# IranTradeSanctions

17.39K

Trump says the U.S. will impose a 25% tariff on countries trading with Iran. Do you think this will be enforced or political pressure remians? Could it escalate geopolitics and impact financial and crypto markets?

Luna_Star

#IranTradeSanctions

• Global markets are once again closely monitoring developments around Iran trade sanctions, as renewed enforcement signals and diplomatic uncertainty continue to shape energy markets, regional trade flows, and broader geopolitical risk sentiment.

• Iran remains one of the world’s most strategically important energy producers, and any tightening or relaxation of sanctions has immediate ripple effects across oil prices, shipping routes, insurance costs, and currency markets.

• Recent discussions around sanction compliance and enforcement have increased volatility in crude

• Global markets are once again closely monitoring developments around Iran trade sanctions, as renewed enforcement signals and diplomatic uncertainty continue to shape energy markets, regional trade flows, and broader geopolitical risk sentiment.

• Iran remains one of the world’s most strategically important energy producers, and any tightening or relaxation of sanctions has immediate ripple effects across oil prices, shipping routes, insurance costs, and currency markets.

• Recent discussions around sanction compliance and enforcement have increased volatility in crude

- Reward

- 2

- 4

- Repost

- Share

Falcon_Official :

:

DYOR 🤓View More

#IranTradeSanctions Iran’s trade sanctions story in early 2026 has escalated from a long-running geopolitical tool into a wide-ranging force reshaping global economics and diplomacy. What began as targeted penalties tied to nuclear concerns and regional behavior has morphed into one of the most complex cross-border legislative and diplomatic challenges in recent decades. The multifaceted sanctions now not only restrict Tehran’s access to capital and technology, but also place pressure on Iran’s entire network of trading partners and global supply chains.

A dramatic recent development came when

A dramatic recent development came when

- Reward

- 9

- 24

- Repost

- Share

MrFlower_XingChen :

:

2026 GOGOGO 👊View More

🎊#IranTradeSanctions Trade at a Crossroads

Iran’s trade sanctions in early 2026 have escalated from a longstanding geopolitical tool into a broad force reshaping global economics and diplomacy. What began as targeted penalties related to nuclear concerns and regional behavior has evolved into one of the most complex cross-border legislative and diplomatic challenges in decades.

The sanctions now restrict Tehran’s access to capital and technology while placing pressure on Iran’s entire network of trading partners and global supply chains.

🚨 U.S. Tariff Threats Shake Global Markets

A dramatic

Iran’s trade sanctions in early 2026 have escalated from a longstanding geopolitical tool into a broad force reshaping global economics and diplomacy. What began as targeted penalties related to nuclear concerns and regional behavior has evolved into one of the most complex cross-border legislative and diplomatic challenges in decades.

The sanctions now restrict Tehran’s access to capital and technology while placing pressure on Iran’s entire network of trading partners and global supply chains.

🚨 U.S. Tariff Threats Shake Global Markets

A dramatic

- Reward

- 5

- 57

- Repost

- Share

Crypto_Buzz_with_Alex :

:

🚀 “Next-level energy here — can feel the momentum building!”View More

#IranTradeSanctions

Recent sanctions on Iran, particularly new measures from the U.S. and the European Union, focus heavily on its oil shipping networks and key trading partners. The goal is to cut off revenue Iran uses for its internal security and military programs.

Below is a summary of the current situation and its main targets:

1. United States Sanctions (Updated January 23, 2026)

· Primary Target: Iran's "shadow fleet" of oil tankers and their management companies.

· Key Action: Added 8 companies and 9 vessels to the Specially Designated Nationals (SDN) list, blocking their U.S. assets.

Recent sanctions on Iran, particularly new measures from the U.S. and the European Union, focus heavily on its oil shipping networks and key trading partners. The goal is to cut off revenue Iran uses for its internal security and military programs.

Below is a summary of the current situation and its main targets:

1. United States Sanctions (Updated January 23, 2026)

· Primary Target: Iran's "shadow fleet" of oil tankers and their management companies.

· Key Action: Added 8 companies and 9 vessels to the Specially Designated Nationals (SDN) list, blocking their U.S. assets.

- Reward

- 9

- 16

- Repost

- Share

AngelEye :

:

Happy New Year! 🤑View More

#IranTradeSanctions Trade at a Crossroads

Iran’s trade sanctions in early 2026 have escalated from a longstanding geopolitical tool into a broad force reshaping global economics and diplomacy. What began as targeted penalties related to nuclear concerns and regional behavior has evolved into one of the most complex cross-border legislative and diplomatic challenges in decades.

The sanctions now restrict Tehran’s access to capital and technology while placing pressure on Iran’s entire network of trading partners and global supply chains.

🚨 U.S. Tariff Threats Shake Global Markets

A dramatic de

Iran’s trade sanctions in early 2026 have escalated from a longstanding geopolitical tool into a broad force reshaping global economics and diplomacy. What began as targeted penalties related to nuclear concerns and regional behavior has evolved into one of the most complex cross-border legislative and diplomatic challenges in decades.

