Don't guess randomly when bottoming out Bitcoin! "This indicator" has accurately identified the bottom of previous bear markets.

2h ago

JPMorgan: Bitcoin futures are oversold, and gold is expected to reach $8,500.

7h ago

Trending Topics

View More151.45K Popularity

11.86K Popularity

393.84K Popularity

2.39K Popularity

15.08K Popularity

Hot Gate Fun

View More- MC:$0.1Holders:10.00%

- MC:$2.4KHolders:10.00%

- MC:$0.1Holders:00.00%

- MC:$2.42KHolders:10.00%

- MC:$2.42KHolders:00.00%

Pin

Don't guess randomly when bottoming out Bitcoin! "This indicator" has accurately identified the bottom of previous bear markets.

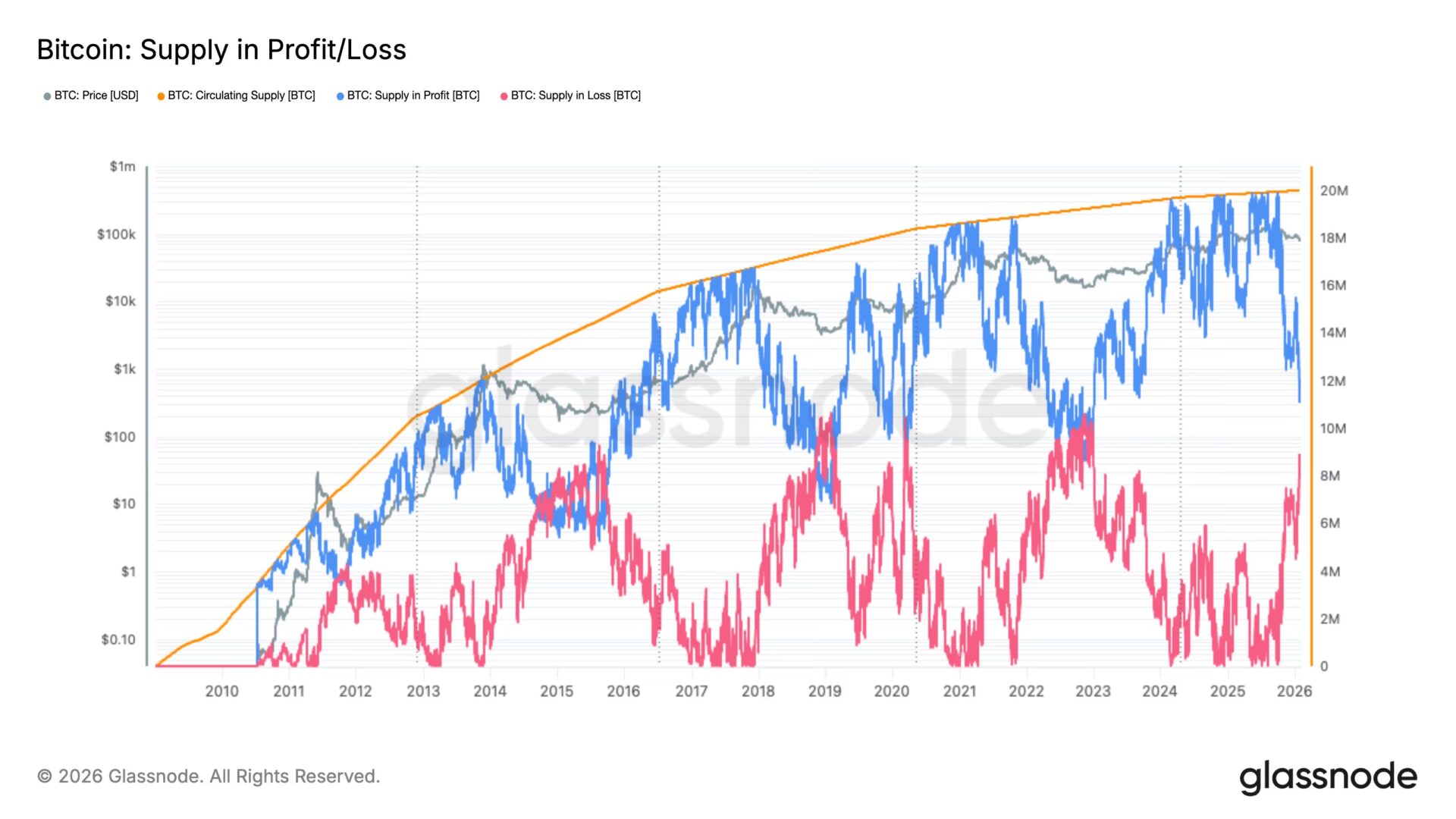

In the cryptocurrency market, “bottom fishing” is an extremely tempting yet highly risky game. If you are also passionate about finding market turning points, this on-chain indicator that has been tested through multiple bull and bear cycles might become your “North Star” for accurately identifying bottoms in a bear market. This indicator is called “Bitcoin Profit and Loss Supply,” mainly used to measure the overall profit and loss status of coin holders in the market — how many Bitcoins are still showing profits on paper, and how many are trapped in unrealized losses. Historical data repeatedly proves that when the “Profit Bitcoin Supply” and the “Loss Bitcoin Supply” trend toward balance, or even intersect on the chart, it often signals that the bear market bottom has formed, indicating that the market has entered the final stage of “capitulation selling,” and the long-term strategic window of opportunity is opening. For bullish investors hoping for a return to a bull market, good news may be just around the corner. Data shows that the number of profit chips and loss chips is showing a trend of about to “intersect.” According to Glassnode statistics, approximately 11 million Bitcoins are currently in profit, meaning these holdings are acquired at a lower cost than the current market price; at the same time, about 8.9 million Bitcoins are in loss. The gap between the two is narrowing, and if this convergence trend continues, it could reenact the bottoming scripts of 2022 and 2018-19. In Glassnode’s analysis chart, the blue line represents the “Profit Supply,” while the red line represents the “Loss Supply.”

When Bitcoin’s spot price fluctuates, moving around the overall cost basis of investors’ holdings, the chips will flow between these two camps. By observing the rise and fall of these two lines, we can gain deep insights into the market’s holding structure and the stress test faced by investors.

Looking back at past cycles, the “intersecting points” of these two lines have accurately marked the bear market bottoms multiple times:

In Glassnode’s analysis chart, the blue line represents the “Profit Supply,” while the red line represents the “Loss Supply.”

When Bitcoin’s spot price fluctuates, moving around the overall cost basis of investors’ holdings, the chips will flow between these two camps. By observing the rise and fall of these two lines, we can gain deep insights into the market’s holding structure and the stress test faced by investors.

Looking back at past cycles, the “intersecting points” of these two lines have accurately marked the bear market bottoms multiple times: