# GoldandSilverHitNewHighs

13.52K

Gold and silver both reached record highs as safe-haven demand increased. Are you adding precious metals here? What’s your strategy?

BabaJi

#GoldandSilverHitNewHighs

🥇 Gold & Silver at Record Highs: Add Here or Wait?

Gold and silver pushing to new record highs is a textbook signal of rising safe-haven demand. With geopolitical risks, renewed tariff threats, and macro uncertainty increasing, capital is clearly rotating toward assets that hedge volatility and currency risk.

But the key question isn’t why they’re rising — it’s how to position from here.

📊 What’s Driving the Move?

• Risk-off sentiment across global markets

• Geopolitical and trade tensions fueling uncertainty

• Central bank demand, especially for gold

• Real yields

🥇 Gold & Silver at Record Highs: Add Here or Wait?

Gold and silver pushing to new record highs is a textbook signal of rising safe-haven demand. With geopolitical risks, renewed tariff threats, and macro uncertainty increasing, capital is clearly rotating toward assets that hedge volatility and currency risk.

But the key question isn’t why they’re rising — it’s how to position from here.

📊 What’s Driving the Move?

• Risk-off sentiment across global markets

• Geopolitical and trade tensions fueling uncertainty

• Central bank demand, especially for gold

• Real yields

- Reward

- 3

- 3

- Repost

- Share

HighAmbition :

:

2026 GOGOGO 👊View More

#GoldandSilverHitNewHighs

As of January 20, 2026, the global financial system is experiencing one of the most significant "tectonic shifts" in modern economic history, witnessing a dramatic "collapse of trust" and the subsequent magnificent surge of precious metals. The developments gathering under the hashtag #GoldandSilverHitNewHighs are more than just green numbers on price tickers; they represent the story of the paper currency empire—built since the 1944 Bretton Woods system—crashing into the hard wall of physical reality.

Here is an in-depth analysis of the "perfect storm" that has prop

As of January 20, 2026, the global financial system is experiencing one of the most significant "tectonic shifts" in modern economic history, witnessing a dramatic "collapse of trust" and the subsequent magnificent surge of precious metals. The developments gathering under the hashtag #GoldandSilverHitNewHighs are more than just green numbers on price tickers; they represent the story of the paper currency empire—built since the 1944 Bretton Woods system—crashing into the hard wall of physical reality.

Here is an in-depth analysis of the "perfect storm" that has prop

SXP2,56%

- Reward

- 50

- 60

- Repost

- Share

kblyfb1907 :

:

2026 GOGOGO 👊View More

#GoldandSilverHitNewHighs

New Highs Are Not Noise — They Are Signals

As gold and silver break into new highs, reading this move as a simple commodities rally misses the bigger picture. These moments mark periods when markets are recalibrating risk.

Historically, gold has acted as a natural safe haven during geopolitical uncertainty, inflationary pressure, and monetary policy confusion. Crypto assets, on the other hand, tend to shine when risk appetite expands. Yet in certain phases of the cycle — especially with Bitcoin — this distinction blurs, and the “digital gold” narrative gains strength

New Highs Are Not Noise — They Are Signals

As gold and silver break into new highs, reading this move as a simple commodities rally misses the bigger picture. These moments mark periods when markets are recalibrating risk.

Historically, gold has acted as a natural safe haven during geopolitical uncertainty, inflationary pressure, and monetary policy confusion. Crypto assets, on the other hand, tend to shine when risk appetite expands. Yet in certain phases of the cycle — especially with Bitcoin — this distinction blurs, and the “digital gold” narrative gains strength

BTC-3,88%

- Reward

- 23

- 40

- Repost

- Share

ybaser :

:

Happy New Year! 🤑View More

#GoldandSilverHitNewHighs

Gold and Silver Hit Record Highs Analyzing Safe-Haven Demand, Market Drivers, and Strategic Opportunities for Precious Metals Investors

Gold and silver have recently reached record highs, driven by surging demand for safe-haven assets amid increasing market volatility and macroeconomic uncertainty. As investors seek protection from inflation, geopolitical risks, and fluctuating equities and crypto markets, precious metals have once again demonstrated their role as reliable stores of value. This trend highlights the enduring appeal of gold and silver as both hedges ag