The sanctions now restrict Tehran’s access to capital and technology while placing pressure on Iran’s entire network of trading partners and global supply chains.

🚨 U.S. Tariff Threats Shake Global Markets

A dramatic de

- Reward

- 12

- 19

- Repost

- Share

repanzal :

:

Happy New Year! 🤑View More

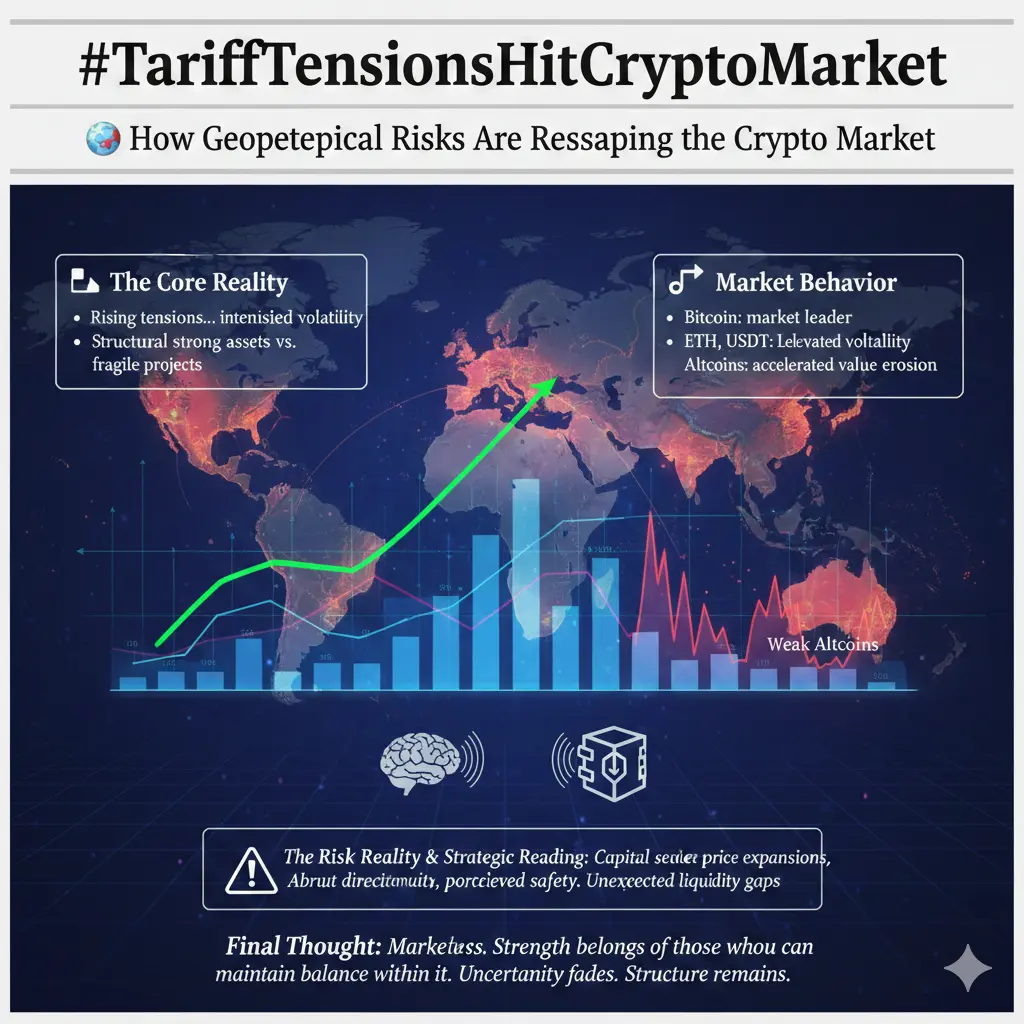

#IranTradeSanctions 💥 The United States’ threat to impose a 25% tariff on countries trading with Iran has sent ripples across global trade, geopolitics, and financial markets. While enforcement remains uncertain, the perception of risk alone is enough to drive volatility across equities, commodities, and digital assets. Market participants are reacting not just to policy announcements, but to the potential structural implications of disrupted trade flows.

Macro and Geopolitical Context

Iran is a major oil producer, and any restriction on its exports could immediately affect global energy mark

Macro and Geopolitical Context

Iran is a major oil producer, and any restriction on its exports could immediately affect global energy mark

- Reward

- 21

- 40

- Repost

- Share

Gazi007 :

:

btc will pump soon lets se whats happendView More

Iran Trade Sanctions: Understanding the Implications and Strategic Benefits for Investors and Traders

Former President Trump’s announcement of a 25% tariff on countries trading with Iran has drawn significant attention across financial, commodity, and crypto markets. While the immediate reaction may appear negative due to potential geopolitical tension, there are several strategic insights and potential benefits for traders and investors who approach this situation with analysis and foresight.

