12:00

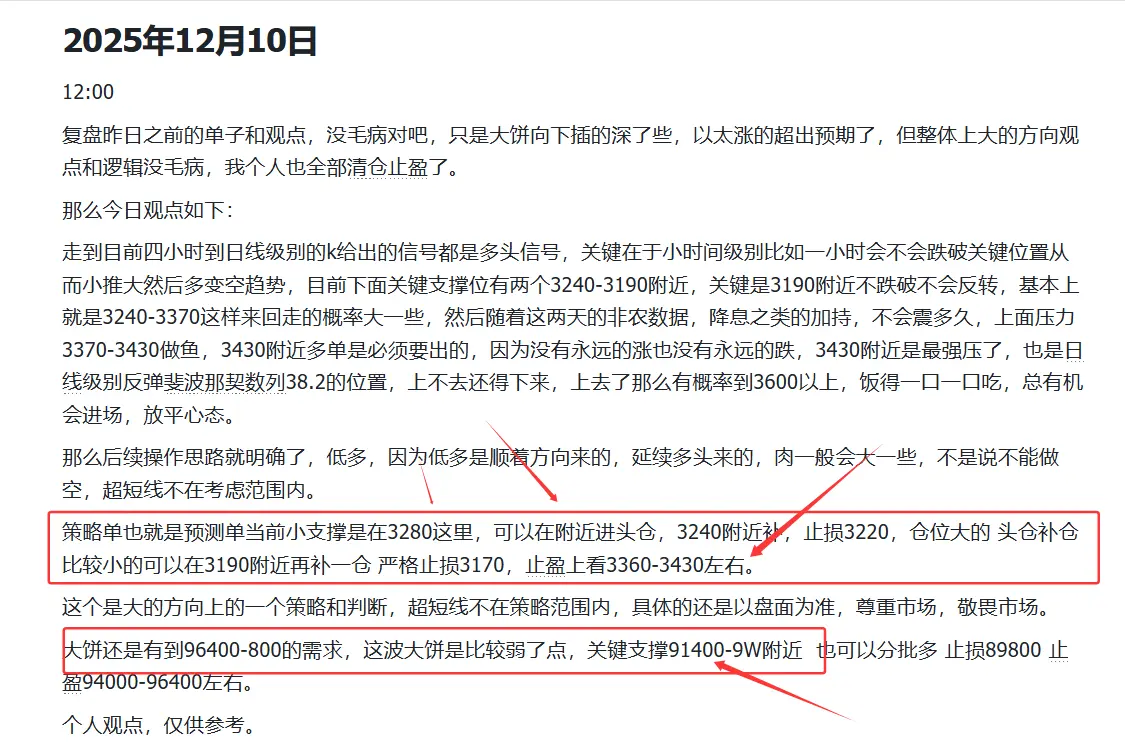

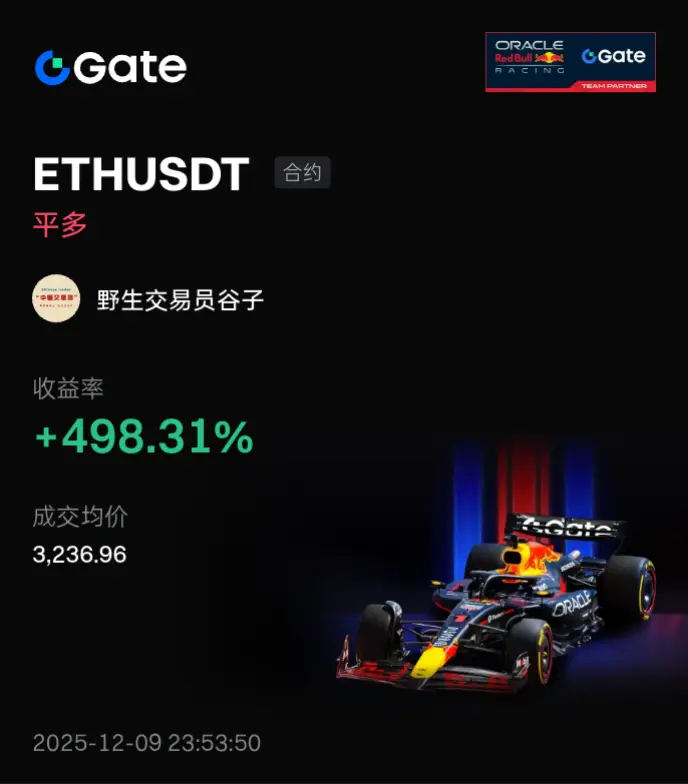

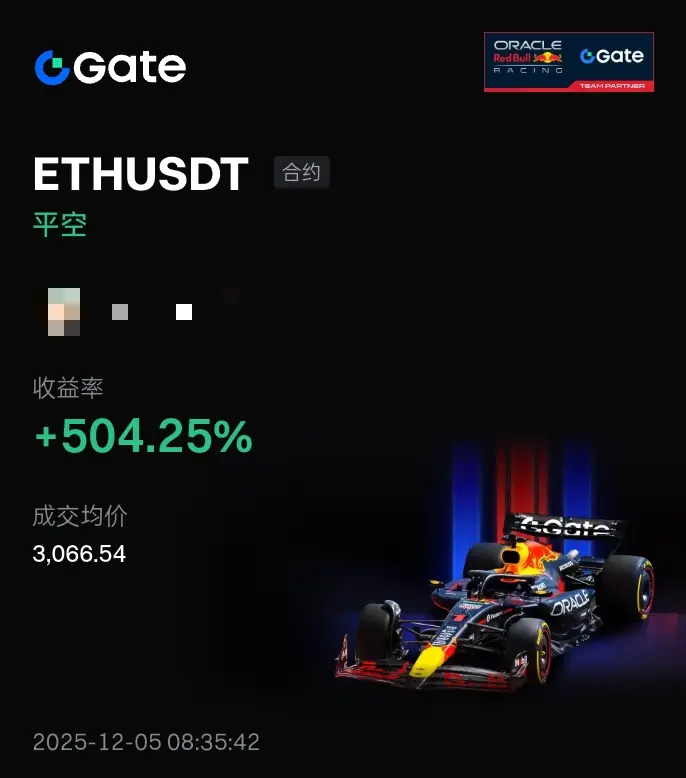

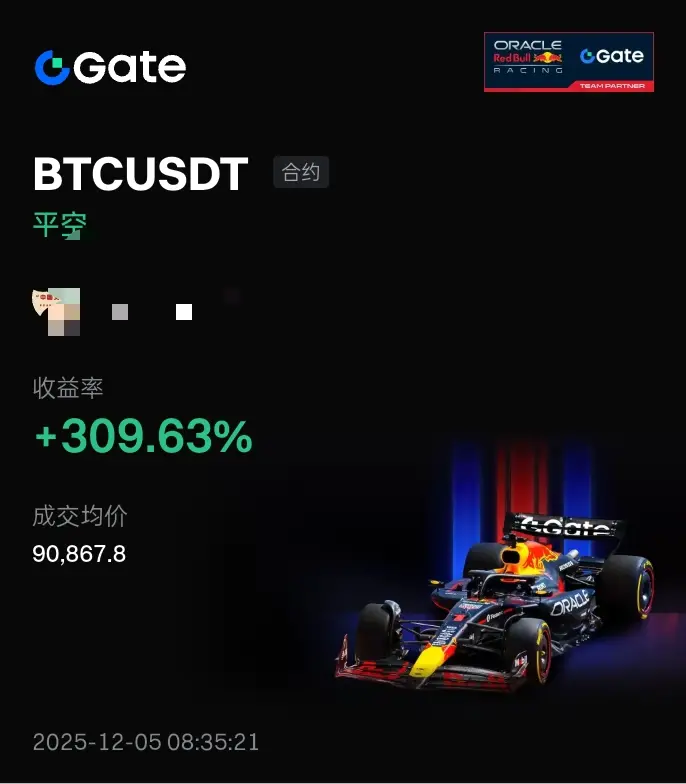

Looking back at yesterday's previous orders and opinions, there is nothing wrong with it, but the BTC is inserted deeper, and the ether has risen more than expected, but there is nothing wrong with the overall direction views and logic, and I personally have cleared all of them and taken profits.

