🔥 **METALS SHOCK: PANIC SELL OR GOLDEN DIP?** 🪙⚡️

Risk assets took a hard hit overnight 😮💨

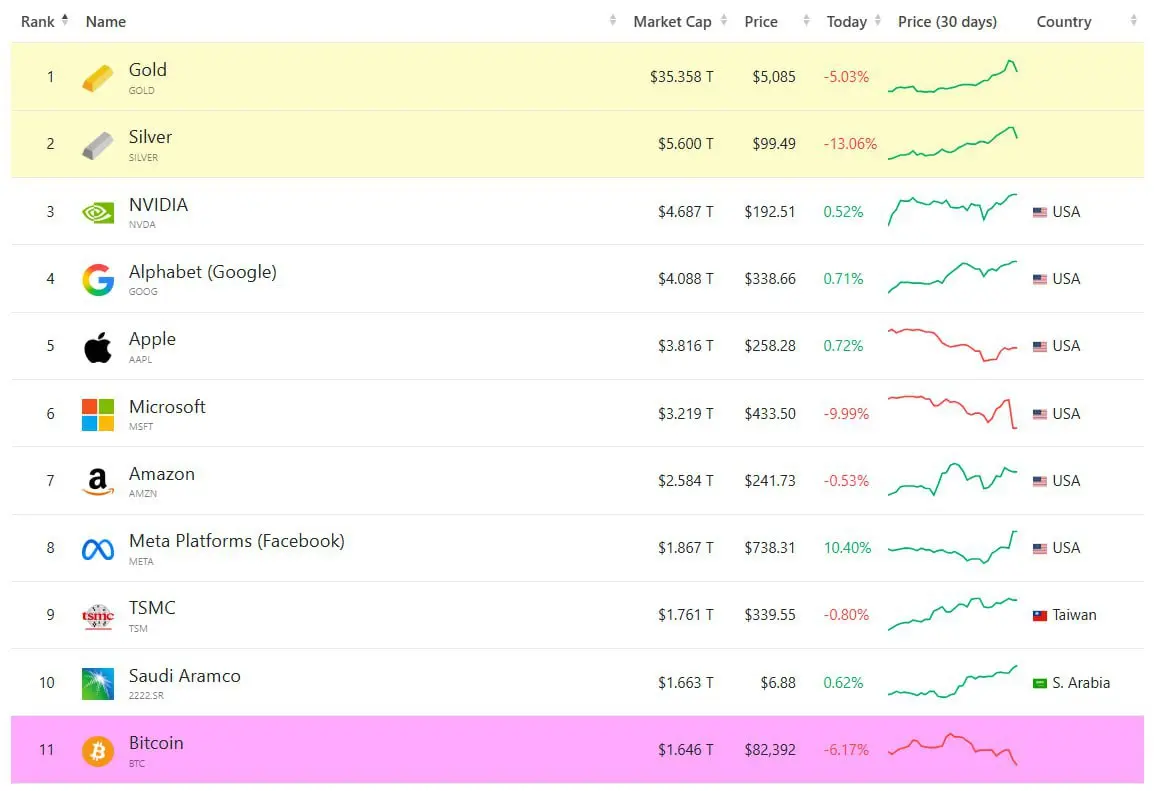

🟡 **Gold** dumped nearly **$300**, sliding to **$5,155/oz**

⚪ **Silver** crashed up to **-8%**, trading around **$108.23/oz**

Big move. Big emotions. But smart traders zoom out 👀👇

📊 **What’s really happening?**

This looks like **classic profit-taking + risk-off rotation** after an overheated rally. When prices go vertical, corrections come fast — especially in metals with heavy leverage and ETF flows. That doesn’t automatically mean the trend is broken 💡

🧠 **My Gate TradFi Metals View**

✨ **Gold:**

* Still a macro hedge against uncertainty 🌍

* Sharp pullbacks in strong trends often become **buy-the-dip zones**, not panic exits

* I prefer **scaling in**, not all-in buying

✨ **Silver:**

* High beta metal = higher volatility ⚡️

* Best traded with **smaller size + wider patience**

* Great for swing trades, not for emotional holding

📈 **Strategy I’m leaning toward:**

✅ Partial dip buys on confirmed support

✅ Keep dry powder for deeper volatility

❌ No chasing, no revenge trading

💬 **Now your turn:**

Are you **buying the dip 🛒**, **cutting exposure ✂️**, or **waiting on the sidelines 👀**?

Share your **Gate TradFi metals strategy** 👇

⚠️ *Risk Warning: Trading involves risk. Volatility in metals can lead to rapid losses. Always manage position size and use proper risk control.*

#PreciousMetalsPullBack

Risk assets took a hard hit overnight 😮💨

🟡 **Gold** dumped nearly **$300**, sliding to **$5,155/oz**

⚪ **Silver** crashed up to **-8%**, trading around **$108.23/oz**

Big move. Big emotions. But smart traders zoom out 👀👇

📊 **What’s really happening?**

This looks like **classic profit-taking + risk-off rotation** after an overheated rally. When prices go vertical, corrections come fast — especially in metals with heavy leverage and ETF flows. That doesn’t automatically mean the trend is broken 💡

🧠 **My Gate TradFi Metals View**

✨ **Gold:**

* Still a macro hedge against uncertainty 🌍

* Sharp pullbacks in strong trends often become **buy-the-dip zones**, not panic exits

* I prefer **scaling in**, not all-in buying

✨ **Silver:**

* High beta metal = higher volatility ⚡️

* Best traded with **smaller size + wider patience**

* Great for swing trades, not for emotional holding

📈 **Strategy I’m leaning toward:**

✅ Partial dip buys on confirmed support

✅ Keep dry powder for deeper volatility

❌ No chasing, no revenge trading

💬 **Now your turn:**

Are you **buying the dip 🛒**, **cutting exposure ✂️**, or **waiting on the sidelines 👀**?

Share your **Gate TradFi metals strategy** 👇

⚠️ *Risk Warning: Trading involves risk. Volatility in metals can lead to rapid losses. Always manage position size and use proper risk control.*

#PreciousMetalsPullBack