Cardano rises near the 0.34 USD mark as investors incur losses of up to 900 million USD

The realization of losses by Cardano (ADA) investors surged in December, marking one of the strongest capitulation phases since 2023. From the beginning of the month to now, the total recorded losses by investors have exceeded $900 million (as of Friday).

Profit/Loss Breakdown

ADA2.72%

TapChiBitcoin·3m ago

BlackRock’s IBIT Achieves 6th Place in ETF Flows Despite Negative Returns

BlackRock’s iShares Bitcoin Trust (IBIT) attracted $25 billion in inflows despite negative annual performance, reflecting strong investor confidence. This trend suggests resilience in the Bitcoin ETF sector, even amid market fluctuations.

BTC0.23%

CryptoDaily·7m ago

Doginal Dogs Founder Says XRP Can Help a Lot of People Retire

Bark, founder of NFT project Doginal Dogs, believes XRP could be the key to helping many investors retire

Indeed, the ultimate goal for many in the crypto world is to generate enough returns to stop working. Some believe XRP’s price trajectory could be pivotal for those seeking financial

XRP3.09%

TheCryptoBasic·10m ago

Citi Forecasts Bitcoin Could Reach $143,000 and Ethereum $4,304 Within the Next 12 Months

Citi expects Bitcoin to rise to $143,000 and Ethereum to $4,304 in the next 12 months.

Clearer regulations and ETF inflows could support steady growth for Bitcoin and Ethereum.

Institutional activity and market trends may drive new all-time highs for major cryptocurrencies.

Citigroup

CryptoNewsLand·31m ago

Bitcoin Consolidates Near $88K as Traders Strap in for a Technical Reckoning

Bitcoin’s price stands at $88,195 as of Dec. 20, 2025, giving the asset a market cap of $1.76 trillion while 24-hour trading volume registers at $37.07 billion. The session has respected a defined intraday band between $86,929 and $88,759, pointing to a market that is active but far from

BTC0.23%

Coinpedia·36m ago

RWAs Bring Real Assets On-Chain, Arkham Data Shows

RWAs bring Treasuries, credit and commodities on-chain via regulated issuers, adding real yield to DeFi without synthetic assets.

Tokenized Treasuries dominate RWAs, with BlackRock and Franklin Templeton managing billions through compliant on-chain funds.

Ethereum leads RWA issuance,

CryptoFrontNews·1h ago

Crypto VC Funding: RedotPay leads with $107m, Fuse bags $70m

During the week of December 14-20, 2025, crypto VC funding reached $335.1 million across 18 projects. Key highlights include RedotPay's $107 million Series B, Fuse's $70 million Series B, and METYA's $50 million funding, reflecting a growing trend in digital finance investment.

XDC7.48%

Cryptonews·1h ago

Stellar (XLM) To Bounce Back? Key Harmonic Pattern Hints at Potential Upside Move

Date: Fri, Dec 19 2025 | 12:45 PM GMT

The broader cryptocurrency market is showing relative strength despite concerns around the Japan rate hike. Cooling U.S. inflation has helped both Bitcoin (BTC)

CoinsProbe·1h ago

Poland Passes Controversial Crypto Law Granting Regulators Extensive Powers Over Digital Assets

Polish parliament passes crypto bill giving regulators new powers over digital assets and exchanges.

Smaller crypto startups may struggle under strict rules while larger firms adapt and continue operations.

Bill aligns Poland with EU crypto rules but adds extra controls that may push

CryptoNewsLand·1h ago

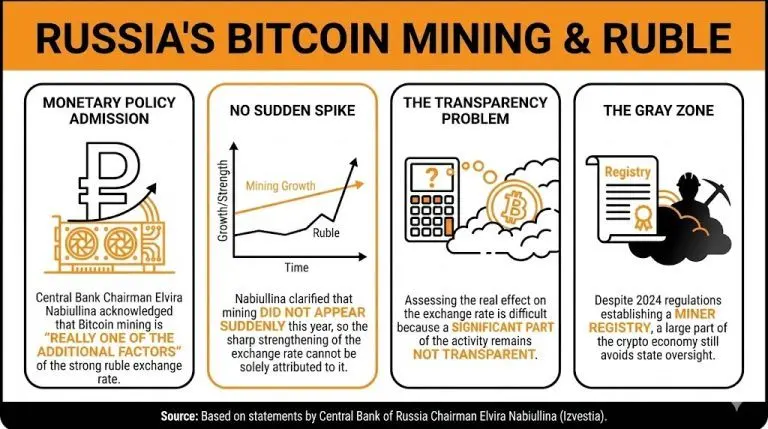

Central Bank of Russia Acknowledges Bitcoin Mining as a Ruble Strengthening Activity

The Central Bank of Russia recently referred to the properties of bitcoin mining and how it could help strengthen the Russian ruble. Elvira Nabiullina, head of the institution, stated that it was still difficult to assess the contribution of the activity in this regard.

