# MacroOutlook

2.67K

MingDragonX

#FutureOutlook2026

Future Outlook & Market Impact (2026)

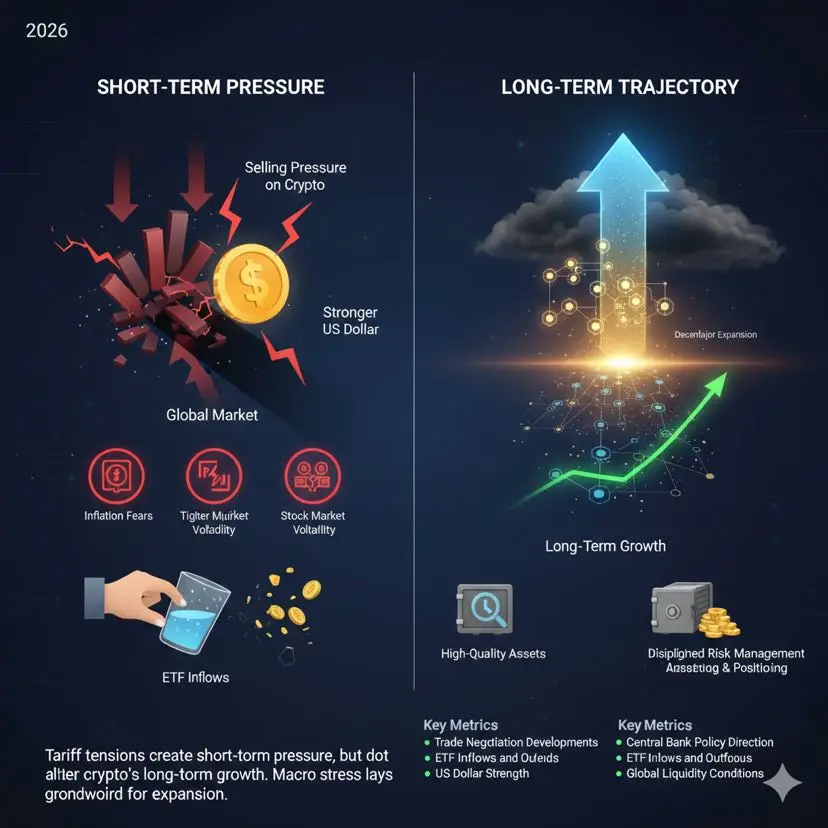

Rising global tariff tensions and renewed trade restrictions have become a powerful macro force shaping financial markets in 2026. As geopolitical pressure increases, cryptocurrencies—highly sensitive to liquidity conditions and investor psychology—are once again responding to uncertainty on a global scale.

When tariff conflicts escalate, markets typically shift into a risk-off environment. Investors reduce exposure to volatile assets and move capital toward perceived safety. This transition often creates immediate selling pressure acros

Future Outlook & Market Impact (2026)

Rising global tariff tensions and renewed trade restrictions have become a powerful macro force shaping financial markets in 2026. As geopolitical pressure increases, cryptocurrencies—highly sensitive to liquidity conditions and investor psychology—are once again responding to uncertainty on a global scale.

When tariff conflicts escalate, markets typically shift into a risk-off environment. Investors reduce exposure to volatile assets and move capital toward perceived safety. This transition often creates immediate selling pressure acros

BTC1,4%

- Reward

- 4

- 3

- Repost

- Share

ybaser :

:

2026 GOGOGO 👊View More

#FedRateCutPrediction Markets are watching the Fed closely — because rate cuts change everything.

🔹 Why Rate Cuts Matter:

• Lower rates = cheaper liquidity

• Risk assets get breathing room

• Investor sentiment slowly improves

🔹 Market Impact:

• Stocks: Relief rallies possible, focus on value & growth balance

• Crypto: Bitcoin and Ethereum often benefit from easier monetary policy

• Altcoins: Selective momentum, not blind pumps

🔹 Reality Check:

• Cuts won’t be instant moon signals

• Data-driven decisions can delay expectations

• Volatility remains part of the game

📌 Prediction View:

The Fed

🔹 Why Rate Cuts Matter:

• Lower rates = cheaper liquidity

• Risk assets get breathing room

• Investor sentiment slowly improves

🔹 Market Impact:

• Stocks: Relief rallies possible, focus on value & growth balance

• Crypto: Bitcoin and Ethereum often benefit from easier monetary policy

• Altcoins: Selective momentum, not blind pumps

🔹 Reality Check:

• Cuts won’t be instant moon signals

• Data-driven decisions can delay expectations

• Volatility remains part of the game

📌 Prediction View:

The Fed

- Reward

- 6

- 2

- Repost

- Share

HanssiMazak :

:

HODL Tight 💪View More

Load More

Join 40M users in our growing community

⚡️ Join 40M users in the crypto craze discussion

💬 Engage with your favorite top creators

👍 See what interests you

Trending Topics

16.27K Popularity

79.5K Popularity

29K Popularity

11.16K Popularity

11.88K Popularity

10.3K Popularity

9.67K Popularity

9.56K Popularity

75.04K Popularity

22.36K Popularity

83.08K Popularity

23.92K Popularity

50.93K Popularity

44.49K Popularity

197.9K Popularity

News

View MoreThe White House convenes bank and crypto industry executives on Monday to discuss the Senate crypto bill

6 m

The Federal Reserve raises its assessment of economic activity, stating that the pace of expansion is steady

7 m

The three major US stock indices have limited short-term fluctuations

8 m

US Dollar Index DXY surges 1% intraday, currently at 96.72

8 m

Federal Reserve FOMC statement removes language about downside risks to employment

8 m

Pin