Gold and Silver Hit Record Highs Analyzing Safe-Haven Demand, Market Drivers, and Strategic Opportunities for Precious Metals Investors

Gold and silver have recently reached record highs, driven by surging demand for safe-haven assets amid increasing market volatility and macroeconomic uncertainty. As investors seek protection from inflation, geopolitical risks, and fluctuating equities and crypto markets, precious metals have once again demonstrated their role as reliable stores of value. This trend highlights the enduring appeal of gold and silver as both hedges ag

- Reward

- 8

- 14

- Repost

- Share

Discovery :

:

2026 GOGOGO 👊View More

#GoldandSilverHitNewHighs

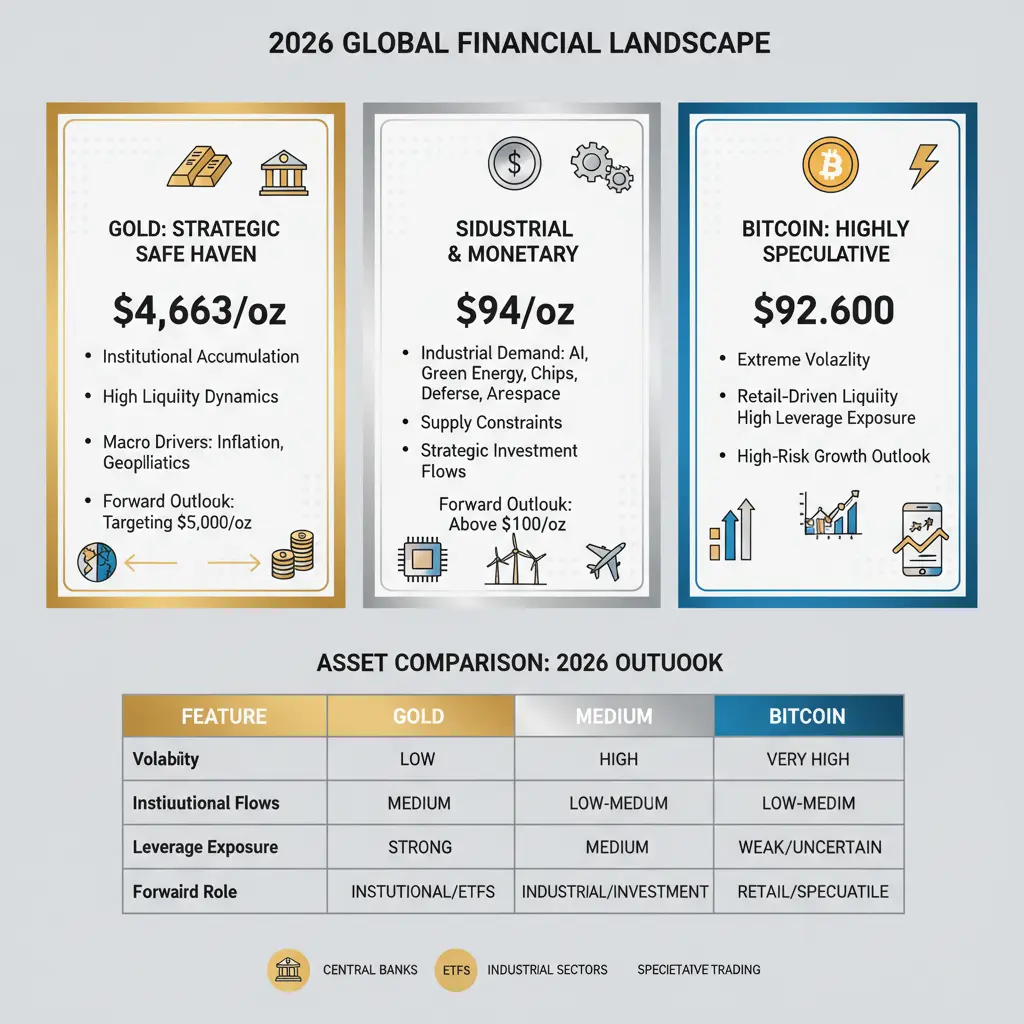

On January 19, 2026, gold and silver surged to all-time or near-record highs, reflecting major shifts in global financial markets. Investors are rushing into precious metals as traditional markets face volatility and uncertainty, while Bitcoin has reacted differently.