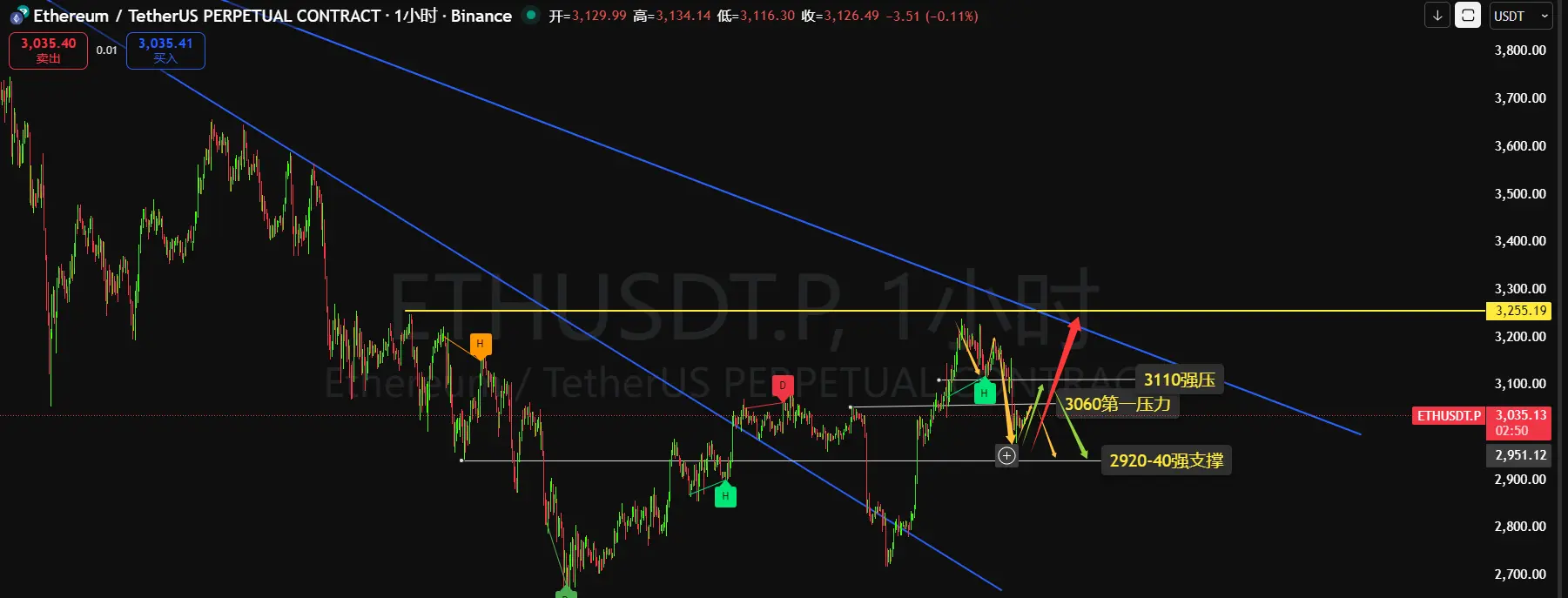

So today's views are as follows: to the current four-hour to the daily level of k given signals are bullish signals, the key is to the small time level, such as whether one hour will fall below the key position to push small and then change the short trend, at present, there are two key support levels around 3240-3190, the key is that 3190 does not fall below and will not reverse, basically 3240-3370 so that the probability of going back and forth is greater, and then with the non-farm payroll data of these two days, interest rate cuts and other blessings, it will not be shocked for long, The pressure above is 3370-3430 to make fish, and the long order near 3430 must come out, because there is no eternal rise and no permanent fall, the vicinity of 3430 is the strongest pressure, and it is also the position of the daily rebound Fibonacci sequence of 38.2, if you can't go up, you have to come down, and there is such a probability that it will go up to more than 3600, and you have to eat the meal one bite at a time, and there is always a chance to enter the market and calm your mind.

Then the follow-up operation idea is clear, low lot, because the low is in the direction, continuing the bulls, the meat will generally be larger, not that you can't go short, ultra-short-term is not within the scope of consideration.

The strategy order, that is, the prediction order, the current small support is 3280 here, you can enter the opening position nearby, make up near 3240, stop loss 3220, the position is large, the position is small, you can make up another position near 3190, the strict stop loss is 3170, and the take profit is about 3360-3430.

This is a strategy and judgment in the general direction, ultra-short-term is not within the scope of strategy, the specific is still subject to the disk, respect the market, and revere the market.

BTC still has a demand for 96400-800, this wave of BTC is relatively weak, the key support is around 91400-9W, you can also buy more in batches, stop loss 89800, take profit 94000-96400 or so.

Personal opinions, for reference only.

Looking back at yesterday's previous orders and opinions, there is nothing wrong with it, but the BTC is inserted deeper, and the ether has risen more than expected, but there is nothing wrong with the overall direction views and logic, and I personally have cleared all of them and taken profits.

So today's views are as follows: to the current four-hour to the daily level of k given signals are bullish signals, the key is to the small time level, such as whether one hour will fall below the key position to push small and then change the short trend, at present, there are two key support levels around 3240-3190, the key is that 3190 does not fall below and will not reverse, basically 3240-3370 so that the probability of going back and forth is greater, and then with the non-farm payroll data of these two days, interest rate cuts and other blessings, it will not be shocked for long, The pressure above is 3370-3430 to make fish, and the long order near 3430 must come out, because there is no eternal rise and no permanent fall, the vicinity of 3430 is the strongest pressure, and it is also the position of the daily rebound Fibonacci sequence of 38.2, if you can't go up, you have to come down, and there is such a probability that it will go up to more than 3600, and you have to eat the meal one bite at a time, and there is always a chance to enter the market and calm your mind.

Then the follow-up operation idea is clear, low lot, because the low is in the direction, continuing the bulls, the meat will generally be larger, not that you can't go short, ultra-short-term is not within the scope of consideration.

The strategy order, that is, the prediction order, the current small support is 3280 here, you can enter the opening position nearby, make up near 3240, stop loss 3220, the position is large, the position is small, you can make up another position near 3190, the strict stop loss is 3170, and the take profit is about 3360-3430.

This is a strategy and judgment in the general direction, ultra-short-term is not within the scope of strategy, the specific is still subject to the disk, respect the market, and revere the market.

BTC still has a demand for 96400-800, this wave of BTC is relatively weak, the key support is around 91400-9W, you can also buy more in batches, stop loss 89800, take profit 94000-96400 or so.

Personal opinions, for reference only.