🔹 Two sides to Aster

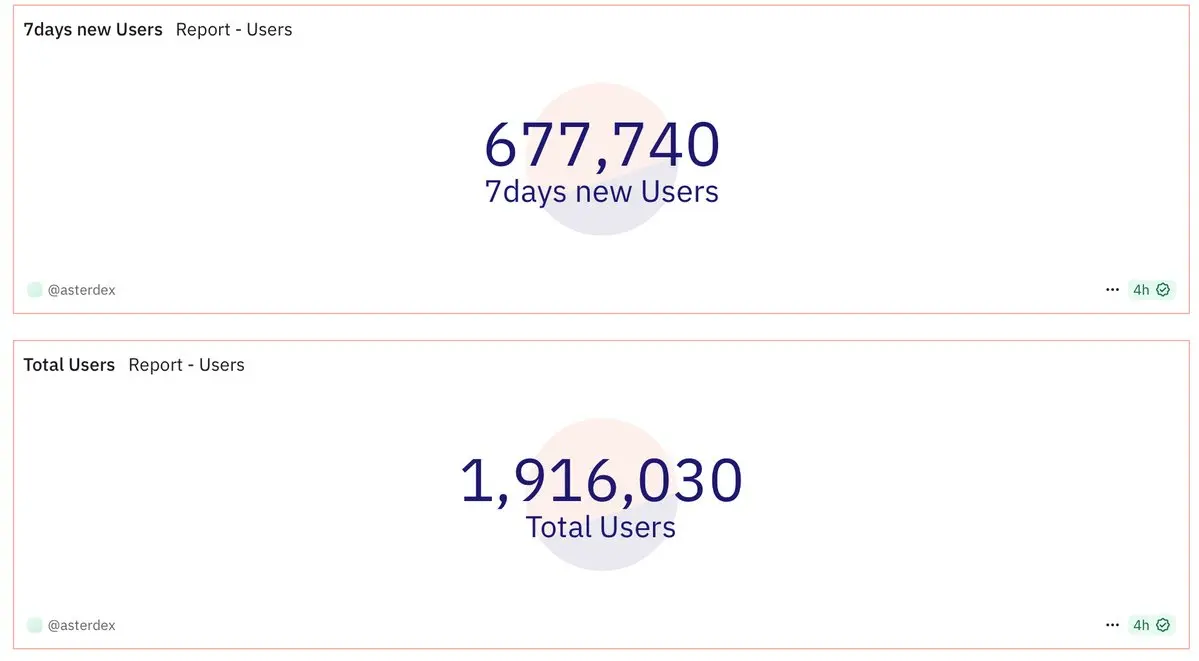

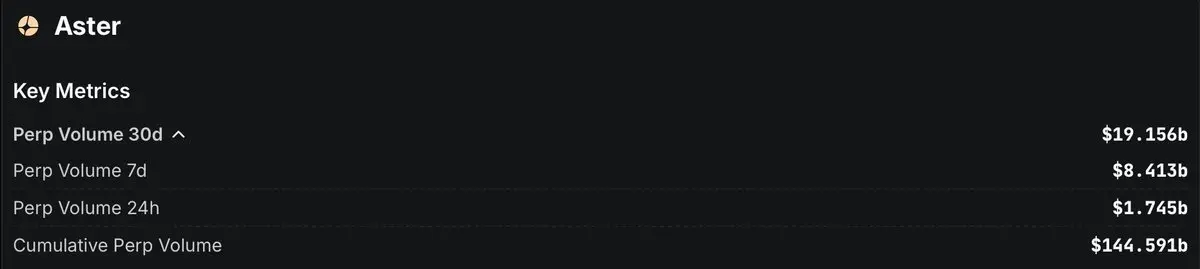

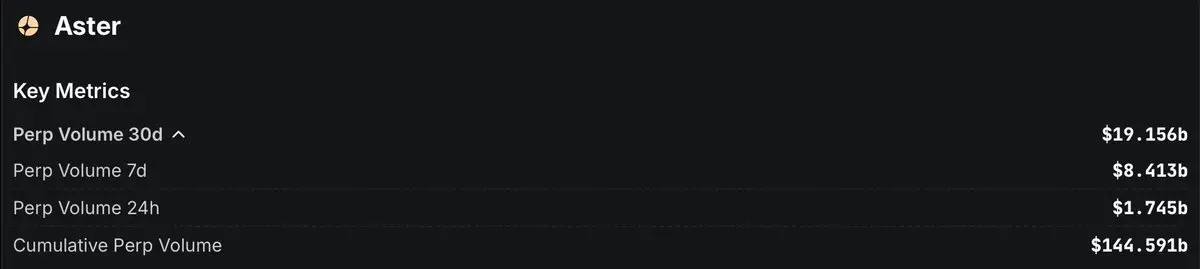

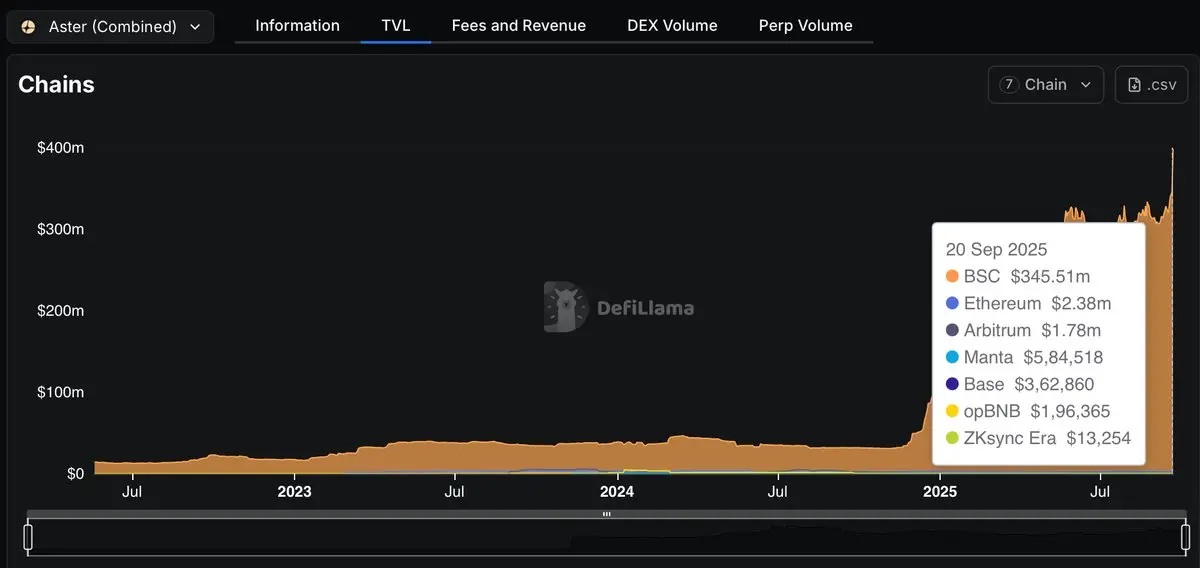

• Aster DEX → the perpetual exchange on BNB Chain

• $ASTER Token → governance + incentive token linked to exchange revenues

DEX adoption creates fees → fees fund buybacks → token reflects adoption.

• Aster DEX → the perpetual exchange on BNB Chain

• $ASTER Token → governance + incentive token linked to exchange revenues

DEX adoption creates fees → fees fund buybacks → token reflects adoption.

ASTER18.21%