📊 Current Prices (Approx) — Gold & Silver

🌍 International Spot Prices

Gold: ~$4,663 per ounce — all-time highs.

Silver: ~$92.93 per ounce — also near record levels.

🇵🇰 Pakistan Market (Approximate Local Prices)

Gold per tola: ~Rs 481,000+

Gold per 10 g: ~Rs 413,000+

Silver per tola: ~Rs 9,400+

💡 Ob

On January 19, 2026, gold and silver surged to all-time or near-record highs, reflecting major shifts in global financial markets. Investors are rushing into precious metals as traditional markets face volatility and uncertainty, while Bitcoin has reacted differently.

📊 Current Prices (Approx) — Gold & Silver

🌍 International Spot Prices

Gold: ~$4,663 per ounce — all-time highs.

Silver: ~$92.93 per ounce — also near record levels.

🇵🇰 Pakistan Market (Approximate Local Prices)

Gold per tola: ~Rs 481,000+

Gold per 10 g: ~Rs 413,000+

Silver per tola: ~Rs 9,400+

💡 Ob

- Reward

- 21

- 28

- Repost

- Share

CryptoVortex :

:

2026 GOGOGO 👊View More

#GoldandSilverHitNewHighs

#GoldandSilverHitNewHighs 🏆💰

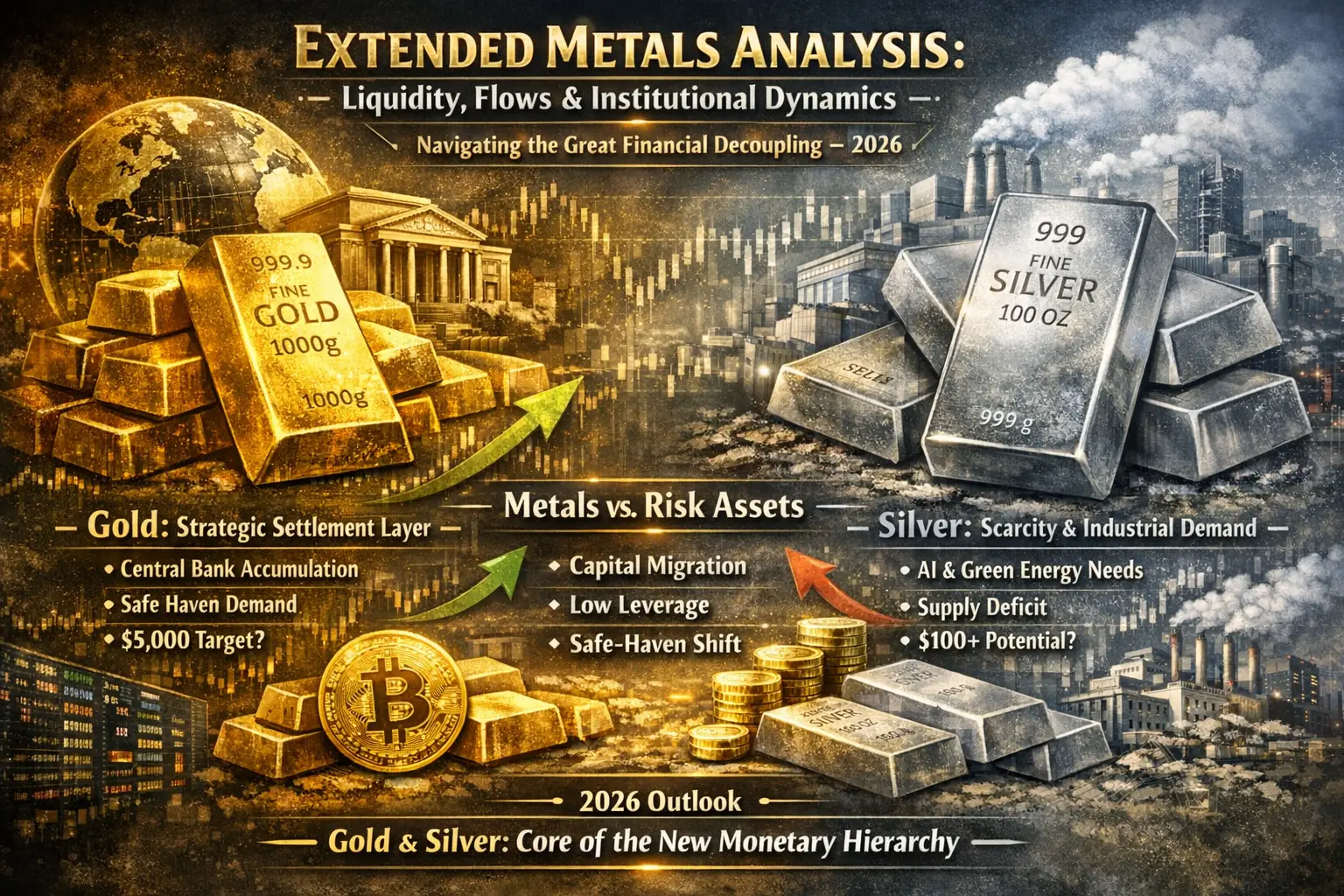

In 2026, the financial landscape is undergoing a major structural shift. Gold and Silver are breaking records, not as a fleeting spike, but as part of a long-term capital reallocation, while Bitcoin and other risk assets behave in fundamentally different ways. This is the era of the Great Financial Decoupling, where tangible, strategic assets dominate, and highly leveraged, speculative instruments fluctuate violently.

Gold: The Strategic Safe Haven (~$4,663/oz)

Gold’s rally is more than a price movement — it reflects deep institutional

#GoldandSilverHitNewHighs 🏆💰

In 2026, the financial landscape is undergoing a major structural shift. Gold and Silver are breaking records, not as a fleeting spike, but as part of a long-term capital reallocation, while Bitcoin and other risk assets behave in fundamentally different ways. This is the era of the Great Financial Decoupling, where tangible, strategic assets dominate, and highly leveraged, speculative instruments fluctuate violently.

