User_any

สวัสดีทุกคน,

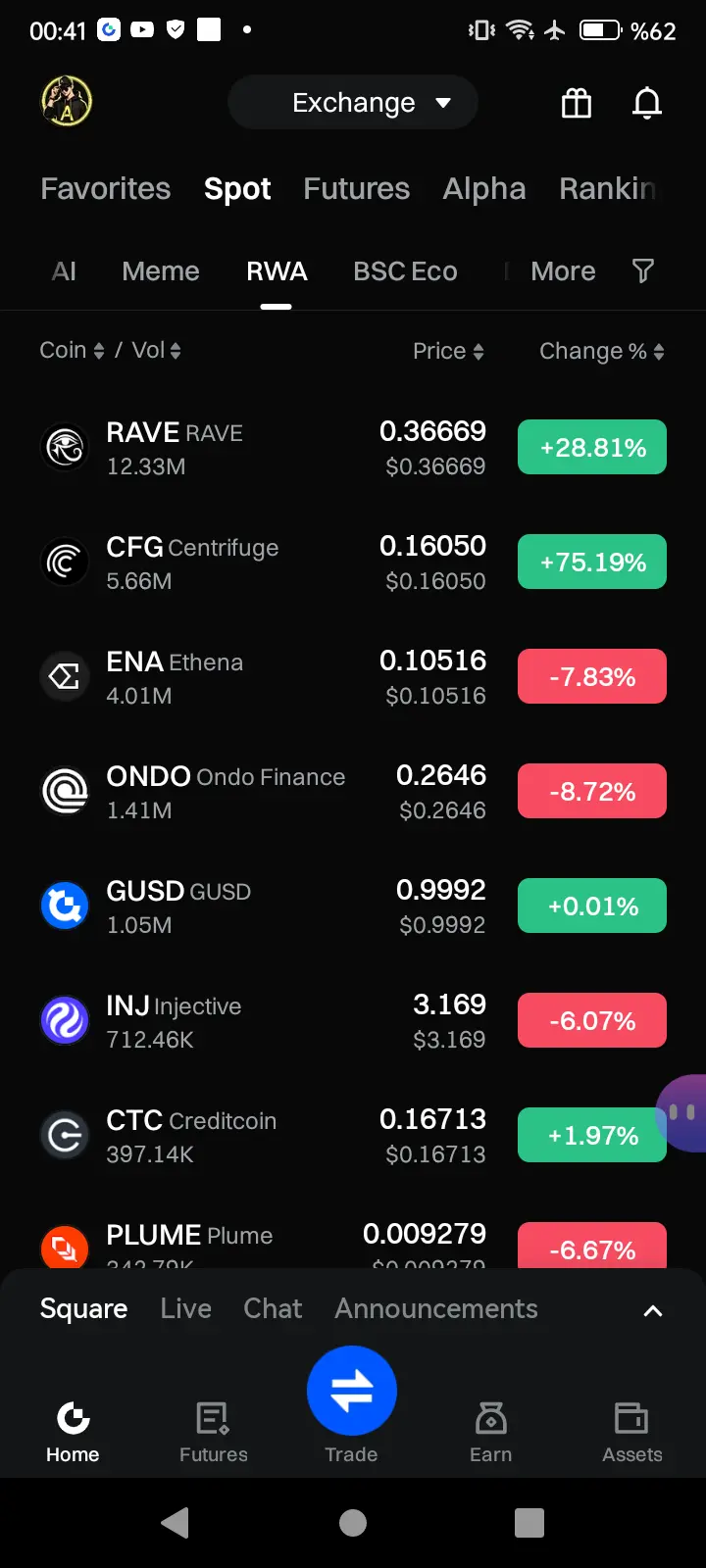

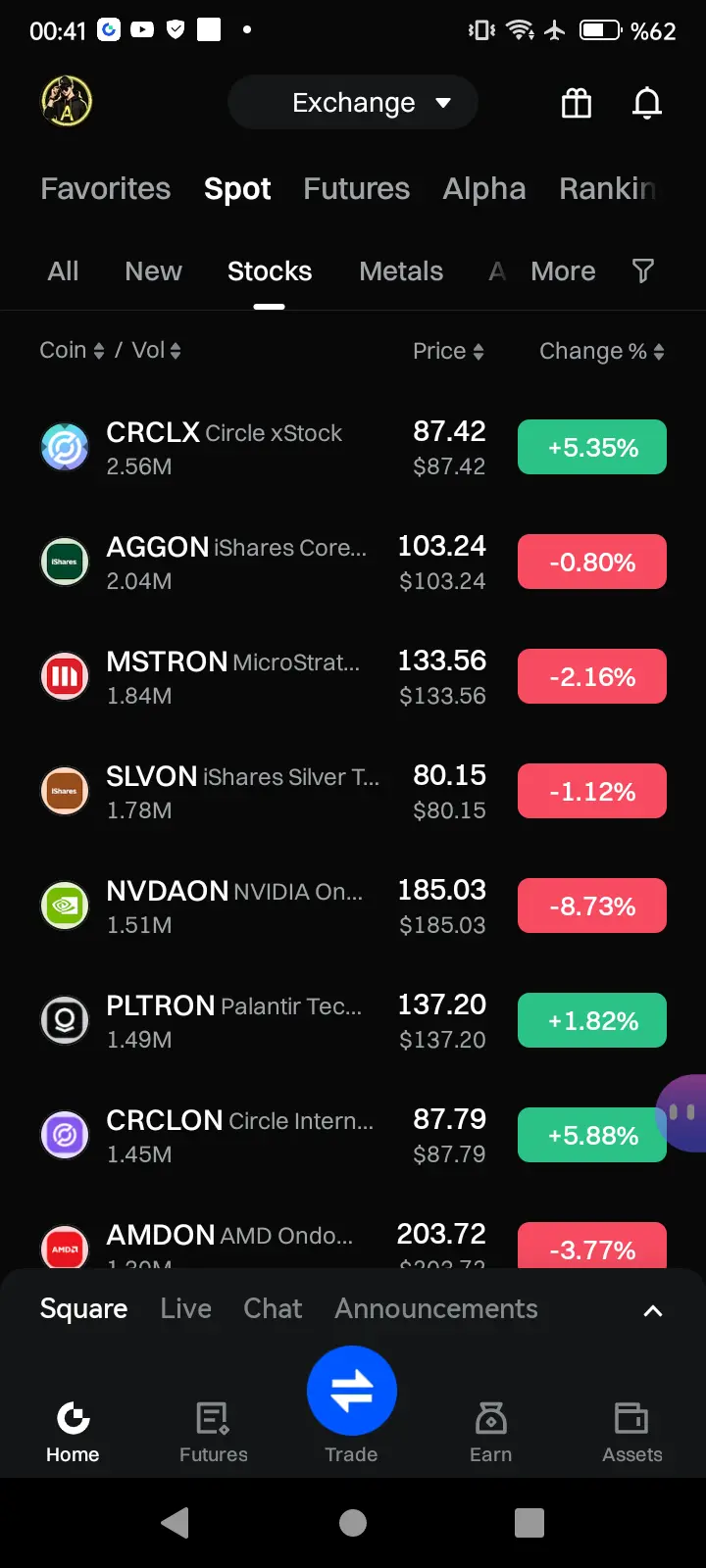

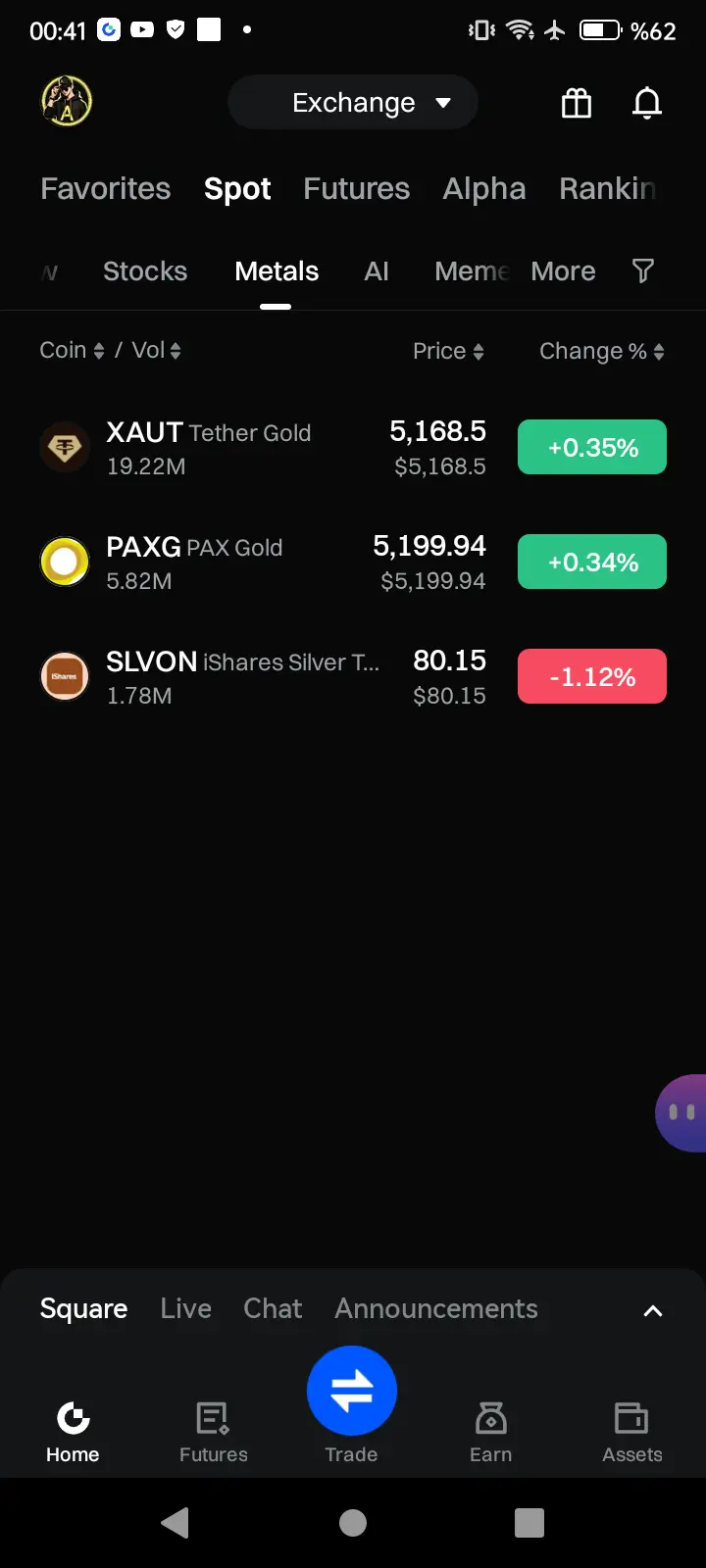

เรากำลังอยู่ในช่วงเปลี่ยนผ่านอย่างรวดเร็วจากความเข้าใจดั้งเดิมเกี่ยวกับคริปโตเคอร์เรนซี ไปสู่การบูรณาการเข้าสู่ระบบใหม่ ในฐานะผู้ใช้ GATE เราเป็นส่วนหนึ่งของการเปลี่ยนแปลงครั้งยิ่งใหญ่นี้ พร้อมกับ ETF, RWAs ได้กลายเป็นที่นิยมของนักลงทุนและพอร์ตโฟลิโอ มูลค่ากว่า 1,000 ล้านดอลลาร์ของกองทุนกำลังเคลื่อนย้ายออกจากตรรกะการลงทุนแบบดั้งเดิม และด้วยความเร่งของการทำโทเคนไนซ์ ความสนใจใน RWAs ก็เพิ่มขึ้นทุกวัน

ภายในปี 2025 ทุกอย่างจะเปลี่ยนไป เรากำลังเห็นการเปลี่ยนผ่านอย่างรวดเร็วจากเครื่องมือและความเข้าใจการลงทุนแบบดั้งเดิม ไปสู่แนวทางการลงทุนใหม่อย่างสมบูรณ์ ด้วย ETF และการทำโทเคนไนซ์ สินทร

ดูต้นฉบับเรากำลังอยู่ในช่วงเปลี่ยนผ่านอย่างรวดเร็วจากความเข้าใจดั้งเดิมเกี่ยวกับคริปโตเคอร์เรนซี ไปสู่การบูรณาการเข้าสู่ระบบใหม่ ในฐานะผู้ใช้ GATE เราเป็นส่วนหนึ่งของการเปลี่ยนแปลงครั้งยิ่งใหญ่นี้ พร้อมกับ ETF, RWAs ได้กลายเป็นที่นิยมของนักลงทุนและพอร์ตโฟลิโอ มูลค่ากว่า 1,000 ล้านดอลลาร์ของกองทุนกำลังเคลื่อนย้ายออกจากตรรกะการลงทุนแบบดั้งเดิม และด้วยความเร่งของการทำโทเคนไนซ์ ความสนใจใน RWAs ก็เพิ่มขึ้นทุกวัน

ภายในปี 2025 ทุกอย่างจะเปลี่ยนไป เรากำลังเห็นการเปลี่ยนผ่านอย่างรวดเร็วจากเครื่องมือและความเข้าใจการลงทุนแบบดั้งเดิม ไปสู่แนวทางการลงทุนใหม่อย่างสมบูรณ์ ด้วย ETF และการทำโทเคนไนซ์ สินทร

- รางวัล

- 26

- 23

- 5

- แชร์

PandaX :

:

สู่ดวงจันทร์ 🌕ดูเพิ่มเติม

การเติบโตของ AI ในคริปโต #DeepDiveCreatorCamp

วิธีที่ตัวแทนฉลาดกำลังเปลี่ยนเกม

เฮ้ โลกคริปโตไม่เคยหยุดนิ่งใช่ไหม? เมื่อไม่นานมานี้ ทุกคนกำลังพูดถึงว่า AI กำลังแทรกซึมเข้าไปในทุกอย่าง ตั้งแต่การชำระเงินไปจนถึงการเทรด และฉันคิดว่าจะมาแบ่งปันมุมมองของฉันเกี่ยวกับเรื่องนี้ มันคือกุมภาพันธ์ 2026 และด้วยไฟเขียวด้านกฎระเบียบที่ปรากฏขึ้นอย่างต่อเนื่อง