Central Bank of Russia

BTC0.23%

Coinpedia·1h ago

Is Bitcoin Cash (BCH) Poised for a Bullish Breakout? Key Pattern Formation Suggests So!

Date: Fri, Dec 19 2025 | 12:15 PM GMT

The broader cryptocurrency market has been showing relative strength despite concerns around the Japan rate hike, while easing U.S. inflation has helped both Bitcoin (BTC) and Ethereum (ETH) remain in th

CoinsProbe·1h ago

IBIT ranking 6th in 2025 ETF flows despite negative returns is ‘a really good sign’

BlackRock's iShares Bitcoin Trust (IBIT) has attracted $25 billion in inflows despite negative performance, indicating strong investor interest. Analysts suggest this reflects maturity in the asset class, with long-term investors focusing on capital management rather than short-term gains.

Cointelegraph·2h ago

Embezzlement Defense: Why Web3 Professionals Should Not Be Victims of Crime?

On October 27, 2025, Pan Gongsheng, Governor of the People's Bank of China, reiterated at the Financial Street Forum that policies regarding the prevention and disposal of virtual currency trading speculation have remained effective since 2017 and will continue to crack down on virtual currency-related business activities to safeguard the economic and financial order. This statement has drawn an insurmountable red line for our country's virtual currency regulation policies.

However, on the other end of reality, a stark paradox is unfolding in judicial practice: many overseas Web3 projects and virtual currency exchanges that are not recognized by law or are explicitly prohibited, when internal disputes occur—especially when accusing employees of "occupational embezzlement"—frequently seek and obtain protection from domestic criminal law enforcement. Some prosecuting agencies, by expanding the interpretation of the concept of "unit" and forcibly connecting jurisdiction, have extended the protections of criminal law for the crime of occupational embezzlement to these entities that should be strictly regulated and severely punished.

This has triggered a

金色财经_·2h ago

File a claim for 4 billion USD! Terra liquidator accuses Jump Trading of "behind-the-scenes trading" triggering the crash

The Terra (LUNA) crash in 2022, which shocked the world and caused $40 billion to evaporate overnight, has now reignited a legal storm. The bankruptcy liquidation administrator of Terraform Labs has recently filed lawsuits against top quantitative trading giant Jump Trading and its executives, aiming to hold the company responsible for Terra's collapse and seeking civil compensation amounting to $4 billion.

According to The Wall Street Journal, Todd Snyder, the bankruptcy liquidation administrator of Terraform Labs, has filed a lawsuit in court. The defendants include not only Jump Trading but also co-founder William DiSomma and former President Kanav Kariya, who stepped down in 2024.

Terra

LUNA-1.6%

区块客·2h ago

Load More

Hot Tags

Hot Topics

MoreCrypto Calendar

MoreHayabusa Upgrade

VeChain has unveiled plans for the Hayabusa upgrade, scheduled for December. This upgrade aims to significantly enhance both protocol performance and tokenomics, marking what the team calls the most utility-focused version of VeChain to date.

2025-12-27

Litewallet Sunsets

Litecoin Foundation has announced that the Litewallet app will officially sunset on December 31. The app is no longer actively maintained, with only critical bug fixes addressed until that date. Support chat will also be discontinued after this deadline. Users are encouraged to transition to Nexus Wallet, with migration tools and a step-by-step guide provided within Litewallet.

2025-12-30

OM Tokens Migration Ends

MANTRA Chain issued a reminder for users to migrate their OM tokens to the MANTRA Chain mainnet before January 15. The migration ensures continued participation in the ecosystem as $OM transitions to its native chain.

2026-01-14

CSM Price Change

Hedera has announced that starting January 2026, the fixed USD fee for the ConsensusSubmitMessage service will increase from $0.0001 to $0.0008.

2026-01-27

Vesting Unlock Delayed

Router Protocol has announced a 6-month delay in the vesting unlock of its ROUTE token. The team cites strategic alignment with the project’s Open Graph Architecture (OGA) and the goal of maintaining long-term momentum as key reasons for the postponement. No new unlocks will take place during this period.

2026-01-28