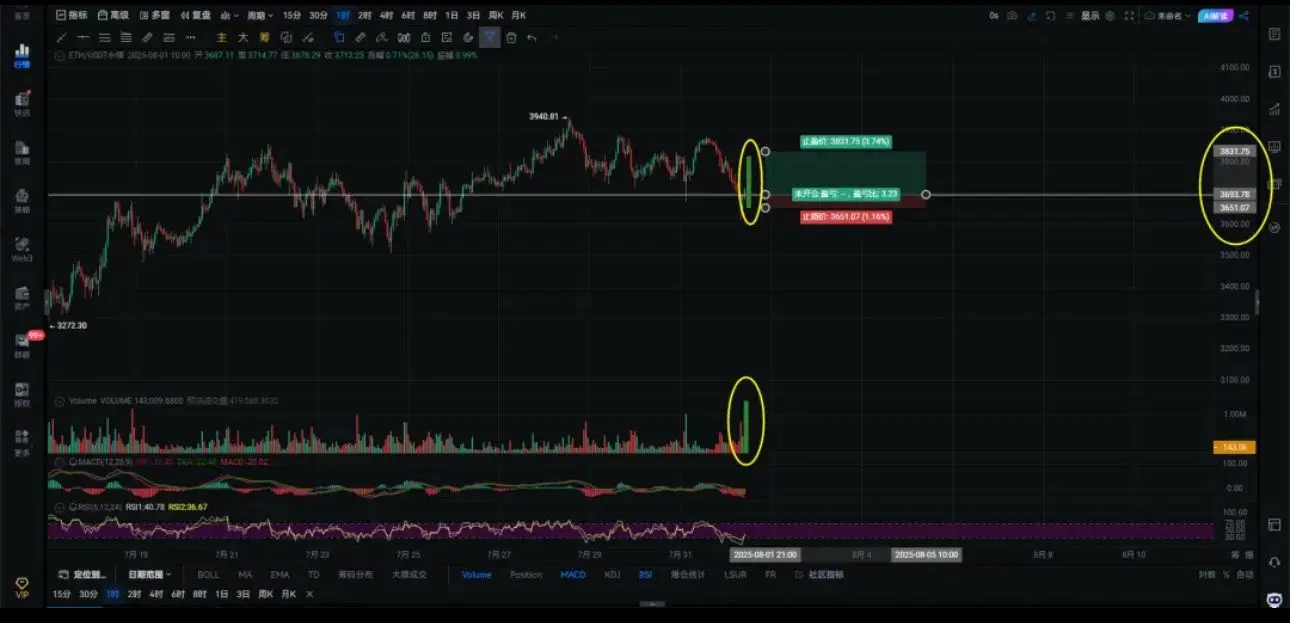

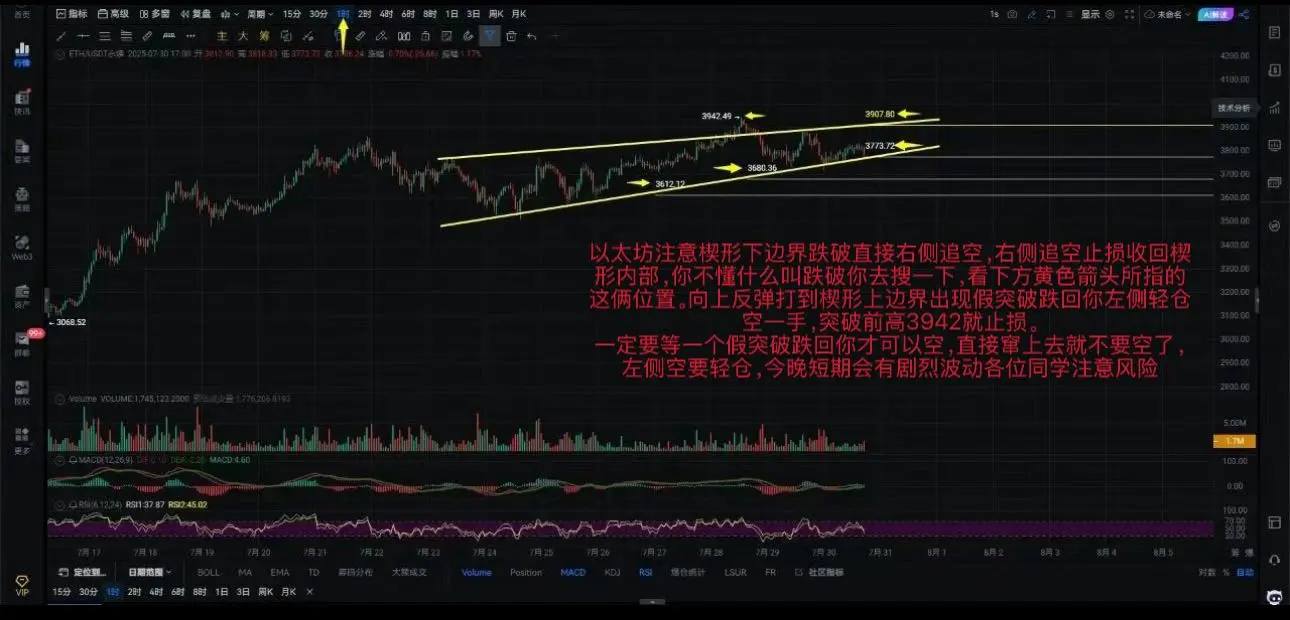

Range trading and key level strategies under the hidden concerns of the Ethereum head and shoulders pattern

The core logic and potential path of the head and shoulders pattern

• Expectation of a rebound at the right shoulder of the head and shoulders pattern: If a head and shoulders pattern forms on the hourly chart, there could be a rebound to around 3850 dollars at the right shoulder, and after the rebound ends, it will continue to decline—currently, attention should be paid to the strength of the rebound, with 3639 dollars being a key resistance. If it cannot break through, the right shoul

The core logic and potential path of the head and shoulders pattern

• Expectation of a rebound at the right shoulder of the head and shoulders pattern: If a head and shoulders pattern forms on the hourly chart, there could be a rebound to around 3850 dollars at the right shoulder, and after the rebound ends, it will continue to decline—currently, attention should be paid to the strength of the rebound, with 3639 dollars being a key resistance. If it cannot break through, the right shoul

ETH-3.72%