One of the key benefits for investors is early market positioning. Geopolitical announcements like th

Former President Trump’s announcement of a 25% tariff on countries trading with Iran has drawn significant attention across financial, commodity, and crypto markets. While the immediate reaction may appear negative due to potential geopolitical tension, there are several strategic insights and potential benefits for traders and investors who approach this situation with analysis and foresight.

One of the key benefits for investors is early market positioning. Geopolitical announcements like th

- Reward

- 16

- 15

- Repost

- Share

repanzal :

:

Buy To Earn 💎View More

Risk aversion in the financial markets is activated but will not be amplified indefinitely

The biggest impact of Iran trade sanctions on the financial markets is to activate safe-haven logic rather than directly changing the economic growth trajectory. Gold, the US dollar, and US Treasuries often attract funds in the initial stage of news, but this safe-haven effect is not linearly amplified; it presents a phased pattern.

The reason is that the market has long been accustomed to the backdrop of Middle East instability. Unless sanctions trigger substantial military or energy shocks, safe-haven

View OriginalThe biggest impact of Iran trade sanctions on the financial markets is to activate safe-haven logic rather than directly changing the economic growth trajectory. Gold, the US dollar, and US Treasuries often attract funds in the initial stage of news, but this safe-haven effect is not linearly amplified; it presents a phased pattern.

The reason is that the market has long been accustomed to the backdrop of Middle East instability. Unless sanctions trigger substantial military or energy shocks, safe-haven

[The user has shared his/her trading data. Go to the App to view more.]

- Reward

- 5

- 4

- Repost

- Share

HighAmbition :

:

2026 GOGOGO 👊View More

The Hidden Impact of Iran Sanctions on the Energy Market

When it comes to Iran trade sanctions, the market's first reaction is often to crude oil prices. However, the impact goes beyond just oil prices itself, affecting the entire energy pricing system's risk premium. As a major oil producer, Iran's export restrictions make the market more sensitive to "potential supply disruptions."

Even if actual crude oil flows do not show a significant decline, as long as sanctions exist, energy traders will price in uncertainty in advance. This is why oil prices tend to experience emotional spikes during

View OriginalWhen it comes to Iran trade sanctions, the market's first reaction is often to crude oil prices. However, the impact goes beyond just oil prices itself, affecting the entire energy pricing system's risk premium. As a major oil producer, Iran's export restrictions make the market more sensitive to "potential supply disruptions."

Even if actual crude oil flows do not show a significant decline, as long as sanctions exist, energy traders will price in uncertainty in advance. This is why oil prices tend to experience emotional spikes during

[The user has shared his/her trading data. Go to the App to view more.]

- Reward

- 6

- 6

- Repost

- Share

HighAmbition :

:

Buy To Earn 💎View More

#IranTradeSanctions Global markets are reacting to renewed geopolitical pressure after former U.S. President Donald Trump announced a 25% tariff on countries trading with Iran. While headlines highlight uncertainty, experienced investors know that volatility often creates opportunity — if approached strategically.

Market Impact at a Glance:

Geopolitical shifts tend to ripple through energy, commodities, currencies, equities, and crypto simultaneously. With Iran being a major energy producer, even the perception of restricted trade can influence oil prices, inflation expectations, and risk sent

Market Impact at a Glance:

Geopolitical shifts tend to ripple through energy, commodities, currencies, equities, and crypto simultaneously. With Iran being a major energy producer, even the perception of restricted trade can influence oil prices, inflation expectations, and risk sent

- Reward

- 2

- 2

- Repost

- Share

HighAmbition :

:

Buy To Earn 💎View More

Load More

Join 40M users in our growing community

⚡️ Join 40M users in the crypto craze discussion

💬 Engage with your favorite top creators

👍 See what interests you

Trending Topics

70.71K Popularity

45.2K Popularity

37.66K Popularity

16.04K Popularity

29.75K Popularity

21.37K Popularity

17.39K Popularity

87.54K Popularity

58.36K Popularity

27.49K Popularity

17.08K Popularity

6K Popularity

260.87K Popularity

26.99K Popularity

166.86K Popularity

News

View MorePin

Gate Square New & Returning Creator Rewards are ongoing!

Your ideas may be more valuable than you think!

Make your first post or come back post to share a $20,000 monthly prize pool!

Post with #MyFirstPostOnSquare to receive a $50 Position Voucher each

Monthly Top Posters and Top Engagers will each earn an extra $50 reward

Your crypto insights could inspire many—start creating today!

👉 https://www.gate.com/postGate Square “Creator Certification Incentive Program” — Recruiting Outstanding Creators!

Join now, share quality content, and compete for over $10,000 in monthly rewards.

How to Apply:

1️⃣ Open the App → Tap [Square] at the bottom → Click your [avatar] in the top right.

2️⃣ Tap [Get Certified], submit your application, and wait for approval.

Apply Now: https://www.gate.com/questionnaire/7159

Token rewards, exclusive Gate merch, and traffic exposure await you!

Details: https://www.gate.com/announcements/article/47889