robo-advisors, the shift toward decentralized and algorithmic finance is already here. It's faster, cheaper, and removes intermediaries. The future of wealth management doesn't need gatekeepers anymore.

- Reward

- 11

- 7

- Repost

- Share

BTCRetirementFund :

:

Are algorithms smarter than humans? Well, then how come the "smart people" at the Federal Reserve in 2008 couldn't prevent it? Sometimes, a bit of human intuition is still necessary.View More

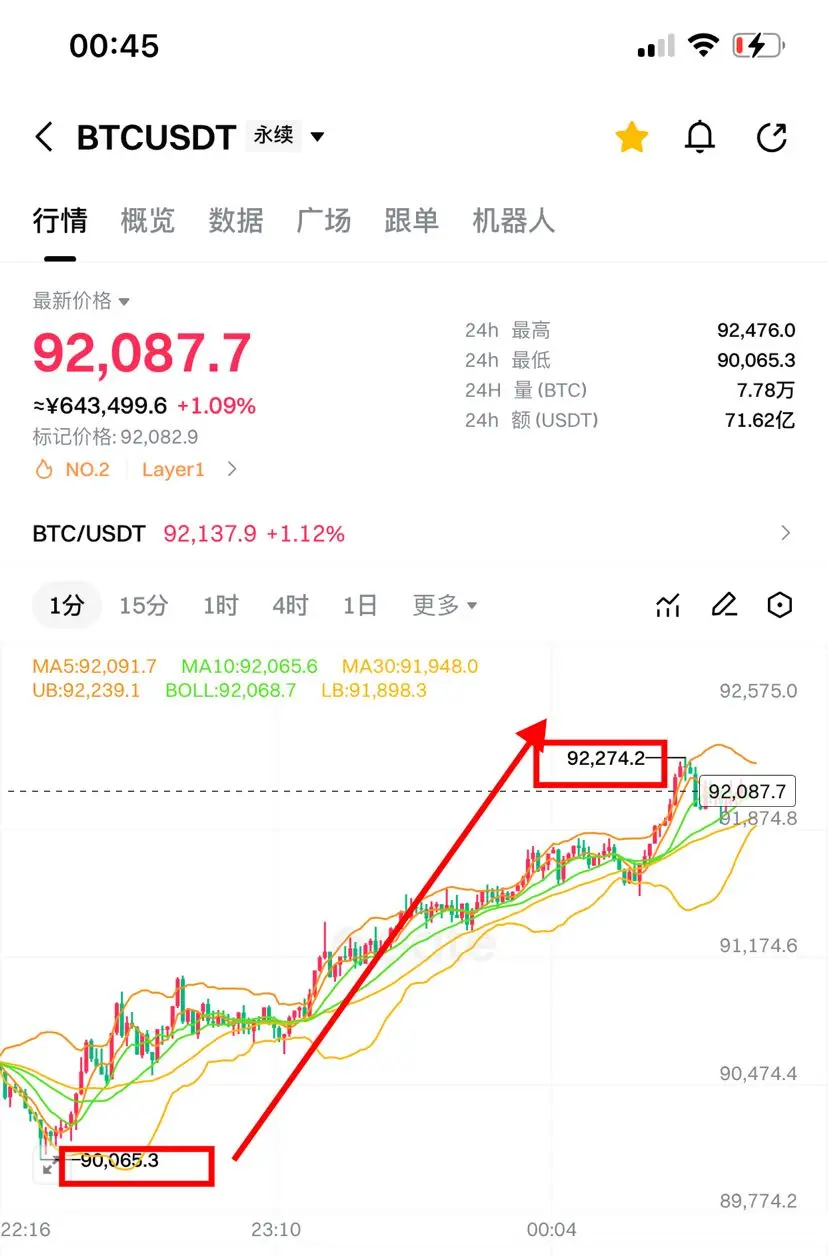

Yesterday, Bitcoin mostly stayed within that range, giving both bulls and bears opportunities to act in the short term. There were two trading moves during the day—first shorting, then going long. The 9.2K level was well captured, and I exited the position in time.

What is the current situation? Multiple attempts to break through 9.2K have failed to hold, and it ultimately pulled back for a correction. The overall structure still looks like a consolidation, with bulls and bears pulling in opposite directions. At this point, don’t be blinded by a one-sided market; instead, keep an eye on the si

What is the current situation? Multiple attempts to break through 9.2K have failed to hold, and it ultimately pulled back for a correction. The overall structure still looks like a consolidation, with bulls and bears pulling in opposite directions. At this point, don’t be blinded by a one-sided market; instead, keep an eye on the si

BTC-0,98%

- Reward

- 6

- 7

- Repost

- Share

SighingCashier :

:

9.2K this hurdle has been stuck for so long, it's really stressful. From your actions, it looks good. I agree with the idea of buying more on dips, but risk management must keep up.

View More

Wall Street's Current Blind Spot: Could This Be The Next Big Short?

There's growing discussion among market observers about a significant vulnerability in mainstream finance that bears striking similarities to the conditions preceding the 2008 crisis. While institutional investors remain focused on traditional metrics, certain market dynamics suggest they're missing critical warning signs. The parallels to the Big Short narrative are becoming harder to ignore—excessive leverage, underpriced risk, and widespread complacency across major financial institutions. Whether this develops into a major

There's growing discussion among market observers about a significant vulnerability in mainstream finance that bears striking similarities to the conditions preceding the 2008 crisis. While institutional investors remain focused on traditional metrics, certain market dynamics suggest they're missing critical warning signs. The parallels to the Big Short narrative are becoming harder to ignore—excessive leverage, underpriced risk, and widespread complacency across major financial institutions. Whether this develops into a major

- Reward

- 14

- 7

- Repost

- Share

ChainComedian :

:

Leverage, risk pricing failure, institutional numbness... We've seen this combination before; it was how things were played in 2008.View More

SOL is currently quoted at 138 USDT, oscillating close to the middle band of the Bollinger Bands at 138.20. This position may seem ordinary, but it is actually a watershed for short-term bulls and bears—whether the support can hold effectively directly affects whether the price can continue to break upward.