การผสมผสาน AI-คริปโตนี้รู้สึกว่าจะระเบิดออกมาเร็ว ๆ นี้ ฉันได้ติดตามเรื่องนี้มาสักพักแล้ว และบอกตามตรง มันทำให้ฉันต้องคิดใหม่เกี่ยวกับกลยุทธ์ทั้งหมดของฉัน – ไม่ใช่แค่ hype แต่เป็นสิ่งจริงที่ทำให้คริปโตง่ายและฉลาดขึ้น

เริ่มกันที่พื้นฐาน: ตัวแทน AI ตัวแทนเ

ดูต้นฉบับวิธีที่ตัวแทนฉลาดกำลังเปลี่ยนเกม

เฮ้ โลกคริปโตไม่เคยหยุดนิ่งใช่ไหม? เมื่อไม่นานมานี้ ทุกคนกำลังพูดถึงว่า AI กำลังแทรกซึมเข้าไปในทุกอย่าง ตั้งแต่การชำระเงินไปจนถึงการเทรด และฉันคิดว่าจะมาแบ่งปันมุมมองของฉันเกี่ยวกับเรื่องนี้ มันคือกุมภาพันธ์ 2026 และด้วยไฟเขียวด้านกฎระเบียบที่ปรากฏขึ้นอย่างต่อเนื่อง การผสมผสาน AI-คริปโตนี้รู้สึกว่าจะระเบิดออกมาเร็ว ๆ นี้ ฉันได้ติดตามเรื่องนี้มาสักพักแล้ว และบอกตามตรง มันทำให้ฉันต้องคิดใหม่เกี่ยวกับกลยุทธ์ทั้งหมดของฉัน – ไม่ใช่แค่ hype แต่เป็นสิ่งจริงที่ทำให้คริปโตง่ายและฉลาดขึ้น

เริ่มกันที่พื้นฐาน: ตัวแทน AI ตัวแทนเ

- รางวัล

- 9

- 9

- repost

- แชร์

Last_Satoshi :

:

สู่ดวงจันทร์ 🌕ดูเพิ่มเติม

- รางวัล

- 7

- 5

- repost

- แชร์

WallStreetTrendResearch :

:

การเทรดเป็นเรื่องของความน่าจะเป็น ยิ่งน้อยการดำเนินการก็ยิ่งมีโอกาสชนะมากขึ้น เมื่อเห็นจุดที่เหมาะสมก็เพิ่มตำแหน่ง การซื้อเพิ่มเมื่อราคาต่ำและขายลดเมื่อราคาสูง อย่าทำการเทรดผิดทาง ไม่เช่นนั้นต้นทุนการถือครองจะเพิ่มขึ้นเรื่อย ๆดูเพิ่มเติม

เนื่องจากแผนงานในเดือนมีนาคมมีการเปลี่ยนแปลง การถ่ายทอดสดจะหยุดประมาณครึ่งเดือน เพื่อนๆ รอฉันกลับมานะ😄

เดือนกุมภาพันธ์ใกล้จะจบลงแล้ว เดือนนี้ฉันได้มอบผลลัพธ์ที่ดีให้กับตัวเอง ผลกำไรโดยรวมในสองสัปดาห์นั้นเกินกว่า 47.5% ของที่ผ่านมา ความใจเย็นและความสงบของฉันกลับมาแล้ว! การทำกำไรในตลาดสัญญาเป็นเรื่องยาก ไม่สามารถพูดได้ว่าฉันเก่งมาก แต่เมื่อเทียบกับตัวเองในอดีต ฉันก็พัฒนาขึ้น ฉันรู้สึกดีใจมากที่ฉันได้เรียนรู้ที่จะควบคุมตัวเอง!#加密市场反弹

ดูต้นฉบับเดือนกุมภาพันธ์ใกล้จะจบลงแล้ว เดือนนี้ฉันได้มอบผลลัพธ์ที่ดีให้กับตัวเอง ผลกำไรโดยรวมในสองสัปดาห์นั้นเกินกว่า 47.5% ของที่ผ่านมา ความใจเย็นและความสงบของฉันกลับมาแล้ว! การทำกำไรในตลาดสัญญาเป็นเรื่องยาก ไม่สามารถพูดได้ว่าฉันเก่งมาก แต่เมื่อเทียบกับตัวเองในอดีต ฉันก็พัฒนาขึ้น ฉันรู้สึกดีใจมากที่ฉันได้เรียนรู้ที่จะควบคุมตัวเอง!#加密市场反弹

- รางวัล

- 7

- 3

- repost

- แชร์

MissKitty :

:

สวัสดีปีใหม่ 🧨ดูเพิ่มเติม

- รางวัล

- 1

- 2

- repost

- แชร์

LirivasiIsATraditionalDance :

:

1000x Vibes 🤑ดูเพิ่มเติม

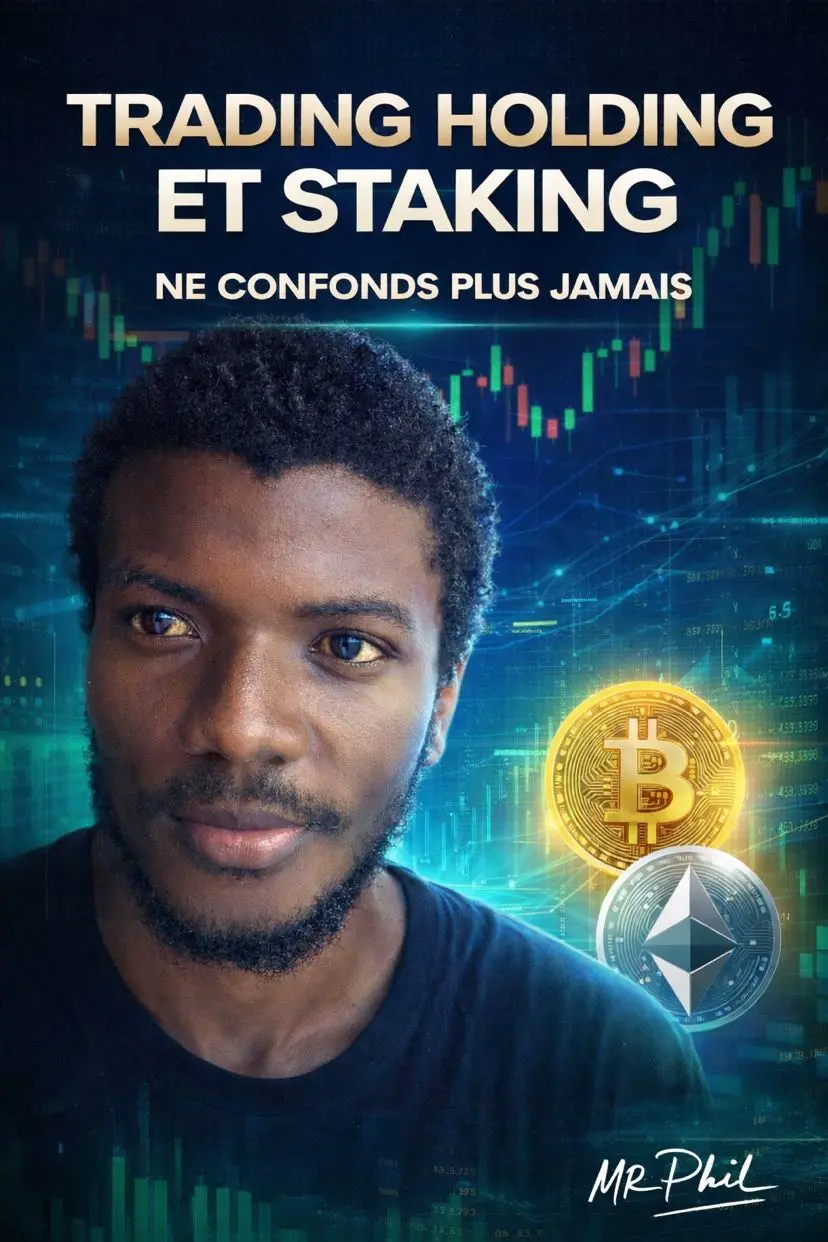

การเทรด การถือครอง และ การ staking: อย่าสับสนอีกต่อไป

ในคริปโตเคอร์เรนซี ไม่มีวิธีเดียวที่จะสร้างกำไรได้ แต่มีสามแนวทางหลัก

การเทรด

ซื้อและขายบ่อยครั้งเพื่อใช้ประโยชน์จากความผันผวนของราคา

ศักยภาพในการทำกำไรอย่างรวดเร็ว แต่มีความเสี่ยงสูงหากไม่มีกลยุทธ์ วินัย และการจัดการความเสี่ยง

เป็นวิธีที่ต้องใช้ความพยายาม แนะนำให้เรียนรู้ก่อนลงมือจริง

การถือครอง

ซื้อคริปโตเคอร์เรนซีและเก็บไว้ในระยะยาว

แนวทางที่เสถียรและน้อยความเครียดกว่า

เหมาะสำหรับผู้เริ่มต้นและนักลงทุนที่มีความอดทน

การ staking

ล็อคคริปโตของตนเพื่อมีส่วนร่วมในเครือข่ายและรับรางวัล

แนวทางที่เน้นรายได้แบบค่อยเป็นค่อยไปและแบบ passive

กำไรโดย

ดูต้นฉบับในคริปโตเคอร์เรนซี ไม่มีวิธีเดียวที่จะสร้างกำไรได้ แต่มีสามแนวทางหลัก

การเทรด

ซื้อและขายบ่อยครั้งเพื่อใช้ประโยชน์จากความผันผวนของราคา

ศักยภาพในการทำกำไรอย่างรวดเร็ว แต่มีความเสี่ยงสูงหากไม่มีกลยุทธ์ วินัย และการจัดการความเสี่ยง

เป็นวิธีที่ต้องใช้ความพยายาม แนะนำให้เรียนรู้ก่อนลงมือจริง

การถือครอง

ซื้อคริปโตเคอร์เรนซีและเก็บไว้ในระยะยาว

แนวทางที่เสถียรและน้อยความเครียดกว่า

เหมาะสำหรับผู้เริ่มต้นและนักลงทุนที่มีความอดทน

การ staking

ล็อคคริปโตของตนเพื่อมีส่วนร่วมในเครือข่ายและรับรางวัล

แนวทางที่เน้นรายได้แบบค่อยเป็นค่อยไปและแบบ passive

กำไรโดย

- รางวัล

- 1

- 1

- repost

- แชร์

Mr.Phil :

:

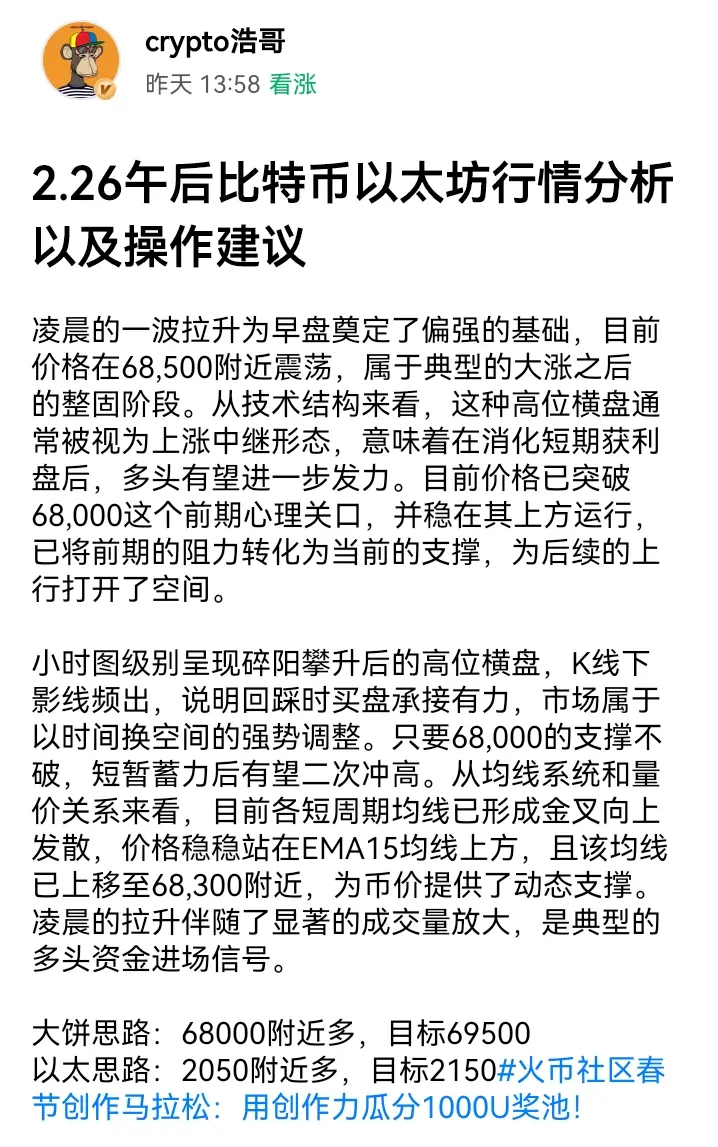

แล้วคุณบอกฉันว่าคุณรู้แล้วใช่ไหม?? แสดงความคิดเห็นของคุณที่นี่และกดติดตามแม้ว่าการปรับตัวลงอย่างรวดเร็วในช่วงเช้าจะทำให้ราคาลดลงแตะใกล้ #加密市场反弹 66600$BTC แต่จากมุมมองทางเทคนิค นี่กลับเป็นการทดสอบแนวรับสำคัญอย่างมีประสิทธิภาพ ตำแหน่งนี้ไม่เพียงแต่เป็นพื้นที่การซื้อขายที่หนาแน่นในช่วงก่อนหน้านี้ แต่ยังซ้อนทับกับเส้นค่าเฉลี่ยเคลื่อนที่ MA60 รายวัน ราคาที่แตะแล้วดีดตัวขึ้นอย่างรวดเร็วและสร้างแท่งเทียนหางยาวด้านล่าง แสดงให้เห็นว่ามีกำลังรับซื้อด้านล่างค่อนข้างแข็งแกร่ง เป็นสัญญาณว่าพลังของการปรับตัวลงกำลังหมดแรง และเป็นสัญญาณหยุดการปรับตัวลง นอกจากนี้ การลงลึกในรอบนี้ยังช่วยเคลียร์อัตราค่าธรรมเนียมของเงินกู้ที่สูงเกินไป ซึ่งช่วยลดแรงขายในช่วงต่อไป

เมื่อราคากลับขึ้นมาที

เมื่อราคากลับขึ้นมาที

BTC-1.03%

- รางวัล

- 2

- 4

- repost

- แชร์

WhenTheMountainDoesn'tMove,The :

:

2026 เร่งด่วน 👊ดูเพิ่มเติม

- รางวัล

- 3

- 1

- repost

- แชร์

mkmknjbhvgcf :

:

81 ก็ยังไปไม่ถึง ยังเหลือ 18- รางวัล

- 2

- 1

- repost

- แชร์

CryptoNomad :

:

อย่ากลัว อย่ารู้สึกเสียใจ อย่าบ่น พรุ่งนี้จะเข้าจดทะเบียน ซื้อในช่วงราคาต่ำ#深度创作营

#加密市场反弹

วันที่วุ่นวายอย่างบ้าคลั่งในตลาด! จังหวะของการฟื้นตัวนี้เกือบจะเหมือนในภาพยนตร์—เมื่อแรงกดดันทางกฎหมายเพิ่มขึ้น “มือที่มองไม่เห็น” ที่ตบตลาดทุกเช้าดูเหมือนจะได้ถอยหลัง

นี่คือสรุปความวุ่นวายปัจจุบันและความหมายต่อพอร์ตโฟลิโอของคุณ:

1. “ปริศนาสองทุ่ม”: บังเอิญหรือระวังตัวทางศาล?

การหายไปของการขายในเวลา 10 โมงเช้ากลายเป็นเรื่องพูดถึงกันทั่วเมือง เป็นเวลาหลายเดือนที่นักลงทุนล้อเลียน (และร้องไห้) เกี่ยวกับการขายออกอย่างเป็นระบบที่เกิดขึ้นเมื่อตลาดสหรัฐฯ เริ่มมีแรงผลักดัน

ตัวกระตุ้น: คดีความฟ้องร้อง Jane Street ซึ่งกล่าวหาการซื้อขายภายในในช่วงวิกฤต Terra ปี 2022 ได้ทำให้บริษัทนี้อ

ดูต้นฉบับ#加密市场反弹

วันที่วุ่นวายอย่างบ้าคลั่งในตลาด! จังหวะของการฟื้นตัวนี้เกือบจะเหมือนในภาพยนตร์—เมื่อแรงกดดันทางกฎหมายเพิ่มขึ้น “มือที่มองไม่เห็น” ที่ตบตลาดทุกเช้าดูเหมือนจะได้ถอยหลัง

นี่คือสรุปความวุ่นวายปัจจุบันและความหมายต่อพอร์ตโฟลิโอของคุณ:

1. “ปริศนาสองทุ่ม”: บังเอิญหรือระวังตัวทางศาล?

การหายไปของการขายในเวลา 10 โมงเช้ากลายเป็นเรื่องพูดถึงกันทั่วเมือง เป็นเวลาหลายเดือนที่นักลงทุนล้อเลียน (และร้องไห้) เกี่ยวกับการขายออกอย่างเป็นระบบที่เกิดขึ้นเมื่อตลาดสหรัฐฯ เริ่มมีแรงผลักดัน

ตัวกระตุ้น: คดีความฟ้องร้อง Jane Street ซึ่งกล่าวหาการซื้อขายภายในในช่วงวิกฤต Terra ปี 2022 ได้ทำให้บริษัทนี้อ

- รางวัล

- 4

- 1

- repost

- แชร์

CryptoChampion :

:

สู่ดวงจันทร์ 🌕- รางวัล

- 7

- 1

- repost

- แชร์

GateUser-afd1ce43 :

:

ของสะสมทองคำใหม่คืออะไร- รางวัล

- 2

- 1

- repost

- แชร์

GateUser-e606ef35 :

:

0.18แพลตฟอร์มการเทรดอนุพันธ์แบบถาวร Decibel ซึ่งเป็นบริษัทในเครือ Aptos Labs ได้เปิดตัวบนเครือข่ายหลักอย่างเป็นทางการ และเปิดตัวแผนคะแนนสะสมอย่างเป็นทางการ Decibel เริ่มต้นให้บริการเทรดอนุพันธ์แบบถาวร และต่อมาได้ขยายไปยังสินค้าตลาดและสินทรัพย์ที่มีความเสี่ยงตามน้ำหนัก (RWA) หลังจากเปิดตัว ปริมาณการเทรดของ Decibel อยู่ที่ 6.4 ล้านดอลลาร์สหรัฐ และมูลค่ารวมที่ล็อคไว้ (TVL) อยู่ที่ 57 ล้านดอลลาร์สหรัฐ Decibel สร้างขึ้นบนแพลตฟอร์ม Aptos และรองรับการเติมเงินผ่าน X-chain ของ Ethereum/Solana โมเดล CLOB บนเครือข่ายของ Decibel ช่วยให้การบริหารความเสี่ยงเป็นไปอย่างโปร่งใส ผู้รับผิดชอบมูลนิธิ Decibel เน้นย้ำว

ดูต้นฉบับ- รางวัล

- 2

- 1

- repost

- แชร์

GateUser-b8637901 :

:

เผยแพร่แล้ว เข้าร่วมกิจกรรม6万美元是不是比特币底部?多维度分析

目前 6 万美元之所以成为生死线,主要基于以下三个维度的深度博弈,这也是最容易出问题的地方:

1. 心理防御 vs. 诱空陷阱 (The Psychological Trap)

$60,000 是一个极强的整数心理关口。

* 疑问点: 市场往往不会在大家都看着的支撑位精准止跌。

* 风险: 经常会出现**“假跌破”**。机构可能会故意打穿 $60,000(比如跌到 $58,500 左右),诱导散户交出止损筹码,清理掉杠杆,然后迅速收回。如果你死守 $60,000 这个数字,很容易被“震仓”出局。

2. C 浪的对称性 (Wave C Equality)

在艾略特波浪理论中,C 浪通常与 A 浪具有一定的比例关系(通常是 C = A 或 C = 1.618 × A)。

* 计算: * A 浪跌幅:92,000 - 61,500 = 30,500 USD。

* 如果 C 浪等长于 A 浪:从 B 浪高点 66,200 起算,66,200 - 30,500 = 35,700 USD。

* 硬核现实: 按照严格的波浪比例,C 浪跌到 60,000 其实还没跌透。如果 3 月份跌破 6 万,下个技术目标位可能会直接指向 $52,000 - $55,000 区间。所以,目前的 6 万支撑更多是靠“共识”在撑着,而不是波浪的最终比例。

3. 矿

目前 6 万美元之所以成为生死线,主要基于以下三个维度的深度博弈,这也是最容易出问题的地方:

1. 心理防御 vs. 诱空陷阱 (The Psychological Trap)

$60,000 是一个极强的整数心理关口。

* 疑问点: 市场往往不会在大家都看着的支撑位精准止跌。

* 风险: 经常会出现**“假跌破”**。机构可能会故意打穿 $60,000(比如跌到 $58,500 左右),诱导散户交出止损筹码,清理掉杠杆,然后迅速收回。如果你死守 $60,000 这个数字,很容易被“震仓”出局。

2. C 浪的对称性 (Wave C Equality)

在艾略特波浪理论中,C 浪通常与 A 浪具有一定的比例关系(通常是 C = A 或 C = 1.618 × A)。

* 计算: * A 浪跌幅:92,000 - 61,500 = 30,500 USD。

* 如果 C 浪等长于 A 浪:从 B 浪高点 66,200 起算,66,200 - 30,500 = 35,700 USD。

* 硬核现实: 按照严格的波浪比例,C 浪跌到 60,000 其实还没跌透。如果 3 月份跌破 6 万,下个技术目标位可能会直接指向 $52,000 - $55,000 区间。所以,目前的 6 万支撑更多是靠“共识”在撑着,而不是波浪的最终比例。

3. 矿

BTC-1.03%

- รางวัล

- 4

- 1

- repost

- แชร์

SunshineRainbowLittleBullHorse :

:

2026 เร่งด่วน 👊【$POWER สัญญาณ】ปรับตัวขึ้นต่อเนื่อง + การปรับตัวในระดับ 1H แข็งแกร่ง รอการระเบิดครั้งที่สอง

$POWER ระดับ 1H หลังจากการพุ่งขึ้นอย่างรุนแรงในประวัติศาสตร์ ปัจจุบันอยู่ในช่วงพักตัวที่แข็งแกร่ง ราคาสร้างฐานในช่วง 1.67-1.85 โดยมี EMA20 (1.5246) ของ 1H เป็นแนวรับเชิงพลวัตที่แข็งแกร่ง แม้ระดับ 4H จะมีแท่งเทียนบนยาว แต่แนวโน้มโดยรวมยังเป็นการยืนยันการพักตัวหลังจากการทะลุผ่านด้วยปริมาณมหาศาล และ OI คงที่ ไม่มีการทำกำไรจำนวนมาก แสดงให้เห็นความตั้งใจของผู้สนับสนุนตลาดที่ชัดเจน อัตราค่าธรรมเนียมลบสูงถึง -0.58% ซึ่งเป็นเชื้อเพลิงสำหรับการบีบสั้น (Short Squeeze) ปัจจุบัน RSI 1H (61.86) ลดลงจากเขตซื้อมากเกิน