Gold: The Strategic Safe Haven (~$4,663/oz)

Gold’s rally is more than a price movement — it reflects deep institutional

- Reward

- 14

- 18

- Repost

- Share

ShainingMoon :

:

2026 GOGOGO 👊View More

Gold remains "steady," while silver moves "aggressively," with capital preferences already diverging

Although gold and silver are reaching new highs together, the underlying capital attributes of the two are quietly diverging. The rise of gold is more dominated by "conservative capital," while silver clearly attracts more trading and aggressive capital.

Gold's advantages are:

* Continual accumulation by global central banks

* Relatively controllable volatility

* Clear macro risk hedging properties

In contrast, silver's characteristics are:

* Combination of financial and industrial attributes

*

View OriginalAlthough gold and silver are reaching new highs together, the underlying capital attributes of the two are quietly diverging. The rise of gold is more dominated by "conservative capital," while silver clearly attracts more trading and aggressive capital.

Gold's advantages are:

* Continual accumulation by global central banks

* Relatively controllable volatility

* Clear macro risk hedging properties

In contrast, silver's characteristics are:

* Combination of financial and industrial attributes

*

- Reward

- 7

- 8

- Repost

- Share

HighAmbition :

:

2026 GOGOGO 👊View More

#GoldandSilverHitNewHighs ⚡ #GoldandSilverHitNewHighs – 19 Jan 2026

Precious metals are back in the spotlight! Gold has surged past $2,050/oz, while silver hits $27.50/oz, marking new multi-year highs. This surge reflects global market uncertainty, inflation concerns, and the flight to safety amid ongoing macroeconomic turbulence.

📌 Market Overview:

Gold: Strong upward momentum driven by rising inflation expectations and geopolitical tensions.

Silver: Benefiting from both industrial demand and investor hedge demand, showing higher volatility than gold.