From a technical indicator perspective, the MACD shows a slight death cross, but there is a detail worth noting: the green histogram bars have not continued to expand. In other words, although the bears have the upper hand, the momentum has not been fully released, and the overall market is

From a technical indicator perspective, the MACD shows a slight death cross, but there is a detail worth noting: the green histogram bars have not continued to expand. In other words, although the bears have the upper hand, the momentum has not been fully released, and the overall market is

SOL-2,95%

- Reward

- 12

- 7

- Repost

- Share

AirdropFatigue :

:

Once you can't get past this hurdle of 136, be really careful going forward.View More

The Thai government is strengthening its regulation of gray capital flows. Recently, relevant authorities issued directives to tighten regulatory frameworks simultaneously in the fields of gold trading and digital assets.

In terms of digital assets, the new policy particularly emphasizes the strict implementation of the "Travel Rule"—which requires trading platforms to record and verify the full identity information of both parties involved in cross-border transfers, similar to anti-money laundering standards in traditional finance. This means exchanges need to establish more detailed user dat

View OriginalIn terms of digital assets, the new policy particularly emphasizes the strict implementation of the "Travel Rule"—which requires trading platforms to record and verify the full identity information of both parties involved in cross-border transfers, similar to anti-money laundering standards in traditional finance. This means exchanges need to establish more detailed user dat

- Reward

- 5

- 7

- Repost

- Share

DefiPlaybook :

:

The travel rules are coming, and the good days of on-chain anonymity are probably truly over. Southeast Asia is about to collectively go ashore, with Thailand leading the way, and other countries will definitely follow suit. Those who still want to rely on exchanges to milk profits will need to change their plans.View More

Gold performed well intraday today, with the second trade of the day directly capturing 14 points, bought at a cost of $4236. The long position at 4579 that was previously set up also smoothly exited at 4593. This short-term rhythm was quite well caught.

Currently, the US CPI data is affecting market nerves, and the main lines of XRP and SOL are also gathering momentum, especially the upward trend of Solana which is indeed worth paying attention to. The MSCI's attitude towards the digital asset market is gradually loosening, and there may be some variables ahead. Stay observant and continue to

View OriginalCurrently, the US CPI data is affecting market nerves, and the main lines of XRP and SOL are also gathering momentum, especially the upward trend of Solana which is indeed worth paying attention to. The MSCI's attitude towards the digital asset market is gradually loosening, and there may be some variables ahead. Stay observant and continue to

- Reward

- 7

- 7

- Repost

- Share

ForkLibertarian :

:

14 points cut directly, this pace is indeed impressive, and once again, the bottom has been successfully reached, right? SOL's recent surge is quite interesting; let's see if the CPI release will break the deadlock.

If MSCI loosens, digital assets really need to be cautious; there are too many variables.

View More

What will the financial landscape look like in 2026? Let's see what major global institutions are saying — stablecoins are quietly changing the game.

The latest market analysis indicates that as stablecoin usage surges, traditional fiat currencies in emerging markets face a new challenge: the reliance of local residents on government-issued currency is decreasing. Although stablecoins claim to be "stable," they are fundamentally eroding the government's control over the money supply.

This is not just a technical issue but a power issue. As more people use stablecoins instead of their local cur

View OriginalThe latest market analysis indicates that as stablecoin usage surges, traditional fiat currencies in emerging markets face a new challenge: the reliance of local residents on government-issued currency is decreasing. Although stablecoins claim to be "stable," they are fundamentally eroding the government's control over the money supply.

This is not just a technical issue but a power issue. As more people use stablecoins instead of their local cur

- Reward

- 15

- 7

- Repost

- Share

AltcoinTherapist :

:

What is the central bank afraid of? Basically, it's afraid of losing control.View More

Recently, a significant policy move in the United States has attracted the attention of the crypto market. The relevant legislation passed at the end of last year has officially come into effect, marking the first systematic definition of digital assets at the regulatory level in the US. Among them, the implementation of the stablecoin regulatory framework is particularly crucial—clear rules that have been lacking for years are now finally being articulated officially.

The market responded enthusiastically. Many participants pointed out that this indicates a shift in the traditional financial

View OriginalThe market responded enthusiastically. Many participants pointed out that this indicates a shift in the traditional financial

- Reward

- 8

- 7

- Repost

- Share

TokenUnlocker :

:

The stablecoin framework has finally been implemented. The previous feeling of being cut down by regulators is gone, but now there's concern that future regulations might become even stricter... Policy certainty = capital inflow. This logic is sound, but don't forget that the clearer the rules, the more restrictions there are.

Basically, what is coming will come eventually. Instead of hiding, it's better to prepare psychologically early.

Certainty > Uncertainty. This wave marks a fundamental shift in the underlying logic, but greedy traders might end up being the bagholders again.

The US has played this hand aggressively—embracing innovation while tightly controlling risks. As the compliant ecosystem develops, retail investors might find it even harder to participate.

This narrative looks good on the surface, but in reality, you need to choose the right projects; otherwise, even if regulations come, you might still not be able to escape.

View More

Load More