ดูต้นฉบับ$POWER ระดับ 1H หลังจากการพุ่งขึ้นอย่างรุนแรงในประวัติศาสตร์ ปัจจุบันอยู่ในช่วงพักตัวที่แข็งแกร่ง ราคาสร้างฐานในช่วง 1.67-1.85 โดยมี EMA20 (1.5246) ของ 1H เป็นแนวรับเชิงพลวัตที่แข็งแกร่ง แม้ระดับ 4H จะมีแท่งเทียนบนยาว แต่แนวโน้มโดยรวมยังเป็นการยืนยันการพักตัวหลังจากการทะลุผ่านด้วยปริมาณมหาศาล และ OI คงที่ ไม่มีการทำกำไรจำนวนมาก แสดงให้เห็นความตั้งใจของผู้สนับสนุนตลาดที่ชัดเจน อัตราค่าธรรมเนียมลบสูงถึง -0.58% ซึ่งเป็นเชื้อเพลิงสำหรับการบีบสั้น (Short Squeeze) ปัจจุบัน RSI 1H (61.86) ลดลงจากเขตซื้อมากเกิน

- รางวัล

- 3

- 1

- repost

- แชร์

ybaser :

:

ซื้อเพื่อรับ 💰️$DOGE ขายชอร์ต!!

เพิ่มเป็นสองเท่าในสองสัปดาห์ สามารถขายชอร์ตเมื่อราคากลับตัว! ราคาพุ่งสูงสุดที่ 0.3 ต่ำมากและไม่สามารถกลับไปสู่จุดสูงสุดได้ สภาพคล่องในตลาดต่ำมาก เทรดเดอร์รายบุคคลและสถาบันไม่ได้ซื้อเหรียญมีมนี้ซึ่งไม่มีแอปพลิเคชันมากมาย และที่สำคัญคือหลายคนซื้อที่ระดับ 0.2 และ 0.3 เมื่อราคาขึ้นก็ถูกกดลงอย่างแรง กลับสู่ราคาตลาด 🈳 เข้าร่วมตอนนี้! 👇👇👇#Gate广场发帖领五万美金红包 $DOGE

เพิ่มเป็นสองเท่าในสองสัปดาห์ สามารถขายชอร์ตเมื่อราคากลับตัว! ราคาพุ่งสูงสุดที่ 0.3 ต่ำมากและไม่สามารถกลับไปสู่จุดสูงสุดได้ สภาพคล่องในตลาดต่ำมาก เทรดเดอร์รายบุคคลและสถาบันไม่ได้ซื้อเหรียญมีมนี้ซึ่งไม่มีแอปพลิเคชันมากมาย และที่สำคัญคือหลายคนซื้อที่ระดับ 0.2 และ 0.3 เมื่อราคาขึ้นก็ถูกกดลงอย่างแรง กลับสู่ราคาตลาด 🈳 เข้าร่วมตอนนี้! 👇👇👇#Gate广场发帖领五万美金红包 $DOGE

DOGE-4.4%

- รางวัล

- 3

- 2

- repost

- แชร์

WengwasudaliswahaYinyin :

:

สวัสดีปีใหม่ 🧨ดูเพิ่มเติม

เริ่มตั้งแต่ปี 2013 และฉันจำได้ว่าจำนวนรวมของเหรียญด็อกคอยน์เคยถูกเขียนไว้เสมอว่า 100 พันล้าน แล้วทำไมตอนนี้ถึงไม่จำกัดอีกต่อไป? มีการย้ายไปยังเชนใหม่อย่างลับๆ หรือไม่ และถ้าเป็นไปไม่ได้ ก็สามารถสร้างเชนด็อกคอยน์ใหม่และกำหนดจำนวนรวมเป็น 100 พันล้านได้ แล้วตอนนี้จำนวนด็อกคอยน์ที่ขุดได้คือเท่าไร จากนั้นจะทำการเผาเหรียญที่ขุดได้ทันที และเปลี่ยนเจ้าของด็อกคอยน์ในอัตรา 1:1 เพื่อให้สามารถลดจำนวนรวมลงได้ แทนที่จะผลิตไม่จำกัด #加密市场反弹 #DOGE

DOGE-4.4%

- รางวัล

- 3

- 1

- repost

- แชร์

GateUser-40f776ca :

:

ตลาดขาขึ้นอยู่ในช่วงสูงสุด 🐂- รางวัล

- 2

- 2

- repost

- แชร์

WaitingForYourKingOf :

:

ผู้ใช้งานที่มีปริมาณการเข้าชม 60 ล้านคน หลายแพลตฟอร์มการเทรดก็พยายามจะขึ้นไป สโลแกนประกาศว่า @E1@ดูเพิ่มเติม

โหลดเพิ่ม

post.trendingtopics

ดูเพิ่มเติม6.8K Popularity

345.23K Popularity

post.hot.gate.fun

ดูเพิ่มเติม- post.mc:$2.49Kpost.holder.count:20.27%

- 2

1

hc

post.mc:$2.44Kpost.holder.count:10.00% - post.mc:$2.46Kpost.holder.count:10.00%

- post.mc:$2.44Kpost.holder.count:20.00%

- post.mc:$0.1post.holder.count:10.00%

ปักหมุด