Correlation with Crypto: BTC and other d

Precious metals are back in the spotlight! Gold has surged past $2,050/oz, while silver hits $27.50/oz, marking new multi-year highs. This surge reflects global market uncertainty, inflation concerns, and the flight to safety amid ongoing macroeconomic turbulence.

📌 Market Overview:

Gold: Strong upward momentum driven by rising inflation expectations and geopolitical tensions.

Silver: Benefiting from both industrial demand and investor hedge demand, showing higher volatility than gold.

Correlation with Crypto: BTC and other d

BTC-3,88%

- Reward

- 8

- 17

- Repost

- Share

AYATTAC :

:

2026 GOGOGO 👊View More

#GoldandSilverHitNewHighs 🏆💰

The Great Financial Decoupling of 2026: Why Gold & Silver Are Winning the Global Re-Ranking

In 2026, the market is undergoing a major structural shift. Gold and silver aren’t just experiencing a temporary spike — they’re entering a long-term phase of strategic capital reallocation. Meanwhile, Bitcoin and other risk assets are behaving in fundamentally different ways, driven more by speculation than strategic value.

Gold: The Strategic Safe Haven (~$4,663/oz)

Gold’s rally is more than a price move — it reflects deep institutional strategy, liquidity preference, an

The Great Financial Decoupling of 2026: Why Gold & Silver Are Winning the Global Re-Ranking

In 2026, the market is undergoing a major structural shift. Gold and silver aren’t just experiencing a temporary spike — they’re entering a long-term phase of strategic capital reallocation. Meanwhile, Bitcoin and other risk assets are behaving in fundamentally different ways, driven more by speculation than strategic value.

Gold: The Strategic Safe Haven (~$4,663/oz)

Gold’s rally is more than a price move — it reflects deep institutional strategy, liquidity preference, an

BTC-3,88%

- Reward

- 11

- 21

- Repost

- Share

CryptoEye :

:

DYOR 🤓View More

#GoldandSilverHitNewHighs

Historic Momentum in Precious Metals: Gold & Silver Surge

The world of financial markets is witnessing a spectacular moment as both gold and silver reach new highs, signaling renewed investor confidence and global economic shifts. In times of uncertainty and market volatility, precious metals have historically served as safe-haven assets, providing security against inflation, currency fluctuations, and economic instability. The recent surge reflects not only market sentiment but also the underlying global dynamics impacting traditional finance and commodity markets.

Historic Momentum in Precious Metals: Gold & Silver Surge

The world of financial markets is witnessing a spectacular moment as both gold and silver reach new highs, signaling renewed investor confidence and global economic shifts. In times of uncertainty and market volatility, precious metals have historically served as safe-haven assets, providing security against inflation, currency fluctuations, and economic instability. The recent surge reflects not only market sentiment but also the underlying global dynamics impacting traditional finance and commodity markets.

- Reward

- 1

- 4

- Repost

- Share

Falcon_Official :

:

1000x VIbes 🤑View More

Load More

Join 40M users in our growing community

⚡️ Join 40M users in the crypto craze discussion

💬 Engage with your favorite top creators

👍 See what interests you

Trending Topics

10.45K Popularity

36.35K Popularity

51.88K Popularity

13.52K Popularity

9.82K Popularity

338.56K Popularity

6.55K Popularity

8.51K Popularity

107.36K Popularity

17.56K Popularity

185.31K Popularity

14K Popularity

6.62K Popularity

8.62K Popularity

150.53K Popularity

News

View MoreData: 492.18 BTC transferred from anonymous addresses, worth approximately $44.03 million

1 m

Data: In the past 24 hours, the entire network has been liquidated for a total of $709 million, with long positions liquidated for $649 million and short positions liquidated for $60.451 million.

10 m

After launching on NPM, Alpha increased by 4477.69%, current price 0.0024629 USDT

18 m

Data: 7.7 million TRX transferred from an anonymous address, routed through a relay, and then sent to another anonymous address.

1 h

Data: If BTC breaks through $94,149, the total liquidation strength of mainstream CEX short positions will reach $2.47 billion.

1 h

Pin